ASIC Crush Independent Content Creators & the End of Ask Firebug Fridays

After much thought and consideration, I’ve decided to end my ‘Ask Firebug Fridays’ segment after the announcement from Australia’s financial services regulator.

On the 21st of March 2022, ASIC (Australian Securities and Investments Commission) published new guidelines for ‘Discussing financial products and services online‘.

These new guidelines have major implications for content creators in the FIRE and personal finance communities.

This is why I wanted to share my thoughts and opinions on these new guidelines and what they mean for AFB moving forward.

What?

In a nutshell, ASIC is cracking down on unlicensed creators who they think are giving financial advice or are seen to be ‘influencing’ their audience.

Their definitions and examples for what constitutes ‘influencing’ are clear as mud.

They don’t even give a clear answer to what defines an influencer either, having followers ‘In the thousands’ apparently 🤷♂️.

But who’s an official follower anyway? Someone who listens to one episode of your podcast or YouTube video? An email subscriber? A Twitter follower?

You’re probably thinking they’re only targeting people giving specific or dangerous advice right?

Well, you’re in for a rude shock.

We can’t even discuss our own investment decisions or strategies apparently 🤔.

It gets worse.

So… discussing financial products online such as “shares” or “ETFs” without a licence is now illegal…

WE CAN’T EVEN TALK ABOUT ETFS?!

🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩

This is kinda a big deal.

Stopping people from discussing ETFs is starting to drift into the totalitarian type of conversation. And I don’t say that lightly, but a government that restricts people’s right to discuss certain financial products under the guise of ‘it’s for your own good’ starts to remind me of that book that George Orwell once wrote.

Maybe you’re not worried about these specific new guidelines, but it’s the precedence that they set that should cause alarm. No one cares about anything until it impacts them.

What would you say if one day ASIC released guidelines prohibiting unlicenced parents from talking about money and investing with their children?

That’s perhaps hyperbole, but these new guidelines are one step closer to that dystopian future.

My other issue is there are so many questions and definitions that have been deliberatively left unanswered or are so vague that no meaningful conclusion can be drawn… but let’s move on.

Why?

Let’s give ASIC the benefit of the doubt and say these new guidelines were introduced to protect investors.

This is a good thing!

If an investor loses money after receiving bad advice from an AFS (Australian Financial Services) licenced professional, theoretically they should have a pathway to recoup some of those losses.

If an investor loses money after receiving bad advice from someone on TikTok… bad luck.

AFS licensees have to adhere to a set of minimum requirements which provide important protections for investors if something goes wrong (aka a lot of expensive insurance).

With the explosion of online financial content in the last few years, it makes sense for ASIC to take a closer look at what’s going on. Most content creators are producing honest/useful stuff, but I have to admit that there’s been a trend of creators clearly making content primarily for monetary benefits.

You know what I’m talking about. Creating content for the hell of creating content to make sure their channel stays fresh in the algorithm. Releasing rehashed stuff every second day basically repeating what they’ve already said 100 times.

If content creators are receiving a monetary benefit, there will always be some bias no matter what.

“Show me the incentive and I will show you the outcome”

– Charlie Munger

I love this quote and it’s highly applicable to this situation.

Content creators that make money from affiliates and/or sponsors will always have a conflict of interest no matter how small.

And this applies to me too guys. I try my best to be as unbiased as I can but we all have some sort of bias no matter what (sometimes at the subconscious level)! This is especially true when you’re getting kickbacks.

I think the ‘why’ behind ASIC’s new guidelines is fair enough and makes a lot of sense viewed from this angle.

Having said all that…the way ASIC has chosen to crack down on these bad actors is heavy-handed at best, and oppressive at worst.

How?

