I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

In July, I felt fortunate to be blessed with the opportunity to work from the comfort of my home. My social side has been longing for more real-life interactions for a while now (hence my co-working space ambitions) but honestly, in the middle of winter I’m pretty content to be inside in a hoodie and moccasins 😂.

It might sound weird to some but I really enjoy going for a walk first thing in the morning when there’s still ice on the grass (my fellow Victorians will know what I’m talking about). It wakes me up and get’s the blood flowing.

During that 15-minute stroll, my mind tends to wander. On occasion, it’s focused on what I want to get done by day’s end. There are moments when my thoughts drift towards upcoming events and the future. And then there are instances when I find myself fixated on that joke I cracked that nobody laughed at 😅.

My walking shifts into autopilot mode, and since I’m mostly unable to reach for my phone or use my computer, it’s just me and my thoughts for a while. Almost like meditation, I guess.

And then there’s a different type of meditation I get when I’m at the gym. There are times at the gym when the physical demands of exercise completely occupy my mind. In those moments, my brain’s capacity for attention becomes entirely absorbed, leaving no room for any other thoughts.

I’m solely focused on lifting something heavy and placing it back down (it sounds funny when I write it out like that).

Having time to let my mind wander and time, when it’s completely focused, are both important mental exercises I need to feel centred.

In other news…

There’s only one week to go before the RASK roadshow tour in my hometown.

There’s going to be a lot of my local FIRE community joining along with other great guests and speakers.

See y’all next week 🔥

Net Worth Update

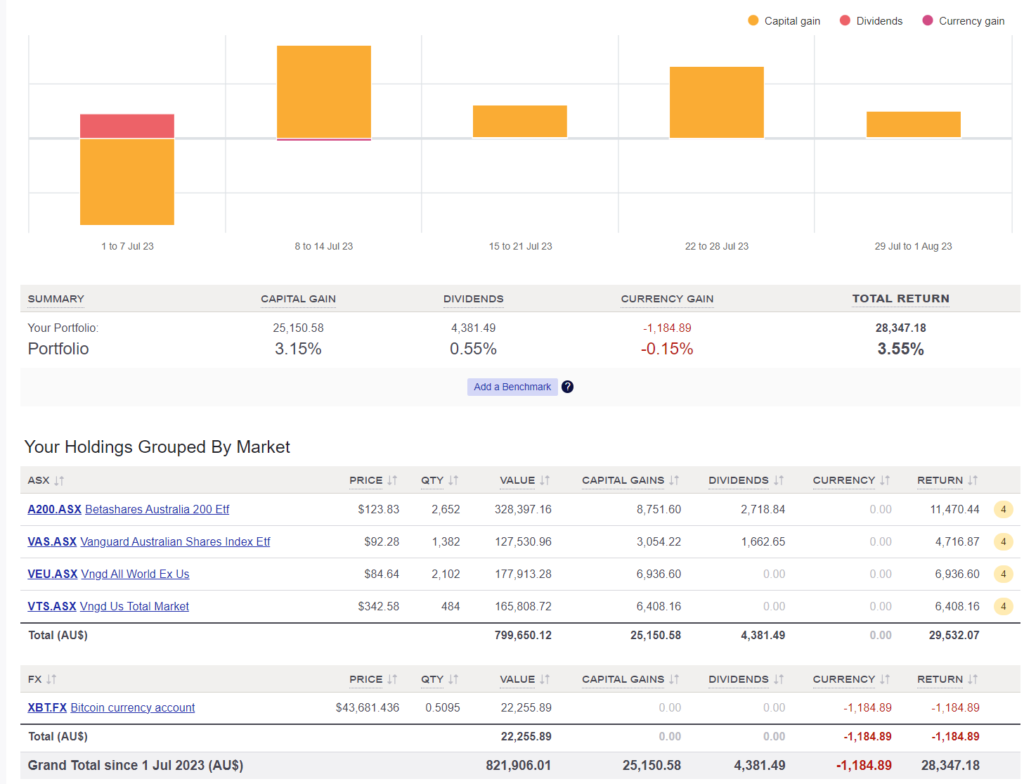

The share market did the heavy lifting in July with BTC being the only asset class that went down.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

It’s been a very, very long time since we had a sub $4K month. This is mainly because we didn’t book any future trips and just stayed home for the whole of July. It’s funny to think that $4K a month was our baseline pre-London.

Shares

The above graph is created by Sharesight

We didn’t buy any shares in July.

I’m planning to record a podcast soon to provide an update on our progress towards FIRE, as I’ve received numerous messages inquiring about it.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

The gains have been a little too good lately!

Like the thoughts on meditation man, and good point on the need for both pure concentration and zero concentration.

I think many people run away from letting their mind wander, and habitually grab their phone any time they aren’t doing anything. So they miss out on the peace of mind/ideas/etc that can bring.

I sometimes spend like an hour at a time letting my mind wander and then also thinking about different things. Could be personality based, but I really find that valuable for resting but also processing life events etc.

Well we did have a down year in 2022 so maybe we were due.

