I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

Speaking as someone who works in data and analytics professionally, you wouldn’t believe how many companies are trying to sprint before they crawl.

The data science hierarchy looks something like this.

A lot of people are trying to jump to the top of the pyramid (artificial intelligence/machine learning) without establishing a solid base.

Half the time these companies don’t even have enough data to warrant paying expensive Data Scientists.

I’ve worked on some incredibly expensive proof of concept projects that had hoped to train models to better predict future revenue streams.

The issue? The company couldn’t even produce the necessary datasets that were needed to train the models. They couldn’t extract their own data into a meaningful format (the Collect part of the pyramid)

They were trying to bake a complicated cake without having the ingredients first.

On the contrary, Spotify’s ‘2022 Wrapped’ feature is a perfect example of how to visualise data in a meaningful and useful way.

They’re not using any fancy pants AI/ML algorithms or training models or any of that higher-level stuff.

They’re just showing you your data. But their presentation of the data is what sets it apart.

This was the first year they releases a wrapped version for podcast hosts. It was really cool seeing some stats for the Aussie Firebug podcast.

It was a lot of fun seeing some of the posts you guys tagged me in on social media too. It means a lot to me when I see the AFB pod has made their top 5 podcasts for the year 🙂

P.S.

I’m so excited to meet some of you guys at the Rask event this Friday.

The event was a total sell-out and there will be more details on the afterparty on my Facebook events page here.

Net Worth Update

November was pretty much a carbon copy of October. Shares and Super were up, Bitcoin went backwards and our cash holdings went down after booking another holiday.

The big story in November for Bitcoin and Cryptocurrencies, in general, was the downfall of a Bahamas-based cryptocurrency exchange called FTX.

Before I get into my thoughts I want to make it crystal clear that I have part of my wealth tied up in Bitcoin.

This inevitably means my views are so what biased. It’s hard for me to objectively write about this story without it sounding like I’m trying to defend something I’m invested in 😅… but here goes nothing.

FTX was at one point in time, the third-biggest cryptocurrency exchange (by volume) in the world. We’re not talking about small potatoes here.

SMB (pictured above) and Zixiao Wang founded FTX in May 2019. On the 11th of November 2022, FTX filed for bankruptcy with reports stating $1.7 billion of customer funds had vanished.

😬

The story is still unfolding but obviously, some shady shit went down and a bunch of people lost their money.

So many people on Twitter, Facebook (in my own group) and Reddit have been parading this story around like it’s some sort of ‘I told you so’ moment.

This attitude represents a fundamental misunderstanding of why Bitcoin was invented in the first place and how third-party intermediaries must be regulated.

It’s actually a bit similar to people trying to tell me investing in shares is like playing the casino every time there’s a market crash. Most of us in the FIRE community know that isn’t true, but it’s unbelievable how widespread that rhetoric is within the general public that doesn’t know how it works.

A quick history lesson on Bitcoin.

- 2008

- An anonymous person/group called Satoshi Nakamoto designed the original bitcoin protocol in 2008 and launched the network in 2009. The whitepaper’s abstract read:“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

- 2009

- The genesis block was mined by Satoshi Nakamoto at the start of 2009. A secret message was instilled within the Block’s raw data:“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

- On October 11, 2009, Martti Malmi helped create the first exchange (Bitcoin for fiat) of Bitcoin, called ‘New Liberty Standard’.

- 2010

- In 2010, the first known commercial transaction using Bitcoin occurred when programmer Laszlo Hanyecz bought two Papa John’s pizzas for ₿10,000 ($253.3M AUD).

- 2011

- In February 2011 bitcoin reaches parity with the US dollar. ₿1 = $1 USD

- The first major users of bitcoin were black markets, such as Silk Road.

- 2013

- Bitcoin’s momentum builds and suddenly rises from $125 USD in September to over $1,100 USD at the end of November.

- On December 18, 2013, a drunk bitcoin trader created a meme when he misspelled hold as “HODL”.

- 2014

- In July 2014, the exchange platform Mt. Gox announced that 850,000 Bitcoins (valued at $460,000,000 USD at the time) had disappeared from the portfolio of its clients. According to investigations, the theft occurred because the hackers managed to gain access to the credentials of an official auditor who worked for the exchange.

- 2015-2017

- The block-size war

- 2017 – present

- Multiple exchanges have been hacked and hundreds of millions have been stolen. The latest and most infamous being FTX

- Bitcoin’s value has fluctuated dramatically

- The network continues to run

There are other important things that have happened but that’s all the major ones I can think of.

