I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

This is going to be a super quick update because I’m currently overseas and haven’t had much time/energy.

At the end of March, Mrs FB and I touched down in a country that has been on my bucket list for as long as I can remember.

It ticks nearly every box I can think of for an interesting adventure.

- Unique and delicious local cuisine✔️

- Different culture✔️

- Stunning scenery✔️

- World-class snow✔️

- Not too expensive✔️

- Great public transport✔️✔️ (maybe the best I’ve seen in over 30 countries)

And then there are some personal attractions I’ve always been drawn to.

- Nerd Central (anime, gaming, manga)✔️

- One of the tech capitals of the world✔️

- Electric vehicle innovation hub✔️

If you haven’t guessed by now, I’m talking about the land of the rising sun…

JAPAN 🇯🇵!

We’re here with another couple for a few weeks before heading off to South Korea.

Here are some shots so far:

Net Worth Update

Shares, Super and BTC do the heavy lifting this month. It was another blowout month (savings-wise) as we loaded up our Wise cards with Japanese Yen and South Korean Won.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Another supercharged month of expenses during our travels.

Shares

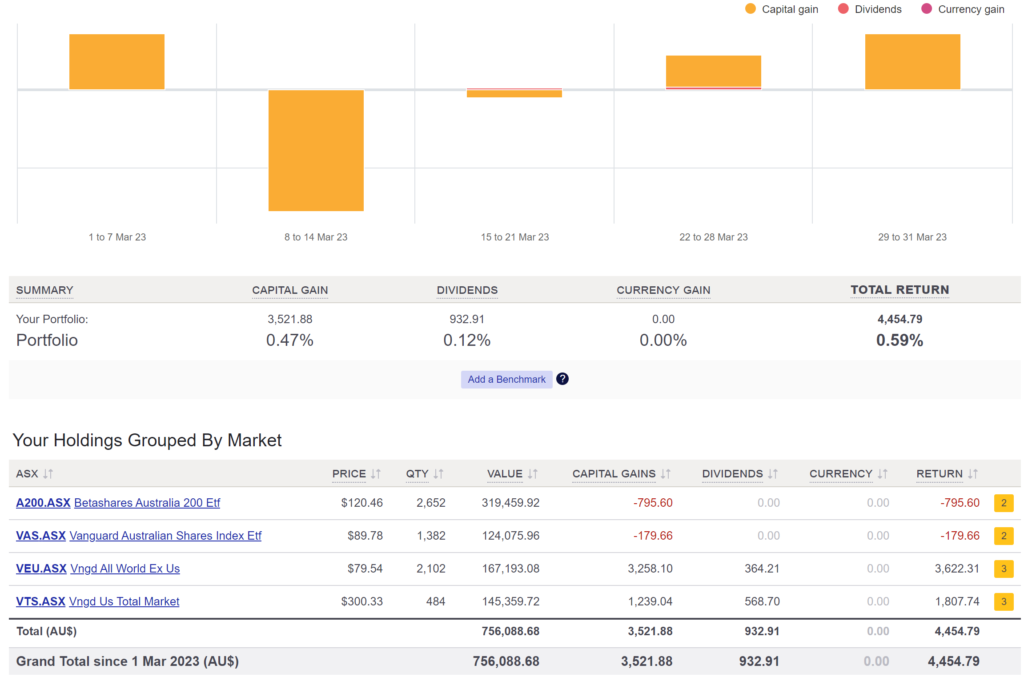

The above graph is created by Sharesight

We didn’t buy any shares in March and have been using our dividends for expenses for a few months now.

Part of me hates not adding to the snowball but everyone has to switch to consumption mode eventually or else there’s not much point in investing.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Has the FIRE movement figured out a FIRE equivalent for the gym culture’s ‘do you even lift, bro?!’ Cause, I feel like you have pivoted and it doesn’t seem as though you’re actively pursuing financial independence any longer.

