I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

The Rask event at the start of December was a smashing success!

When Owen asked if I was interested in hosting a panel, I was initially a little bit hesitant.

“I’m anonymous mate, and it’s hard to keep your anonymity at a live event. Especially one that’s being live streamed😅”

But I promised him that I’d think about it.

I’ve been blogging since 2015 and a lot has changed in my personal life. One of the main reasons I hide my identity was because I was worried that my employer would find my website and it would cost me promotions during my accumulation phase.

“Matt’s not sticking around long term, best to give the coordinator job to someone else”

Hiding my identity was crucial if I ever decided to pull the plug on this site and have it fade into obscurity.

But those aren’t relevant concerns anymore. And after having so much fun at the Sydney FIRE meetup, I made a promise to myself that I would be more involved in the real-world FIRE community and not just online ones.

I contacted Owen again and said… “I’m in”.

This ultimately entailed hosting a panel and being part of another one.

You can check out my segments on YouTube (I’m on from 3:09:20 until the end).

Oh, and in case you’re wondering, Owen was kind enough to lend me a party shirt which was the theme for the night 😂

There’s nothing better than meeting people in real life and hanging out at events like this one. I met heaps of people at this event and we had a little FIRE meet-up afterwards too. I’ll be doing a lot more of these events in the future so I hope to meet some of you guys there and have a chat in real life 🙂

The silly season was in full effect in December which meant plenty of barbecues, beer and backyard cricket.

One area where I felt a bit left out was end-of-year work breakups.

Everyone I knew was heading out to social events for work in December. I was invited along to a few but it just isn’t the same.

2022 was a strange year for me.

On one hand, it was awesome because of the following:

- Travelled heaps

- Only worked 2-3 days a week on something I like doing

- Had copious amounts of free time to spend on whatever

- Was able to do a lot of home renovations with my old man. This improves our lives + is quality time with family, win-win

- Spent time developing hobbies and working on my health/fitness

This sounds perfect, right?

Well, in typical first-world problem fashion… I felt a little bit… dissatisfied or something.

Maybe dissatisfied isn’t the right word. I’m not sure what exactly was wrong but I know it has something to do with a lack of growth.

I’ve been a ‘man with a plan‘ for as long as I can remember.

I think I’m hard-wired to have long-term goals or something and I seem to get lost when I’m not working towards them.

I’ve been marching towards the goal of FIRE for the last 10 years and even though we haven’t hit our FI number, we’re living the life I envisioned which was always the goal. I know the portfolio will eventually grow to our number one day.

I feel less and less motivated by FIRE each day. We have set ourselves up financially speaking and have been enjoying the fruits of our labour for the last 2-3 years travelling around the world, getting married, buying a home etc. etc.

This has been lovely.

But I can’t help but shake the thought… what’s next?

I’m still young.

What do I want to achieve?

Why do I want to achieve anything in the first place?

Can’t I just be happy with what I’ve currently got? I love my life, but I feel like I can do more.

Does anyone else have these issues!? Am I crazy?

I came to the realisation last year that 99% of people I like spending time with will not stop working in their 30s, 40s, or 50s even if they were financially free. Mrs Firebug has voiced that she will still teach a few days a week post-FI too.

This is a tricky conundrum. I have all this free time now, but I can’t spend it with friends and family because they’re at work!

I’m starting to miss that feeling of having a dedicated team to work with and all the other benefits that come with a great culture.

That was one of my favourite parts about the fast-paced work environment in London. The work was interesting, challenging at times and fostered a motivational atmosphere.

My line of work doesn’t have anything like that where I’m from.

I don’t want my old job back, because that’s not what I’m looking for. But I think I’m going to really ramp things up in my business with the hope of building out a small team in the future.

If I can’t find a local company that has what I’m after, I’m going to try to make it myself!

New long-term goal activated!

I’ve also been tossing up the idea of starting a co-working space in my hometown.

The co-working space goal isn’t concrete yet because there are already a few spaces popping up locally but they’re not quite what I’m after. If I find a good one though, I’m more than happy to just go there.