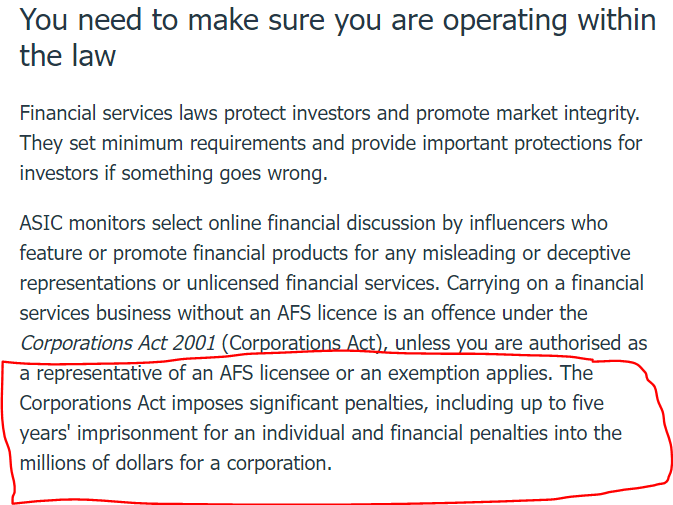

ASIC’s solution to regulate an influx of online financial content creators is to make them pay for a licence (which can cost tens of thousands of dollars a year) or threaten litigation to the tune of $1M+ dollars in fines and up to 5 years in jail… 🙃

To say that this is harsh would be putting it lightly.

To put that into perspective, Australian gangster Mick Gatto has served less jail time than the maximum sentence ASIC can dish out…

A financial content creator might serve more jail time for talking about ETFs, than Mick Gatto… 🤔

I’m starting to think we’re losing the plot here?

Lazy Policy Personified

Let’s recap so far.

ASIC’s solution to a few bad apples within a thriving community of online financial content creators is an all-encompassing blanket rule that will crush independent media.

It’s sorta like dropping a nuclear bomb to get rid of an ant nest in the backyard.

Overkill doesn’t even come close to what these new guidelines are and the only people who are going to be left standing are the big media corporations that can afford to pay the licence fee which can be as high as $30K a year.

Here’s an idea. Why didn’t ASIC just come out and say that anyone who monetises online financial content needs to hold an AFS licence?

It’s a lot more specific and tangible and would weed out people who are only in it for the money pretty bloody quickly.

But no. In typical government fashion, the corporate watchdog releases new guidelines that are so vague and light on details that 99% of online financial content creators are caught in the crosshairs.

I understand resourcing constraints and ASIC doesn’t have the time to monitor everyone and everything but surely there’s a happy middle ground.

A few bad apples shouldn’t ruin it for everyone.

Is The Cure Worse Than The Disease?

The public opinion of the financial sector has been in tatters ever since the royal commission in 2017.

