I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

As a relatively new father of three months now, I feel compelled to write about a device that has significantly improved the well-being of both my wife and me.

And I promise I’m in no way, shape, or form affiliated with the company selling this product.

The bad boy pictured above is called a SNOO, and it’s basically a smart device for your little bambino.

This thing is crazy:

- It has 4 different levels of ‘rocking’, which helps soothe your baby to sleep.

- It has a microphone to detect if your baby is crying (which can then increase the levels up or down depending on what pre-made settings you have assigned in the app).

- It has a speaker for white noise and a ‘hushing’ sound if your baby starts to get upset.

- The app tracks your baby’s sleeping patterns, which apparently is useful if you want to sleep train (we haven’t got this far yet)

But most importantly, it helps you and your partner get better sleep for the first 6 months, which is invaluable.

We got our SNOO second-hand for $800, which might sound like a lot of money (and it is), but good God, that sum seems laughably low compared to the value it has brought us.

Picture this:

It’s 4:30 AM, and you have been jolted awake by your baby’s cries.

You’re smack bang in the middle of some REM goodness and so tired you could nearly throw up. You’re just about to flick the covers off and rock your baby back to sleep when you hear the SNOO’s responsive rocking motion kick it up a notch and start soothing your baby.

You give it a minute or two, and, to your absolute astonishment, your baby goes back to sleep, and you get another glorious sleep cycle.

🙌

Words can’t explain how glad I am that we set ourselves up before having kids. Now, spending nearly $1,000 on a device like this doesn’t cost me a wink of sleep. I would have never done that in my 20’s and it gives me anxiety to think I would have forgone such a great innovation for the sake of getting ahead financially.

The SNOO has been a godsend for us so far, but I’ve also read that it bites you in the ass when you have to take it away… but I’ll take 6 months of sleep and then deal with the consequences any day of the week.

Good luck, future Firebug 😅

Net Worth Update

Santa came early for us share market investor in December.

A huge month for all asset classes to boost our NW to a record high of $1,283,257.

| Years End | Net Worth |

| 2021 | $1,038,417 |

| 2022 | $1,171,120 |

| 2023 | $1,283,257 |

We started 2023 at $1,149,655, which means we increased our net worth by $133,602 during the year.

But here’s the astonishing thing… we didn’t make any investments throughout the year, and we spent all of our dividends!

Yeah yeah yeah, I know 2023 was an exceptional year, but still.

The power of compounding is crazy!

We spent all our investment income, took two trips abroad, had a baby, didn’t work for six months, made no new investments, and yet our net worth still grew by over $130K — absolutely mind-blowing! 🤯

For anyone reading this who might be just beginning their journey, I have one message for you:

Keep going.

The snowball is so bloody hard to get going. But once it’s rolling, it gets easier and easier. And you get to a point where it feels like you’re playing this money game on easy mode.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

A pretty normal month spending-wise.