That’s not to say there’s any judgement from here! If anything, it seems like your financial backing has given you the confidence to live the life you want to most, knowing that you have a steady snowball accumulating and you can focus on the now.

But maybe just check if flamingobug.com domain is available or not? 😉

Hope you’re enjoying Japan. Great photos and plenty of envy building up over here.

Cheers!

I’ve gone through a few pivots throughout my FIRE journey fo sure!

I’m much more into living a FIRE lifestyle vs an all encompassing mission to reach financial independence as soon as possible.

FIRE is more to me than just money.

It’s about creating the ideal lifestyle and obviously money plays a crucial role but it’s not the be all and end all.

Die with Zero has had a profound impact on me during the last 18 months and I’ve reprioritised a lot.

A think semi retirement and Flamingo FI are fantastic concepts too!

I’m still on the road to FI. Just slowing things down to enjoy the fruit of my labour sooner rather than later.

As an oldie that in hindsight kind of followed the FIRE approach well before it was defined, I believe you have found a great balance between FI and living life (and no, I am not proposing another acronym). I have followed the fire movement for a few years out of interest and your journey has been one that you appear to have achieved a good balance between building wealth – both financial and life.

While it is possible to live very cheaply, memorable experiences can be expensivel not to mention that life does throw many unexpected challenges at one that can cost large amounts of cash . You have built a strong store of wealth and can now have wonderful experiences that will leave great memories because you are not tied to working to survive without having to worry about the next unplanned expense. A great position to be in.

The Die With Zero is an interesting read and the message it contains needs to be considered by everyone and is close to what I have followed for the last 10 – 15 years. It does assume a certain level of financial means which is fine.

My approach was very simple – get a good paying job, pay off all debts as fast as possible (very lean times here), invest as much as possible and once I had reached a point of financial comfort, start living plenty of experiences while still earning an income to finance them. Probably not overly different to your journey, except you started at a much earlier age than myself and some of your experiences are much more interesting than what I have done – but I am still having my experiences.

Congratulations and keep living life.

Thanks for the comment DollarWise. It sounds like we have both followed a similar path.

You guys have done an amazing job. I hope you are super proud of your achievements. You have managed to save so much and still live a full life with travel and great experiences. Awesome! I’m loving your podcast. I grew up in the valley too!

Thanks for the comment Kate 🙂

As a rather new comer to putting my FIRE plan into action (not exactly new to FIRE philosophy, more so new to taking that initial step to invest) your cash buffer sits around $50k. Is this your emergency, 3mths expenses for 2 people or is it just a number you prefer to sit aside?

I’ve been frugal setting aside $20k and that’s after also reading die with zero and letting go of the purse strings a little as I train myself to enjoy the now just slightly after being so strict accumulating

Welcome Abbie 🙂

The ~$50K is our emergency fund. It’s on the larger side of things because I don’t have a steady income and we’re saving up for a new car soon. It kills me a bit to know so much money is just sitting in our offset but it helps our sleep at night factor.

Now that you have an Australian PPOR, do you think you will look to change your ratio of AUS to International ETFs?

Why would that be a consideration? To ask that you must have a reason why that would come up?

It’s not something I’ve thought about tbh. Our holdings are slowly changing their weightings due to us spending our dividends now. We should slowly but surely become more globally weighted because Aussie shares typically have a higher dividend yield.

Hi,

This might be a rookie question but can you clarify if the super in your sheet varies based on extra contributions on top of 10.5% and the monthly returns?

I have a much smaller portfolio mostly in VA, NDQ and individual shares, some amount in BTC and Ethereum that I don’t touch. I don’t do any extra contributions to super but considering small amounts every month.

Thanks,

Nikita

I haven’t been adding extra to my Super since 2018 (when we moved to the UK). All gains in our Super accounts come from the market plus 10.5% from Mrs Firebug’s wage.

I hope that clears it up.

Cheers