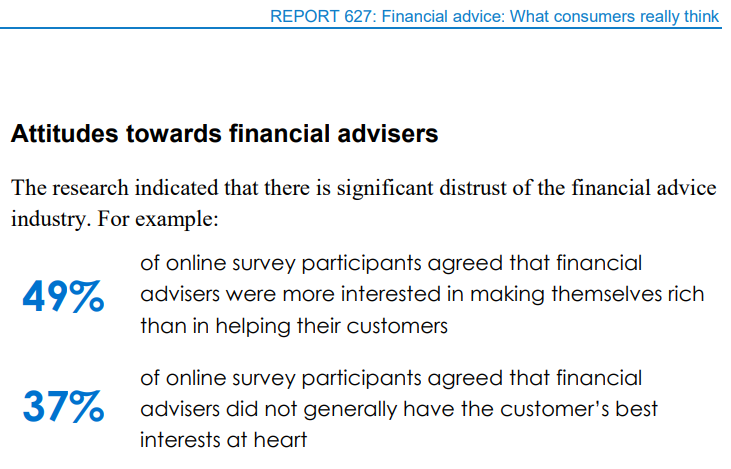

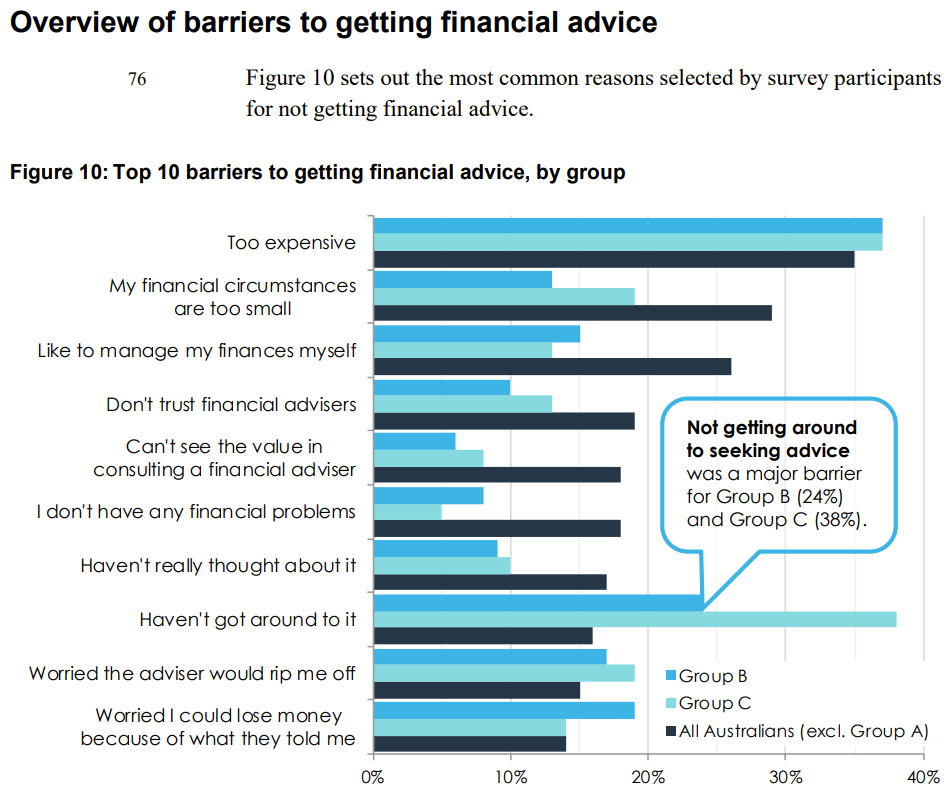

ASIC released a report in 2019 titled: Financial Advice: What consumers really think which found that 49% of those who were surveyed didn’t get advice because they thought advisers were more interested in making money for themselves. On the other hand, 35% didn’t get advice because the costs were too high.

A lot of people are being priced out of financial advice and even more, don’t trust financial planners. The data backs this up time and time again.

I’m not saying regulation is a bad thing, but I think these new guidelines are doing more harm than good.

The truth of the matter is that legislators have made the costs of offering financial advice so high, that the people who need it the most can rarely afford it.

Who should we be prioritising?

The 22-year-old that’s just finished her marketing degree and is trying to make some good financial decisions for the future?

Or the 64-year-old multimillionaire Boomer who owns 7 investment properties?

Why do the legislators think online financial content creators are so popular?

We’re filling a gap in the market that has been created largely because of overregulation.

Some regulation is needed, but these new guidelines are going to wipe out good education material that helps bridge the gap between “I don’t know anything at all” to “I feel confident discussing my financial future with a professional”.

That’s where we content creators thrive! We make stuff relatable and give personality to what can otherwise be a dry topic.

Casualties

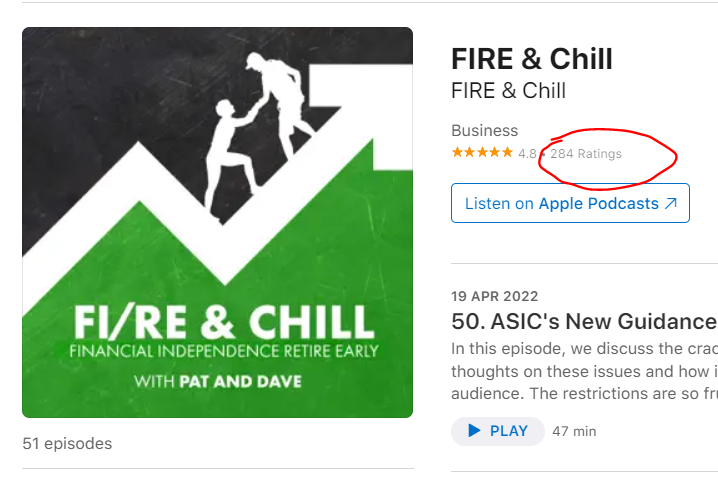

One of my favourite podcasts ‘FIRE & Chill’ decided to shut down in April because of these new guidelines.