What happened with FTX and all the other exchanges is not a fault of the technology.

Ironically, the entire value proposition of Bitcoin was a P2P transfer of value without needing a third party because they can’t be trusted… and then everyone started storing their coins with third parties.

Bitcoin was created to give financial sovereignty to the individual. You could send and receive your money without having to get permission from a financial institution.

Better still, you could protect your money from mistakes made by bureaucrats and central bankers.

The Australian dollar is a safe and secure currency so this concept is probably foreign to the majority of readers. But imagine if you lived in Venezuela, Zimbabwe or Turkey. Some countries have frozen their citizen’s accounts so they can’t take out their own money. And then they have the audacity to say it’s for their own good!

Let me make something crystal clear. I would never recommend anyone to put their hard-earned money into such a new technology like Bitcoin. Hell, I’m not even that confident myself that Bitcoin will be around in 10. It’s just too damn risky and so many things could go wrong.

However, what happened to FTX is in no way shape or form, a fault of the technology (which has a number of other shortcomings). It was greedy human nature/corruption that caused the collapse. I can’t speak for the creator, but I reckon there’s a good chance that greed and corruption played a big role in the motivation to create money that’s free from centralised human influence. It’s a lot harder to collude when the majority is in control.

This brings me to another interesting discussion point.

I had a fun back-and-forth with The Motley Fool’s Scott Phillips (a former podcast guest) on Twitter the other day.

Here was the Tweet thread.

Shouldn’t that be up to the the individual to assess @TMFScottP?

I’d never allocate that much % to such a speculative technology personally, but when does self responsibility kick in?

Who’s going to make the decisions on what’s too risky and what’s allowed?

— Aussie Firebug (@AussieFirebug) November 29, 2022

If you’ve followed this blog long enough you probably know that I’m a big advocate for civil liberties and freedom for the individual. I don’t believe the government should restrict my investment options when I’m using my own money. I believe in the freedom of choice even if that choice carries risks.

I think it’s reasonable to allow individuals to make their own decision even if it’s potentially self-harming.

It’s a different story when it comes to affecting third parties though and that’s the reason why I’m in favour of regulating exchanges. I personally don’t think exchanges should be allowed to hold customer coins in a custodian manner. This goes against everything Bitcoin stands for in the first place.

Not your keys, not your Bitcoin!

Back to the point. Whenever the topic of rules and regulations in Super is brought up, eventually, all roads lead back to the same argument.

“Their risky investing does affect me because if they lose their Super the taxpayer will have to fit the bill”.

And this is where it ends for me. Because if that’s the way you think, then literally every single risky activity could potentially be affecting the taxpayer.

Do you smoke?

That’s selfish because you could get sick and then medicare has to fit the bill. We should ban that.

Do you race motocross?

That’s selfish because you’re increasing the likelihood of hurting yourself and having a tax-funded ambulance come and get you. Please consider others before you go out dirt jumping. We should ban that.

Do you eat junk food?

That’s selfish because the consumption of junk food increases your likelihood of medical morbidities which might put further strain on the tax-funded system. We should ban that.

Ok. Maybe I’m being a bit pretentious.

And those examples aren’t exact apples-to-apples comparisons but it’s really hard to think of anything that doesn’t have third parties affects.

Like seriously. I could draw a very long bow with just about anything to tie it back to third parties.

We put higher taxes on certain goods and services to discourage people from participating (such as smoking and alcohol). But we don’t outright ban them.

Where do you draw the line?

Ultimately, I’d never encourage or suggest to anyone that they should start buying Bitcoin in their own SMSF, but that doesn’t mean I’d support the government outlawing it.

Education is key. Forcing people never works as well IMO and we should be allowed to try and fail in our endeavours.

I’d love to know your thoughts on the topic. Should certain risky assets/investments/speculations (whatever you want to call them) be banned from Super?

