I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

*Updated 08/02/2024: There was a miscalculation for this update that was originally published. I’ve updated the title and numbers to be accurate. The oversight was due to failing to record the sale of 87 VTS units on 08/12/2023 in my personal spreadsheet during a busy period, which has now been updated for accuracy.

I’m not one for making New Year’s resolutions, but if there’s one area where I really want to improve in 2024, it’s getting stuff done now and not later.

“Tomorrow is often the busiest day of the week.” – Spanish Proverb

This quote really hits home for me. It perfectly captures how I often catch myself thinking, “Ah, I’ll just do it tomorrow,” but then, before I know it, four weeks have flown by and it’s still not done.

I’ve made it a real priority to just do the bloody job (whatever they my be) today and don’t push it out unless it’s absolutely necessary.

I used to stroll by the weeds sprouting in my garden, always telling myself, “I’ll tackle that over the weekend.”

But this year, I’ve changed my tune. Now, the moment I spot them, I simply bend down and yank them out.

Starting off strong is key for me. I make it a point to pick out a couple of tasks in the morning, be it something on my laptop or just tidying up around the house, that I know I can knock out fast and easy.

It’s all about building that initial momentum. Once I’m on a roll, it’s easy.

This productivity hack does have its drawbacks… it’s harder to kick back and relax since it feels like there’s always something on the to-do list.

I’ve wrestled with this dichotomy my whole FIRE journey.

I want to reach financial independence so I can relax and prioritise all the other non-working aspects of my life. Yet, I can’t help but feel like I’m squandering an amazing opportunity if I’m not being productive.

One thing’s for sure… procrastination is no friend to either goal.

Another NY reoslution I’ve made that’s done wonders for my productivity (and probably hygiene) – no phone when I’m on the throne.

It’s unbelievable how much time I waste scrolling on my phone when I’m on the loo. It’s also kinda gross as well 😂.

Net Worth Update

The share market had another great month In January which propelled the NW to all time highs.

We saw a pretty hefty chunk of cash go out the door, thanks to a few pricey buys we needed for setting up the co-working space. I’m not including those in our ‘expenses’ chart below since they weren’t about keeping up our standard of living. Instead, they were one-off purchases tied to getting the new business off the ground.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

.

Shares

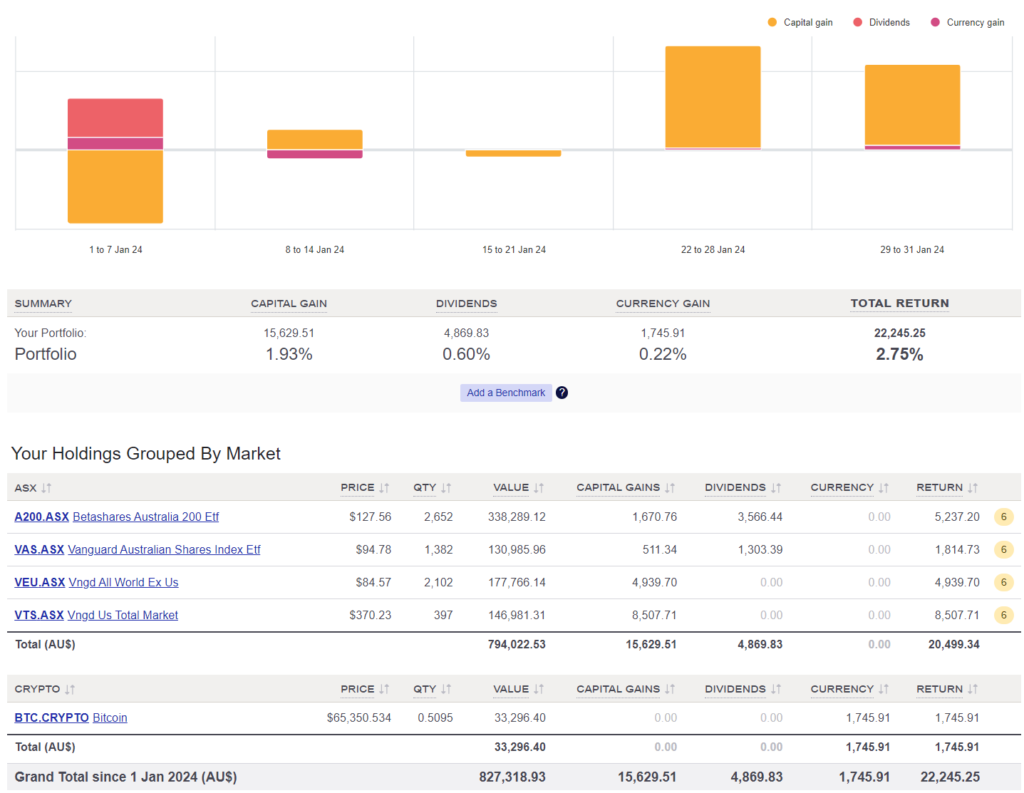

The above graph was created by Sharesight

Seeing nearly $5K in dividends come through in January was definitely a welcomed sight.