Sad day today.

Our last episode of FIRE & Chill just went live. @PattheShuffler great working with you over the last 2 years mate, had lots of fun!https://t.co/jejn9MId6H

— Dave Gow | Strong Money Australia (@strongmoneyaus) April 18, 2022

This is a podcast that averages 4.8/5 on 284 ratings on iTunes and has conservatively helped 10’s thousands of Australians with financial literacy.

Here were two guys making relatable content, for free, that had great reviews.

Another victim of these new guidelines was John Palmer from the very popular YouTube channel ‘INVEST for the future’. John spoke about investing fundamentals drawing from his decades of experience and never charged any money for his videos.

“I know everybody would still like the videos to be there, but I just can’t afford to take the risk”

-John Palmer

Family Finance is another creator that had to delete a bunch of content. She now can no longer give an opinion on financial products 👎

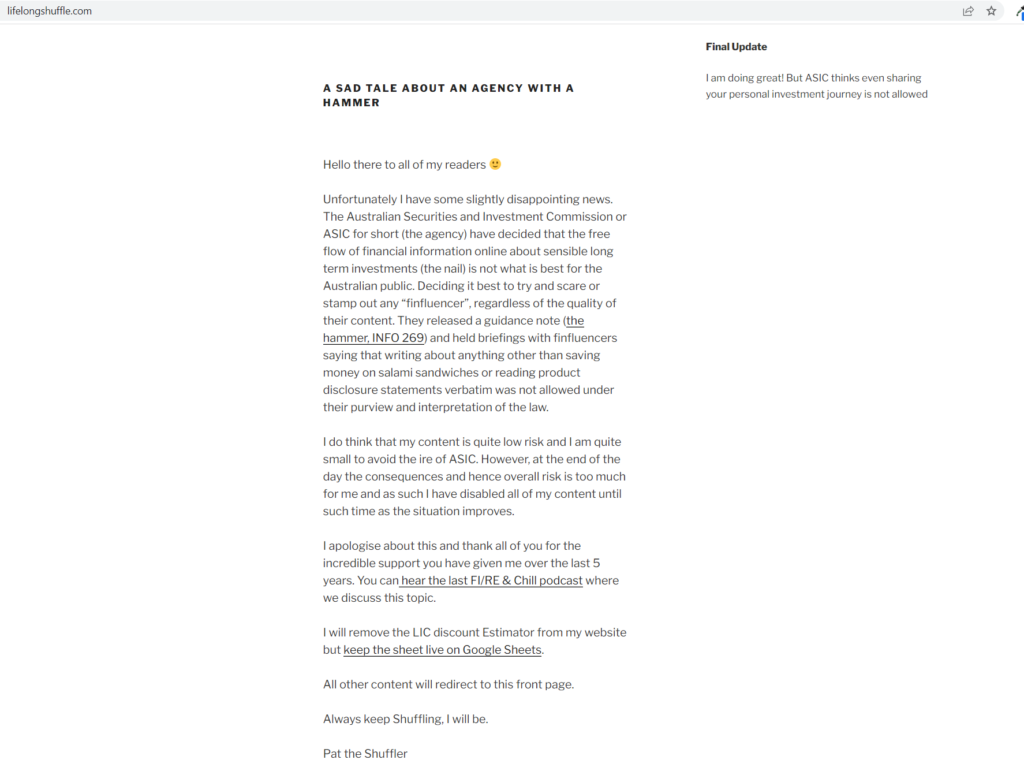

The Lifelong Shuffle blog is another one that has gone into hibernation because of the new guidelines.

