by Aussie Firebug | Nov 19, 2021 | Podcast

Summary

Today I’m speaking with Chi Lam, an ex team-lead in the medical devices industry who lives in Sydney with his wife and 2 daughters. Chi was recently featured in an ABC Everyday article where he shared his story about how he quit his full-time job in his mid-thirties and redesigned his life so he could spend more time with his family.

Some of the topics in today’s episode include:

- Who is Chi and when did he start thinking about financial independence? (06:37)

- Chi shares the traumatic story of how he and his family came to Australia from Vietnam. (07:51)

- What Chi learned about money and life from his experiences as a child refugee. (13:19)

- When, how and why Chi got started investing in property. (16:18)

- Chi talks about the day he quit his job and what made him take that leap of faith. (28:45)

- How Chi’s side hustle/passion project has grown into a full-time business on his own terms. (36:02)

Links

by Aussie Firebug | Nov 18, 2021 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

October was a great month for a number of reasons.

Regional Victoria COVID restrictions started to ease up and we were afforded a lot more freedoms which have been a real blessing. We had planned a weekend away with a bunch of friends that unfortunately had to be cancelled a few months ago. But due to the easing of restrictions, we re-booked the trip to the high country and just hoped that nothing else would pop up.

My mate Jimmy organised this trip which was a weekend away in an old school log cabin at Tamboritha… which some of you guys out there reading might remember from school camp! Most of the group went to the same school growing up and it was a trip to be back at Tamboritha as an adult nearly 20 years after our school camp there.

The high country was beautiful and one of the best features of the trip was the absence of phone service. The campgrounds were so remote that no one really looked at their phone for the entire weekend which was refreshing. We played a whole bunch of boards games (any Secret Hitler fans out there?) and cards and everyone was just living in the moment. I’d really forgotten what it’s like to hang out with people without mobile phones.

Negative 2 degrees in the morning was a bit rough, especially considering the showers were semi-outside lol. But overall, an amazing get-away with a great bunch of friends (and kids) that was much needed after all the recent lockdowns!

Net Worth Update

Oh so close… again 😅

Another month of just falling short of joining the two comma club see’s the old NW land in the high 900’s at the end of October. This is a much better result than I had anticipated considering our holdings in SOL (which came about after the Milton merger) had a decent pullback. I’m sorta kicking myself about not selling Milton before it merged… We’ve actually sold out of SOL now (mid-November) for two reasons.

- We wanted to sell Milton anyway to move to a pure ETF portfolio. This was mainly due to simplicity reasons (VAS, A200 and MLT covers a lot of the same companies)

- We are gearing up to do debt recycling after we sell our last investment property (IP2)

But if I had just sold Milton before it merged we would have been up around $10K, but it’s easy to look back and make all the right moves… I can’t really complain after what happened with MLT (the special dividend and insane jump in share price) and we’re still way up even with this $10K pull back so… meh.

The major driver for the increase in OCT came from good old fashion hard work and savings with a little bump from our Super accounts.

Pretty normal month on the expenses front.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Properties

IP2 has been on the market for less than a week and we have 4 offers, all of which we’re willing to accept 🎉🥳. We just have to accept one now and sort out the settlement date which is super exciting. We should have everything wrapped up by the November update I think 😁. This was the final piece of the puzzle for us to execute our debt recycling strategy so I’m really excited to nip this in the bud.

Property 1 was sold in August 2018

Property 3 was sold in April 2021

*DISCLAIMER*

The current value of our properties is a rough guesstimation based on similar surrounding properties. I only really update these when we get an official bank valuation

