I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

Firstly,

I’m going to be in Sydney this Saturday night for the FIRE meetup.

If you’re interested and want to hang out, the event is on Facebook here.

We headed to New Zealand for the school holidays in September.

This was our 3rd overseas trip for the year which is out of the ordinary for us. We’re planning on travelling throughout our early retirement but this year has been supercharged.

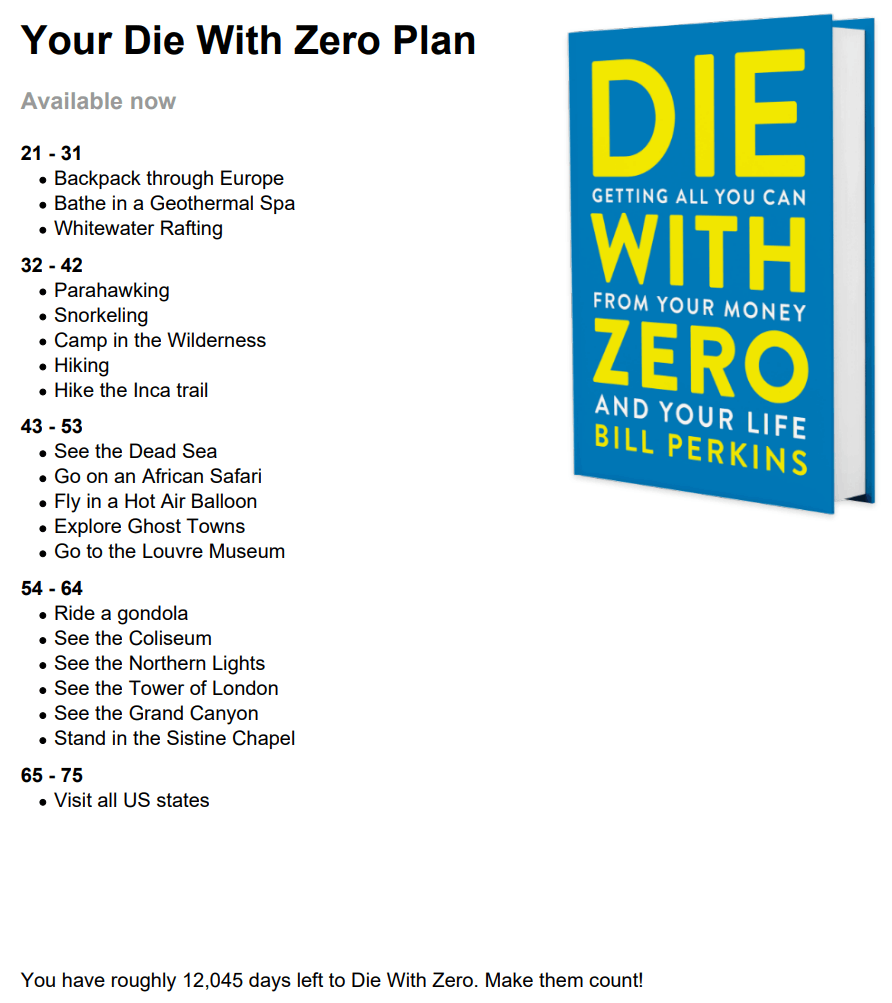

I attribute the excessive travel to a book I read early this year called ‘Die With Zero’ by Bill Perkins.

To cut a long story short, Mrs FB and I are trying to do as much travelling as we possibly can before we have kids.

After I read ‘Die With Zero’ I kept thinking…

We’re young, fit, healthy, have no dependents and have enough money to last 30+ years if we really wanted to. Why don’t we pull back on the accumulation phase a tad and start to harvest our hard work before we get tied up with raising a kid?

The logic makes sense to me. There are a bunch of experiences that lose value as you get older or are not available to you anymore. And conversely, there are some experiences that can be enjoyed much more when you’re older and can appreciate them.

Backpacking through Europe, whitewater rafting and hiking the Inca trail all take a certain level of fitness and stamina to do. These experiences would best be enjoyed when you’re young.

Other experiences like seeing the Pyramids of Giza, riding a gondola in Italy and seeing the northern lights are less demanding and will probably be appreciated much more as you age.

Writing down everything you want to experience in life and putting them into decade buckets helps to highlight the point I’m trying to make.

Here’s an example plan

So basically what I’m getting at is you’re going to keep seeing our travel pics roughly every 3 months until we have kids 😅😂.

But back to NZ…

I had actually been to New Zealand before and we really wanted to do Japan instead but the travel restrictions are still a bit weird. I think you can technically travel there but everything you do has to be via a tour guide. So we decided it would just be easier to jump across the pond and check out the land of the Haka, sheep and hobbits 🙂

Here are some pics during our travels.

We started in the North island and made our way down to Queenstown where we spent most of our time. Milford Sound is amazing and the drive to Wānaka was breathtaking.