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Shares

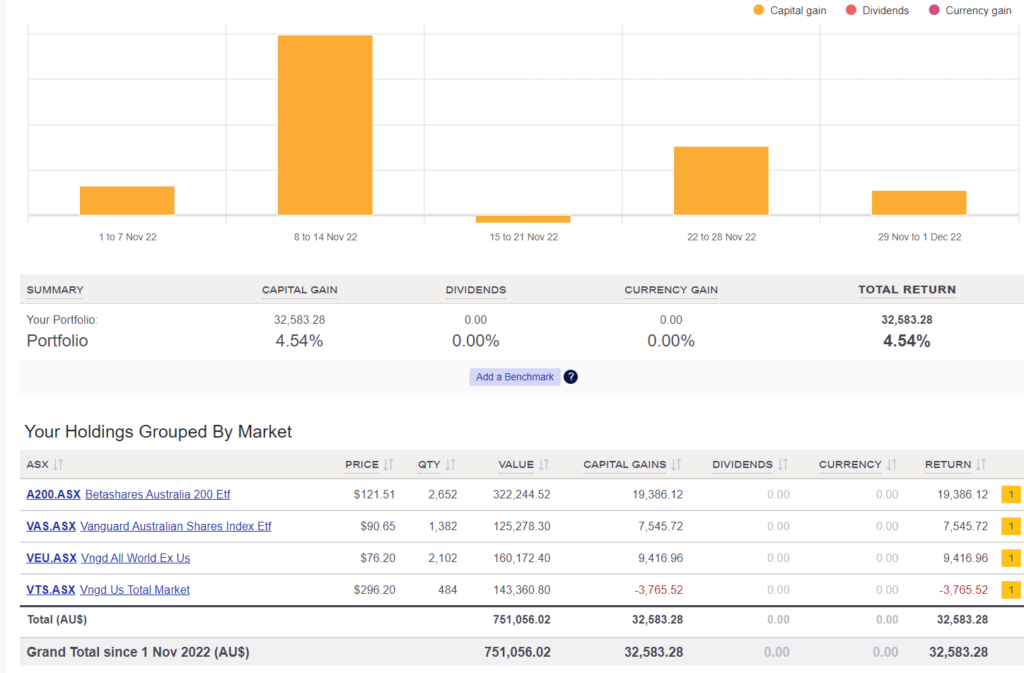

The above graph is created by Sharesight

A big month for our shares.

We didn’t purchase any shares in November but we did buy $2K worth of Bitcoin.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Some laughable logical fallacies on show with your commentary around your crypto financial libertarianism.

Comparing smoking with crypto is funny – remind me how much smoking is taxed to offset the costs on the health system? 70%? I’d be cool with a 70% tax on Buttcoin to offset the costs of bailing out cryptards.

Last time I checked motocross was a niche bogan sport but if it did impact the health system it should have additional costs on it to offset the impact

Junk food (read: Sugar) should be taxed and probably will in future and it will be a good thing.

Vote #1 Lleyonhelm!!

Lol at bogan sport.

I already addressed your concerns in the article and my main point was that those risky activists are not banned.

Yes, some of them are taxed.

There’s nothing wrong with taxation.

Great summary mate, frustrating the comments from people who haven’t spent 5 minutes trying to understand what Bitcoin is and it’s potential and just parrot the media lumping Bitcoin with all other cryptocurrencies!

Thanks mate.

That’s the thing, I think it has real potential but it also might be worth $0 in a few years.

No one knows for sure.

Shouldn’t it be up to the individual to make that judgement call?

If we banned everything that potentially affects the tax payer, life would be pretty boring.

Education, taxes where necessary and some regulation is a much better solution than outright banning something IMO

Great and thought-provoking post – as always.

My comment is to ‘Bilbo’:

Maybe, just maybe, because you don’t like something doesn’t make it bad? Proclamations such as “Last time I checked motocross was a niche bogan sport” ruins any credibility you may/may not have.

I also don’t like Crypto, but that don’t mean I have to be holier-than-thou about it.

You might want to lift your game!

Re: regulation of Super, I don’t have a firm opinion about restrictions on crypto, but when you talk about ‘your money’ I think we need to be clear about the significant tax concessions available through super (at contribution, accumulation and pension phase).

In exchange for those benefits (which let’s be honest, disproportionately benefit high income earners) I think it’s reasonable for the government to place extra conditions on the use of that money.

This is a fantastic point Cass and one I hadn’t considered before.

I’ve always viewed Super as the individuals money. But your point about the tax concessions have made me rethink that a bit.

Good food for thought. Thanks for the comment

Don’t rethink it too hard. What – the government takes less of your money off you now, so that you support yourself later on?

As for who it benefits, well it’s hardly a surprise if the people who pay the most tax get the biggest discount. Remember Super when first set up had no tax on contributions at the start – until the government saw all this money it could then tax…..

By the same logic we can let people withdraw their super and take it to casino – self responsibility! Super should not be seen as “my money” but as a protected withholding kept by the government until the retirement, then it becomes your money.

I think where I’m tripping up is thinking it’s my own money.