So here’s the plan for the next decade or so:

- Build a small team of 4-7 people. Create an epic working environment and throw kick-ass Christmas breakups

- Start a co-working space in my hometown

Net Worth Update

Not much to report here.

Pretty much everything went down (shares having the biggest drop).

I cashed in a fairly large invoice at the end of December which helped a little.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

A really cheap month for us. We bought most of the presents throughout the year and prepaid for our new years eve celebrations.

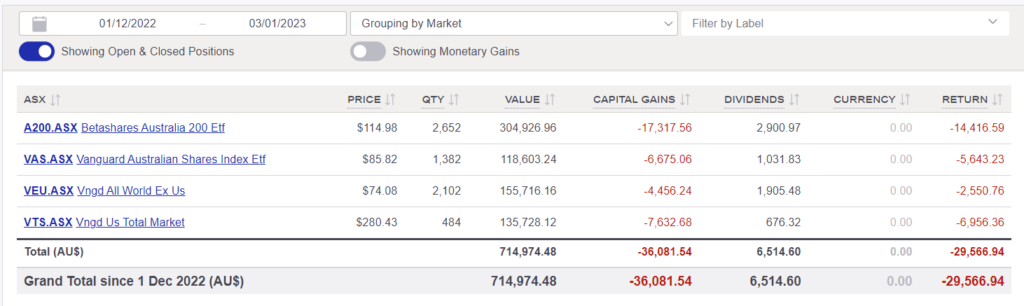

Shares

The above graph is created by Sharesight

A lot of red!

$6.5K worth of dividends is nice though.

We didn’t buy shares in December because I’ve finished all of my consulting work for the time being. I’m now switching my focus to building and selling this digital product that I built. I need to win a few more multi-year contracts if I have any hope of employing people and fulfilling my dream of having a small company one day.

This means we need more dry powder for that sleep-at-night factor.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Vanguard ETFs paid dividends in December?

That Sharesight view uses the ex-dividend date, rather than the payment date.

What Matt said ☝️

I had a feeling it would be something like that haha

Fantastic to hear that the Rask event went well, and thanks for taking the time to meet up!

It’s great that you’ve come up with some plans to keep you busy and give you something to work towards, it’s so important to have meaning in your life.

Like wise mate. You’ll have to come to the next event!

Great update Aussie Firebug, and it was fun seeing you speak at the Rask event!

The ‘what’s next’ question is a big one, and I guess the key is to just keep trying things and combinations out – and remember that where the FI journey has reached the point you have reached there is no real ‘fail’ option.

Simply learning about what you do and don’t like in practice is the ‘win’ here.

I am thinking about the same issues, albeit with the market recently conspiring to give me even more time to think about them! 🙂

Dude! Were you at the event? Or did you just watch the live stream?

Thanks for these detailed updates. I love following along as we are progressing at basically the same net worth and tracking rate. I get alot of value out of it. Would you say following the same trajectory you will hit your FI number in approx 4 to 5 years?

No worries Amber.

Hard to say, I’ve hardly worked the last 2 years but I’m planning to really ramp things up this year.

If we kept our current pace, it might take another 10 years to reach full FI.

It all depends on how successful my new company is.

Great update. Those are similar questions that I’m pondering in terms of what to do once I reach FIRE. Still a few years away.

Any update on your choice of EV? For those in the community that are with employers that offer novated leases, there are some fantastic benefits to be had.

Cheers Chet.

We’re looking at the Ioniq5, EV6 and Model Y. I still can’t justify the price yet. But they seem to be getting cheaper and cheaper.

I’m trying to hold out for another year or two.

The first two are really hard to even buy due to availability (unless you’re looking at second hand) and the Model Y just had a juicy price drop, so maybe that’s the sign you’ve been waiting for!

Tell me about it.

We’re trying to book test drives and it’s almost like all the other manufacturers don’t want our business.

Tesla was the only one that had cars available and a super smooth process to book a test drive. I was on the phone with Kia for an hour bouncing around departments. They basically said they had no cars available and couldn’t get me in for a test drive. Disspointing to say the least.

