I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

Not a lot to report for this month so I’ll just be posting the basics.

Net Worth Update

Ouch!

The markets hammered our portfolio in August with Share and Super being hit the hardest.

Honestly, I’ve been quite occupied throughout August, so I haven’t been keeping a close eye on things. Nevertheless, as we begin to withdraw from our portfolio, these somewhat significant downward swings are stinging a bit more.

All good though. My business signed another client in August, so there should be a big PO coming my way in the coming months.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

We hardly left the house in August which was reflected in our low expenses.

Shares

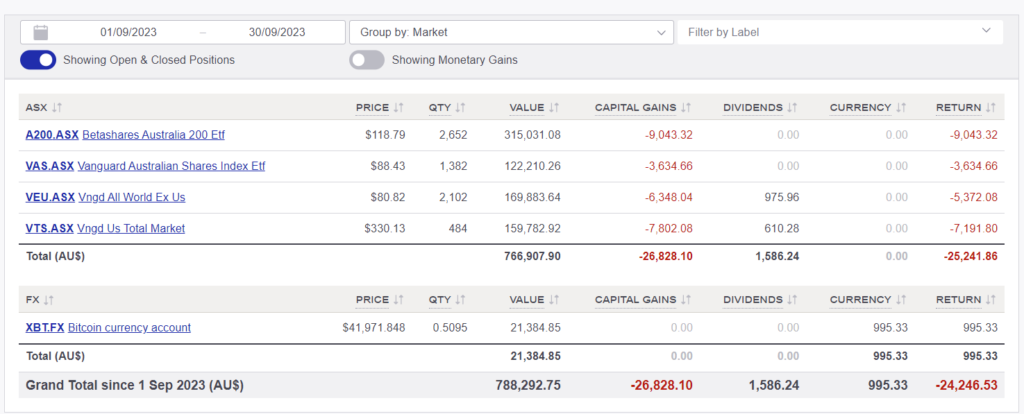

The above graph was created by Sharesight

Once we get the $$$ from the upcoming PO, I might consider buying more shares, although I find myself leaning towards reinvesting the funds back into the business. Both options are quite tempting.

Growing the business seems way more fun, though haha.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

The big takeaway for me here is that you’re down about half the average yearly wage in the last 2 months and yet it’s barely noticeable when you look at your total net worth. So yeah it sounds like a lot but it makes almost no difference to your situation.

Congratulations on the new contract for your business, great to hear!

Thanks HIFIRE!

I’m so keen on this Biz mate, it’s a lot of fun and I’m learning so much. I’ll probably write an article about it soon.

Do you own the share portfolio under your name or in an entity? Eg trust.

I’ve bought ETFs under my name – current balance is around $20k.

Trust.

Hey Aussie FB, could you replay with a link to why/why not a trust is a good move?

Too much to cover for a comment.

Have a listen of this podcast I did a few years back https://www.aussiefirebug.com/terry-waugh-structuring/

The probability of a larger correction in shares is high. I don’t believe this is a good moment in the cycle to be 80% stocks. Maybe I/m wrong but personally I’d be nervous with that kind of exposure.

I would have taken some profit out of the stellar run in recent years and made some more defensive bets. I’m older so that’s probably my different perspective on the current economic conditions.

I guess only time will tell.

Being young(ish) does allow me to sleep easier, knowing I have many years ahead to recover if the markets do blow up.

Hi FB, thanks for putting up these updates.

I am looking at this and benchmarking to our own situation with respect to the viability of living from the passive income from ETFs and other investments. The value of ETFs may have dropped but I am guessing over the past 12 months you had about 24K of distributions from the ETFs? Plus about 3.5K on bank interest on the 64K cash in HISA (e.g. ING at 5.5%). So 27.5K PA in passive income from those sources. Perhaps that is not quite FIRE yet! Hopefully you have income coming in from websites and the business.

I note your expenses are quite variable and I do wonder what your core living costs budget looks like? Expenses are quite personal but are important given those are the other half of the FIRE picture besides income. For us we have about 20K of lean living costs excluding housing (we rent due to work location), but if we moved back to an old PPOR that would be about 30k to 35k total costs PA. So if this portfolio was us we would still need a part time job to cover the gap.

I am curious why have shown passive income on the chart based on 4% drawdown rather than actual income generated? You have shown the actual expenses each month – but would that reflect expenses when FIREd?. I think the real income generated would also be informative as a real world demonstration and comparing apples to apples (re expenses in the lead up and revenue in the lead up to FIRE).

While yes you can sell some units to make up the difference if you were FIREd (4% guide), but then that will also decrease the number of units earning you revenue next year. I know in theory selling is not worse than dividend income, but psychologically I find it hard to sell down the capital! Especially so if there are many years before I could access super or if the super balance was low (IMHO 165K in super is a bit lean). I have a feeling that if you were selling down the investments outside of super then you would want a bigger chunk in super to be there when you hit 60. Indeed the majority of your wealth should be inside Super by the time you hit 60 for the tax efficiencies of it.

Thanks again and sorry if it was a bit of a ramble.

Hi Oz-Fi,

We 100% haven’t reached FIRE yet, still working on it 🙂

I put these numbers out to be as transparent as possible and show others what our jounrey looks like.

Our financials have been quite dynamic over the past 4-5 years, mainly due to travel. However, since the arrival of our baby, expenses have significantly decreased, as anticipated.

In 2024, we anticipate gaining a clearer understanding of our new lifestyle costs. In 2018, our annual spending, including rent, was around $48K. Considering the recent surge in inflation, it’ll be intriguing to see our updated baseline next year.

4% is the general rule of thumb and selling down units were always part of our stratgey since the start. Yet, I acknowledge the psychological challenge of selling units versus spending dividends, even though the end result is the same (excluding tax).

Personally, I find total return a more accurate measure, but that’s just my perspective.

The funny thing is, many financially independent individuals I’ve encountered continue to generate income outside their portfolios. While spreadsheets are crucial, real-life experiences suggest that many early retirees supplement their income through additional cash flow sources. This insight is why I don’t stress too much about the modeling.

Cheers

With the halving in April 2024 consider adding more BTC to your portfolio now. Take profit when it rises in late 2024/ early 2025 then reinvest that money into your shares. Yes, it’s a high price now but there’s a spot BTC ETF about to be approved in the next couple of months in USA and that will effect the price greatly this time round with the largest asset companies in the world entering the market when this is approved, ARK, Vaneck, Blackrock, Fidelity, Invesco, Valkyrie etc.

Since my last post BTC up 2.5k in 50 days 🙂