I can understand a lot better if I think of it as the government’s money they give you once you hit preservation age.

Under that setting, outlawing certain assets classes makes sense since it’s public monies and not the individuals.

Thanks for the comment Vlado

I’s not held by government, rather it’s held in trust for you once you pass criteria (age, death)

Thanks for the update, always enjoy reading it. And great for zooming out and seeing the progress overall, good on you. Just did the survey looking forward to seeing how that goes too.

Thanks Natasha 🙂

Hey,

Just recently decided to move my super to 100% BTC. Here’s the logic behind it:

– Super structure really helps long-term hodling, can’t withdraw means can’t gamble it away

– Taxation is theft, so less taxation is better

– Diversification is achieved by me investing outside of super, at the same time I have access to that money and if I see a better business opportunity, than investing in 200 dying companies through index fund – I’ll go for it.

– I have russian origins and what happens when government runs out of money? They raid your super and you can’t do anything about it, so holding my own keys gives me some piece of mind.

– Most importantly I consider BTC to be hedge against the government, if government and super system collapse at any point in time – “no super withdrawal” rule disappears and I will be able to start using it to support myself financially

“Tax is theft” – you’re probably saying that after being born in a public hospital and educated in a public high school.

The idea that somehow our societies would just work perfectly if there were no tax is laughable. You only have to look to the US to see how individual greed doesn’t allow for society to support itself without government intervention.

While I don’t advocate for more taxes, I’m actually fine living in a highly taxed country so we can have the lifestyle we do.

As for crypto, I’m old enough to remember Ostrich eggs from the early 90’s and have a similar thought toward crypto.

Bitcoin should most definitely be allowed in Super. It’s going to continue to be a fantastic asset to hold long term. It must just be held in cold storage and not on exchanges.

If you allocate a small percent of saving towards Bitcoin during this bear market, it’s will become a much larger percent of your portfolio in years to come.

“Taxation is theft” aahhahahahahahahahahahahahahahahahahah

No seriously……..hahahahhahahahahahahahaha

Ok, for real this time….

Do you also think using the health system, fire brigade, roads, etc, etc, etc is theft? Yeah, didn’t think so.

As for Super and bitcoin….

Super is absolutely NOT the Government’s money. It is our money, held in trust, until such time as we meet certain release conditions. It is a dangerous precedent to classify it as the Governments money. Of course, the Government will change the release conditions and take other such liberties to effectively gain control of that money but that is no different to any of the other ways and means they can take control of our money outside Super.

So is Bitcoin the answer? Personally, I do not think so. Should it therefore be banned within Super? I’m not sure were I sit on that. I generally agree with AussieFB about regulation and education, etc. But there are some things that are banned and maybe something like that, inside Super should be one of them.

I’m glad I made you laugh,

It’s a catchy phrase, but what I’m saying is – there are better models.

Here’s an example https://free-cities.org/

Dubai can be another more tangible example.

Does high earner need more public healthcare than a low-income earner? Are you happy subsidising roads for heavy road-users? Do you even know where your money is going and do you have a say in that proportionally to your contribution?

Fire brigades? Really? It’s relying on volunteers to exist, government doesn’t spend shit on them.

What part of the world do you live in Sergey?

In Australia, metropolitan fire brigades are staffed by salaried fire fighters, who get paid pretty well. The country or rural fire authorities are volunteer.

As for using Dubai as an example of somewhere to hold in high regard, NEXT!!

Hi Adam,

Thanks for the comment.

Who controls the trust that holds the money? The more I think about it, the more it seems like Super isn’t really your own money until you hit preservation age.

What does ‘your own money’ even mean anymore?

There are restrictions on how I can spend my $$$’s I own outside of Super right now but I still consider that ‘my money’…

Damn, I’m opening up a can of worms. I need to go take a walk haha

It’s your money. Your employer and/or you (salary sacrifice, post tax contributions) put money into a fund. The govt doesn’t let people access it till a certain age because 90% of people don’t have the discipline to not spend it.

Btw is your BTC exposure through an ETF or do you go through and exchange?

Thanks for sharing this update, definitely some thought provoking points you make. It has stimulated plenty of spirited debate in the comments section!

I appreciate you putting yourself out there by posting these updates, it is fantastic to see someone being so transparent with their finances and approach to money, but you definitely make yourself a target for “critiques” of your investment strategy and philosophy.

For what it’s worth I am also a big believer in personal responsibility and self-reliance, and to digress slightly I must say it has been a libertarian’s nightmare these last few years.