Yeah mate, blame Australia and our laws, or lack thereof. These auto companies send the vast majority of their units to other countries that have much stricter limitations and quotas in place, and we end up getting the dregs or whatever is left over at the end. That’s why we tend to see 100-200 Ioniq5s for sale at a time Australia wide, only for them to get snapped up literally in minutes.

The Ioniq5 was my first choice but I just couldn’t get my hands on one (brand new). So I ended up going for the Model Y because, yknow, they would actually sell it to me.

If you’re keen on an EV6, try a broker. We were told by Kia in Feb last year it would be a 2+ year wait on the EV6, then we contacted 2 brokers. 2 months later we were offered a car by each broker!

Ours arrived in July and we love it.

Great tip.

What made you go with the EV6 over the model Y?

I am trying to work out what I should do career-wise now, well before I am in your position, let alone reaching FIRE. Definitely feeling similar to yourself, lack of purpose and fulfillment – but being trapped financially makes it very hard to charge now!

Figuring this stuff out sooner rather than later is ideal. I’m too conservative.

I needed a certain level of financial freedom before I quit my job and started exploring different options.

But if you’re not happy in your current job, you don’t need to save and invest for 10 years before taking a risk. It depends on a number of things of course but I wish we could have done the London trip 4 years earlier.

Life is too short!

Yeh that is something always burning at the back of my mind. Almost 40 now and I was a mature age Engineering graduate, and felt I have been playing catchup since, always looking to expedite growth or finding the right role etc.

It sure is tough taking a risk now, it will inevitably lead to adding at least a few years to reaching FIRE.

I find volunteering can hit the spot of feeling connected and doing something useful

Great advice!

I had the same dilemma and someone I worked with said that comment about kids and I remember being somewhat offended and disarmed.

Anyone fast forward 4 years I now have a 6 month old and I am SO grateful for past me saving and investing and I am working a few days a week and my life is so full. And I completely understand the comment now that it sounds cliched about kids changing everything but I have so much purpose and I hated having the spare time now I would love some…Wish I had done it sooner to have that fullness and constant to do list.

Highly recommend therapy as well. I think sometimes that productivity and needing to do stuff can go a bit unhealthy in a way in terms of a coping mechanism as it is so hard to sit in the moment without having to work towards the next thing. It’s a really interesting concept to explore with a pro.

Great comment KG.

I think about that all the time, why do I feel the need to be constantly productive?

I have to achieve SOMETHING every day. If I don’t, I feel crap.

Is this a product of being apart of the rat race for so long? Did our ancestors feel like this? Why are we made to feel bad for too much relaxation?

Yeah 100% agree it’s weird a one.

I like mojo Crowe he is Ash Barty mindset coach which is cool as she obviously quit on top of her game and it’s really interesting some of his podcast. He has a course which looks good but I haven’t done it.

Life is not very simple but is good.

I also reccomend listening to Eckhart Tolle podcast has some interesting spiritual take in living in the moment and the ego. He wrote the power of now and Oprah talks to him a bit.

I personally find being an engineer it comes with the personality type. I think to get that degree and job etc I’ve had to be laser focused and work really hard and then work itself was not as difficult. I worked in the mines and had two week off at a time and sounds amazing but some days struggled not having a big to do list and sense of achievement. I am married to an electrician and it’s interesting how he does not feel this way at all and I’m so envious of his ability to relax and not be planning for the future. That said he is very bad at thinking a few weeks in advance so we balance each other out.

Same, I am a massive over achiever and cannot fathom getting through the day without ticking at least 3 things off my list of to do items. I dont know how to ‘do nothing’and not feel guilty about it.

