I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

My second month of dad life has been going great.

Yes, there are times when getting enough sleep can be difficult. But boy oh boy it’s all worth it when you see your little one’s adorable smile 🙂

I’m not kidding; it’s like black magic. I’m pretty sure evolution has developed this way to give parents an additional gear they can tap into when things get hard haha.

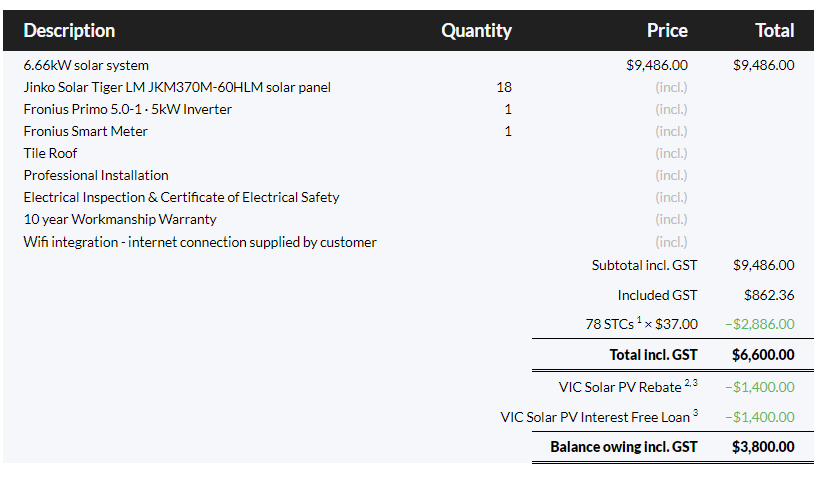

As a data nerd, I’ve been looking forward to seeing how much more electricity we would use when the baby arrives. This was one of my biggest motivators for installing our 6.66 kW solar system in October 2021.

Our out-of-pocket cost for that system was $3,800.

Our usage comparing October last year to October this year has been the following:

| Month | Grid usage | Consumed directly from solar | Total Usage | Self-sufficiency | $ Saved (based on 39c/kWh) |

| 22-Oct | 115 kWh | 102 kWh | 217 kWh | 47% | $40 |

| 23-Oct | 153 kWh | 151 kWh | 304 kWh | 50% | $59 |

Since the three of us are home most days, our energy usage has increased by over 40%. And I suspect this will only increase as our baby grows up.

The other significant factor is we will be buying an electric car next year (trying to hold out until the new model Y drops). Our solar panel energy consumption will skyrocket from that point onwards and the payback period will significantly speed up.

It’s going to be cool to calculate how much our panels save us in a few years and compare that to how much we would have received if we invested it instead.

