I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

Before we get into the update,

The 2022 Aussie FIRE Survey is currently open.

We had 1,298 submissions last year so that’s the target to beat 🎯.

The survey only takes about 10 minutes and I’m going to be leaving it open for the whole of November.

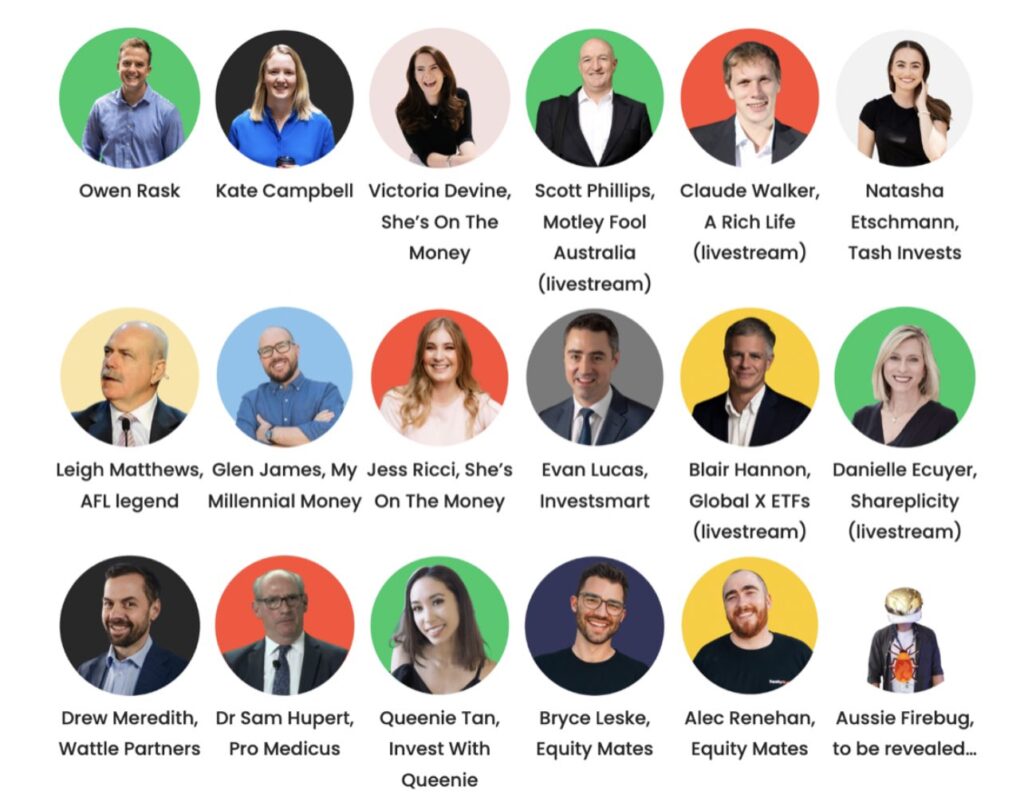

I headed up to Sydney in October for some sightseeing and to finally attend an in-person FIRE meetup that I’ve been trying to make happen for years.

Americans have a financial conference expo for money nerds and content creators called FinCon. I have been secretly hoping for years that someone would create a similar style event here in Australia which is pretty much what happened.

The boys at Equity Mates announced their Finfest (financial festival) a few months ago and I knew this would be a great opportunity to kill three birds with one stone.

I was originally planning to take the wife with me to Finfest but my mate Luke heard about it on one of my podcast episodes and said he was really keen to come with us. So he ended up taking my wife’s tickets since she wasn’t really keen in the first place lol.

Luke’s wife joined the crew and the four of us had an absolute blast over 4 days exploring Sydney, hanging out at Finfest, meeting everyone at the FIRE meetup and chatting with the team at Pearler HQ.

Here are some shots:

My highlight was definitely meeting people at the FIRE meetup.

I love receiving emails from readers/listeners that enjoy AFB content but it’s so much better when you get to meet members of the community face-to-face.

Shout out to Derek too who helped organise the meetup 👏, although the music was really booming at the bar that I lost my voice from speaking so loudly 😅.

We ended the weekend by meeting the team from Pearler at the WeWork office. I had been banging on about this co-working space during the whole trip and I was low-key very excited to show everyone what it was all about.

Awesome co-working spaces are something I sorely miss from London and I’ve been trying to pitch the idea to Luke (who’s a builder) that we should try to do a watered-down version of WeWork in our hometown. I have no idea if it would work but I’m very confident more and more people are going to start their own little business in the coming years.

I just love the vibe at those types of places. The energy and atmosphere at co-working spaces that are mainly made up of entrepreneurs/creatives is inspiring. I found that there’s a lot of cross-pollination of ideas when you get a bunch of like-minded people in different industries in the same room.

Working from home this year has meant that socialising at work is basically non-existent for me.

Starting a co-working space would be awesome and Luke and I have already checked out a potential space in town. There’s a lot more research to be done and it’s exciting to think about the potential. I’ll be sure to keep ya’ll updated 🙂

Lastly, I’ve received some emails from my fellow Victorians asking when the Melbourne FIRE catchup is happening.

Well, it was a bit late for me to organise something and it’s surprisingly difficult to book a place without paying a fortune so I’ve decided to piggyback off an event that Rask Australia is hosting.

I was invited by Owen (founder of Rask) to speak at the event along with a whole bunch of other awesome guests.

I’ve always been a bit hesitant doing live gigs just because of the whole anonymity thing but I think it’s time to step out into the light.