I could go on and on showing other examples of great content creators that have been impacted by the new guidelines but I think you get the point.

The new guidelines are inadvertently snagging 99% of fantastic freely available Australian-specific resources.

Below is an AFR article titled ‘These young investors don’t want ‘finfluencers’ to go‘ which tells us what we already know. Many young investors don’t trust the financial industry and are looking for alternatives.

As I’ve previously mentioned, 49% of Aussies don’t get advice because they think they’re being ripped off and 35% think it’s too expensive.

You’d think that ASIC would be putting more time and energy into ‘cracking down’ or improving the professional industry where the public has clearly lost trust?

Yet, ASIC is targeting online financial content creators who have amazing repour within their communities that don’t charge a dime.

I want to repeat this point because it’s important.

Many young people have lost faith and can’t afford advice in the industry that ASIC regulates largely due to over-regulation. Content creators start to fill this void and collectively rack up millions of views, downloads and sessions from a generation hungry for financial knowledge. The numbers don’t lie. If people didn’t like what the content creators were making, they wouldn’t watch, listen or read.

Shouldn’t we want financial education to be accessible for everyone and not just those who can afford it?

More regulation sounds good in theory but the data suggests that it isn’t working.

I have no doubt in my mind that ASIC had the best intentions when they came up with these new guidelines.

But as the old Portuguese proverb goes…

The road to hell is paved with good intentions

Rules for thee but not for me

One of my biggest gripes with this whole fiasco is the hypocrisy.

ASIC’s position is that unlicensed content creators might ‘influence’ investors to make costly decisions yet ASIC themselves are publishing content that’s detrimental to wealth creation.

Case in point, the Moneysmart website.

Moneysmart is a Federal Government website, brought to you by ASIC.