Love the musings on meditation mate. I keep my phone in the other room when I’m trying to do work. It really helps to keep it away from arms lenght. Little attention stealing machines they have turned into 😂

How was your Rask event? We have ours on Tuesday and I’m pumped!

How are you planning to pay off PPoR ? Eg. Minimum repayments over 30 years and additional weekly cash contributions to get down to 20, 15 or 10 years ? If pay off too fast then will loose investing money. Or are you planning to use dividends from A200/VAS or some annual capital growth from VTS ? Or another slow option could be to use superannuation to pay house off if don’t need amount estimated in super age 65 ish.

I honestly want to keep redrawing out of our PPoR and use those funds for more investments. At this stage, we have no plans to ever pay it off completely. That might change in the future though.

I don’t understand drawing on homeloan at these interest rates. For me $1 saved is $2 earned. After tax saving 6% on mortgage I would have to have earned a much higher percent on investment after tax to even break even. We made the call to pay our home off (conservative) but are now accelerating journey into dividends from here. Want to use bitcoin next 18 months to increase dividend position…here’s hoping

Do you have a blog post outlining your reasoning re: why you don’t plan to completely pay off your home? Thanks!

Hmmm I’m pretty sure I covered it in a podcast episode but I can’t remember which one.

It basically comes down to the fact that I’m betting that investing, after accounting for taxes, will be more profitable than saving on interest with a home loan over the long term.

Maybe Moccasins are better than mockersons ?

Haha, I came here to say the same 🙂 Long live the moccies!

Yep, was going to point out the typo too!

Aussies spelling 🙂

😂 I couldn’t concentrate on anything else after I saw ‘Mockersons’

🤦♂️

I’ve fixed the typo lol.

Love reading your updates every month!

Just wondering why you don’t include super as a part of your FIRE portfolio?

Due to the fact that I can’t access those funds until my preservation age, and my complete lack of confidence in politicians’ ability to refrain from altering the rules!

Great update, really interesting to see what you’re doing. Thanks for sharing.

Nowadays when I work at home I almost always get up and go for a 30-40 minute walk in the morning at around 6:30am. It’s a really great way to start the day and provides a bit of exercise which I wouldn’t normally get walking from the spare room, to the kitchen or toilet.

Very few distractions, allows me to think about various different things and also mentally plan ahead for the coming day.

It’s become such a habit that even if I don’t have to get up for work, I still usually do the same on a weekend or public holiday.

There’s something magical about the morning.

I had a similar experience in London when I used to ride to work. Absolutely freezing, but it felt great to get out and about so early.

I do this also, 5k’s or more in the morning, listening to podcasts though

How many dividends did you get this month? It would be nice if you broke that down instead of just lumping it into “Shares” each month.

It’s in the Sharesight image, mate.

We received $4,381 worth of dividends in July.

Enjoy reading your journey to FI. Morning walks are the best part of the day to reflect, meditate, listen to a podcast (yours included), listen to a book (highly recommend the current book I am reading ‘Not Today The 9 Habits of Extreme Productivity ‘ By: Erica Schultz, I have never read a productivity book introduction that put tears in my eyes as this one).

Thanks for the kind words Mick!

I’ve just added this title to my wish list in Audible 🙂

Hi Firebug,

I am new to following you, Kudos for the transparency you embrace in sharing your personal wealth. I am in a similar position to you a few years back. The exception is that we are keeping one house as an investment property and renting our residence. With your excess cash, I see you went heavily into the stock market over a short period. I would be interested to hear your point of view on why you did this and did not dollar cost average your way in over several years while parking the rest of your cash in an offset (what I am currently doing). What was it that gave you the surety to do this? Would you have changed your approach on reflection (guessing, probably not looking at the results)? Did you fear you may miss out on buying opportunities? Looking forward to your thoughts and opinions.

Keep up the great work,

The Scottish Accountant

Hi Lewis,

Welcome to the blog, mate.

I have read a lot of literature on this topic, and statistically speaking, lump sum investing (all at once) works out better the majority of the time.

Dollar-cost averaging is fine, though, and it can help from a psychological point of view.

I had confidence in our deicison from the data but if I could go back in time I would have chosen DCA because the market dipped straight after we invested lol.

Keep up the great updates & reflections mate! Inspiring hearing your journey.

Cheers,

Nelson

Any chance we can see your holdings grouped by market since first purchase?

What do you mean by market? As in which ETF?

Hey man, I’ve been meaning to ask

I’ve got 50/50 shares between VDHG and VAS, but I want to start buying IVV instead of VDHG. In a general sense, does it make more sense to leave the ~$30k in VDHG and just start buying IVV? Or does it make more sense to sell my VDHG shares and dollar cost average into IVV? I’m more thinking about the management fee on VDHG, although dividends received each year will cover that.

It all depends on what you’re trying to achieve.

If it were me, I value simplicity and would probably consolidate VDHG because it only has $30K.

The less I have to manage, the better, in my opinion.

Gday! Is there a reason you focus on Aussie shares instead of say the S&P 500? Cheers! love your work mate 🙂

Dividends!

Not the most optimal way to invest, but I find it the easiest in terms of psychology. The money lands in our bank account without us having to do anything, and we spend it. I have a mental block when selling down shares.