by Aussie Firebug | Mar 30, 2016 | Financial Independence, Investing, Podcast, Retire Early

Subscribe on Itunes Subscribe on SoundCloud

Subscribe on SoundCloud

Summary

I have been following today’s guest for a few years now. He is one of my favourite FI bloggers and has recently hit financial independence in his mid thirties.

The Mad Fientist analyses the tax code and looks at personal finance through the lens of early financial independence, he develops strategies and tactics to help you retire even earlier.

Most personal finance advice is geared towards people retiring in their 60s or later and doesn’t apply to those pursuing early financial independence. The Mad Fientist focuses on providing advice and innovative tax-avoidance methods specifically for people wanting to break away from full-time employment very early in life.

You can check out his site here but be warned, a lot of the information is geared towards the US system. But not all is lost, there is also countless information that can be transferred to an Australian striving for FI so I would defiantly check it out.

One of his best resources is his podcasts which can be found here. I have listened to all of them and they are fantastic! A big reason that I started to podcast was because of how much quality info I was able to get out of the Mad Fientist’s podcasts.

Show Notes

Transcript:

Aussie Firebug

Hi guys! Welcome to another episode of the Aussie Firebug Podcast, the Financial Independence Podcast geared towards reaching financial independence in Australia. Today’s guest is the Mad Fientist and on steering in a slightly different direction towards today’s podcast because the Mad Fientist doesn’t live in Australia, but his stories are very inspirational and I read his blog. So I thought I’ll get him on here anyway. So I’ll introduce him. Mad Fientist, for my listeners that may not know who you are, can you just please tell us a little bit about yourself and how Mad Fientist came to be?

Mad Fientist

Yeah. Sure. Thank a lot for having me. This is cool. It’s fun talking to somebody in Australia from the UK, which is where I live now but I’m actually from the States.

Aussie Firebug

Yes. We’re just talking about that. You’re originally from the States and your girlfriend or wife is from the UK?

Mad Fientist

Yes. I studied over here my junior year of university and I met my wife now. That was way back in 2002. So I met her while I was studying over here. As soon as I graduated, I moved back over. We lived here for about four years and we went back to the States for the last six and a half, I think.

Aussie Firebug

Oh nice.

Mad Fientist

We just moved back over to the UK. We’re in Edinburgh, Scotland. That’s good being back. The weather is terrible but the people are good. It’s been fun. But yes, the Mad Fientist, it came about probably I think it was back in some time in 2011 and I think I launched in 2012. I’ve always been good with money. For some reason I just always wanted to have like a portfolio to manage. I didn’t have any goals for that portfolio. I just like the idea of having money and investing it all that fun stuff. I’ve been a good saver for all of my career. But it wasn’t until 2011, when I think I stumbled upon the blog getrichslowly.org. I don’t know if you’re familiar with that over in Australia.

Aussie Firebug

Yeah, well, I do know what you’re talking about. I don’t know if my audience would read that but I definitely suggest you go and check that out if you haven’t because it’s a pretty massive blog in this space. I have been across there.

Mad Fientist

Yes. I guess it’s one of the biggest. The guy that created, J.D. Roth, he created it and just put up a bunch of really great stuff over the years and then he sold the blog for like crazy amount of money a few years ago, I think. I don’t read it too much anymore because J.D. was the whole reason that I read it.

Aussie Firebug

He was one of the first ones, isn’t he?

Mad Fientist

Yes, he was definitely one of the firsts and one of the most poplars’ as well. At that point, I really don’t know what the blog was. I don’t know how I stumbled upon it but when I did I was like yes, this is exactly what I want to do. I want to get rich slowly. I want to do it right. I don’t want to do any like ‘scammy’ things. I just want to put along and get rich. I didn’t really know that I wanted to get rich but rich is better than poor, I guess.

Aussie Firebug

Yes, absolutely. In the blog, does it talk about or are they talking in the blog or is it mainly an investing accumulating assets sort of blog?

Mad Fientist

Yes, a lot of it was in struggling getting on debt things which obviously, I was pretty interested in because I never had any sort of debt issues.

Aussie Firebug

For someone who studied in UK, that’s all right because I always see these horror stories of US people taking out this hundred plus thousand dollars to study which is just a crazy.

Mad Fientist

I got really lucky. I actually did study in the States. I only studied in the UK for one year. It was like I study abroad in exchange programs. I did study in the States and I was really lucky. At that time, I was in high school. I was living in North Carolina. The University of Carolina order public university in the States. It’s an amazing institution. But since I was living in North Carolina, I got in-state tuition. So, I think I only paid like five or six grand a year. I did have student loans. I left with probably about twelve grand worth of student loans.

Aussie Firebug

That is awesome. My degree cost in Australia. I don’t know exactly how the American system works but basically, here we have the HECS System. The government gives you a loan and you only have to start paying it back when you starting earning over certain threshold. There isn’t any technically interest applied to your loan every year but it’s indexed by the CPI so they just basically [05:35] thousand dollars in 2012, in 2013, whatever the equivalent of thirty thousand dollars is, that’s how much you owe so I chuck on extra twelve hundred bucks. That is pretty good system.

Mad Fientist

Yes, there are government subsidized loans and things like that. I think I probably had like one of those because one of my interest rates was really low. It’s not you can’t really get screwed as a student when you’re not careful.

Aussie Firebug

I heard these stories.

Mad Fientist

It’s crazy. It’s absolutely insane. You got these kids going to school paying hundreds and thousands of dollars and then they have no job prospects at the end there because they studied something that is not perfectly marketable. It’s a terrible system and it’s unsustainable really on today’s day and age. I think, it’s must be honest way, but I think I got really lucky in the back that I was able to go to a Top 25 school and only pay five grand a year. That was great. That was a huge because otherwise, I will be spending my twenties paying off debt. So yeah, back to getting rich slowly. I stumbled upon this and I didn’t really understand what a blog was before that which was pretty embarrassing because I’m a computer science major in software as a career. But I got into it because I was good at Math rather than I was a big computer geek online all the time or something like that. I was like; this is what a blog is. This is cool. Some guys talking about their stories how to get rich slowly and I think this is great. I didn’t really touch too much on early retirement. You must have, I guess, posted something on Jacob Lund Fisker who is the guy behind earlyretirementextreme.com.

Aussie Firebug

Yes, another classic.

Mad Fientist

That just blew my mind. Sometime in 2011, I stumbled upon early retirement extreme, I was just like this is what I’ve been saving for. This is exactly what I want. I don’t want a fancy car or a big house or anything like that. I want freedom. I didn’t realize that freedom was that easy to get if you just focused really hard and save a bunch of money over a few years. So, that completely changed the game. At one side, I realized that that was my goal. There’s definitely a lot of stuff that I can do to get there quicker. I knew I could research investment strategies and figure out ways to reduce my taxes and all these sort of things that will take a lot of research. I know I’m pretty lazy and I won’t do that unless I have sort of extra motivation so I figured I have to start my own site, my own blog and research these strategies and write about them. The need to put up consisting content will force me to do the research that I know I can do that would get me to financial independence quicker. This is like early 2012, in around that same time; I was also wanted to create a podcast. At that time there wasn’t sort of like financial independence and early retirement podcast or anything. So, I launched the financial independence podcast.

Aussie Firebug

Which I loved by the way.

Mad Fientist

Oh, great! Thanks.

Aussie Firebug

I listened to every episode. I know it’s based in American always talking about 41Ks and Roth IRAs. I used to have an idea of what you’re talking about and all like the big forms that are always US based which is the reason I created Aussie Firebug to give Australia and people who are trying to get financial independence in Australia a bit of tips and tricks that they are relevant to our way system. I love you. I love your podcast. I always listen to it.

Mad Fientist

That’s great. That was of selfish thing. I’m on this path, full force into this financial independence. I really want to talk to people that already got there and learn tips and tricks from them. That’s been great. I’ve got to try with Mr. Money Mustache, J.D. Roth the guy that created Getting Rich Slowly. That was really cool because that was the first blog I ever read and then, here I am interviewing them for my podcast and stuff like that. That’s been great. That’s really how it all came about and it sort of expanded in a lot more than I anticipated. It’s really taken over my life actually. It’s been a lot of fun. I just meet up with a lot of readers and other bloggers over there all over the world which been great.