Thanks Matt (nice to see you on YouTube seminar, and hopefully you do a catch-up in Melbourne), I enjoy reading your blog, and listening to your podcast (my cousin was asking me for advice, I suggested some books to read, and also to listen to your podcast). We have started to enjoy more of our hard early work investing over the years and living well below our means (we started with a picnic table for a dining table when we bought our home), and paid off our home many years ago. This has meant we can now travel more with our son, taking him on trips we could only dream of when we first got married. As well as can partake in riding , in particular building ebikes (I can’t justify the prices they ask for the ones in the shops) riding the many charity rides (Fiona Elsey,Amy Gillett etc ) with my mum and family and not worry about can we afford it. We just came back from touring the East coast of Tasmania, it was amazing (if you like amazing food, drink, wilderness, roads MTB riding etc, then highly recommend taking your own car and visiting Tassie (I saw a number of Tesla’s on the boat…. listening to your podcast you mentioned you are considering one. I looked at them, but they can’t take the weight of 4 ebikes)

Thanks again

Any online resources that you recommend for e-bike building? I was hoping for a AFB podcast on this but wondering if you have any tips/ places to start in the hope of ditching a car in the family

Hi John,

The website I use for ebike building is https://endless-sphere.com/forums/.

To build ebikes I used Micah Toll’s book ‘The Ultimate Do It Yourself Ebike Guide: Learn How To Build Your Own Electric Bicycle’ (I also built an ebike battery using his other book on building ebike batteries, he has a number of books including DIY solar, electric motor cycles etc).

I also ride the electric bike to work and other places when I can (weather permitting), as not only it saves money, but is also has other benefits including fitness, mental health, and you get to enjoy the environment around you due to slowing down (even though I get to work in almost the same amount of time in a regional city in Victoria) My car usage has gone down.

Matt. Nothing gave me more purpose than having kids. Work is necessary I think, but kids are no.1 !

I think we are all hard-wired for it. To care for something greater than ourselves.

I build my e-bike using this exact conversation kit.

It’s still going nearly 10 years later.

I have to charge the battery once every 3 months (because I only use it on hills).

It has been such a great investment.

Cheers Mick,

Tassie is awesome, isn’t it. I need to get back there someday soon.

What’s this about a Tesla not being able to carry four bikes? I’ve seen videos of them towing boats!

The download on the towbar for a Tesla model Y is about 70kg. A MTB ebike with battery is about 25kg, so two ebikes are ok. Some of the cruiser ebikes you see are about 35kg.

No way dude. Where are you getting 70kg from?

Check this video out.

From Tesla’s website for the Model Y “The hitch receiver is designed to support vertical loads up to 72 kg).” [1] . A trailer download can be 159kg.

The reason from research is, it is because of the increased download force when you move something from over the towbar ( I am no engineer, but did a lot of research when looking into the model Y, to understand why the difference, as it would have been a perfect car for us). This is something that is catching out USA buyers when they go to put on bike racks for ebikes. We have this issue on our 2014 Camry Hybrid, where the download is only 30kg. If the model Y didn’t call out the 72kg, the 159kg would have been more than enough. Hopefully Tesla amend this in time.

Just be careful about putting on non genuine Tesla hitches, as Tesla is stopping them to turn on the towing mode [2].

[1] https://www.tesla.com/ownersmanual/modely/en_kr/GUID-F5C80FF5-8DE3-4750-8BAF-0DCC0CFA0C5C.html

[2] https://www.drive.com.au/news/tesla-owners-tow-bars-using-towing-software/

Wow, well there you go.

I guess you could put the bikes on a trailer but that would be a bit annoying.

Hopefully they improve this in future releases.

Congrats on finding your ‘FIRE’ to expand your business mate! I love running a small team and have found it really rewarding, being able to outsource so you only need to spend a few hours a week allows you to focus on the stuff you REALLY love. It also keeps your brain active and stops it from turning to mush! Cheers

Thanks Cap,

I’m actually trying to add MORE work hours to my week haha. What a contradiction.

I need that real-life interaction though. Zoom calls just aren’t the same for me.

How’s the over seas trip going? The pics are looking 🤌

Hi Aussie firebug- love your work and transparency, I’m 62 and have learnt so much from u. A little bit of wisdom for u- well it’s my idea of what could be going on for u- I used the same analogy for a friend of mine, so hear goes- u have left the “ old” life behind, don’t want it or need it- now you’re are heading into your new life- but your in the corridor in between the two- it’s full of shadows, cobwebs, doubts, unknowns, so we have all these feelings and we are not sure what it all means- this is good but can take a while, as my Dad would say you are sorting the wheat from the chaff- old farmer- but one needs to sit with the discomfort till the answer arrives- I wish u the best of everything. I hope this helps. A grateful fan ❤️❤️❤️❤️❤️

What a great analogy Margie.

