I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

I’ve said it before, and I’ll say it again.

As much as I love online communities, nothing beats in-person gatherings with like-minded people.

Which is why it was so awesome to have the guys from the Rask team come down to my hometown and put on a roadshow. The FIRE community in Latrobe Valley showed out, and we had a packed room filled with like-minded individuals, all enjoying a great evening together.

It was so cool to meet folks who came all the way from the other side of Melbourne to be there too. I really did my best to chat with everyone that night, but if I didn’t get to you, I’m genuinely sorry, and I hope we can catch up at the next meetup.

Shoutout to Adrian from Chartscape for creating this personalised poster that beautifully illustrates our net worth journey (with the blue graph in the background) from the very start up to our July update. It’s an awesome digital art piece, and it’s hanging up in my office mate 🙂

Net Worth Update

I had a big tax bill for the company, which, along with some other big expenses, was the primary factor behind the substantial loss this month.

All other asset classes went down too except for Super.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

August was a fairly typical month for us.

Shares

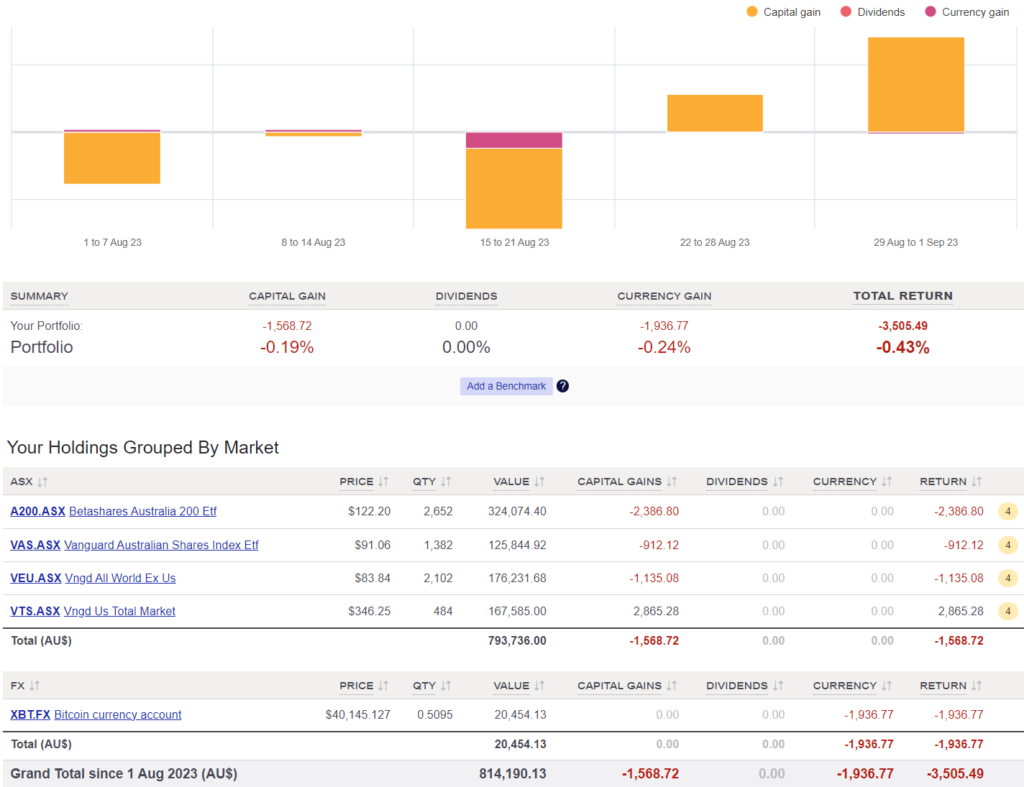

The above graph is created by Sharesight

We didn’t buy any shares in August.

I’m currently working on a long-overdue article. It will provide an update on our current strategy and where we stand in the grand scheme of things. You can expect it to be released before the end of the month 🙂

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

Love the blog and the honesty and how you put yourself ‘out there’ with real numbers. Based on ‘what you know now’, how many years do you reckon before you think you’d be ‘financially independent’? And would you look to continue with the blog post financially independence?

Hi Captain FI,

Thanks for putting your figures out there, that helps me understand our net worth a little better. What has been your strategy in obtaining shares? Do you debt recycle? Interesting to see you also include your PPOR. Ours doesn’t look nearly as impressive if I remove that 😂

Hard to say. We have just had a baby, so it’s challenging to forecast what our upcoming expenses are going to look like.

And my business income is so unknown. We could reach our goals in 2 years, or it could take another 10 🤷♂️

Sorry I’ve that’s not very helpful.

Once we do hit it, I’ll probably pull back from AFB content. Maybe a post here and there but definitely not every month.

I love the Hawaiian Shirts. It shows you guys are serious (it has a collar) but ready to party 🙂 That digital art is pretty sweet too.

When is September coming mate?