I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

Not a lot to report for the month of May.

I’ve been working nonstop on my business and preparing for a big conference at the end of June.

It’s amazing how fun work is when you’re in control and have a personal goal to work towards. What’s equally amazing is how many different hats you have to wear to get other businesses to buy your product.

In the month of May, I’ve been a:

- Marketer

- Developer

- CIO

- CEO

- Graphics designer

- Data Engineer

You’d think that building a product that’s better than anything else in the market would be enough.

But it’s not.

So much of what drives business is relationships. I remember when adults use to tell me that networking was one of life’s most important skills.

“Get out there. Meet people. Get to know them”.

It’s hard for a teenager to fully grasp what this means.

But as I’ve gotten older, it’s become crystal clear that developing relationships is paramount if you want to do business.

Another slightly annoying thing is how much authority LinkedIn has.

I’ve never posted on LinkedIn before. I had a profile years ago but it’s been sitting dormant because I just didn’t see the point. The whole website seemed like a showoff extravaganza.

But it has a level of authority in the niche that I’m selling to (government). Potential clients were telling me it was a red flag that my company didn’t have a LinkedIn presence 🙄.

So I had to put some effort into building a company page and posting some content.

This social media peacocking is part of the game you have to play when you’re new. It just is what it is. And if I want to reach my goals, I can either play the game or give up and try something else.

Wearing these different hats for the company and learning different skills is fun. It’s not what I want to be doing all the time but I absolutely love learning about the human behavioural science of commerce.

I’d wager that 90% of the deal comes from marketing and your reputation/relations in the industry. If you have a good rep and are known to produce exemplary work, half the battle is won. When you’re the new guy on the block, you have to establish authority by building brand awareness and offering a competitive advantage.

This is something I’ve always wanted to have a go at and it’s been a lot of fun so far. I’m hoping that I can land a big contract or two after the conference and hire someone.

My dream of the co-working space is on pause until early next year.

Net Worth Update

Everything went done this month with Super being the only asset class in the black.

A lot of cold hard cash went out of our accounts in May too.

The two big reasons for this were a big tax bill for the company and the cost of the June conference.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

I don’t include company expenses in the above graph because we don’t rely on them to maintain our lifestyles. I’ll probably remove company assets (cash) from these updates eventually to make things clearer too.

Shares

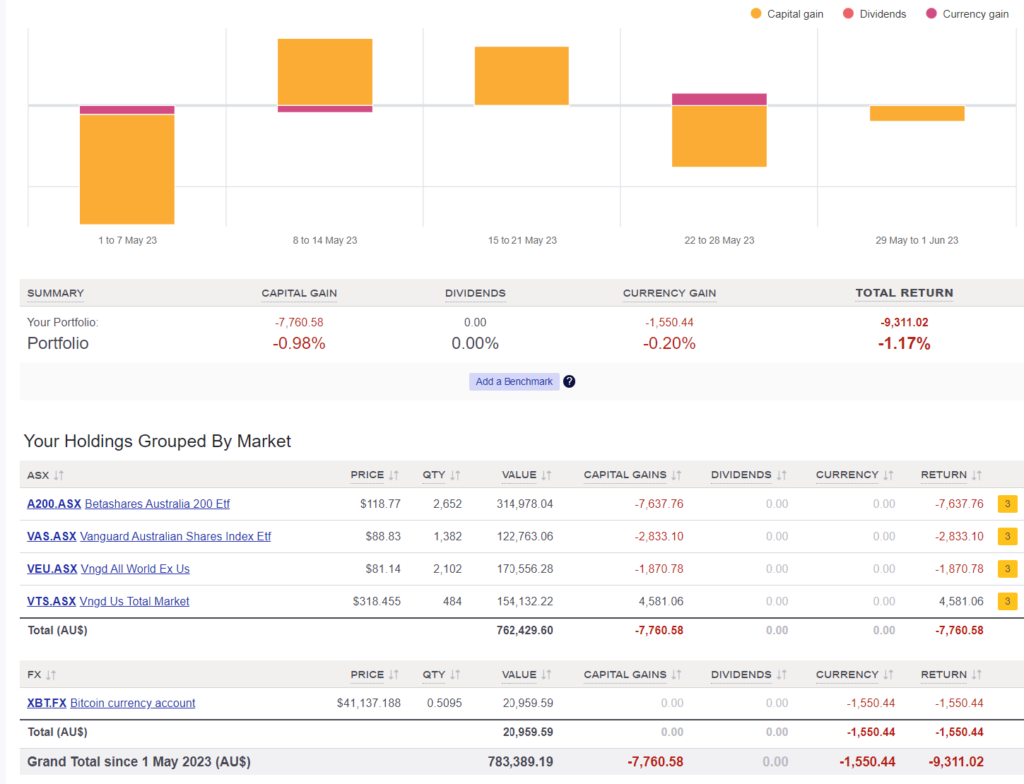

The above graph is created by Sharesight

I’ve added our Bitcoin holdings to our Sharesight portfolio!

This was really cool because I’ve never worked out the total return we’ve made since 2017. As I type this out today, we’ve had a total return of 4.44%. A lot of that has to do with buying the bulk of our Bitcoin last year and the price of BTC going down a fair chunk since then.

I’m still waiting for businesses to offer the lightning network so we can use our coins in day-to-day transactions. Maybe that day will never come but I’m hopeful for now.

No new purchases again for May. Most of our spare cash is going into the business.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Best of luck with the business mate, hopefully you start getting some big contracts!