Aussie Firebug

Yes, you’re gaining pretty big like I think I heard in your last podcast or the one before maybe, you were nearly in Top 10 on the investing category in iTunes.

Mad Fientist

Yes, that was crazy. I published an episode and then I logged in. That was like twelve or something in all of investing podcast which is insane. I guess that would be a good advice for anybody out there whose like interested in blogging or podcasting. First, you are going to pick something that you’re really interested in because you might work that it takes to do anything for the amount of money that comes in. it’s just you’re working for pennies.

Aussie Firebug

Yes. Absolutely.

Mad Fientist

You have to love it. It takes a long a long time. Well, it doesn’t necessarily have to take a long time. I’m sure other blogs comes into scene and just exploded. If you have patience then it builds over the years because I’m not good at marketing at all or I don’t really comment on other people’s blogs and all these stuff that people tell you to do that you are following. I just write. Luckily, a lot of it has been good. The people have liked.

Aussie Firebug

Yes. You have some really quality posts, man. The only thing is, like I said before, I wish that for the Australian system, they were all in the US but I do appreciate the effort that goes in all.

Mad Fientist

Thanks. A lot of the articles are definitely US based. I talked a lot about tax avoidance and things and all the vehicles that I talked about that help, facilitate tax avoidance.

Aussie Firebug

Some of them I find like your common advices, common advice, spend less in want, invest the rest, like that’s relatable in any country you live in. for the people listening, I’m sure someone will go to your site, can you give overview of your 41K, your IRA, and what a Roth is because we’re going to seem less system in Australia. Strategies I can work exactly the same but if you could explain those terms and what they are you think would be relatable.

Mad Fientist

Sure. If somebody does come to my site, probably the podcast is the best place to start for foreigners because a lot of stuff is more relatable. Definitely, I’ll dive into those real quick. 41Ks and IRAs are sort of tax advantage accounts where you don’t pay tax on the money when you put it in and it grows tax free and then you pay tax when it comes out. That is sort of tax deferred retirement savings. You probably heard of things like a Roth 401(k) or Roth IRA, those things are also tax free growth but you get taxed before you put the money in and then you can take it out tax free.

Aussie Firebug

Okay. Depending on your strategy works that in one way or another, is that right?

Mad Fientist

Right. A lot of my writings have been. The whole point of starting a Mad Fientist is to do research specifically for people who are pursuing financial independence or want to retire early. Like most mainstream financial advice is geared to work until you’re 65 and then retired. Since your income in spending are so drastically different throughout our career and after our career, most of the mainstream advice makes absolutely no sense for people like us. So, that was part of the thing I started to do research and tried to figure out strategies specifically for people on the path of financial independence to figure out what the best way of going about is. What I found is taking advantage upfront when you’re young and making a lot of money in your career before you retire early. It makes a lot more sense to take advantage of all those sort tax free put in the money accounts. Then, figure out ways to get it out tax free later when you lower your income to lower levels. That will lower tax brackets.

Aussie Firebug

I have read about the Roth IRA that you speak about which sounds so cool but we can’t do it in Australia. We have another system here called a Superannuation. I don’t know if you ever heard of it but it sounds very similar to the 401(k). Is there an age restriction you have to reach to withdraw money traditionally out of the 401(k) or IRA?

Mad Fientist

You start to getting forced to take money out of traditional IRA or things like that at a certain age. Roth, there is no minimum required distribution so you can leave that or leave it to your kids or whatever you want. Some of them do force you to start taking money out. As you get older, some of the accounts allows you to add more or wants you pass like 55 years old because you’re getting close to your retirement so you can really start to choose the

[crosstalk].

Aussie Firebug

What’s the difference between an IRA and a 401(k)?

Mad Fientist

IRA is an individual retirement account so that’s something I can open up no matter who I’m employed by. A 401(k) is usually set up and managed by your employer. The difference between the two, they’re really similar, it’s just one is through employer. 403(b) is pretty much like 401(k) as well for non-profit employers.

[crosstalk]

Aussie Firebug

If you had theoretically, let’s say, you put a bunch of money in your account and you needed the money. You’re 40 and you needed the money, depending on if it was rough or not, you cannot just withdraw with those accounts whenever you choose?

Mad Fientist

In Roth, you can take your contribution out whenever you want because like I said, it’s taxed already. The government doesn’t care so you can put 5000 in to your Roth this year and then when you’re 40, you can take out that 5000 with no penalty or no problem because it’s already been taxed. The growth on that 45,000 has to stay on there unless you get penalized. For a traditional 401(k), it’s a bit more difficult because like I said, you didn’t pay tax on it or if you do, take it out early. You’ll get penalized and you’ll get taxed but the whole rough conversion letter idea is that you can’t convert that into a Roth so you paid taxes from conversion but then you can withdraw that after 5 years, after the conversion. So that’s a way to get money out of your 401(k) or your traditional which is actually really huge. When I found that, that really changed the game because that meant that I can continue to introduce all these tax advantage accounts but I can still access that money in early retirement. Look into your Super and see if there are any loopholes that you can transfer it into another type of account or things like that.

Aussie Firebug

Yes. There’s another guy that has a blog in Australia, that’s been super expert on being trying to get him on the show but I think he just started to work at a Super company. Basically at Super, the employer has to pay a certain percentage of your wage. I think it’s like 12% and it goes in your Super account. In your Super account, you can choose your risk to it. I think everyone just automatically put into conservative when they joined and then you have to log in and actually physically change it if you want to but it’s like spread across all different asset classes. It’s got bonds, stocks, real estate, and gold. It’s very nicely diversified for you. I guess what the government told to do was to make a compulsive saving for everyone and let that grow. In Australia, you can’t withdraw any Super until you turn 65 currently but they changed the minimum age, I think, last year before. So, who the hell knows how old I will have to be before I can start withdrawing my Super? At the moment 65, so I’m sure by the time I get about 80, it’s really good tax saving vehicle-like, I believe your 401 and IRAs.

Mad Fientist

You can’t get access to.

Aussie Firebug

Exactly. You can’t get access to it.

Mad Fientist

I always say to people, early retirement contains standard retirement. So a lot of people are, why am I going to retire early? I don’t want to put money into this account that I can only get access to when I’m 65. And what I say is, “You know, standard retirement is within the bubble of early retirement so you need to save for whatever, 35 to 65. But then, you have to save for 65 plus because you’re not going to go back to work when you’re 65. So, take advantage of these accounts when you have them. And you’ll find you have more money than you need when you’re 65 and I guess that’s a good problem to have.

[crosstalk]

Aussie Firebug

Absolutely. When I’m close to the age, I’ll be dumping everything I can. But at the moment, it’s not going to help me get financial independence soon. I initially have to reach the retirement age. The only way you can get to it early is on the special circumstances like if you declare bankruptcy or something happens and you’re dying in financial stress or something like that. I think they let you access it. And the other thing is you can set up a self-managed Superfund. That just means you can invest a little bit more freely. But you still can’t get access to it until the age that they set. It’s a bit different.