I have to say, Queenstown is seriously one of the most stunning places I’ve ever been to in my life. It’s not hyperbole to say it has 360 degrees of incredible scenery surrounding the town. The combination of the three snow mountains and lake is simply phenomenal.

I love what they’ve done from a town-planning perspective too. A lot of walkways and an entire area near the pier that’s open to pedestrians and not cars 👏.

And how could I talk about Queenstown without mentioning their arguably most famous product… the FERG BURGER!

I’ll also give a massive shoutout to the Ferg Pie too. It would have to be up there with the best bloody pie I’ve ever eaten. Simple incredible.

I also caught up with Ruth from the Happy Saver whilst in Queenstown.

It was so cool meeting her and her husband Johnny in real life. We met for a morning coffee which lasted 3 hours!

Ruth and Johnny are some of the best examples of what FIRE and early retirement is all about. They’re the embodiment of being smart with your money and maximising happiness. We hit it off so much that Mrs FB and I actually swung by their home a few days later after coming back from Milford Sound.

It’s always fun checking out another podcaster’s set-up and home office.

Oh and lastly, for those wondering… yes, I did do a Bungy jump. It was 10 years ago when I first went, but I still did it!

Net Worth Update

Holy moly.

Pretty much all our assets got smashed except for Bitcoin which was up a bit.

The share market had big losses and combining that with our trip to NZ meant that the old Net Worth took a decent dive this month (our second biggest drop ever).

We bought $1K of Bitcoin at the start of September and we plan to do another $5K into ETFs for October once one of my freelancing invoices comes in.

A few people have been commenting on our unusually high cash buffer lately.

There are a few reasons for this:

- We want to buy a new car in the next 12 months and I leaning more and more towards an EV that doubles as a home battery solution. That might cost $60K+ all up.

- Mrs FB isn’t sure what she’s going to do next year in terms of work. Maybe she won’t work at all… this means our cash flow will be impacted which has resulted in us having a higher cash buffer. It helps our sleep at night factor

- My freelance business is sporadic. I love being a freelancer because flexibility and creative freedom are awesome! But if you need a steady paycheck, freelancing ain’t it. This again means that we just feel more comfortable having a higher cash balance than usual.

I’m finding it hard to allow myself to start harvesting money from the portfolio. I think this is one of the biggest physiological advantages of receiving dividends as opposed to selling shares for income. Receiving dividends just feels better because you don’t have to sell anything. Even if there’s not a mathematical difference between the two, I’m more likely to receive dividends and start to use them to pay for expenses vs selling down my portfolio for some reason.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

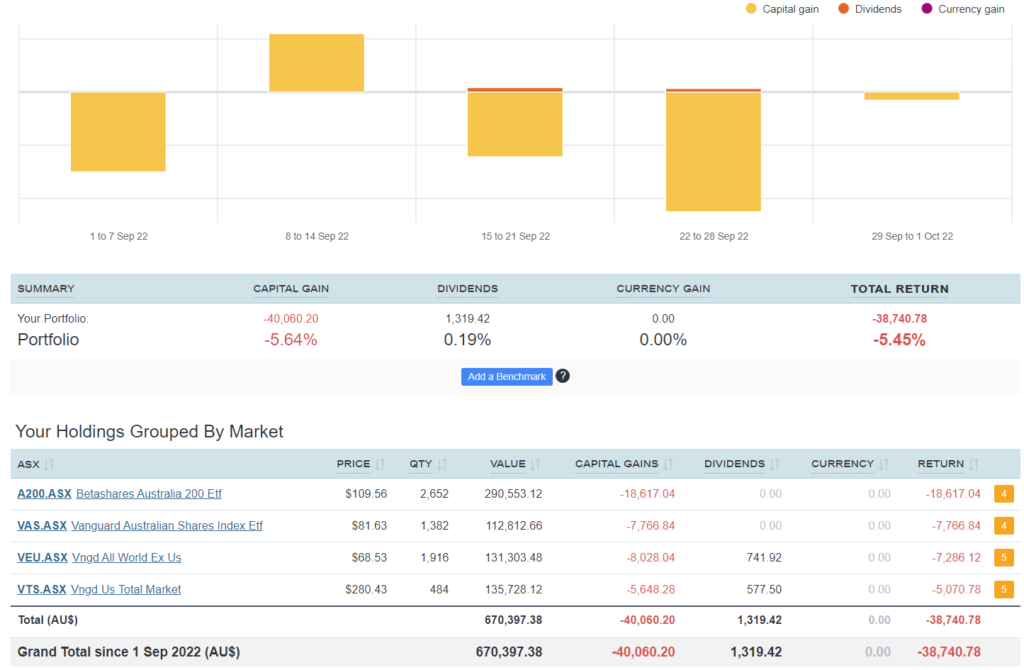

Shares

The above graph is created by Sharesight

A lot of red this month.