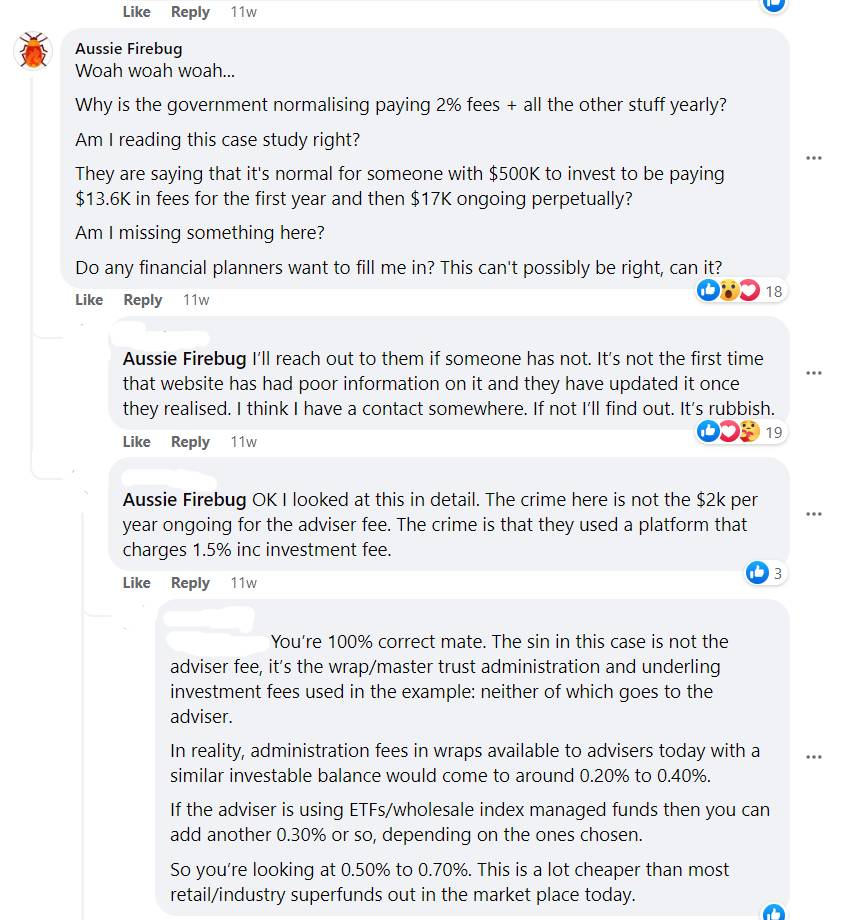

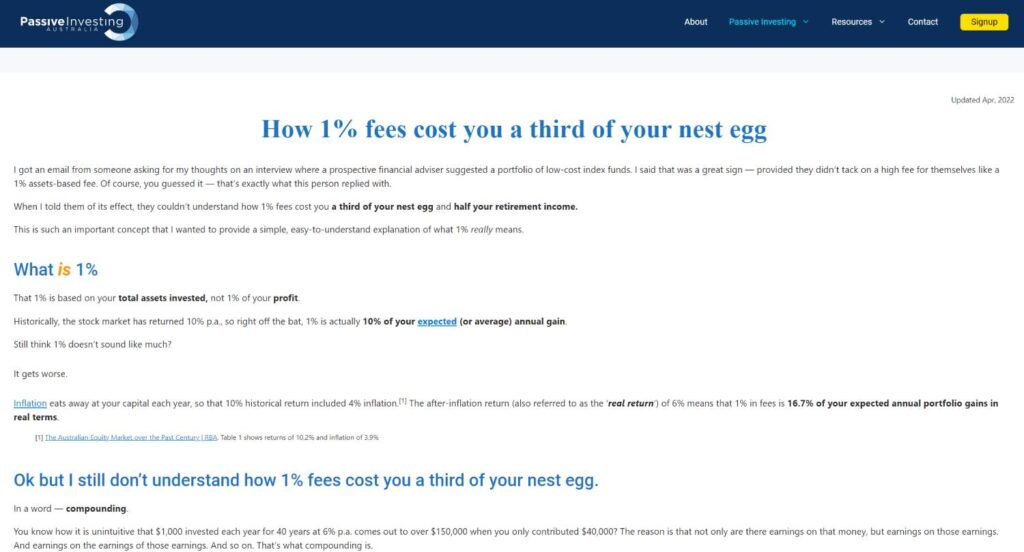

To be fair, they have a lot of great free resources and tools but their advice for financial fees is downright terrible.

Here’s a cracker.

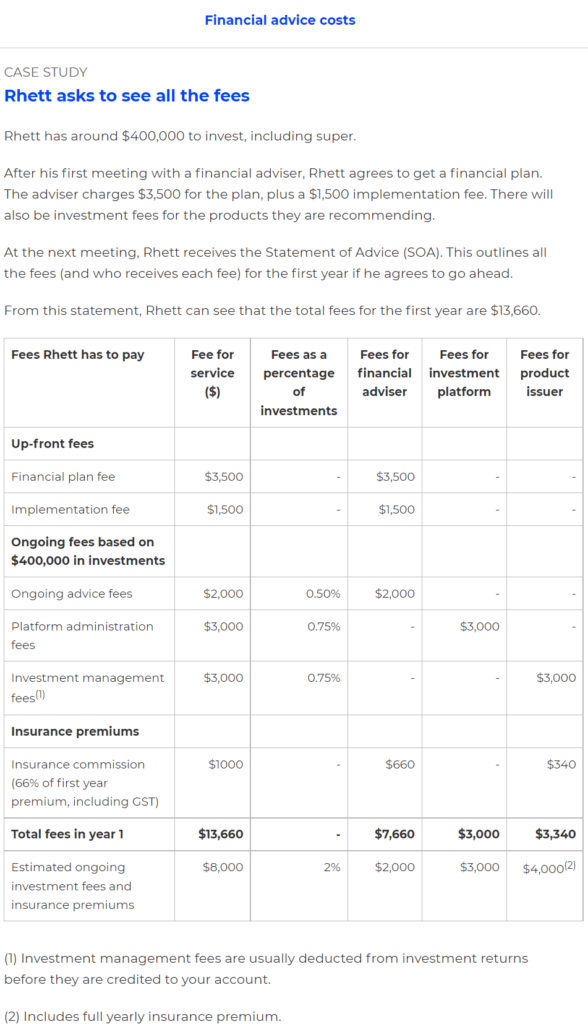

I won’t go into all the details but the important part is what they’ve published as the fees for this case study.