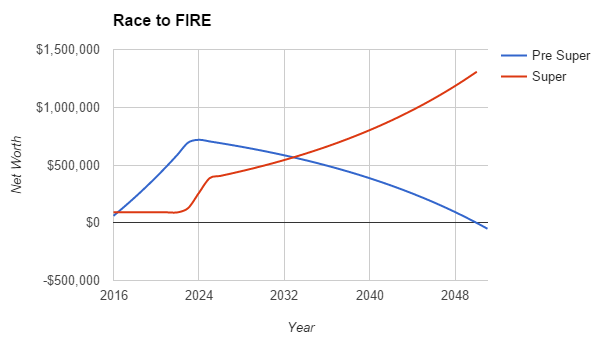

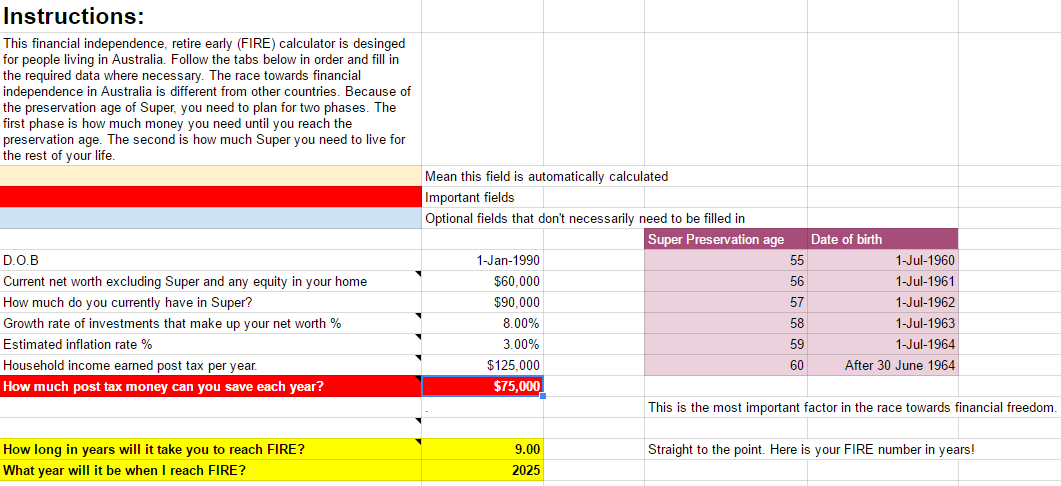

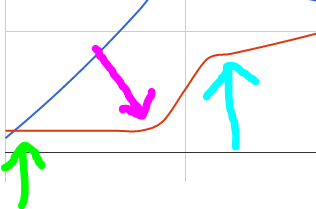

Mad Fientist

Yes, if I were in Australia, I’ll just break my retirement planning to pieces: post-retirement age and pre-retirement age. Invest a lot of funds to handle my post-retirement age into the Super tax advantages. Then, I figure out somewhere else to invest for pre-retirement age funds as well. The important thing is don’t just forget about your 65 plus life because hopefully you’ll live 90 or 100, you still need to fund that. Focus on both.

Aussie Firebug

Absolutely. Good segway, speaking of investing, what is your preferred method to investing? Are you more of a passive index fund sort of guy at real estate or what you invest in?

Mad Fientist

Yes. Right now, I’m fully passive index one. I’ve owned two houses with my wife since we graduated. We did really well in the first one which is now set as up quite nicely and didn’t do great on the second one. But we certain knew that going. We bought up a place and rent it over a month. The only reason we bought that actually is because there are no other rents where we needed to live. We knew we’re only to stand a few years so we didn’t do too great on that. But there wasn’t an investment. I’ve only bought real estate as homes to live in and I won’t be doing that anymore. I’m very happily renting again. I wouldn’t have ever called myself a real estate investor. I’m fully index funds, high stock allegations. I don’t have any bonds at the moment.

Aussie Firebug

Is it 100% stocks?

Mad Fientist

Yes, 100% stocks. Probably 10% of that is international stocks, probably about 10% cash. I tend to have too much cash. I need to deploy my cash. I usually sit on it for too long and then, get up to like 15% and I need to do something about it. That’s it. I’m happy being more aggressive because I’m currently still working. I just don’t think bonds are too appealing right now. I’d rather just have a reduced portfolio if I need to work. Instead I rather work and just have high allegation bonds. That’s it. I’m fully indexed funds. I’m really tempted by renting real estate but for some reason it’s not just really appeals to me. I know how I am when I own property it’s not fun whereas, in this index funds, no matter how bad the market’s down like there’s absolutely no stress for me which is nice. So I think I probably stay this way for a long time just because I do like the stress free nature of index fund investing.

Aussie Firebug

Yes, definitely. Where you invested in index funds in 2008?

Mad Fientist

Yes. I loved putting more money into it. That was actually a really nice thing. I told you, I made a really good property on my first house. So that was in Scotland. We bought a house and two and a half years later we sold it for more than 50% than we bought it for. It just so happened, it was rate before the world. It was about to collapse. At that point, a lot of our money was tied up in that house but once we got out then the whole world collapsed and that’s when I started putting a lot more money into the stock market.

[crosstalk]

Aussie Firebug

Good timing.

Mad Fientist

That was really good. That was really lucky. It could have run either way. Honestly, the week that we are meant to closing the house was the week that in the UK, in Northern Rock Bank, they had a bank run and people are like queued in the corner and trying to get all their money out of the bank. That was just like, Holy shit, the whole world is collapsing. What’s going on? Please let this house sell and it went through luckily. It was good timing for that.

Aussie Firebug

It’s just crazy. I don’t know if you read too much about Australia insuring the global financial crisis but we were largely unaffected. We have a massive morning boom happened when that was going down. China was buying us shit load or iron ore and coal and everything from us. I remember looking on forums and our reading newspapers, like what’s ever they complained about? Nothing’s even bad happen. It’s not until I read about how lucky Australia was that we didn’t really see any real recession or declined during that time. The government played a little part to do it. The main things were the humongous boom that we had. But in 2008, maybe even earlier, the government releases stimulus and they gave everyone earning under certain amount, a thousand bucks. So they gave everyone in the country, a thousand dollars and just go way out in stores and spend just to stimulate the economy. That was pretty sweet.

Mad Fientist

Wow! Nice. I had no idea that Australia was relatively on this scale.

Aussie Firebug

Yes. When you say stuff like that, I won’t even know what that looks like because it didn’t really happen in Australia. That’s crazy. It would have been, I couldn’t even imagine that happening if it in real, I’m sure.

Mad Fientist

Yes, that was greater at the time that we moved back to the States. We sold the place in Scotland. Transfer the money over to dollars which was awesome because that was like the best exchange rate that has ever existed. 2.097, we got when transferred that money over to dollars which was great.

Aussie Firebug

You are lucky. Do you buy lottery tickets or what?

Mad Fientist

It really was perfect timing but it could have gone in the other way like I got caught up into the property boom that was happening. We bought our house like a two bedroom, one bath; a small house which was perfect house for us at the time and everything. I just saw what was happening to house prices on our street. I almost bought our neighbor’s. She left and I was like, I’m going to buy this one too. This is amazing. Then, my wife was rarely talking to me out of it. She’s like, remember how much work we have to do to get this one and all of these stuff.

Aussie Firebug

Is this in UK still or this is in America?

Mad Fientist

It’s in the UK still. I must spot that and I think, if I have done that, we would have missed the boats on both houses, I think, because like I said, that was raid. Foundations started to crumble and started to crack. Had we been raid in the middle over renovation project on another house, we wouldn’t have set the one we were living in obviously. Then, we wouldn’t have two houses that are worth a lot if we have been just sold the one. It was really good timing. It was pure luck. I can’t claim to know when some real estate at the top or anything like that. It was just very lucky that we wanted to move in the States. It’s the time that we did. It’s just very lucky that we didn’t get carried away.

Aussie Firebug

I’m sure you thank your wife for that.

[crosstalk]

Mad Fientist

You guys have really crazy real estate situation going on there, don’t you?

Aussie Firebug

Oh, absolutely. It’s oh my God. So we got two biggest cities: Sydney and Melbourne. It’s hard to definitely say what’s going on there. But it’s so obvious, especially in Sydney. The income to price ratio of houses is just absolutely insane at the moment. I think Sydney is like a million dollars average or something, ridiculous like that, like I don’t know who’s buying these houses. Melbourne’s not quite as bad, but it’s still pretty bad. Yeah, a lot of economists saying it’s a humongous bubble, it’s going to pop any month, I think 2017. They’re kind of predicting a lot of things for 2017. But they’ve been saying that for years but as I said before, when the JFC hit, we were just very fortunate that we had a morning boom to take us through that time. A lot of economists were predicting that [31:06] was going to pop back then and I don’t think anyone was predicting how much coal I know China was going to need from Australia during that time. So it was kind of interesting. The real estate market in Sydney, I just don’t know who would be investing there because I’m investing in real estate myself but the yield is so disgustingly bad in Sydney that you would have to be losing hundreds and hundreds of dollars every week in the hope that it is going to be bought for a higher price than you use to count. It just doesn’t sound logical to me.