Net Worth Update

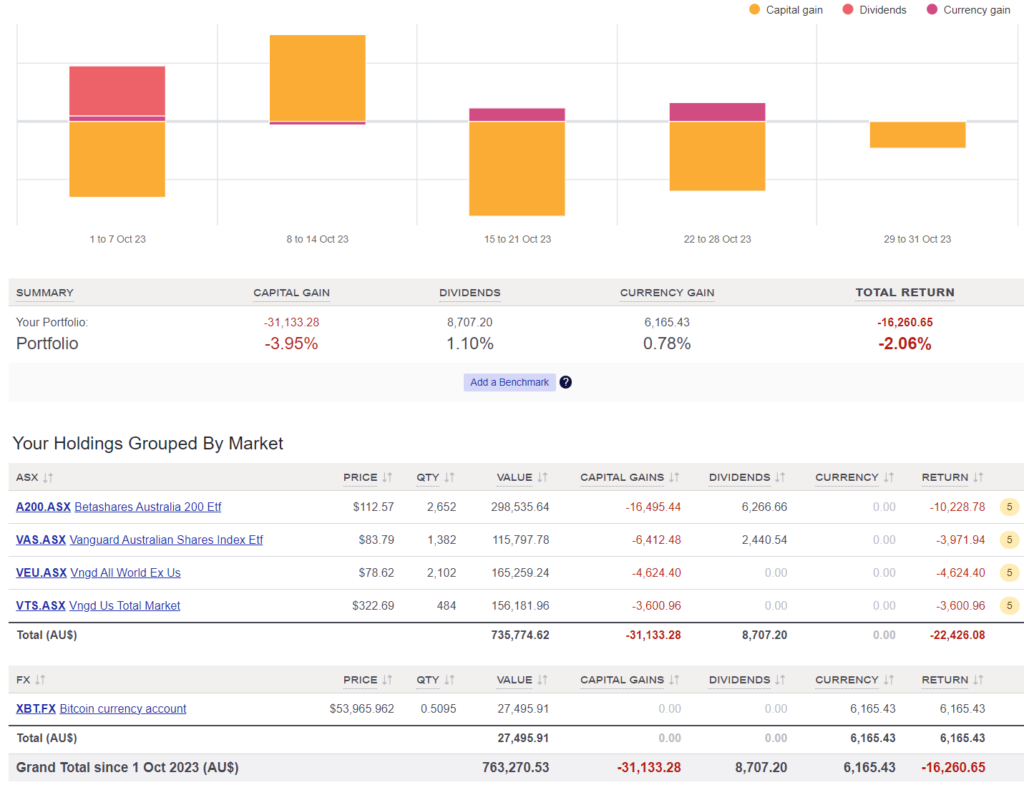

Another brutal month with our shares and Super being hit the hardest.

On a positive note, Bitcoin increased by 30% in October!

I haven’t used my Bitcoin yet, but I’m interested in finding out where I can spend it. Does anyone know of any cafes or stores in Melbourne that accept BTC or are on the lightning network? I’m curious to see how easy the process will be.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Another quiet month on the expense front. We’re really not spending a lot of money at the moment.

Shares

The above graph was created by Sharesight

$8.7K in dividends slightly softens this bad month from a psychological point of view, but still, not great.

We made no purchases in October. We are still keeping our cash position high until I secure some contracts that will be landing in the coming months.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

Dolly loves himself some bitcoin, and I’m this article they advertise so,where you can buy in BTC.

https://www.afr.com/markets/equity-markets/how-sharemarket-bets-took-an-nba-legend-from-basketball-to-bitcoin-20230824-p5dz7y

Sorry meant to link article ☝️

G’day Firebug,

What’s your end goal 1.9 should be enough no?

Re Bitcoin. Two thing’s. I ran a crypto blog interviewing people in the space for a while lot’s of research required. Bitcoin is not BTC. Repeat Bitcoin is a not BTC. This is why what I’m going to say next will make more sense. You can’t really use BTC fee’s are atrocious, it’s too slow. So you asked about Lightning, this was supposed to solve all that…sigh, it didn’t, well not really. Lightning is layer 2. That’s like saying your new solar panels don’t really work so you had to buy a new Pv sticky sheets for on top of them….check Twitter, lightning Devs resigning enmasse because of security and other issues. Look up BSV the real Bitcoin invented by Aussie Craig Wright. His court case starts in Jan. Tip, I wouldn’t wait to buy real Bitcoin till after the case, it’s at 70-80$ AUD right now, buy five or ten even if it crashes who cares no big loss because the upside is insane.

is the upside insane or are the crypto shills insane?

Not sure you should be shilling a dead version of Bitcoin. Most exchanges have removed this token and Coinbase are forcing people to sell or withdraw it before they turn off support for it in January.

https://www.coindesk.com/markets/2023/11/07/coinbase-ending-support-for-bitcoin-sv/

Hi there Andrei,

We have $1.19M, not $1.9M, but regardless, I’ll stop these updates once our FIRE portfolio’s income (based on the 4% rule) eclipses our expenses.

Interesting thought on BTC not being Bitcoin.