And I want to remind you that the title of this article is ‘Financial advice costs: Pay the right price for the right financial advice’.

Rhett’s total fees for the first year are $14,000 (Moneysmart’s aggregate column is wrong). This is made up of:

- $7,660 for the financial adviser

- $3,000 for the investment platform

- $3,340 for the product issuer which includes full yearly insurance premiums

$14,000 in fees is 3.5% of Rhett’s original investment.

Worst still, this case study estimates investment fees and insurance premiums to be $9,000 (another summing error) per year ongoing perpetually. And $2,000 of that being the fee for financial advice regardless of changes needed to be made or not.

All up that’s an ongoing fee of 2.25%.

90% of people will have no idea if 2.25% is high or low which makes advice from a government-run website like this so insidious.

How on earth is ASIC justifying this content when they know better than most that normalising these fees serves to further line the pockets of advisers and product issuers rather than the investor.

This is a huge problem because so many people are going to read a case study like this, that is backed by the government and just assume that paying an ongoing 2.25% in fees is reasonable.

In fact, this exact case study was posted in the FIRE Facebook group where most of the professional financial advisors also agreed that the case study fees were too high.

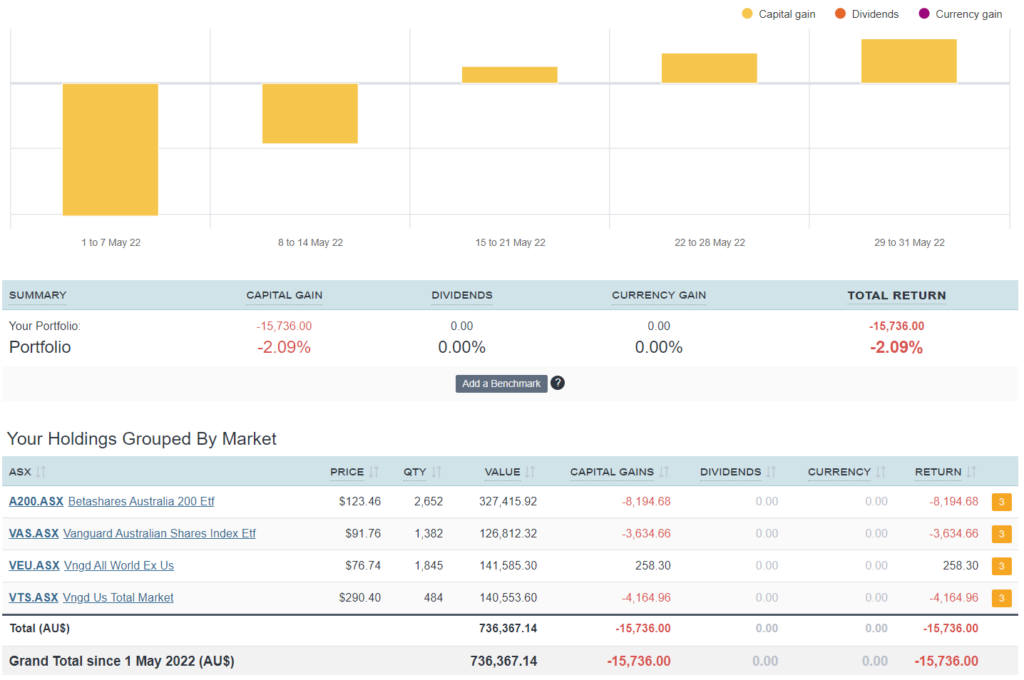

But as most of us know in the FIRE community, fees play an enormous part in your wealth creation journey.

A great explanation of this can be found here on the PIA website.