Mad Fientist

No, it’s gambling.

Aussie Firebug

Yeah, all, I got 3 properties and they’re all cash deposited so they make money without capital gains but obviously the people buying in Sydney and Melbourne that’s all their chasing like they have sort of derived a little bit from the fundamentals of investing coz it’s just.

Mad Fientist

Right.

Aussie Firebug

Yeah, it doesn’t make sense to me. And I think a lot of serious investors, it doesn’t make sense to them and I don’t know anyone I go to a lot of property seminars and forums, pretty much no one who is a seasoned investors is buying in Sydney at the moment. There’s a lot of people that have sell their house down the road in Sydney, get bought for $500, 000 in 2013 and sell for a million dollars in 2015. And I think, wow, this real estate investing is really easy. I can just do it.

Mad Fientist

Right.

Aussie Firebug

So I think there’s going to be a lot of heartache over the next couple of years, but we’ll see. No one knows, right? Like it’s hard to call the top of a bubble and predict when it’s going to pop in anyone’s guess really.

Mad Fientist

Yeah but it’s pretty inevitable.

Aussie Firebug

Yeah.

Mad Fientist

Everyone wants to stay out of it.

Aussie Firebug

Yeah, that’s the thing. I am saving up hard. I definitely began to start investing in index fund like [33:22] and even big just escape big buffering cash at the moment because you don’t know what’s going to happen like even the places that I’ve invested in, which is not Sydney. It could affect the whole country.

Mad Fientist

Oh yeah.

Aussie Firebug

Because those two big cities is where majority of people live and Australia’s a bit weird, I don’t know if you’ve read much of the real estate market here but they’re pretty much hasn’t been a decline in those two cities in like maybe over 20 years or close to 20 years or something. And it’s just been boom after boom and there’s a bit of a mantra that you can never lose a property in Australia and that’s ingrained in people like a lot of parents, they tell their kids get a property as soon as you can afford one and you can’t lose your property. So it got me interested. It’s kind of really interesting, could be a really good opportunity for people to cash up on the sidelines.

Mad Fientist

Absolutely, yeah, that sounds like a similar situation to American 2007.

Aussie Firebug

Yeah.

Mad Fientist

You can never lose. Just buy it. Buy as big of a house as you can afford and the bank we’ll let you. At that time, they are letting you buy ridiculous crazy properties like when we moved back to the states, my wife was going back to school, she wasn’t earning anything and she was a foreigner and couldn’t work, and so, she definitely wasn’t going to earn anything. She was there on a student visa. I was working remotely for a Scottish company on a month to month contract basis, so I didn’t have any sort of contract that would ensure that I’ve made certain amount every year. I was just working on month to month pretty much and I think we got approved for like $450,000 mortgage or something and I was like, how was that possible?

Aussie Firebug

Have you watched The Big Short?

Mad Fientist

Yeah I did. That was awesome. I read the book too.

Aussie Firebug

Was it like really accurate?

Mad Fientist

Yeah, yeah. It was crazy like luckily I was smart enough to know that I don’t want to or need a $400,000 house but most people went there and like, yeah, buy 2.

Aussie Firebug

Yeah, Australia’s a bit weird. Have you ever heard of negative gearing before?

Mad Fientist

No.

Aussie Firebug

So I am pretty sure it is unique to Australia and maybe a few other countries do it. But it basically goes like this: if you invest in real estate, you can do it in shares as well but it doesn’t really work because not many people take it loans for shares. Basically, if you invest in real estate and it makes a lost for the [36:13], your rent minus insurance rates, interest and everything, you lose five thousand dollars, let’s say, so, 36:25 cost you five thousand dollars. What you can do in Australia is go to the tax man and say, my income for the year was a hundred thousand. If you have a hundred K, but I have an investment property that I lost five thousand on. So you minus the five off your income so it brings your taxable income down to ninety five K (95K). The Five Thousand Dollars that you lost, the tax that you got charged on that 5K you can claim back on your tax return. For every dollar that you lose on the investment property, you might be able to claim like 37cents to the dollar. Which doesn’t make any sense. But it’s cushions the blow a bit for people that invest in real estate at a lost. Basically, encourages more people to invest in real estate. That’s what I think is originally designed to help mom and dad investors get their food in the door in real estate even it was gonna cost them money because they can get a nice fat tax return at the end of the financial year. It’s a bit stupid because you spend a dollar only to save, 37 cents in tax. It depends what tax practice you’re in, but I actually have an article about it and what’s dumb and why you shouldn’t do it. You should, if you’re paying more tax that means you’re earning more money. That’s what you wanna be doing. You’ve want to be paying more tax.

Mad Fientist

Yeah, absolutely doesn’t make sense to trade dollars for 37cents so, sounds like a crazy situation going on there, as well you will be in a nice position if you have a nice cash cushion in some conservative investments to take advantage when the whole shit show blows up which is inevitable that it will.

Aussie Firebug

Absolutely. We see how that spans out. Back on to financial independence, have you hit financial independence at the moment or was that still a thing you’re working towards?

Mad Fientist

We moved back to Scotland in August of 2014. And in that point I was planning on just quitting my job for good. I’d hit the number that I was targeting and that was a perfect time coz I was so wanted to move back to Scotland. Yeah. I’ve hit my number and I’ve actually continued working. I had a meeting with my boss, like Hey, I’m moving to Scotland and the first thing out of his mouth was do you wanna work remotely? So, I talked to my wife about it, and it was, that sounds good actually. That takes away all the stuff I hate about the job, which is the commutes and being trapped in there from 8 to 4:30 or whenever I used to work…

Aussie Firebug

It can be, I used to commute…Worst thing ever.

Mad Fientist

But they will let me keep programming which is something I like to do and would keep me get paid which is something I like coz how else…

Aussie Firebug

Absolutely.

Mad Fientist

Yes. That’s what happened. We left Vermont which is where we were living at the time, I’ve just been working remotely since, then I took 3 months at the beginning of 2015 coz we wanted to do a big trip Southeast Asia. So yes, after only working remotely for a few months, my bosses, it was like, Hey, I wanna go travel for 3 months, I can either keep working or I can take 3 months unpaid leave. They decided on unpaid leave and that was great. Ever since we’ve been back in Scotland, I’ve just spent work remotely and it’s been great. It’s amazing, one, how much you enjoy your job much when you don’t have to do it?

Aussie Firebug

Yeah.

Mad Fientist

It’s even better when you have the power to, pretty much as demand exactly what you want out of the job. Since I didn’t expect to have the job at all, I’ve just spent, only doing things that I wanted to, asking for things that I want, just like 3 months to go travel around Thailand. It was, no way I could’ve done that 5 years ago. But now, I didn’t expect to have the job, it’s something that I didn’t, it’s made my life so much better.

Aussie Firebug

That’s awesome.

Mad Fientist

Yeah, it’s great. It’s been really good. It’s been interesting since I didn’t expect to have this income coming in. We’ve also loosened the purse string was, it feels like I’ve gone crazy. After spending my whole life being very frugal, it feels like we’ve just gone absolutely insane. Like we live right in the center of [41:32], but then we do anything that we want. But surprisingly it didn’t really move the needle, I think, that frugal habits are really deeply ingrained. Feels like, I’m going crazy and just spending on anything that I want, really. I’m not spending that much more at all. Just because of those habits they’re just such a part of me….

Aussie Firebug

Absolutely.