I’ve always likened Lightning to an abstracted programming language. Directly programming in machine code is challenging—difficult to read, write, and maintain. Therefore, abstractions are built on top of machine code. For instance, I can write Python code easily, and it eventually gets executed at the machine code level.

These additional layers of abstractions significantly enhance the underlying machine code.

I think you are so smart and have shared so much insight regarding finances that I myself follow but

it might be good to add some more info to your knowledge base regarding Bitcoin. Totally understand if it’s not your thing but if you have some time please watch this video, it changed my views in a big way!

https://youtu.be/8St36RjHd2E?si=VVw8cEQF657W-sIC

Thanks, Eliza.

Great video. I really enjoyed “Line Goes Up” by the same guy, Dan Olsen. In fact, I tried to get him on my podcast.

I think he has a lot of valid criticisms, and I agree with much of what he says. However, I still believe this new technology has the potential to improve our current financial system. It might not be BTC, but one day, I strongly think there will be a system that makes it easy to pay for goods and services at a lower fee, settling faster than EPTOS.

BTC has the potential to achieve this in my opinion, but there’s a good chance it never does.

On the Bitcoin side of things. If you’ve never used it, and have seen a 30% increase, unless you start using it all like cash, you might find tax time a nightmare.

If you treat it like cash and go through it quickly, then the ATO doesn’t care. But if you hold it like an investment, then you’ll be expected to pay CGT everytime you dispose/spend it. Do you really want to trigger a CGT event each time you buy a coffee?

Interesting point and one I’d not thought about. I’ve often thought that until bitcoin has the utility of being able to be used for purchasing goods/services, it’s a spec investment – a good one.

Triggering a CGT event every time you buy something would be a nightmare as you say! Eg; let’s say you buy a Tesla with Bitcoin, what happens then? No conversion to Fiat involved but is that tax event still triggered given the Bitcoin was sold as such?

I guess the ATO is evolving their stance as time goes on.

That’s right, each disposal/transfer of BTC will trigger a CGT. Move some BTC from your wallet to an exchange? CGT payable on network fees you just spent transferring it.

Buying some ETH with your BTC. CGT triggered and now you owe the ATO fiat AUD. Same for the coffee/Tesla.

This is all trivial stuff if you keep good records and use tax calculator tools at tax time. Just needs planning to ensure you have enough BTC/assets/cash to hand over at tax time.

Of course this also works in a down-cycle. Did you incur a CGT loss when you buy that coffee/Tesla? Then you can offset that loss in future years gains.

Hi Phil,

This is interesting.

If I spend BTC to buy things, will I or won’t I get taxed? Is there legislation on this?

I can perfectly understand how someone converting their BTC back to fiat would have to pay CGT, but I’m not sure how buying BTC and then spending BTC would incur CGT.

If the ATO (& their international counterparts) don’t treat spending BTC as a CGT event wouldn’t they be recognising it as a legitimate currency? A step I would wager many taxation offices/governments would not be on board with at this time.

Do you take into account the equity in your PPOR? Although you are not adding to your portfolio, you might be surprised how much the value of your house has been increasing. It can make “I am not adding” feel more positive, knowing this is compounding in the background.

Personal note. You will find your upcoming Christmas (your child’s first Christmas) very special. Please take time to really enjoy this. When my son had his first Christmas my wife brought a special decoration for the tree. We have photos of him holding this and him sitting next to the tree. My son is now a teenager but it is a really nice memory to have each year when we hang this particular decoration on the tree.

I usually update our PPoR value twice a year.

I’m so excited for Christmas! She’s starting to take everything in. It’s going to be unforgettable 🙂

Would love to see you crunch the numbers more on solar and in some interesting ways (like compared to the stock market or % return). It seems people still get hung up on the feed in tariff. Getting a Fronius inverter installed on a 6.6kw system for under $4k seems like amazing value to me. In WA last time I looked the Sub $4k systems all had cheaper inverters.

Yep, I plan to do a whole post about it.

The feed-in tariffs used to be what people focused on, but they are so low now that it hardly moves the needle. Consuming your solar power is where the real savings come from these days. I think the tariffs will continue to drop anyway.