I found myself mulling over our passive income setup recently.

We’ve got five days each year that we really look forward to. There are the four days when dividends get paid out, plus that extra special day when we receive our refund from the franking credits. And honestly, the wait between those five days never feels long. Just as one batch of dividends lands in our account, it feels like the next payout is just around the corner.

I love this way to invest, especially from a psychological point of view. It’s like having a mini payday always on the horizon.

Passive investing. Simply amazing!

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

Lovely article AFB! Co-working space sounds awesome!

Are you still purchasing shares or just letting the snowball grow?

We’re channeling our savings into different ventures for now. The snowball has grown large enough for us to feel comfortable exploring other opportunities.

Have you done or would you do an article covering the basics of keeping sharesight accurate.

I hold A200, VEU, VTS and also DHHF (only one with auto reinvestment) and more often than not things are off by 1 or 2c. How do you reconcile these accurately?

Good question, I’m also interested in this answer.

Also you have 6 new/items that need verification, do you actively reconcile, as Trav mentioned?

Hi

Can I just jump in here. First time poster… :-), long time follower…

Its time I started using sharesight for my share tracking for myself (6 holdings) and my wifes (4 holdings).

I actually have run with excel since ’90s when I first bought into “which Bank” via the IPO, but my wife is more recent and all history is in CommSec. I decided TODAY, I must act and just wanted to ask for any tips or suggestions on loading/entering my current holdings to get started. Cheers

Do you DRP by any chance?

Yes for DHHF I do.

Good one Matt. A little mantra I live by is – “Do the hard thing” it really keeps me honest, and after listening to Huberman he confirms “doing the hard thing” is great for you Anterior mid cingulate cortex (aMCC) for building will power.

Love Huberman! That’s a great Mantra to live by Dingo

Every month after I read your updates the first thing I do is try and convince my husband to move 😂

It always challenges my mindset because although our net worth is higher we’re still very much stuck in the rat race paying down our (exhorbitant) Sydney mortgage and not spending as much time as we’d like with our two little boys – Seeing you guys start to spend a bit more the last year and enjoy your time with your little one has really hit home and has us both thinking about it much more seriously this month! So thanks for sharing as always (and a HUGE congratulations!). I agree on the dividend investing. I know lots of people prefer growth, but getting those deposits every quarter are what makes the returns feel real to me too.

It’s a balancing act, Christie. It also depends on where your friends and family are.

My wife and I have been so incredibly fortunate to live in a low-cost area where our friends and family are. It makes achieving FIRE (financial independence, retire early) a lot easier compared to Melbourne and Sydney.

Seeing my daughter grow up every day has been the biggest dividend our portfolio will ever distribute. We are incredibly lucky 😊

Go Firebug!!!! It’s fun to see your numbers grow!!!! It’s also fun to be a little ahead of you too 😆!!!! Admittedly I was jealous of your UK stint when we really pulled our numbers ahead of yours so maybe you’ve got more assets in the life memories bank?! Not sure when our enough will be, maybe another year or two, famous last words!!!!

Thanks, Emma, and congrats on your portfolio growth!

I’m glad these updates have provided some fun competition. I was always inspired by the US bloggers who published their numbers, too.

It can make the ‘boring middle’ fun and exciting.

Co working space sounds awesome, I moved to Melb for the buzz within the local tech scene, this combined with a smaller town with a community vibe would be great. I can also relate to the push pull of being productive and not knowing how to shut off. I’ve somewhat accepted this now as the price you pay for having a curious mind that will take you places.

It made me contemplate though how happy I would actaully be when I do get to FI. This lead to the decision of going down to 4 days a week last year for about 6 months at 20% pay cut to prototype the lifestyle. It’s crazy how different a 4/3 split feels compare to 5/2 – it’s almost 50/50!

I wrote myself a letter on my last day of full time work, outlining my thoughts and the things I feared most were what others would think, ie: lazy, and a personal loss of momentum which turned out to be half true. That momentum loss funnily enough provided the space and time to reflect heavily, work on a few things and make a shift in my career – doubling my salary on my return to full time with another company. Big learning experience on gunning for a full exit versus more flexibility and options.

I can relate to a lot of what you’re saying T.

My relationship with work has evolved so much over the last 14 years I could write a book about it!

Looking fwd to the Feb update