Mad Fientist

It’s been a really cool experience. It’s something I wish I had done earlier. I was so focused on the end goal. That number. That I didn’t realize that I could’ve been using the power that I gained along the way to make my life even better at the time. And that’s something that I’ve been trying to right more about this world. It’s like people focus on that final, finish line, which is a mistake because… I read a post, called Happiness through Subtraction. It talked about just how, I was so focused on the end goal, but once I crossed that finish line, I wasn’t any happier. We’re really looking at it, now, it makes sense. Why would one extra dollar in my bank account make me any happier that one less dollar. Which is really would have, boils done to it. Like you’re focusing so much on this single number and then you think once you hit it you’d be fine. But it really wasn’t like that. Instead, rather than focusing on that number I should have been using the power that I have but like now I have enough that I can pay for all of our essential expenses. Why not go to my boss and say, I’m working 2 days a week instead of 1, I want an extra 5 grand because I did all this stuff. I should have been using, in that way, coz at that point, even before you hit that full financial independence when you have a few money you can, you could be jobless for a year and still be fine. Or 2 years or whatever. 5 years. Rather than be stuck in a miserable job, either change, try to find a new one, take a few months off to really figure out what you want to do or start demanding what you want out of your current job. If they don’t agree, you can either accept that and move on or you can find another job and use your few money to give yourself some time to find something that will really make you happy. That’s a really important lesson that I learned along my path. It’s, I wish I would have quit, or tried to quit in a couple of years earlier and got myself into this situation because, like I said, it does make me feel like I have a job. It’s just great. I do a little bit of coding, which I like to do. I don’t have to deal with any of the other stuff, like, right now, 10am, and I’m in my pajamas talking about Aussie Firebug and I can get my work done after this. And if I have to work late, that’s fine. Whatever, in an apartment, it’s just really flexible which is what I really hated about full time work, is not having any flexibility or freedom.

Aussie Firebug

Tell me about it man. It’s a good thing you mentioned that because that was basically what I was last year. When I discovered Financial Independence, I did, I was so excited, we had this, I had a similar experience to you. I was always pretty free and I’ve got days without money but when you’re not striving for something, it’s like, you keep saving and you keep saving and then always like, well, I had all this money in the bank but I’ve better spend it on some coz what’s the point of being the richest man in the graveyard, but then, as I soon as I find out that it was a thing, I read Rich Dad Poor Dad and that was the first eye-opening book that I’ve ever read. I was like, holy shit! What? Like people actually do with this? Then, I went to seminars and I met people that had already done I was like, Oh my gosh, this is what I want to do. I dedicated so much time just trying to get my saving trade as high as possible. For a while there, I was completely miserable at my job just because I knew how many years away I was until I raised that final number. I really had to focus on liking my job again because I got a great job, I work with good people but it’s a bit toxic if you’ve so obsessed with this thing. And you have this goal, you wanna work so hard to get to a bit… it just takes time and that’s just the way it is. You definitely… I almost, I remember thinking, I wish I didn’t know about this. I just kept saving without acknowledging, coz I would have been so much happier at work.

Mad Fientist

Yeah, I know that happens. If you focus on the journey instead, and just try to improve. Use the power that all that money that you’re building up gives you along the way to improve your life as you’re pursuing it. Hopefully, by the time you get there, you won’t even notice coz… well yeah, I have my number now I’m not gonna change anything coz I’ve worked my life into such a state that I enjoy everything that I do.

Aussie Firebug

Totally. What was your… what’s been the biggest hurdle you’ve encountered in your journey so far?

Mad Fientist

It’s actually along these lines. At the time, my wife and I were living in the woods of Vermont, really quite isolated, just based on what we both worked. We had picked this one village pretty much to live in and that was quite out there, in the middle of nowhere, which is really beautiful and everything. Vermont’s a beautiful place. But, it wasn’t an ideal situation, because it was around this time that I really got obsessed with this whole financial independence thing. So, all of my time was just spent researching strategies and writing my [47:59] and I became really isolated. I didn’t wanna do anything else that would either cost money and delay my progress or that wasn’t towards finding ways to get there quicker. Around this time, I actually went back to school, I got a free master’s degree. I worked for… an Ivy League college in the area. The whole reason I got the job, really was because I always thought I wanted to get a grad degree just to see if I could do it. But I know I didn’t wanna pay for, once I get on the path of financial independence. But I realize that the local highly respected university allowed their employees to get a free masters.

Aussie Firebug

Wow, that’s a sweet pack.

Mad Fientist

Yeah it was great. It was around this time that I was pursuing that as well, I also had a full time job. I was part-time student, which is really quite taxing and then I was doing this 49:07 stuff. At the time, that was really when the blog was starting to gain a lot attraction. So, it was really busy, but I didn’t realize that I was isolating myself and ended up leading to depression. Looking back, it was obvious I was depressed. But at the time, I’d be happy once I hit pi and then I can figuring everything out. It wasn’t a good situation. That was definitely the hardest part. That period of obsession where I was just so busy that I didn’t want to do anything else other than save money or think about ways to grow my money quicker. It made my wife unhappy. She was, all her family and friends were across the ocean and we’re just sitting in the woods at Vermont and she’s just stuck with this guy who doesn’t want to do anything or spend any money or go anywhere.

Aussie Firebug

I think I can relate to that. Definitely, especially…

Mad Fientist

Seriously, you don’t wanna get into that sort of funk.

Aussie Firebug

Yeah, absolutely, I think I definitely wasn’t that funk. I’ve come to realize now that you probably gonna have a much easier and better time, even if you have to delay financial independence, two or three years. That, in the great scheme of things isn’t so bad which means your life is greatly improved during your work is.

Mad Fientist

Absolutely. Couldn’t agree more. And the funny thing is, it’s never been about early retirement for me. I have so many other things that I wanna pursue, and am sure a lot of them could earn money if I tried, or may even have tried to get a new job or… I’ve just released a post yesterday, saying that I’ve just….

Aussie Firebug

Oh, I read that. Yes. I was gonna ask you that. The astronaut thing.

Mad Fientist

Over the years, I’ve wanted to play a part in some ways of NASA’s next big task of trying to get somebody to Mars. Whether or not that’s an astronaut role or working on the ground for them in some capacity.

Aussie Firebug

Are you a fan of Space X?

Mad Fientist

Yeah. Right. Space sex or any of the companies that would’ve launch recently. Just starting to think about what’s the next chapter. There’s so many interesting things to do. And a lot of them paid to do them. That’s why I was so crazy that I was so focused on getting to this stupid number, when I knew I wouldn’t necessarily stop earning money for the rest of my life, anyway. I completely agree you need to focus. At the end of the day the whole things’ about just happiness. There’s no reason to make yourself miserable. Pursue a goal that you think would make you happy. Work on happiness now as your saving. Then you eventually have more freedom to try other things to make you happy. Really, it’s about happiness at the end of the day. Don’t sacrifice that now for some time in the future.

Aussie Firebug

Very, very wise words. Now, I’m gonna steal some of what I heard from your podcast, which is the fast money round. But it’s gonna be U.S. triumphs. This is U.S. style fast money so my listeners I’m sure you’re not gonna know what these things mean. Majority, whom I think you will. But basically I’m just gonna give you two options and you just yell at the option that you like best.

Mad Fientist

Okay.

Aussie Firebug

Bernie Sanders or Hillary Clinton?

Mad Fientist

That’s interesting. I tried to stay out of politics as much as possible coz this makes me angry. I have not been following. I’m probably one of the least informed of any American. But I would,

Aussie Firebug

Isn’t Bernie from Vermont?

Mad Fientist

Yes, Bernie is the Senator from Vermont.

Aussie Firebug

Oh man. That’s a light up for you. C’mon…

Mad Fientist

I’m not from Vermont. I just lived there. I’ve no hardcore allegiance but…

Aussie Firebug

Okay.

Mad Fientist

Let’s just say Hillary, just because I loved Bill Clinton so much. I thought he was a great president. Just having him around to bounce ideas off that he would think will be valuable.

Aussie Firebug

Okay. I love Bill as well. I have absolutely no idea what these policies were like. But he had charisma. I didn’t think he was bad to be the face of American politics. I quite liked him.