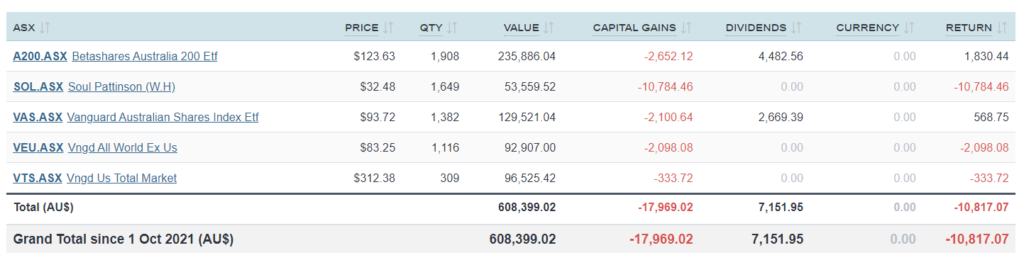

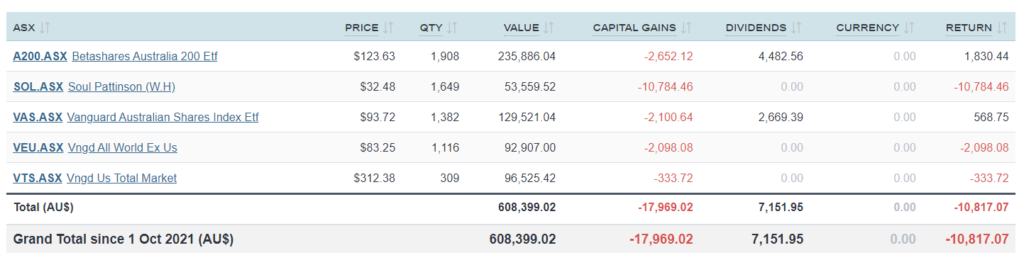

ETFs/LICs

The above graph is created by Sharesight

SOL KILLED us in October… but as I’ve mentioned above, we already make a lot of money with the special dividend from Milton (not shown in this screenshot) and the recent share price jump. So if I zoom out a bit, MLT was still a great investment and I’m more than happy to offload SOL even though it’s dropped this much in the last month.

No buys again in October. Getting everything ready for debt recycling now which should see us drop in ~$200K in the coming weeks. Watch this space 👀.

Networth

by Aussie Firebug | Nov 12, 2021 | Podcast

Summary

It’s my absolute pleasure to welcome Ruth onto the show today. Ruth lives in New Zealand and is better known online as The Happy Saver. She has a very popular podcast and blog where she writes about managing money, living the good life and not working too hard.

Some of the topics in today’s episode include:

- Who is Ruth and why did she create The Happy Saver blog and podcast? (4:49)

- Ruth shares her personal money story and how she became interested in investing. (10:10)

- The important life lessons Ruth learnt from losing her family home in an Earthquake. (16:11)

- Property investing – the significant differences between NZ & AUS tax laws. (19:28)

- The major advantage of investing in the share market in NZ. (24:40)

- Advantages of living in the country over the city. (29:48)

- What does Ruth actually invest in? (35:43)

Links

by Aussie Firebug | Nov 5, 2021 | Podcast

Summary

Today I’m speaking with Terry Waugh who you may know as TerryW from his online legal and tax tips. Terry is admitted as both a solicitor and barrister to the Supreme Court of NSW as well as the High Court of Australia and holds specialist qualifications as a Chartered Tax Adviser. He operates as a lawyer specialising in tax, estate planning, asset protection, and trusts for property and share investors.

Some of the topics in today’s episode include:

- What structuring options do investors have when owning or controlling assets – specifically property and shares? (05:22)

- Land tax – when is it relevant to property investors? (08:34)

- Do many people invest through a company and what are the benefits of doing so? (10:43)

- What trust structures work best for property and share investors? (13:40)

- What is a trust, how do they work and how do investors benefit from trust structures? (15:44)

- What are discretionary trusts and why are they so commonly used? (19:05)

- What are the main pros and cons of using a trust structure and when does it make sense to use one? (20:49)

- How does a trust structure protect your assets? (25:20)

- How do distributions work when investing through a trust? (27:10)

- Who can pay money into a trust and how does that work? (29:42)

- When does it make financial sense to set up a trust? (34:38)

- How much do trusts cost to set up and to keep running? (35:34)

- What is a bucket company and why would anyone use it? (36:14)

- Terryw’s Tax Tip #14 – Never park money in a loan – why avoiding mixed purpose loans is so important. (40:09)

- How to set up and execute a debt recycling strategy in 2021. (42:54)

- Are testamentary discretionary trusts a good option for preserving wealth for your kids? (47:49)

- Why Terry thinks that a testamentary discretionary trust is the ultimate structure. (50:00)

- Buying an investment property through a company structure. (54:06)

- Protecting your own assets when entering a new personal relationship. (55:34)

- Who is the best person to see for investment structuring advice – a lawyer, accountant or financial adviser? (01:00:12)

Links

by Aussie Firebug | Oct 22, 2021 | Podcast

Summary

Today I’m speaking with Paul Benson from the Financial Autonomy podcast. Paul is a tertiary-educated financial planner with over 20 years of experience. We talk about the role of a financial planner and Paul gives us some real-life examples of how financial planners are able to assist us with our FIRE journeys.

Some of the topics in today’s episode include:

- What exactly is a financial planner?

- Why do financial planners have a bad rep in the FIRE community?

- How much does a financial planner actually cost and what should you expect for that fee?

- How do financial planners get paid and how do you tell a good financial planner from a bad one?

- If someone already has a dialled-in FIRE plan, where is the value in paying a financial planner?

- How to find a good financial planner. Is there a financial planner directory in Australia?

- What questions should you ask and what to avoid when choosing a financial planner?

Links

Transcript:

Heads up grammar police, the following transcription is half human half machine and not 100% perfect so expect a few typos and errors…

Coming soon