I think Bitcoin is a hedge against government overreach, Central Bank Digital Currencies and increasing authoritarianism. I also hold a very small % of net worth in this speculative asset class, in self-custody as well to protect it from charlatans such as Sam Bankman-Fried.

It is interesting to contrast his treatment with other ponzi scammers such as Bernie Madoff, who was in handcuffs the next day once his chicanery was unearthed. SBF must have some powerful friends.

Keep up the good work and thanks for sharing.

I really appreciate the comment David.

It’s weird that civil liberties and freedom have negative connotations these days… I mostly blame Trump for that lol.

A healthy mix of individualism and collectivism will probably produce the best outcome.

I don’t mind paying taxes to fund/subsidise great socialist programs like medicare, HECS loans and the pension.

But I also want to have autonomy over how to invest in my Super.

It’s a balancing act IMO

It’s great to see the podcast doing so well mate, nice to see some reward from all the hard work you’ve put into it over time! Same with the portfolio!

Interesting thoughts on crypto/SMSFs etc, like you I lean towards the idea that people should take personal responsibility for these things both when they go well and when they don’t, but the reality is in that in our society there are a bunch of guard rails both good and bad. There are already a bunch of rules around what SMSFs can and can’t invest in, and whilst I personally would take the approach that SMSFs should be able to invest in crypto (although I don’t invest in it myself) I can see the case for restrictions on doing so. Sometimes there’s no answer that will keep everyone happy!

On a related note, one thing that the people who talk about tax concessions for super never seem to bring up is that if you save enough money, then because of the means testing of the age pension, you don’t get any age pension. At roughly $40,000 a year for a couple receiving the full pension, that’s a lot of money to be missing out on and may well be more than the tax concessions that have been received. If you live for 20 years after age pension age, so 87, that’s 20 x $40,000 = $800,000 you’re missing out. You’d need a pretty big balance in super to have received enough concessions to compensate you for missing out on that, particularly given the tax free threshold outside super.

Guard rails is a good analogy.

The tax concessions are really interesting.

But what’s the alternative?

Invest outside of Super, don’t get the concessions AND don’t get a pension?

I’m all for building up a nest egg that’s accessible before 60 but purely from a numbers point of view it’s hard to beat investing inside of Super.

I think when you’re deciding whether you should put extra money into super you really have to look at when you’re planning on needing that money. If you want to retire at 30 or even 40, putting anything extra into super likely doesn’t make much sense at all. If you want to retire at 59, then you’ll only need one year of available funds to plug the gap. Everything in between probably requires you to have a decent look at the numbers and your overall situation!

The most snarky comments I’ve seen on your blog. At some point you’ll say ‘sod it!’ and it’s a shame how this can happen to those who put their opinions out there online.

Great post. A balanced and open-minded view of crypto in general. The shakeout of all the bad actors in the Luna fallout, which FTX is really just an extension of, is a good thing in my view.

The outrage in some of the anti-crypto comments are pretty outrageous, and I can’t fathom why people care what others do with their money. Being angry that there’s dodgy actors and some people get screwed over is one thing, but the comments are more along the lines of “I told you so”, “Serves you right” etc.

Perhaps there’s an element of jealousy of those that made big profits while they sat in the sidelines missing out. Or perhaps there’s a human nature element to it when one doesn’t understand something well enough.

It sucks that some of the platforms like BlockFi / Celsius got caught, but they were swimming naked when the tide fell, so to speak. Celsius with exposure to UST and BlockFi with FTX as a crumbling foundation.

The thing is, people don’t lose their marbles and decry the entire concept of corporate entities and share ownership as tulip mania when some company is caught up in major corruption (Airbus, Enron, One.Tel, Lehman Bros, Theranos, VW, Madoff, HIH etc etc.)

The fact that the comprehension of what Bitcoin is compared to Crypto in general is pretty telling all over. We’re still so early.

Reminds me of this from 1993.

https://www.youtube.com/watch?v=2kfIFDX9kE4

P.S. Agree with Crypto in a SMSF.

Great comment Big Dog.

There’s a bloke in my Facebook group that posts negative things about Bitcoin and other Cryptocurrencies. I keep thinking… “Mate, if you think it’s going nowhere, wouldn’t you be better off ignoring it?”.

Doesn’t make any bloody sense haha.