Mad Fientist

Yeah. Like I said I’m the worst person. Well, we don’t have a TV at all. I tried to stay away as much as possible. We don’t have a TV at all on our place. We watch Netflix on the laptop every once in a while…

Aussie Firebug

Oh. Okay. That makes sense. So you do watch series and stuff still… show…

Mad Fientist

Yeah. My wife and I, usually, we prefer, schedule. Watch an episode in a laptop and read before we fall asleep and stuff. We don’t have a TV that connects to live news. I tried to stay away from news, as much as possible. Usually just makes me angry. I don’t know. Politics and things that I have no control over really…

Aussie Firebug

I feel you. I play chess in my spare time but, whenever I play online coz it just makes me angry coz you get to a certain level and you start getting’ trashed by people that’re there and you over and over again and then, I just wanna become the best chess player ever. but I know it’s never gonna happen. So it just ends in tears every time. So I have a real normal chess, like I have a game once in a while but I can’t get to heavily involve, coz I was just getting pissed off. Anyway, we’re getting off topic. Back to the money round.

Mad Fientist

Sorry, that wasn’t the fast answer.

Aussie Firebug

Yeah. East Coast or West Coast.

Mad Fientist

East Coast.

Aussie Firebug

East Coast. Pepsi or Coke?

Mad Fientist

Either.

Aussie Firebug

Either? C’mon.

Mad Fientist

Either. Yeah. No. I’ve rarely drink soda but I’ll do coke and I like the…

Aussie Firebug

You probably got shares of Coke so Coke.

Mad Fientist

I have shares in Pepsi. I have one. No, I have two shares in Pepsi so, when I was a kid my dad bought me one share of Pepsi, one share of Wendy’s, which is a fast-food burger chain when I was a kid. One share of Disney, and one share of the company he worked for.

Aussie Firebug

That’s awesome.

Mad Fientist

So I have these annoying two shares of Pepsi that give me 2 dollars’ worth of dividends every year that I have to then file on my tax return. So, I don’t know where the actual stocks certificates are. I don’t even know how I would sell them. But I just wanted to get rid of them coz it just a burden at tax time for 2 dollars a year.

Aussie Firebug

So much of an antique man. You gotta hold on to that.

Mad Fientist

I know. It’s great at the time. It’s like he taught me about stocks and I would check the papers and then maybe that’s why I like stocks and stuff…

Aussie Firebug

He’s was a good dad, taught you about stocks. That’s awesome.

Mad Fientist

Yeah, he was good. But now, it’s really annoying. Worry about these dividends when it comes to tax time, so yeah, I would still stay with Coke.

Aussie Firebug

Okay. Leno or Letterman?

Mad Fientist

Letterman.

Aussie Firebug

Lakers or Celtics?

Mad Fientist

Celtics. Coz I lived in Boston for a while.

Aussie Firebug

In-and-out or five guys?

Mad Fientist

Five guys. But that’s only because I don’t spend too much time on the west coast. But In-and-out once and that was really good. But, I don’t know if that’s because all the hype got to my head. There it was, 5 guys.

Aussie Firebug

It has a little hype. I’ve had both. And I think 5 guys are good, they’re so American, 5 guys was the better burger. But in and out was so much cheaper. Like, it’s third of the process on like half the price.

Mad Fientist

Great. Next time I move out west, I’m gonna try again, but 5 guys, it’s because I’ve had it more.

Aussie Firebug

Interesting fact of the day. Shaquille O’ Neal earned something like 60 Five Guys restaurants. Don’t ask me how I know that. But I just know that somehow. I don’t know why I know that but interesting to a bit. Millers or Budweiser?

Mad Fientist

Budweiser. Although both are pretty terrible.

Aussie Firebug

I did want Budweiser but…

Mad Fientist

But there’s so many other better choices.

Aussie Firebug

Have you been to Germany? Coz I hear…

Mad Fientist

… Gone crazy? Is it the same there? Is it just gone insane with craft beer?

Aussie Firebug

I wouldn’t say insane, but…

Mad Fientist

Oh, it’s coming then…

Aussie Firebug

It’s coming then….

Mad Fientist

Coz like in America, there’s just a brewery in every corner now, it really nuts.

Aussie Firebug

Oh really?

Mad Fientist

But it’s really good. Coz all the beer’s really tasty, so…

Aussie Firebug

Oh, nice. I think I’m gonna know the answer to this but Mac or PC?

Mad Fientist

Mac.

Aussie Firebug

Which is funny coz you’re a computer guy and I’m actually a computer guy as well and, I’ve got a computer science degree which is really weird because I don’t know if you had a post about this or not. In some correlation, I swear a bit, people striving for financial independence and being heavily involved in computers. Do you find that?

Mad Fientist

Absolutely. It’s huge. I think Mr. Mo Mustache did the post. Some crazy percentage of his audience were campsite people.

Aussie Firebug

That is weird!

Mad Fientist

Because like, my entire life, is about optimizing stuff, like optimizing less lines of code, more efficient algorithms, all that sort of stuffs. It makes sense in the whole financial independence pace because that is actually what you’re doing. You’re just trying to find these optimizations and streamlining the way you do things and making everything very efficient which is exactly what I do for my job. It definitely makes sense.

Aussie Firebug

It does make sense. It’s so funny but, being a Comp. Sci. guy, I don’t know I find my work, IT in Australia, heaps of IT professionals, they’re Windows dudes. And if you’re Mac, it’s like oh, you’re Mac…

Mad Fientist

Why would I pay double for a computer when I can get a perfectly good Dell, or whatever and it will like half the price, or at least half the price. I was always against it. Always against Apple…

Aussie Firebug

Coz all these people buying’ $2000 Facebook machines.

Mad Fientist

Right, exactly. I was like, never gonna happen. But then I got this job, at this university that I talked about, they gave me a Mac book pro, and my life completely changed forever.

Aussie Firebug

Really?

Mad Fientist

When I see people using Windows machines, I feel so sad inside. It is such a nice experience, they’re just, I have another, I have a Mac book pro retina through work as well, and it’s just the best thing I’ve ever owned I think.

Aussie Firebug

I’ll give them these dynamite quality products, like, the hardware is the best but I’m just, a Windows man.

Mad Fientist

Have you ever tried it? Have you ever like…

Aussie Firebug

My girlfriend has a Mac book air, and I never know how to bloody do anything on it. I’m a database administrator/systems admin. I can’t navigate my way around a Mac as well as I can at Windows.

Mad Fientist

Once you get past that hurdle, that’s definitely, at first that’s really annoying. But once you get past that, you’ll just be like, this is what life should be like.

Aussie Firebug

Really? Okay.

Mad Fientist

All the DBAs and Sys admins at my work are begging to get Macs.

Aussie Firebug

Really?

Mad Fientist

A lot of them are buying their own machines, bringing them in and using them coz they won’t, their bosses won’t buy them Macs.

Aussie Firebug

Okay. You’ve got me intrigued.

Mad Fientist

I would easily shell out a couple of grand for a Mac book pro. And for someone that spends no money on anything ever, for me to…

Aussie Firebug

Yeah, that’s big.

Mad Fientist

…bigly do that…It’s just huge. It, I’m on the thing fifteen hours a day, three straight years, it doesn’t even seem any different on the day we bought it. Or the day my boss bought it. It’s awesome.

Aussie Firebug

That’s big guys. The Mad Fientist is saying, he’s gonna fork out thousands of dollars for a machine, you know it’s quality. Okay.

Mad Fientist

Exactly.

Aussie Firebug

I will, I still love my Windows but I’ll keep an open mind. And when it’s time to upgrade, I will think back this conversation. It might influence me. Dunkin Donuts or Starbucks?

Mad Fientist

Dunkin. I miss Dunkin. Up in New England, they’re really big. You can find one anywhere. If you’re driving on a road trip or in the airport, and you need a coffee, I definitely prefer their coffee and it’s always fun to get a donut or a bagel also.

Aussie Firebug

Last. PlayStation or Nintendo 64.

Mad Fientist

I’m not a very big video game guy. So, I would say N64 because that’s probably the last console I guess, you call it, I have ever owned. I think I gotten… back in the day.

Aussie Firebug

That is the correct answer. I was going to terminate this podcast i you said PlayStation.

Mad Fientist

I would even go as far to say, probably just classic Nintendo, I would prefer N64

Aussie Firebug

Oh even like the Atari or something?

