by Aussie Firebug | Jun 10, 2023 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

Not a lot to report for the month of May.

I’ve been working nonstop on my business and preparing for a big conference at the end of June.

It’s amazing how fun work is when you’re in control and have a personal goal to work towards. What’s equally amazing is how many different hats you have to wear to get other businesses to buy your product.

In the month of May, I’ve been a:

- Marketer

- Developer

- CIO

- CEO

- Graphics designer

- Data Engineer

You’d think that building a product that’s better than anything else in the market would be enough.

But it’s not.

So much of what drives business is relationships. I remember when adults use to tell me that networking was one of life’s most important skills.

“Get out there. Meet people. Get to know them”.

It’s hard for a teenager to fully grasp what this means.

But as I’ve gotten older, it’s become crystal clear that developing relationships is paramount if you want to do business.

Another slightly annoying thing is how much authority LinkedIn has.

I’ve never posted on LinkedIn before. I had a profile years ago but it’s been sitting dormant because I just didn’t see the point. The whole website seemed like a showoff extravaganza.

But it has a level of authority in the niche that I’m selling to (government). Potential clients were telling me it was a red flag that my company didn’t have a LinkedIn presence 🙄.

So I had to put some effort into building a company page and posting some content.

This social media peacocking is part of the game you have to play when you’re new. It just is what it is. And if I want to reach my goals, I can either play the game or give up and try something else.

Wearing these different hats for the company and learning different skills is fun. It’s not what I want to be doing all the time but I absolutely love learning about the human behavioural science of commerce.

I’d wager that 90% of the deal comes from marketing and your reputation/relations in the industry. If you have a good rep and are known to produce exemplary work, half the battle is won. When you’re the new guy on the block, you have to establish authority by building brand awareness and offering a competitive advantage.

This is something I’ve always wanted to have a go at and it’s been a lot of fun so far. I’m hoping that I can land a big contract or two after the conference and hire someone.

My dream of the co-working space is on pause until early next year.

Net Worth Update

Everything went done this month with Super being the only asset class in the black.

A lot of cold hard cash went out of our accounts in May too.

The two big reasons for this were a big tax bill for the company and the cost of the June conference.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

I don’t include company expenses in the above graph because we don’t rely on them to maintain our lifestyles. I’ll probably remove company assets (cash) from these updates eventually to make things clearer too.