We got a great deal. This was back in 2021, though. I have seen quotes rise substantially since (friends and family have had units installed lately).

https://btcmap.org/ is where it can be spent, using the lightning network. Its working for El Salvador so any bugs will get ironed out in time. As far as BSV goes, well, BTC has a much larger network, thus value. And Craig Wright, well who knows, lets see what happens in court….

Wow, great map! I’ll have to track down some of those stores 🙂

I really appreciate you continuing to publish these numbers. It makes such a difference to see someone’s real journey & not just the theory. I have also appreciated your honesty as the journey & priorities have changed – again very real & I am sure many people identify with this.

It would be interesting if you had the data of the cost of your child each year . I had a child just over a year ago and find my spending has gone up a lot, and probably a lot more than I would have predicted if I had added all of the unit costs together

I think the main reason for this being a shift in my prioritise, with me valuing time and convenience much more than delayed gratification. I much prefer to have the thing that will help with the child now then to suffer, save and wait. Or to really need it, not have it and add stress.

Also there is so much less time for optimising the budget, it has fallen so far down the priority list. I spend most of my time now adapting quickly to the next milestone things I need and change of clothes size or season. If I am at the shop and have the opportunity to get something I do as even shopping is not as easy as before.

But my going out to eat spending has dropped drastically! Restaurant meals are just no longer as enjoyable as before.

Great comment, Kate.

I find we pay the convenience tax a lot more these days too. Call it lifestyle inflation, I guess.

I got a CryptoSpend account. I send my crypto there and have a card that I can then use at any checkout like a regular EFTPOS card. I use it at Coles etc. It’s Australian. I am happy with it.

I will say that on two occasions I went to pay for something, it declined for no reason at places I have used it successfully before. (It’s worked fine since) … so because I’ve had that experience, I always make sure I have a backup card just in case there’s an issue at the merchant’s end (That’s what CryptoSpend told me – it’s an issue at the merchant’s end). Otherwise it’s been easy to top up and withdraw from. 🙂

https://www.cryptospend.com.au/

I’ve seen these before but they’re just converting BTC into fiat behind the scenes right?

Wish you enjoy your fatherhood and I like reading your blog and you inspired me to create my own blog even I am only one to record and not many readers. But I guess that it is meaningful things to share experience like you did.

I used to buy ETF CRPTO and I thought that the risk will be less than invest directly in Bitcoin. Then, it become the most worse ETF I hold and lose 80% value.

I noticed that you include Bitcoin in your FIRE portfolio even though it doesn’t generate passive income. Why is that?

I guess at a broader level, what is your plan with Bitcoin? To sell when you make profit e.g. double or are you planning on holding indefinitely?

I have a small portion myself but I’m struggling with whether I hold it until I make some money and covert that to EFTs or hold it indefinitely even though it isn’t generating income like a gold bar

I used to stake my Bitcoin and generate income from it, but I’ve stopped doing that now. Our current plan is to spend our BTC down to $0. I’m more inclined towards its potential rather than its investment prowess.

My goal is to use Bitcoin as a technology, not just to hodl and get rich. Specifically, I want to explore using it for travel expenses in places like Indonesia, Egypt, and the USA, making payments from my phone with minimal fees. I’m interested in witnessing what Bitcoin can evolve into.

I guess my question would be, would wouldn’t I include it in our FIRE portfolio considering it’s similar traits to cash?

Hi AFB, great to see your progress and that you are enjoying fatherhood.

I wondered, how are you accounting for taxes in your FIRE calculations. Have you factored it into your expenses or the 4% rate? Keep up the great work. P.s. we have a Model Y and love it.

Thanks Oliver,

Yes, taxes have been accounted for within our 4% rule.

I love the red line / blue line chart view! I just updated my own spreadsheet to include exactly the same.

I have all the data for the past couple of years and now I’m ready to really focus more on getting the spending down and the investment income line up in 2024. Thank you!