I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

I found out one of my mates was diagnosed with cancer this month.

He originally beat it two years ago, but it’s just returned during a trip with his family.

He’s married to his beautiful wife and they have a young daughter.

Fucking brutal.

“A healthy person has a thousand wishes, a sick person has only one.”

– Unknown

Mortality is a great reminder that most of the things we worry about don’t really matter.

And conversely, the simple stuff we take for granted is really goddamn important.

I consume a lot of self-empowering content from very successful and happy people. An emphasis on gratitude always pops up somewhere in the book/podcast.

It only takes 5 minutes and is strongly and consistently associated with greater happiness. Gratitude helps people feel more positive emotions, relish good experiences, improve their health, deal with adversity, and build strong relationships.

It’s basically a life buff that’s really easy to unlock yet so few people do it.

Kinda like a good night’s sleep. Everyone knows you should prioritise it, but somehow we end up scrolling on the couch for another 45 minutes 🤷♂️.

When I heard about my mate’s bad news I had the usual reaction of sadness and empathy for his family.

Life’s really unfair sometimes.

But I also started to think about how bloody blessed my family was. How much of my personal worries and annoyances paled in comparison to life and death.

The art of perspective and gratitude is a gateway to happiness.

What are you grateful for in your life?

Here are my top 5 in no particular order

- Loving partner with aligned goals.

I have the best teammate for the game of life and I’m 10 times better as a person with her than by myself - My health and fitness.

Life’s easier/better/more fun when I’m in shape. I get more out of life when I’m fit and it’s a privilege to be able to move my body. Some people are born without ever getting the chance to push themselves physically. - My parents.

I appreciate them more every year I grow older. They gave me a head start in life and showed me the blueprint to succeed. Something I hope to emulate when I become a dad one day. - Being born in Australia.

One of the best countries on earth. More opportunities have been opened just from being born down under than I’ll ever properly appreciate. - Our home.

I spend a lot of time in our home. I wake up every day with an appreciation of where we live and the lifestyle we have. Crashing on our huge couch to watch some shows on our 70-inch TV after a busy weekend never gets old. I have my own office. A veggie garden. A nice patch of lawn. Double garage. Central heating. The list goes on. This is such an enormous luxury that 90% of the world’s population will never get to enjoy.

Whenever I’m feeling down I try to concentrate on what I have rather than what I don’t. It works about 95% of the time.

Net Worth Update

Slight dip in shares with BTC and Super having small bumps.

Our cash reserves continue to take a hit as we keep booking overseas trips 💸

We’re really embracing that ‘Die with Zero’ mentality😂

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Another super expensive month after we booked more activities for Japan.

Shares

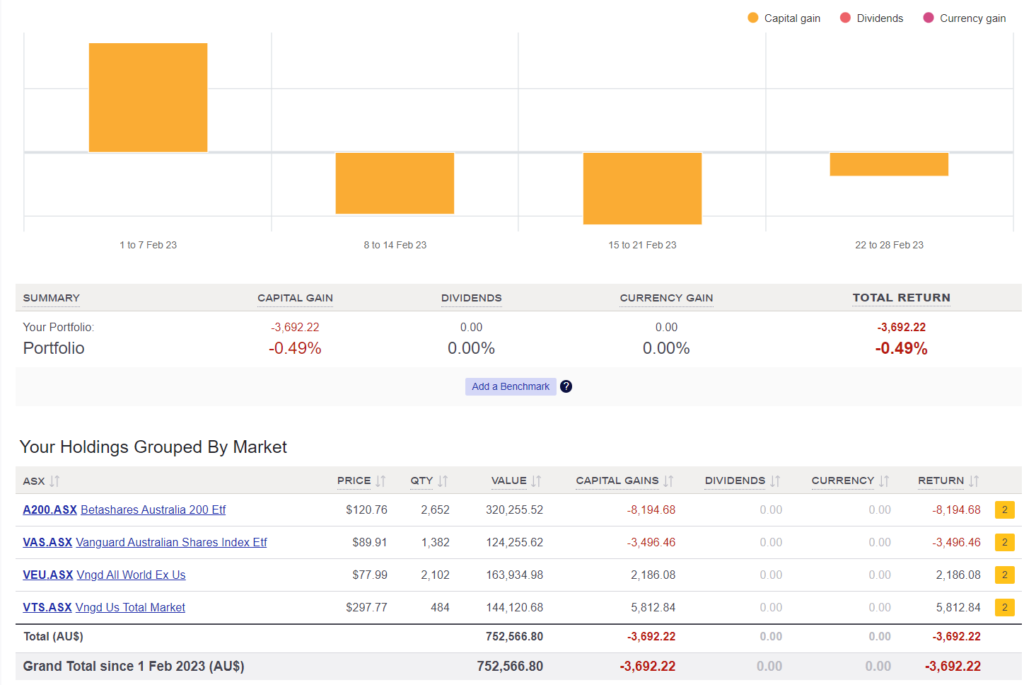

The above graph is created by Sharesight

Diversification is important!