Shares

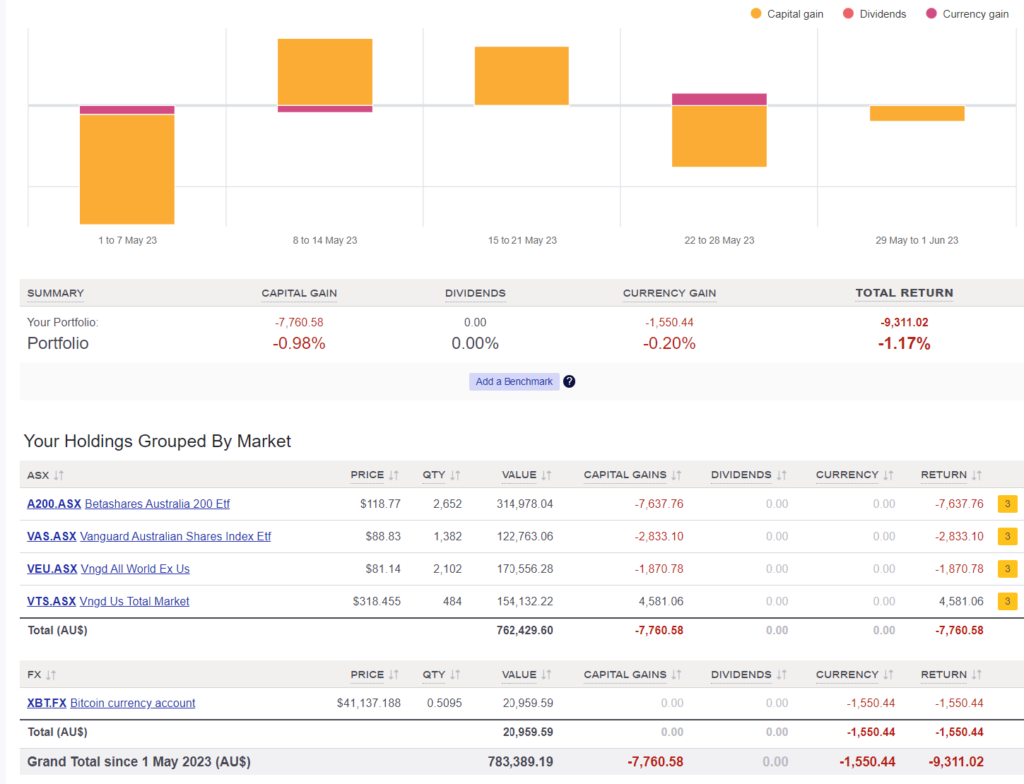

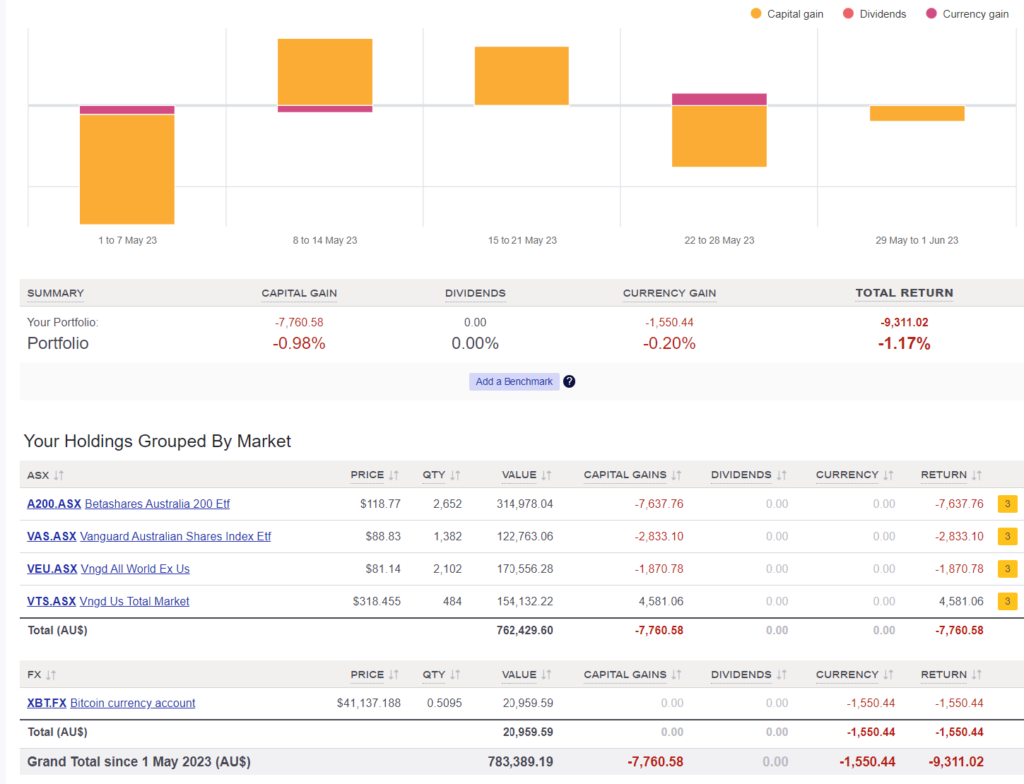

The above graph is created by Sharesight

I’ve added our Bitcoin holdings to our Sharesight portfolio!

This was really cool because I’ve never worked out the total return we’ve made since 2017. As I type this out today, we’ve had a total return of 4.44%. A lot of that has to do with buying the bulk of our Bitcoin last year and the price of BTC going down a fair chunk since then.

I’m still waiting for businesses to offer the lightning network so we can use our coins in day-to-day transactions. Maybe that day will never come but I’m hopeful for now.