Mad Fientist

No. No. I wasn’t an Atari guy. I had a Nintendo back when I was a kid… played all the games so that was my biggest video game period. Whenever that was popular…

Aussie Firebug

The 64 also made console, all top. I don’t care what anyone says, you can…

Mad Fientist

Is it…

Aussie Firebug

You can delete my mail on this, I don’t care. That is my view. It had four controllers, It had a gold nice super smash Bros, Mario Kart that nothing would beat that console. All the CGs have better consoles now, but just during its age and what it did. That is the best. Sleepovers were never the same. Marvel or DC?

Mad Fientist

Marvel.

Aussie Firebug

Nickelback or a pickle?

Mad Fientist

A pickle. Definitely a pickle.

Aussie Firebug

Did you see that Facebook page?

Mad Fientist

No I didn’t.

Aussie Firebug

It’s like nick… no, what it say, I bet you this pickle can get more likes than Nickelback and it hit like 50, like millions of likes and it beat Nickelback fan page, so…

Mad Fientist

They’re definitely Lemon Creeds or worst back.

Aussie Firebug

I think they cut a bit of flak, I don’t know who the hell so that this Nickelback hate on the internet. I just think, I don’t really like him but I think they cup it a bit too much. I don’t think that….

Mad Fientist

I could see it. Creed and Nickelback, I can see why the hatred is there. I don’t know what it is about them but I feel it passionately so I don’t think I was in full in sort of hyper…

Aussie Firebug

Fair enough. Ok. Wrap things up, may I, it’s been an absolute pleasure. Thank you so much for being on the podcast. I hope you enjoyed half as much as I did.

Mad Fientist

I appreciate you asking me on. Definitely it’s been good and it’s just amazing that you’re on the other side of the world and it’s like you’re, still can’t believe that Skype is free.

Aussie Firebug

Best ever. Yeah. It must be nice I don’t know how many interviews you get, but I always listen to your podcast where you’re the interviewer, so, I hope I did a good job interviewing you.

Mad Fientist

Perfect. You did great. It was a lot of fun. I appreciate you having’ me.

Aussie Firebug

No worries. I’ll make sure you check out Mad Fientist’s site, guys, I put it in the shared notes. Thanks a lot for listening and if you want to jump over to iTunes and just search Aussie Firebug, you’ll see my podcast. Drop us a comment. I really enjoy reading them and the more you comment, if you want me to ask certain questions to certain people or you want me to interview a certain person, I’d love to hear about it. Write the show even if it’s bad. That’s it. Thanks a lot. See you next time.

by Aussie Firebug | Feb 2, 2016 | Financial Independence, Investing, Mindset, Podcast, Real Estate

[soundcloud url=”https://api.soundcloud.com/tracks/281465926″ params=”color=ff5500&auto_play=false&hide_related=false&show_comments=true&show_user=true&show_reposts=false” width=”100%” height=”166″ iframe=”true” /]

Subscribe on Itunes Subscribe on SoundCloud

Subscribe on SoundCloud

In this episode I chat to Ben Everingham who was able to retire from full time work at the age of 29.

Ben knew he was not wired the same as everyone else when he started working full time and quickly discovered that the ‘normal’ working life was never going to make him happy. After a Euro trip at 19 and finishing Uni, Ben was able to land a great job in Sydney earning over 6 figures. Most would think that they have it made with a great job straight out of Uni but after working a while Ben knew that this job was never going to satisfy him long term and whilst the money was great, he was miserable.

After reading Rich Dad Poor Dad, Ben’s eyes had been opened up to the possibility of investing and business ownership. Eager to get started, Ben was able to purchase 6 properties within 4 years and started his own business, thus achieving his goal of quitting full time work before the age of thirty…

Transcript:

Aussie Firebug

Welcome to the Aussie Firebug podcast where we talk about finical Independence in Australia

Today’s guest is Ben Everingham who managed to retire froem full time work at the amazing age of 29

Welcome to the podcast Ben

Ben

Thank you so much, excited to be here

Aussie Firebug

I guess we’ll start with, lets just go back to the very beginning

When did you know you wanted to be financially independent?

Or when did you even discover the concept of being financially independent?

Ben

That’s a really interesting question, so there is probably two key stories for me that really stand out from things that have happened over the last ten years that were really meaningful

One was when I was 19, we were sitting around having some beers with about 20 of my mates at the times at the age when you still have the big crew of people that you hang out with at the weekend.

We were sitting around and someone suggested that we book a trip to Europe in a couple of months, so the next day four boys and myself went and booked the trip and two months later we were over there.

It was the exact sort of trip that you would imagine a 19 year old would sort of do and that was sort of the partying and having a fun time.

I got to this point actually it was probably 6 weeks into the 8 week trip and I’m sitting watching the sun set on my own in Paris watching the sun set behind the Eiffel tower and I was sitting there and I know this may sound a little strange but as I was looking at the Eiffel tower and I was looking at the sky and at that time the sky looked extremely chaotic to me and all of a sudden, I looked up again and it was almost like it was…this is really odd especially for me…it was almost like the starts had become straighter and align themselves and it was like my future was opened up to me and I knew at that point I had to do something difference it was a massive transformation experience for me

Aussie Firebug

Wow that’s quite the epiphany

Ben

Haha I don’t even know if I believe in this stuff. but it was one strange moment that, like it was literally like it was my future was mapped out in front of me and I knew not at the time what I needed but I knew that was on my way and so I came back and moved to Queensland from Sydney. I thought that in that time of my life I needed to get away from lot of influences in my life that were, you know a lot of party people and not a lot of people that were really going anywhere and so I started fresh and that was the first major experience

Aussie Firebug

Wow that’s crazy

So let’s just rewind a bit, so you were 19, were you working full time at that stage or at Uni?

Ben

Yeah I dropped out of Uni about 6 months into my course and it was my second gap year. I took two gap years basically. So I had been working full time for about six month saving for the trip

Aussie Firebug

And was that an eye opener? Because I know for me when I first started working full time, it was mind blowing. I always knew the hours and I know people went off and worked 8-5 Monday to Friday but it’s not until you actually start doing it I think…it’s such a full on experience…OMG it’s just so much time I’m at work. And I quite like my job. I don’t know if you went through a same experience. But I remember my first year that I was just like “this is crazy!” and I don’t even work that many hours.

I have mates that do the fly in fly out work and their working 4 weeks straight with one week off. This is mental! It’s wasting so much life?

Did you have a similar experience in them 6 months when you were saving for your trip?

Ben

Absolutely I knew from the first day I started my first job that I wasn’t wired the same way as the people I was working with. My first job was with the major elevator company as a laborer or a laccy one of the electricians and I just realised I was wired differently straight away like I wasn’t interested in taking breaks I was just interested in interested in getting the job done as quickly as possible and getting the hell out of there. I worked in that job for the six months before a left and I used to have this guy who was about sixty years of age who used to ride me every day and the day that I left he said sorry to see you go, you were the best young employee we have had here and I really thought you could have gone a long way. And I was like your half the reason I was bailing on this job because you are such an ass to me for that period of time. Ha ha hah. It’s funny how, how things come around like. It was definitely an eye-opener and it is something I would definitely never want to do it again.

Aussie Firebug

Right so you knew that you didn’t want work full-time for the rest of your life. And you go on this trip and the stars align and your like something is happening here I need to change my path so then how do you then, from that moment… because a lot of people don’t realise that financial independence is a thing. I remember reading about it, I was like my mind was just blown, I was like you just keep buying these things that make you money assets, and if you buy enough assets they can replace your income. My mind was just blowing when I read that I was like that so simple why hasn’t anyone told me about that before or why haven’t I heard that before. Then I had my doubts, I’m interested to know your experience with that. Was that something that you’ve always been around all is their family members that had reached it would do you discover that on your own?

Ben

No unfortunately I had to discover that my own not a lot of people that I grew up with all their families or my families had a huge amount of surplus money at the end of the week or the months so fast forward from Europe four years I was finishing a university degree in about six months before finishing the degree I picked up this book by Robert Kawasaki called Rich dad poor dad. I’m sure a lot of people listen and have read that book it such a foundational book for a lot of people as well. And I read this book and I just said, holy shit. It completely opened up my eyes to what is possible and from that moment forward I knew that assets and businesses were better than wages and jobs. I focused on buying assets as soon as I finish university with the intention as soon as I have the right skill set to go out to succeed to leave full-time work and start a business.