Aussie shares have a tumble but the rest of the world was up.

We didn’t buy any shares in February.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Hi AFB, when did you make the decision to go to 60% Aus/40% int split? I thought you were previously intending to do a 40% Aus / 60% int split. I know the precise split isn’t overly important and there isn’t a ‘right’ answer – I more just wanted to make sure I hadn’t missed an article!

Thanks for all the work you do mate, you have been a huge influence on my (and I’m sure many others!) approach to finance and life.

Great words on mortality and very sorry to hear about your friend.

I wrote about the decision in the strategy 2.5 post.

Thanks for the kind words 🙂

Sorry to hear about your friend. Great gratitude attitude 🙂

Hi mate. Sorry to hear about your mate. Sounds like he must be young? Tough no matter which way you look at it.

Are you buying BTC at this stage, or just holding?

I get the impression you’re not earning/buying(investing) much of any stocks these days.

Thank you for another net worth update.

We’ve pretty much pumped the breaks on all investing/work during the last 6 months.

All of our money has been going into overseas trips. We’re trying to get in as much as we can before kids haha.

I’ve also been working on my business. I’ll probably start saving/investing again later this year.

You could call it another mini-retirement.

Really sorry to hear about your mate. I hope a way to beat it for good is found.

Thanks for another good article and great reminder on gratitude.

My wife and I have been saying 3 things that we are grateful for in that day before going to bed for the last 3 Yeats which really is something that is such a wonderful anchor for us.

Great idea to get the travelling in before kids 🙂

That’s absolutely brutal about your friend. I’m so sorry to hear it. Hopefully he can beat it again. ❤️

Hi Afb,

Very true on mortality and appreciation for what we are given in this world.

Would you be better off paying down you hecs loan quicker now that inflation rates have gone so high and possibly higher in the next 12 months,

It might be a better return on your after tax money

I might be better off financially but I’m prioritising experiences these days. I don’t really care that much about being wealthier. I know our portfolio will grow to our FI number one day.

Sorry to hear about your mate, Matt. A timely reminder for us all.

Quick question – what are you seeing/what are your thoughts on current interest rates and how they would affect an investment strategy? For people using the debt recycling method and investing lump sums every 6 months, it seems it would be wiser for them to hold their money in an offset given the guaranteed, risk free return and the average stock market performance at the moment.

I could not be more aligned in regard to the Die With Zero mentality. Finished the book last month and immediately booked some exuberant travel. The realisation that we need to experience things now while we still can (ski trips to Japan with our parents for example) has been a game changer. Very easy to say yes to things now from that frame of mind. The flights being more expensive than pre-COVID made me pause, but I feel like Bill Perkins is in my head now telling me to spend.

I have to say though, it’s almost comical how most FIRE personalities seem to mirror the average punter. The Mad Fientist sent out a warning that we will be too frugal, regret it, then return to a more sustainable savings rate. I saw you do this and I’ve done the exact same. Looking back that extreme frugality seems crazy, but Die With Zero was the nail in the coffin of frugality. Now comes the fun part of enjoying the benefits of having a solid nest egg to enable prolonged semi-retirement.

Thanks again Matt for all the encouragement and inspiration you offer through your blog/podcast. We (like many others) would not be in the position we are now if we hadn’t found you in 2017.

Hey AFB, wondered if you could make a spreadsheet that helps show the tipping point between having cash in an offset vs ETFs please? On the left, showing how much you’re saving in interest charges with your cash in the offset (where you can play with various interest rates 2-20%, and on the right side showing the compound interest gains.

It would be next level if it could incremental contributions and rate changes.

(And would you sell some shares if your PPOR interest rate went to over 10%?)

The reason I ask is, it’s particularly confusing to optimise when comparing lower interest rates on bigger balances (mortgages) vs higher potential returns on smaller balances (shares)

Thanks AFB if you can!

With rates now where they are, I would have thought money in the offset would be a non brainer for the time being. When you take tax into it, you’re going to struggle to consistently beat the offset with an ETF.

Just came back to confirm the name of Bill Perkin’s book. Just wanted to share that it’s actually free for the ebook version if you have an amazon prime subscription.

Figured a few others could take advantage of this.