No new purchases again for May. Most of our spare cash is going into the business.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | May 7, 2023 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

We landed back in Australia at the end of April after a month abroad.

Japan was such a unique adventure and I’m really glad we persisted with booking it. We were close to going last year but the Covid restrictions meant we would most likely get a half-baked experience.

I have so many great things to say about Japan that it’s hard to know where to start.

As most people would have probably guessed, the food was amazing.

Ramen is life 🍜!

Interestingly enough, we found that Sushi was more of a delicacy than a quick lunch snack like it is in Australia. I think the West has bastardised Sushi. We didn’t see any deep-fried chicken sushi rolls for example 😂.

The cities are so clean! I’m talking ridiculously clean. Australia is pretty clean by world standards, but Japan is next level. And it’s ironic because it’s so hard to find a bin. Cleanliness is built into their way of life.

I’m not sure if this is common knowledge or not (I didn’t know about it) but it appears that Japan has a strong biking culture. It was one of the first things that jumped out at me when I was walking around Tokyo on our first morning. So many people were riding their bikes around. And hardly anyone was wearing a helmet! There were so many bikes that we routinely saw bike parking signs outside of restaurants directing people to park their bikes around the corner and not to clog up the footpath.

I had heard that Japanese people were respectful but the level of politeness still surprised me. Even if they didn’t speak English, they would often go out of their way to accommodate our group. I loved the constant bowing too. Gestures of respect and welcome radiated throughout the cities and towns we visited.

It was so cool to learn some Japanese history before our trip and then see some of those historic sites in real life.

Fun fact of the day, for about 200 years, between the early 17th century and the mid-19th century, Japan pursued a policy of isolation known as “Sakoku,” which literally means “closed country” in Japanese. During this period, Japan severely restricted contact with foreign countries and only allowed limited trade and diplomatic relations with China, the Netherlands, and a few other countries.

The Tokugawa shogunate, which was the feudal government that ruled Japan during this period, believed that foreign influence and ideas could undermine their power and control over Japanese society. To prevent this, they imposed strict regulations on travel and trade, and prohibited Japanese citizens from leaving the country by penalty of death.

As a result, Japan remained largely isolated from the outside world and developed its own unique culture, traditions, and technologies. However, this policy also hindered Japan’s economic and social development, and eventually contributed to its vulnerability to foreign powers, leading to the country’s eventual opening to the world in the 1850s.

Brasilian Jiu-Jitsu can be traced back to Japan through its roots in traditional Japanese Jiu-Jitsu which is cool. I trained at a Dojo in Osaka and will cherish the experience forever.

BJJ in Osaka

I felt like a kid again when we did a day trip to Universal Studio Japan. They have the only Super Nintendo World theme park in the world!

Super Nintendo World

I have a few photos of Super Nintendo World but they honestly don’t do it justice. Check it out on YouTube if you want to see it but it’s actually insane. Like, the amount of detail in this world is crazy. It’s like I was transported back to being 10 years old playing the SNES with my dad haha. They even had little mini-games inside where you had to punch the coin blocks to get more points and beat the Goomba’s in a race plus a whole bunch of other stuff. We all had a little Bluetooth band (I’m wearing my Luigi one in the pic) which recorded your score whilst in the world. You could look up the scoreboard for the day and see where you ranked. It was CRAZY!

We didn’t go on that many rides because the wait times were also crazy but I just loved being inside the theme worlds and visiting the shops and little shows. My second favourite place was Harry Potter World and the detail they went to was better than Super Nintendo World. They had built a goddamn castle on a hill that you could legit go into and walk around in!

We ended our Japanese trip by visiting the city of Hiroshima.

Hiroshima is located in the western part of Japan’s main island, Honshu. It is best known as the site of the first atomic bombing in history, which occurred on August 6, 1945, during World War II.

At 8:15 a.m. on that day, a United States B-29 bomber named Enola Gay dropped an atomic bomb over the city, killing an estimated 140,000 people, many of them civilians, and injuring countless others. The bomb, nicknamed “Little Boy,” devastated the city, destroying most of its buildings and causing widespread fires and radiation poisoning.