Shares

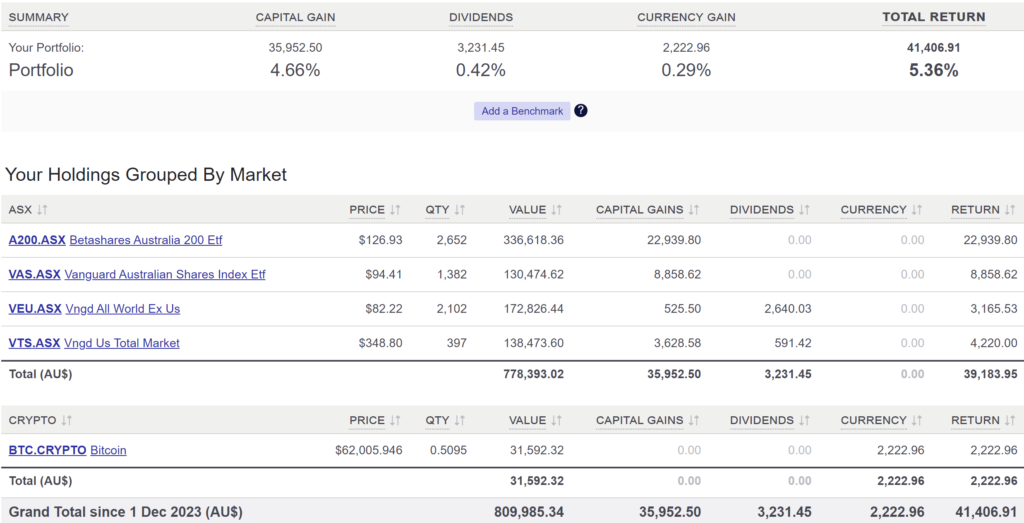

The above graph was created by Sharesight

For the first time ever, we sold a significant amount of shares in December.

We sold $30K worth of VTS to help seed our co-working dream.

We opted for VTS as it had become the most out-weighted holding compared to VEU.

I didn’t want to sell any of our Australian shares (A200 and VAS) because they will naturally decrease in weight over time as they typically distribute larger dividends.

Mentally, I struggled with the decision to sell such a significant number of shares, but I had to keep reminding myself what was actually important.

Do I care more about missing out on market gains, or is it more important to me to chase a dream?

Given that my family and I are in a comfortable financial position, I believe the above question is rhetorical.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

I Inspiring stuff, mate! Thank you for the words of encouragement “keep going”. The whole snowballing and getting it started feels daunting.

I feel like I’m looking at my future given you’re a few years older than my wife and I. We’re keen on building our ETF portfolio up over the next 3-4 years with the intention of reaching some level of FI for family planning.

We’re only at the “start” of our FIRE journey as we have a relatively small portfolio mainly because we prioritised saving up for our home last year.

Looking forward to your future updates, especially for any parenting tips/gadgets!

Jesus. Outsourcing parenting to an electronic rocking crib…. What have we become……

That’s what all the Boomers keep telling me 😂

Thank you for the keep going. I’m a late FIRE starter (mid 30s) and sometimes it feels hard to keep up the 50% plus savings rate. But your encouragement gave me another confidence boost.

I’m just paranoid about surveillance when it comes to smart devices (I even keep my phone in a signal blocking pouch when I know I won’t need it). Do you know what data is collected and transferred? Have you looked into this?

Thanks Frank.

I work in data professionally so I have an idea of just how much data they must be collecting. I try not to think about it 🙈

Thanks a lot, SFB.

Enjoy the journey and it won’t be long before the power of compounding really takes off.

Cheers.

Hi Firebug. Yes 2023 was a better year! I got a similar return to you but have more net worth. How did you get 130k from a 770k portfolio? That’s 17%? Or are you also tracking your house? (Is that the ppor?l

Cheers Jo

Keen to hear more on this? What is the tipping point for compounding to generate this income?

It really varies based on your investment choices. Most of our shares are in Australian companies.

I began to really see the impact of passive income when it hit around the $400K mark. However, it’s different for everyone.

Our shares did 15.43% (US shares did a whopping 24.86%) but it was Bitcoin that really pushed us up. It returned 154%!!!

What an interesting update!

Looking at your super amount vs shares amount I’m wondering what your thoughts are regarding maxing out your yearly Super concessional contributions to build up that balance to eventually reap the benefits of compounding in that asset class?

Great to read about the SNOO too, first time I have ever heard of it.

Thanks, Mark.

Super is always such a controversial topic within the community.

We have chosen not to max out Super in return for more financial flexibility (such as seeding a business venture).

If you have the majority of your wealth tied up in Super, you’re limited.

If your goal is to be as rich as possible when you hit 60, then Super is the way to go.

We just wanted more freedom and flexibility earlier on in life.

If I had discovered FIRE in my 40s, I would have gone all in on Super, no questions asked.