I’m feeling a bit guilty for not taking this opportunity to pour in as much money as we can. The thing is though, I’m not all as fussed about it as I once was. We’re living a great life at the moment and I know we will get to full fledge FIRE one day anyway.

I keep seeing the market drop and have thoughts about picking up some more lucrative contracting work to get more cash to invest. But this of course comes at a cost of time, energy and stress. I’m pretty happy with where we are sitting at the moment so I’ve just been plugging away with my freelance business and enjoying life travelling around.

It’s so hard to shift out of accumulator mode after being in it for most of your life. There reaches a point where building wealth takes a back seat to other endeavours. Even though we’re not full FI yet, I feel like we’ve reached that point now.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

I have been looking at the charts if the USD keeps rising it may be possible that our cash will end up been almost 40% devalued just look at whts happening with GOLD prices in AUD vs USD at the moment and compare with DXY with what happened during the 80s.

Can you please explain the process of buying bitcoin?

Thanks

I think it’s time to move from growth into preservation. It’s clear that we’re now in a very volatile period, with falling stock AND bond prices. Maybe you could get someone on who is expert at managing assets at a time like this? I agree with the holidays, by the way – might as well spend before inflation eats away at your pot!

I second that. I worry that the underlying principle of Fire (longterm average stock gains) won’t work anymore. Think Japan’s lost decades wich still hasn’t recovered, Argentina, Weimar Republic etc. On the other hand preservation comes at a cost. Would love to learn more. Otherwise: congratulations, awesome achievements!

Also see Ray Dalio’s predictions of a changing world order.

Thanks.

It’s easy to get caught up in the doom and gloom talk. Maybe it will be another lost decade… who knows?

What I do know is that there’s also a risk of sitting on the sideline waiting for the perfect time to invest.

I’m also very confident in my ability to adapt to different environments. It’s possibly the best thing that we humans do. We adapted to different circumstances and innovate.

Time will tell I guess.

As in what exchange do I use and stuff?

Travelling with kiddos can be fun too. Before my daughter was 3 we took

her to thr USA mainland, Hawaii Twice, Bali, Vanuatu, Singapore, Malaysia and Japan. She even learnt to snow ski in Japan. Then came COVID, but we have still managed Norfolk Island, Cairns, Snow Skiing in NSW and about to head to Bora Bora in Nov!

It is wonderful to travel with a child who is so excited to see things for the first time. She is a great traveller and loves a long haul flight even!

Any tips on how to raise your kid to enjoy travelling or is it just a lucky dip?

Would be great to see more NZ pics! Although people are saying how much the markets have fallen, we really should be prepared that a 30+% fall might happen, or indeed happen once a decade or so. In the grand scheme of things, this year hasn’t been that bad for the ASX if you hold something diversified. It’s around -14% year to date just now…

What EV have you got your 👁 on?

I have been looking at getting rid of our ICE car and going for an EV next year as well.

BYD Seal looks good though doesn’t double as a home battery….

Ioniq 5 and Kia’s EV6.

I need to check out the BYD cars too.

So exciting you guys are going to be travelling more! My husband and I consciously did this too and we managed to fit in some AMAZING trips before we had our son.

He’s now 2.5 and we’ve started travelling with him a bit – travelling with kids is still wonderful and I love seeing things through his eyes and making memories as a family, but it’s definitely not the same as when it was just the two of us.

Not better or worse, just different – We move more slowly and spend more time in each place, and we focus on different things and do different activities. I’m so glad we took the opportunity to travel while we were younger, but also set ourselves up to keep travelling after having kids and beyond!

Love the NZ pics – that’s where we’re headed next 🙂

Great to hear Christie.

“Not better or worse, just different” that’s a great way to put it 🙂

I love the idea of doing a bunch of the travel and fun stuff before you have kids, not surprisingly given this is what we did ourselves! As you say there’s a lot of stuff that is best done while you’re young, fit, healthy and all that so that your body can handle it.

So true HIFIRE.

It’s funny because Mrs FB basically had an afternoon ‘rest’ most days. We’d get up early and do a hike or something but we had to have some ‘down time’ after lunch haha. We already need a rest and recovery period and I imagine it only gets worst as you age lol. Trying to fit in all the high physical stuff this decade.

Have you had a look at the infrastructure required to use the car as a home battery? When I looked about a year ago it was like $13000 which is more than a few stand alone battery solutions. You get a bigger battery with a car, but also it only works when your car is home.

I’ve decided to go for an xc40 even though it doesn’t support home charging as I just can’t see any benefit yet.

I’m trying to get someone on the podcast specialising in this area. Current costs are around $10K right now I think. Not great but at least it’s going down.

I wouldn’t be surprised if the government introduces a subsidy eventually.

I’m watching space like a hawk. I think I’m 3-5 years too early though 😅

Haha, New Zealand seems fun, and wish FIRE life is also good and achievable for them.

Travel is top of my list too and the shutdown has actively made me consider accelerating my plans for that. I’ve done the majority of what you have on your list which is lucky!