A building that survived the bomb.

We visited the Hiroshima Peace Memorial Museum which is dedicated to preserving the memory of the atomic bombing and promoting a message of peace and nuclear disarmament.

I’ll be honest, the audio tour was really hard to get through. The stories you hear from the survivors plus the images and artifacts in the museum were devastating.

I could go on and on about Japan but I’ll wrap things up here. Solid trip and we will be back one day!

We flew to South Korea for five nights after leaving Japan.

We stayed in the capital of South Korea, Seoul.

I was impressed with the number of electric cars in Seoul.

Mrs FB and I would routinely be surprised by how quiet some streets were. They were full of cars, but sometimes it was 100% EVs. So eerie when you can’t hear cars coming. I think manufacturers may need to address that in the future.

It makes sense since both Kia and Hyundai are Korean companies and they are near the top of the EV frontier.

My favourite part about visiting South Korea hands-down was going to DMZ (Demilitarized Zone).

The Korean Demilitarized Zone (DMZ) is a 250-kilometre-long and 4-kilometre-wide buffer zone that separates North and South Korea. It was established after the end of the Korean War in 1953 as part of the armistice agreement between the two countries.

The DMZ is one of the most heavily fortified borders in the world, with troops from both North and South Korea stationed along its length. The area is strictly controlled and access is limited to authorized personnel only.

DMZ at the border of North Korea

We got 10 meters from the North Korean border by going down into The Third Tunnel of Aggression but photos were strictly forbidden down there.

The Third Tunnel of Aggression is a tunnel that was discovered in 1978 by South Korean forces near the Korean DMZ. It is one of four known tunnels that North Korea dug beneath the DMZ with the aim of launching a surprise attack on South Korea.

The tunnel is approximately 1.6 kilometres long and 2 meters wide, and is located about 50 kilometres from Seoul. It is estimated that it could accommodate up to 30,000 North Korean soldiers per hour in the event of an invasion.

The tunnel was discovered after South Korea became suspicious of several sinkholes that had appeared near the DMZ. They conducted an investigation and eventually discovered the tunnel, which had been dug through solid rock by North Korean soldiers using explosives and pneumatic drills.

This is pretty funny but apparently, North Korea told South Korea they were just mining for coal and had stuffed up the drilling. This excuse may have worked if there was only one tunnel, but South Korea has officially found four so far apparently there are more than 20 😂

Net Worth Update

Everything was up in April except our cash holdings.

I’ve spent a fair chunk of change promoting my company hoping to land a big contract this year. I’m going to start ramping things up as soon as I have more work.

I’m not going to lie, it’s really nice being able to get home from a big holiday like our Japan/South Korea trip and not have to be back in the office first thing Monday morning. But I’ve been craving a new challenge for nearly a year and I still have a dream of fostering my very own fun/exciting work environment. Combining that with a community-based co-working space is the dream!

But I need a hell of a lot more money to make this dream a reality. And more important than money, I need contracts.

I don’t really care about the money so much as I care about having enough work to sustain a small team. I should be able to start looking at putting 1 or 2 people on towards the end of the year if everything goes to plan.

If you have skills in Python (pandas, sqlalchemy, requests), SQL and/or any data visualisation program, shoot me an email and we can have a chat. The job could be done remotely but I want to hang out with great people in the real world so coming into Latrobe Valley a few days a week would be a must.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

A few big expenses for the business this month.