Definitely you dont want to wait until 67 isnt it? with some sort of transition to retirement early access. But also you only want to spend super money once you are 67. Now im 40ish I think I need to pump my super as you can only put in so much per year and I want to make sure I max that out at the $1.5M limit as well as a few M outside super to RE! Peace.

I believe you can access from 60 if you either retire or change employers at that age. And current limit is $1.9m not $1.5m.

You can put more than $1.9m into super, it’s just that $1.9m will be transferred to a pension account at retirement paying 0% tax, whilst the remainder stays in your accumulation account paying 15% tax.

And you can withdraw money from either accumulation or pension account during retirement.

@ JohnD Yep , Spot on mate ! Age 60 is the target to get to first

@ JH – Age 67 is the Age Pension. Age 60 is first access to Your Superannuation Tax-free.

Thanks Matt,

After I posted this I listened to your latest Podcast episode and you answered this question!

Cheers!

Mark

I’m reading about this SNOO device and thinking about your infamous podcast with Dave and Pat about the ridiculous amounts that people spend on children (which led to our podcast!) and it’s pretty amusing to see how things have changed! Great to see you spending money on things that make your life easier/better, that’s what the money is there for!

Great to see another positive month for the portfolio as well.

Yep – never listen to people comment on raising kids before they have kids!! I’ve never heard of a Snoo but wish it was around when my kids were born.

Haha it wasn’t our finest moment. I’ll try to stick to things I have first hand experience in!

What happened here?

…For the first time ever, “you” sold a significant amount of shares in December

Typo. Fixed now

Yeah, I was reading that as well and was like “no I didn’t”.

We FIRED just before our baby was born and the only bougie thing we got was the SNOO! So worth it! And we sold it for close to what we paid when we were done 🙂 Don’t stress about the SNOO to cot transition… it was actually so easy! All the other SNOO parents I know said so too 🙂 enjoy the extra sleep!

Good luck with the co-working space! Looking forward to hearing all the updates about it.

Wish I knew about the SNOO when I had a newborn. Sounds amazing.

I completely echo your sentiments on the Snoo, it’s been fantastic addition the the nursery setup. We managed to get our Snoo, pram with all accessories including the bassinet add-on for $1250 second hand, a massive $2.2k saving if buying brand new.

One note of advice, is be aware of being dependent on the Snoo if making trips further afield that you’re unable to take with you. We’re heading up the coast and will be no room in the car for it, so have been frantically weaning our little man off it the last two weeks.

We actually crammed it into our car for New Year’s Eve, haha. The car was packed to the brim, but we didn’t want to take the chance of having sleepless nights, so we decided to bring it along.

Mate, as a father of twins who was working through those first 6 months, I have to admit my first though was ‘jeeze, just one kid and semi retired???’

Then after talking to my wife we decided we would have bought two SNOOs had we known about them 🙂

Would be great to hear more about the co-working space, specifically the trials and tribulations od setting it up. Vlog series maybe? 😜

I’ll see what I can do mate. Maybe a podcast is in order.

Haha yep, always gotta check in with the boss.

Thanks for sharing, how do you invest in BTC in Australia? I heard there is some issues with binance.

Great update and good luck with the co-working space! Let me just say PLEASE do a ton of research before deciding to sleep train your baby… new mum here too and decided not to do it. 😉

Hi Mate, it’s very impressing.

May I ask which Broker you are using/used to buy the ETFs? I’m looking for a suitable one to get start asap. CommSec is very expensive, but safe. Some other online broker e.g Stake is much cheaper, and has Chess sponsorship, but your cash is collected and pooled with other people in client trust account, and as per their PDS, there is no requirement for disclosure and auditing of accounts. is this a concern in your opinion?

Thank you, Elysia,

Due to the recent updates in ASIC guidelines, I’m unable to disclose which broker I’m using, unfortunately.

I hope you understand.