LinkedIn is so ridiculous nowadays, way too many cringe posts from “thought leaders” who haven’t shown much thought and aren’t leaders. I reckon some decent prompts into ChatGPT would get you some better marketing material than 90% of the stuff out there.

Dude, GPT has been my SAVIOUR with content on LinkedIn. I’m not sure how I would have survived without it.

Thanks for the update mate, love reading these every month.

Bitcoin is an interesting area, it looks like we have similar amounts of our net worth in BTC. I plan on increasing to about 5% soon and become a whole coiner (i.e. own 1 BTC).

I think interest will increase in this area, it seems like it already is now (possibly because of my algorithm amplifying people that are pro-bitcoin haha). It is definitely a hedge against the fiat money system for me, the more I look into it the more unsustainable it seems.

The Fed’s balance sheet has gone from 800 billion in 2008 to 8.8 TRILLION today, it just seems unsustainable to me.

US debt is up to 32 trillion and around half of US Treasuries will expire in the next 2 years (meaning the US Government will need to refinance at the now higher interest rates). It feels like we are heading inexorably towards financial calamity, or a turning point in the long-term debt cycle in Ray Dalio’s parlance. The US Government has a few options:

1. raise taxes,

2. reduce spending,

3. default on the debt or

4. print money

History has shown the most palatable option for government is always to print money (or dilute the amount of Silver in the currency in the case of Ancient Rome’s Denari).

Something to keep a close eye on going forward, people definitely need to understand the hidden tax of inflation and invest accordingly.

Cheers for the update mate!

Thanks David.

Interesting takes mate.

I’d like to see more innovation that actually delivers superior services.

I’m waiting for it. I have more wallet ready to go but I’ve yet to come across a merchant that offers payment via BTC or Lightning.

I’m not 100% sure if Bitcoin is the answer but I’m confident that the financial system as a whole is ripe for a shakeup in the coming decades.

The power to create money out of thin air is destined to be abused.

Great Post as usual AFB. Interesting comments on money printing and the Fed. Money printing (in Australia also) leads to inflation and devaluation of purchasing power of your currency. I discovered a really cool calculator for CPI in Australia with the title “The Australian dollar has lost 98% of its value since 1923″….

A bit scary – but anyway, worth a look if anyone is interested.. It has some nice information: https://www.officialdata.org/Australia-inflation

Cheers

Thanks for the link mate.

That site is interesting.

By the FED shrinking its balance sheet, doesn’t it also risk reversing some of the benefits accrued by its expansion? Seems like they have been reducing slowly over the last few months, $25 Billion here, $50 billion there :o)

AFB, looks like the US Market is doing OK this year so far VTS up 13.5% YTD, whereas VEU 9.8% and VAS 3.66% YTD. With the latter both pretty much down over the month are you still regularly buying, or just dividend reinvesting now with other projects underway?

We having been buying this year and have actually started to use our dividends to fund our lifestyle for the first time ever.

I’ve had a very relxed 2 years but I’m looking to ramp things up with the business over the next 12 months. If I land some big contracts, I’ll switch to buying mode again.

When you are ready, share the link to your business in this network.

Data for me assists me resolve problems, and identify ones I didn’t know I had (can’t wait for AI paired with quantum computing to do this even better).

I’m not sure I want to cross contaminate my two communities.

Maybe one day

I’d love to hear more about how you’re managing the company finances. I’ve just started down this path myself.

What specifically would you like to know?

VAS dropped their MER down to 0.07% which is identical to A200.

Will this have any impact how you’ll be investing between the VAS/A200?

A200 is now 0.04% see https://www.betashares.com.au/fund/australia-200-etf/

Excellent. Thanks Mat.

Thanks for sharing your journey mate, gives great perspective as to what you can achieve. Btw the FIRE calculator is a game changer, I realised I can cut back on hours and start planning my financial situation next couple of months and over the year. I only started reading over your blog since finishing my Contract up in Easter, so going to enjoy the 10 weeks off before commencing my next work journey helping a new startup in Consulting.

My networth is 1.3m by 38 through cash, shares and investment properties. Growing my shares portfolio is my number 1 priority to achieve a steady passive income through dividends, ETFs and high growth stocks. I find it a funny fact that 2 of my investment properties I lived in for 8 years probably delayed reaching FIRE sooner. I guess it’s the pros and cons if I had rented for 8 years than living in those properties as my primary residence, but no regrets, I really enjoyed being a homeowner.

Anyway, keep up the good work and look forward to hearing about the progress in your business. I’ll have a cold one for ya!

No worries Mr KrabbyPatty.

I look forward to sharing my business journey with everyone 🙂

Hi, thanks for all your great work and insights over the years, it’s very interesting. I am planning on dollar cost averaging a large amount of capital into about 8 ETF’s over a few years.

But I have heard ETF’s can be quite complicated when it comes to doing your tax return, especially if you’re new to investing in ETF’s and choose to do the tax return yourself like I do thru the MyGov website.

Have you found this to be true and how do you overcome this to make it simple?

No worries Muz. I’m glading you’re enjoying the content.

A lot of the tax information is pre-filled these days. I use Sharesight which helps with filling out a tax return but my strucure is complicated (we invest through a trust) so I use an accountant.

A lot of people have commented in my Facebook group that their tax obligations just show up in MyGov which is great.

Check out this article.

https://help.sharesight.com/au/how-sharesight-can-help-with-completing-your-tax-return/