How on earth did the responsibility of not being ripped off, fall to a bunch of content creators without any formal education in finance.

It’s almost as if ASIC wants to normalise these fees so AFS licence holders can still profit after paying an arm and leg in regulatory costs impose on them by the very same organisation…

I wonder what would happen if the majority of the population became financially literate and stopped paying these high fees 🤔?

One could speculate that ASICs’ main source of revenue would dry up pretty quickly.

But that’s just speculation of course…

The End of Ask Firebug Fridays (AFF)

These new guidelines have already claimed a few scalps in the FIRE community and AFF will, unfortunately, be added to the list 😢.

I started this FIRE Q&A back in 2018 after getting hundreds of emails from readers each month. I was putting so much time and effort into answering the same questions that I thought a public Q&A podcast would be able to spread the knowledge better.

The AFF segments are clearly in breach of these new guidelines which unfortunately means they will have to be removed.

I’m going to leave the episodes up for the month of July and then remove them from my podcast RSS feed.

If you want to keep an offline copy for yourself, use this link here.

The AFB podcast will be restricted to the interview style format which will focus on the journey, mindset, and life philosophy. I’ll have to tip toe around discussing specific financial products.

We’ll see how it goes.

What Can We Do?

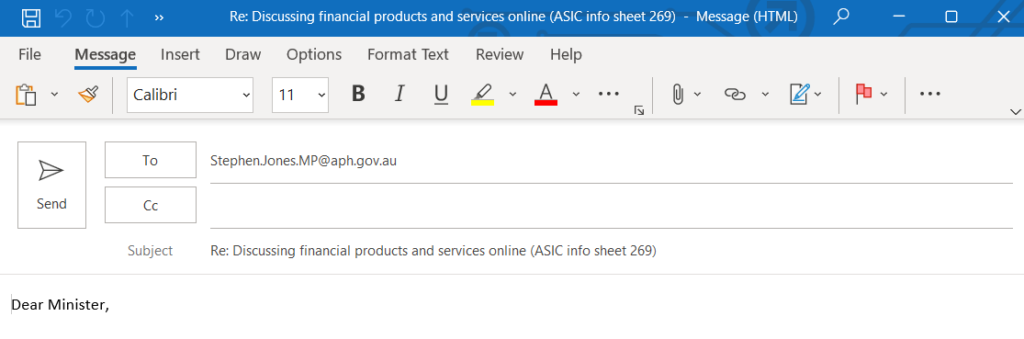

If we want to make real change we need to communicate our message to the legislators that make the rules.

Stephen Jones is the Federal Member for Whitlam and the Minister for Financial Services.

He has real power over how the legislation is written. ASIC merely enforce the law, they don’t make them.

Emailing his office is probably our best bet.

His email address is [email protected] but if you’re on a computer or smartphone, clicking the below link will automatically create an email filling in all the important fields.

If you’re going to send me an email, here are some key points you might want to include:

- Introduce yourself and the issue

- Explain why this issue is important to you

- Include an ask (suggest a change or alternative)

- Be passionate and polite

- Request a follow-up

Wrapping Up

These new guidelines won’t affect me or my family that much. I might have to shut down a part-time hobby I enjoy which is creating content for the Australian FIRE community.

It’s the next generation that I’m worried about.

I can tell you right now that if these guidelines were in effect back in 2015 I would have never bothered creating AFB at all.

There’s a bunch of teenagers growing up right now that will become interested in their financial future in the next couple of years.

Who are they going to relate to?

It sure as hell isn’t going to be a middle-aged Aussie Firebug that’s hopefully blogging about the perils of raising children by that point.

The next generation of Australian financial content creators will most likely never appear because of these guidelines.

The finance industry will keep trucking along and there will be some bigger financial media corporations getting around but it won’t be the same as the independent grassroots movement over the last 10 years.

Maybe we’ll look back and say that the last decade was the golden age of free-flowing information driven by a small bunch of enthusiastic finance nerds on the Internet…

As always,

Spark that 🔥