I’ve been chilling in the corridor for a few years. I’m ready to punch through the next door now 👊🚪 yeeeeew!

Short and sweet, always a joy to read (currently waiting on Athens airport so appreciate the lack of ads and slow loading times haha) keen to hear how your business idea goes!

Thanks mate.

How’s Athens? I heard it can be a bit dodgy. Great history though

In the red six out of the past 12 months…like all of us:)

“One of us, one of us”

I’m a long term reader, first time commenter. Your blog came the exact week that I had been pondering something I’ve read recently about finding a balance and living somewhere in the space between hedonic adaptation and ambition regression, neither being a satisfying state to be in. I hope you find yours, I’m working towards mine too!

I haven’t come across the term ‘ambition regression’ before. That was an interesting Google. Thanks 🙂

P.S. Humans are bizarre!

Hey mate, sounds like you’ve got some good goals ahead of you. As a couple of others have said, maybe consider volunteering a day per week, that’s one of my goals when I eventually hit FIRE. I am lucky enough to do some volunteering via my job, and I find it really fulfilling. You’re in the fortunate position where you have lots of time and freedom, so you can potentially do some real good. 🙂

This is a really good idea Raven. Something I need to look into more

Nice philosophical update mate! 😉

It’s a delicate balance sometimes, aiming for new things while being happy with how things are.

I think what matters is we get to remove money from the reason why we do things. So we can start something new for the purpose of like you said creating a great small business work culture or working space etc. Something we can be proud of when we look back later.

So I think we need a good ‘why’ behind any new goals undertaken, otherwise it’ll distract us too much from enjoying our current life and won’t end up being a meaningful use of our time.

Sage advice as always Dave.

Your wisdom really doesn’t match a 33-year-old 😂

I think you were a stoic philosopher in a previous life mate ☯️

Lovely article AFB. I am curious if you could do a podcast/article about the digital product that you created

(obviously I know you would not want to give away too much).

Was it a particular niche that you identified? And if it was in the visualisation space how do you compete with Tableau / Power BI?

Have you found marketing the product to be difficult?

How do the multi-year contracts with companies work, is it all Government departments?

A few people have asked about this.

I’ll think about it if/when we have a foothold in the market.

1. We have identified a niche

2. It’s not visualisation software. It’s more data engineering

3. This is the hard part but I have a few different strategies I’m going after this year

4. They usually sign up for 3-4 years. It’s how most software licenses are sold within government departments at a certain level.

That shirt has gotta be from Lowes!!! In true ‘FIRE’ fashion. Haha – great to finally put a face to a name after all these years. Looked like an awesome event, mad kudos to going to be a part of it all – you’ve done pretty well with the anonymity since your blog’s infancy.

Thanks Elim. I’m not sure where Owen got it from haha.

I can relate to the not knowing what to do after being so “busy” and “driven” for so long. Volunteering is where I am finding there is a need for people with “time” as their resource. I live in a small local town as well in region NSW not far from VIC border. If there are any interests you have the align with a local group (Scouts, Library, Schools, Vic Parks) it might be fun to look into it. Especially if you want to suss out future activities for potential future kiddo. Checking it out when you have time before they come along is a great resource for future decisions, and you network with future peeps that have similar family values to you for those bbqs, maybe camping trips, group trips to the beach,etc. That’s my tips as a recent parent to littles and also struggling with finding a lack of purposeful involvement with other adults “doing something”. Hope that might help you with ideas to explore locally.

Great tips Rose.

There are a few groups I’ve been thinking about volunteering with. I should reach out and just do it!

Cheers

Hey mate. What is the rationale behind selling all your IPs. Do you have a blog post where you explained this?

I give some brief commentary around the decision here mate (under the properties section).

https://www.aussiefirebug.com/nov-2021-net-worth/