Thanks for the update. I’m curious about the time line of Bitcoin. Are there similar software/internet based technologies that give an example of how long it would be until regular people would be using Bitcoin? I’ve only really heard niche uses, like black market transactions, one guy escaping Ukraine, el Salvador novelty tourism. What’s a similar technology and what’s the time frame until it becomes widespread for a functional purpose? I also wonder what happens in one hundred years (or however long) when there are no more new blocks. How’s that work?

My confusion is what is the logic of “investing” any money in something as speculative as crypto currency when there are so many other more proven, easier options to make money such as individual shares, etf’s, index funds, managed funds, and property where the odds for success are more in your favour. Are people buying crypto to make quick money and then there are some doing it for ideological reasons. Even if people say they’re only investing a small amount (5%) in crypto, what’s the point if they end up losing that 5% of their money and the missed opportunity costs of being able to use that lost money elsewhere.

I can’t speak for everyone, but we invest for three reasons:

1. I like being involved with new technology and playing around to see how it works. I actively look for merchants that accept Bitcoin. I want to use it. I want to ask store owners why they are using it etc. It’s interesting.

2. Speculation

3. Ideological reasons. I think it can be a superior form of money. Faster, cheaper and more convenient without centralised powers manipulating it. Converting our fiat into Bitcoin helps contribute (a very small contribution I might add) towards mass adoption

Great post and progress. Keep up the useful work with you website and pod. I have been looking at BTC as a very small amount of my portfolio mainly because I find it interesting. I have the mindset that it is likely it would end up $0. I have done lots of reading about it (sometimes getting frustrated with the arguments between both sides in the debate).

I keep getting stuck on what type of and where to store any BTC I buy?

Exchange could go broke (happened recently), hot wallets could get hacked, cold wallet could be lost/break. Storing you wealth creation is important with any asset.

This to me has always been a big risk. Given the most recent news in BTC space has made me even more stuck.

What are others thoughts of BTC storage and which storage is safest?

A podcast on this would be great as well.

Az

Thanks Az.

I’m a fan of cold offline wallets.

I’ll consider a podcast about this in the future.

Have you considered the encryption to Bitcoin isn’t as secure as you may think. It seems very plausible the ‘anonymous person/group called Satoshi Nakamoto’ is most likely the CIA. Not a bad way of financing foreign espionage/political interference etc. Just food for thought, I sympathise with your reasons for Bitcoin I just think you’re better off burying some silver in your back yard and having faith in no one. You don’t know what you don’t know. All the best Bryan.

Interesting comment Bryan. Thanks for stopping by

Hi, with your ETF’s what’s that like in regards to doing your tax returns at the end of the financial year. Does it make doing your tax returns more complicated? Does it result in paying more in capital gains tax since a lot of ETF’s buy and sell stocks during the year? Do you need to use a specialised Accountant and does this mean the Accountants charges are higher. Thanks.

More complicated than what?

There is a capital gains component to it. That’s why you must do your research before you invest. Our simple three-fund splits mean very little work for my accountant. There are plenty of people who do it themselves.

I agree with your point that people can keep their Bitcoin secure from fraud by not using exchanges and keeping custody of it themselves. However, the ease of using these exchanges is a big part of why Bitcoin has gotten so much more popular over the years. I can’t imagine the majority of people deciding to invest in Bitcoin would have done so if the exchanges didn’t exist.

No exchanges -» No new users -» No new money flowing into the system -» No self-reinforcing feedback loop caused by ever-increasing prices

Viewed this way, centralised exchanges are actually a core part of the system that you can’t eliminate – but curious to hear what others think.

I don’t have any issues with exchanges. But they shouldn’t be holding customers’ keys! They should just be there to facilitate a marketplace. That’s it.

Instead, you have all these cowboys trying to sell their exchange coins to customers and offering them insane yields that were never sustainable.

Hi Mate, thanks for all the incredible content. Just a quick question, with VTS and VEU are you just collecting the dividends into a bank account and then reinvesting? I cant find a DRP with them? Thanks

VTS and VEU are domiciled in the US and dont have a DRP.

Thanks mate.

Yep, you got it. Money hits our account, we transfer it to our broker and reinvest.

Cheers

Any chance you can add overall portfolio return as well as the monthly return graph from sharesight.

A little something for you to consider regarding Bitcoin:

‘The hashing algorithm used to protect the security of bitcoin, called Sha-256, was created in 2001 by the National Security Agency in the US (world leaders in cryptography).

There is no way the NSA would release the Sha-256 technology that protects bitcoin if it could not access it. The Chinese know this, which may be why they have banned bitcoin. And the day the world discovers that bitcoin is insecure is the day it is worth precisely nothing.’