Aussie Firebug

Yeah I almost had an identical experience. Rich dad poor dad was actually the second financial book but I ever read. I originally read Stephen McKnight’s book 0 to 135 properties in 3.5 years. That’s an awesome book. I remember the same sort of thing, just reading that and your like this is like so up my alley and why isn’t everyone doing this. Rich dad poor at is a really good mindset one I think, gets you to think about things differently. It just makes so much sense, when I was reading that I was like this this is exactly what I wanted to do. You know trading your time for money for 40 or 50 years and relying on the government to help you out with retirement just seemed crazy to me. I always have in the back of my head, that people were actually retiring early and that just blew my mind. And I just had to get there as soon as possible. Yes that book was a big eye-opener for me as well

Ben

I remember something that happened to me post university. I was lucky, I got accepted into one of the big companies in Sydney’s graduate programs, for a lot of people that’s a fast track way to make a career. I realise that once I finished high school, done the degree gone and worked the big corporate job I still was never going to be fulfilled doing that. It was at that point I went on a trip with my girlfriend who is now my wife to Bali after working with IBM for a couple of years. She said your miserable and you’ve got to leave and at that point again we packed up a second time and moved from Sydney to Queensland and from that moment forward I didn’t make a single decision again based on fear or lack or something that wasn’t in alignment to where I truly wanted to be. And I just decided from that point on I would actively gain the skills required to actually be a business owner as opposed to an employee long-term.

Aussie Firebug

Right so you knew that working for someone else and doing the normal 9-to-5 day grind career sort of thing wasn’t for you. So you read Rich dad poor dad, was investing or businesses your first preference. Where did you sort of go from there?

Ben

So investing was definitely my first preference because I came from mindset which is probably like a huge amount people in your audience which is you have to follow a certain path to achieve a certain result and that path is School, University, great job paying a huge amount of money, and maybe investing in a couple of properties and retiring.

For me I listen to this guy a huge amount when I exercised called Jim Ronan who talks about financial independence and achieving financial independence. His first goal for every employee is to replace their full-time wage while their working in their job. And then he goes on to say that he replaced his full-time wage by three times before he left his job. That was always my goal, so I was earning good money over six figures by the time I was 23/24. And I was looking to replace my wage by three times which was a ridiculous goal. I don’t know why I had that goal, it was probably because I was listening to him so much and I thought that was financial independence. Where it ended up being someone further down the track that convinced me to leave my job because I replace my basic living expenses and I was ready to move on and do what I love full time.

Aussie Firebug

Right so you went down that investing road first and you discovered property, why properties what attracted you to property?

Ben

I think the number one attraction to me was that I understood it. I have met people during university that were millionaires through property and I knew that they weren’t smarter than me, I knew that you didn’t have to be a rocket scientist. And I just love it, I love the concept of buying something of average quality with potential and manufacturing potential into the deal. And I also thought the one thing you can do with property was use leverage. I only had a $20,000 deposit within the first year of leaving uni and I knew that 20 grand leveraged in shares might have only been about $40,000 I could buy whereas with property at the time I could buy a 400,000 asset using first home buyers grants and things like that. So for me that was extremely attractive because leveraged and compound interest to me is what it’s all about

Aussie Firebug

So what sort of property investor would you say that you are? Are you buy and hold sort of guy or are you into developments or renovations?

Ben

I’m all about buying and holding now but by buying and holding I develop or renovate. I will never just buy and hold something and hope that the market goes up I will make sure I can manufacture at least $100,000 plus into the deal before I even buy.

Aussie Firebug

You retired from full-time work at 29 do you work at all these days?

Ben

I actually work harder than I have ever before. But I actually work doing what I love every single day which is helping other people buy property. It’s my passion I am absolutely obsessed with this stuff it’s all about contribution now as opposed to making cash though.

Aussie Firebug

It’s funny that you say that work harder than you ever have before because I read a lot about people that have made it to the end goal. They’ve reach financial independence… because some people do it without ever starting their own business. They just work their 9-to-5 today job and they slug it until they have enough investments to cover their living expenses which is totally Ok way to do it. It’s interesting to read about those people into a like that is a lot of say that when they get to the end of the journey, like they only have six months to go and theoretically should be able to retire really soon. Suddenly working this job is a lot better and waking up to go to the job is suddenly not as difficult and not so much doom and gloom as it was before like it was 10 years earlier and couldn’t see the light at the end of the tunnel. Is that psyche sort of in your mind, you could turn around tomorrow and say hey I don’t want to do this I have enough money from my investments to retire and not work whenever I want to. Do you think that plays any part of it in what you doing now and why you work as hard as you do?

Ben

For me I would never be content it’s just not my nature. I come from a competitive sports background type, I can’t help it I love being involved in the game. I don’t want to be a spectator to life. For me I get a lot of my needs for significance and contributions through my day job now. For me those basic needs like survival and basic living needs are met and those things that are a little bit further up the chain to me get met through work. I’ve tried to sort of kickback, saying that. We have taken at least 12 weeks off in the last 12 months to travel and holiday and spent time the family. We will work extremely hard but will work extremely focused as well. It changes the way you work from 9-to-5 to working extremely hard for stints and then playing or relaxing extremely hard to stints as well.

Aussie Firebug

That’s awesome that you have the flexibility to do that and is one of the main things that attracts me to strive for financial independence so it can give you just that, the independence to do whatever you want and go on holidays and spend more time with your family. I know now I’m working full-time and it’s crazy, like I have a partner and I play footy, I swear I hardly have any time as it is now. I commute now each way to work which doesn’t help that but still, I’m thinking down the track and see people having kids now and am thinking how am I going to get the time to do everything I enjoy, seeing I already don’t have enough time as it is now and I know what people do when that happens they have to give up something, they drop the gym they drop the footy they drop something they like doing this just like work kids and there is very little fun time in between for yourself. And I just did not want to be in that position which is why am trying to get to where I’m going. Having children now yourself, you have two kids, that must be an absolute pleasure to you and your wife to know that you have that flexibility.

Ben

absolutely to me a huge part of our motivation now comes from our kids. Kids changed everything. One thing growing up is that my dad worked really really hard he come from absolutely nothing. From the time I was one half to the time I was four and a half we literally lived in a caravan while they saved for their first property. They bought their first property when interest rates were at 18%. My dad couldn’t buy a beer at the end of week that how hard it was. I learn’t from observing them that one, I don’t want to miss those early stages which is why I left work when my daughter was a year and a half, I’ve already felt like I’ve lost more than enough time in her life.

And secondly my dad ended up turning his situation around by turning around buying some great investment properties and starting some really successful businesses that are still running 15-20 years later. Listening to them and seeing the things that they missed out on that if they have made decisions at the age that you and I are their time now would be completely different. I don’t want to trade time for money and I don’t want to miss out the most important things which is being able to say yes to most of to the things that you really care about and to find time for the things that inspire you to do your best work and not to just exist there for a pay cheque.

Aussie Firebug

Sounds like he was a bit of an entrepreneur himself. Sounds like you’re a bit of a chip off the old block. Sounds like your old man had some influence on you.

Ben

Yeah sure he showed me it’s possible and he didn’t have a businesses that failed. I never looked at business is a risk as I could see how it could work.

Aussie Firebug

Absolutely and I think it’s a big thing about it to see people who have actually done it. Before I knew any about anything to do with financial investing and financial freedom and all that. Once you discover it, I went to a heap of property conferences and I’m meeting all these people and it’s like whoa they’re actually out there, these people actually doing it and now I’m interviewing yourself that retired from work at 29 its crazy. It’s awesome, you have that the back your mind that this might be possible, you read about it but when you meet someone who is actually doing it that puts it into perspective and it really validates it that this is the actual thing. You manage to retire from full-time work at 29. Your parents managed to buy a property when interest rates at 18%. Do you think properties in the two capital cities are unattainable and what would you say to people for people looking to buy properties in the two capital cities where the prices are very very high at the moment. What are your thoughts on that and that current situation.

Ben