I’ve remained anonymous throughout the years partly because I didn’t want my boss to know that I’m planning to retire early. I thought it might negatively affect my career progression during my accumulation phase.

But since I’m my own boss now, it’s less of an issue 😂.

There are limited tickets but you can get $10 bucks off the price if you use the code fire on checkout (limited to the first 25 spots)*.

Tickets are available here.

There’s going to be an afterparty too but I don’t know all the details yet. I’ll be making an event about this catch-up on my Facebook page.

I’m really excited to be speaking and I hope I can meet some of you guys at the event 👊.

*I’m not receiving any kickbacks for that code/the event

Net Worth Update

A big month for our shares with Bitcoin being our only asset class that went backwards.

Sydney was relatively expensive but nothing major.

We bout $2K of Bitcoin during the drop in October.

Cash remains high and our shares are back in the 700’s

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

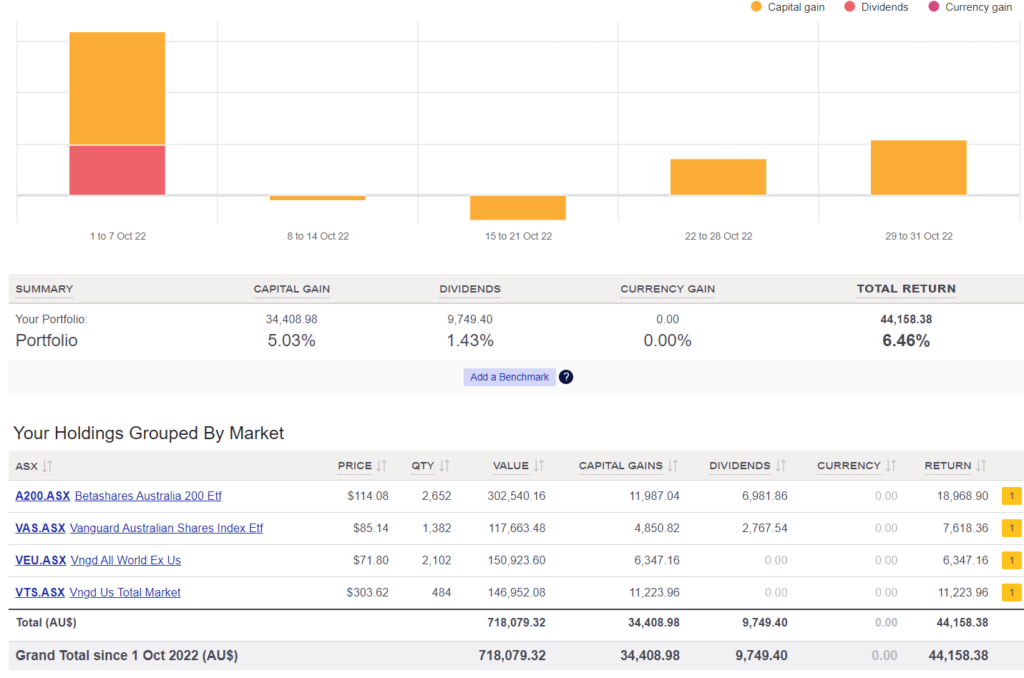

Shares

The above graph is created by Sharesight

Nearly $10K worth of dividends 🤑🤑🤑.

We’re still down ~$20K overall for the year but it’s always a nice little psychological boost seeing that much money being generated from the portfolio.

We bought $13K worth of VEU in October too.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Awesome mate where and when is the event in melbourne ?

9th of December. Location TBA but I know it’s ganna be in the CBD 🙂

Thanks for the link, I just clicked through. Will you invest in individual stocks next year or will anything change?

Cheers.

No plans atm. Sticking to ETFs for the foreseeable future.

Our small Bitcoin holdings are our biggest gamble. But I’m not ruling out a satellite portfolio one day maybe.

The Rask event looks good! Having said that, sooo many speakers and it’s an evening event. I imagine they’ll only speak for about 15 minutes each, haha.

There are going to be multiple people on stage at the same time. I’m in a group too.

Most of the presentation are for 30 minutes.

Goodday mate! Long time follower. What platform do you use for your shares ? Pearler for example ? Would you recommend any please ? Can you trust those platforms such as Pearler or SelfWealth ? THanks again

I can’t say anymore since ASIC have barred people like me from speaking about financial products. But let’s just say it starts with a ‘P’ and ends in ‘er’ and you may or may not have typed it in your comment 😉

Hi mate. I was thinking as reading the post ‘I wonder why you’re still anonymous’…. And then I read about the Rask TBA event. Good on you for going public 👍

Anyway, mate I enjoy following your blog but on iPhone/iPad safari, when trying to read these comments, it a;ways scrolls back up to the top. Near impossible to read them. Has been like this for years.

Thanks Dickrog,

I had to pass up opportunities in the past due to my anonymity, but this Rask event was just too good to decline.

A few people have told me about this bug before. What version of the iPhone are you using? It works fine on my wife (iPhone 13).

Hi 👋 just a question regarding your net worth, do you not have a super balance? Or is that included in your shares?

Super is in there.

Currently at $145K 🙂

Hi, has the recent collapse of FTX made you have any second thoughts about investing in crypto?

Nope. I’ll be addressing that in the next net worth post.

What happened to FTX was exactly the type of thing Bitcoin was invented to stop. Holding your coins on an exchange defeats the purpose of a decentralised currency IMO

Hi, why does your VEU not have any dividend?

Maybe the Ex-dividend date wasn’t in October?