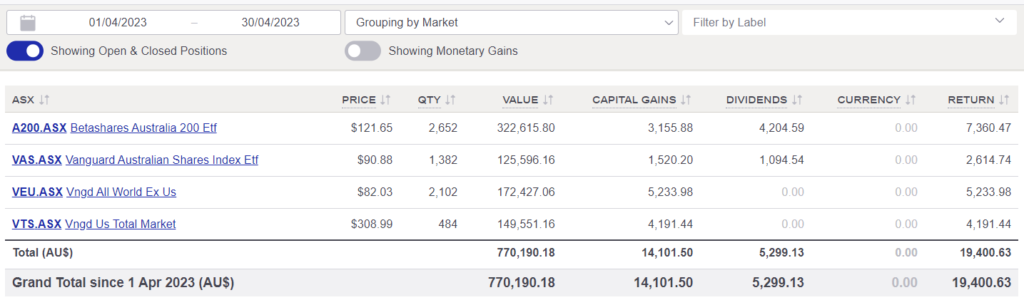

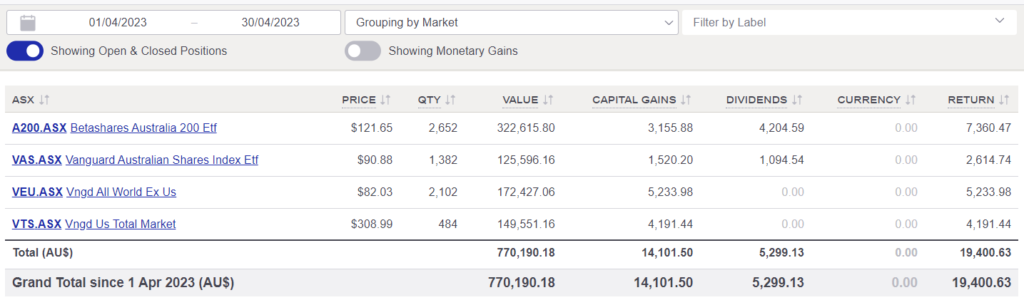

Shares

The above graph is created by Sharesight

A big month in the share market but no new purchases.

All spare cash went into the business in April. I’m hoping to start investing again after the next contract.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | Apr 17, 2023 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

This is going to be a super quick update because I’m currently overseas and haven’t had much time/energy.

At the end of March, Mrs FB and I touched down in a country that has been on my bucket list for as long as I can remember.

It ticks nearly every box I can think of for an interesting adventure.

- Unique and delicious local cuisine✔️

- Different culture✔️

- Stunning scenery✔️

- World-class snow✔️

- Not too expensive✔️

- Great public transport✔️✔️ (maybe the best I’ve seen in over 30 countries)

And then there are some personal attractions I’ve always been drawn to.

- Nerd Central (anime, gaming, manga)✔️

- One of the tech capitals of the world✔️

- Electric vehicle innovation hub✔️

If you haven’t guessed by now, I’m talking about the land of the rising sun…

JAPAN 🇯🇵!

We’re here with another couple for a few weeks before heading off to South Korea.

Here are some shots so far:

Bullet Train

Cherry Blossoms (photos don’t do it justice)

Deer at Nara

Friendly Deer

Tokyo Temple

Botanical Gardens Kyoto

Ramen🤤

Shinjuku @ night (feat. Godzilla)

Tokyo Dome

Bamboo Forest Kyoto

Net Worth Update

Shares, Super and BTC do the heavy lifting this month. It was another blowout month (savings-wise) as we loaded up our Wise cards with Japanese Yen and South Korean Won.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Another supercharged month of expenses during our travels.

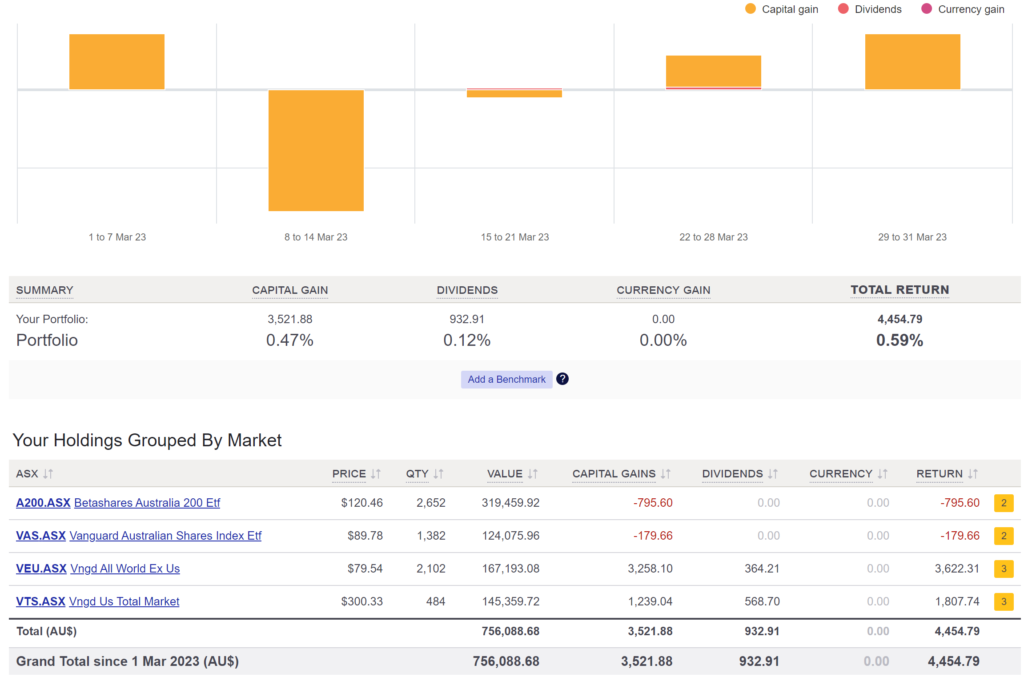

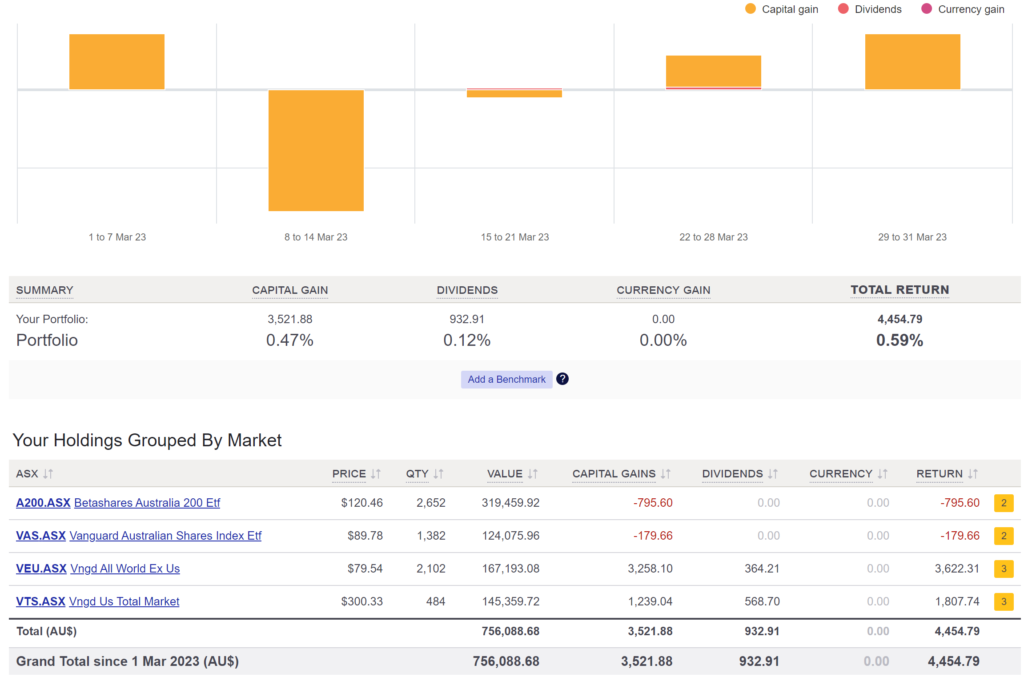

Shares

The above graph is created by Sharesight

We didn’t buy any shares in March and have been using our dividends for expenses for a few months now.

Part of me hates not adding to the snowball but everyone has to switch to consumption mode eventually or else there’s not much point in investing.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Networth