by Aussie Firebug | Oct 12, 2022 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

Firstly,

I’m going to be in Sydney this Saturday night for the FIRE meetup.

If you’re interested and want to hang out, the event is on Facebook here.

We headed to New Zealand for the school holidays in September.

This was our 3rd overseas trip for the year which is out of the ordinary for us. We’re planning on travelling throughout our early retirement but this year has been supercharged.

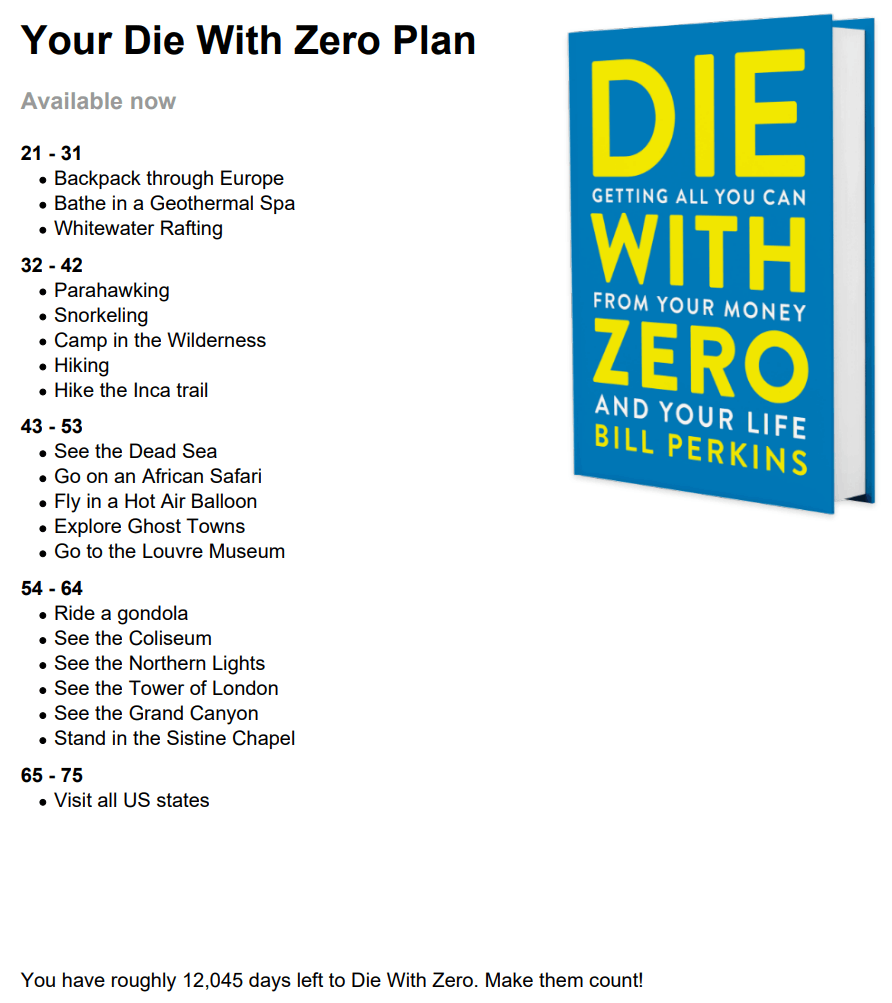

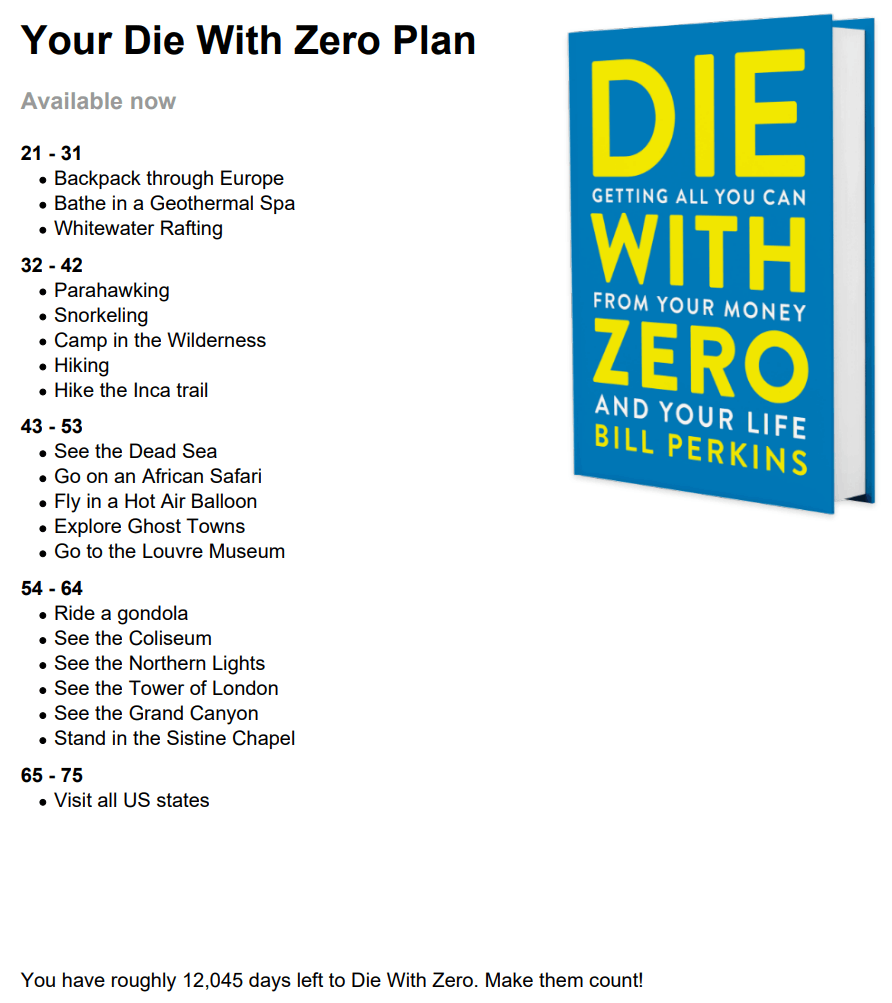

I attribute the excessive travel to a book I read early this year called ‘Die With Zero’ by Bill Perkins.

To cut a long story short, Mrs FB and I are trying to do as much travelling as we possibly can before we have kids.

After I read ‘Die With Zero’ I kept thinking…

We’re young, fit, healthy, have no dependents and have enough money to last 30+ years if we really wanted to. Why don’t we pull back on the accumulation phase a tad and start to harvest our hard work before we get tied up with raising a kid?

The logic makes sense to me. There are a bunch of experiences that lose value as you get older or are not available to you anymore. And conversely, there are some experiences that can be enjoyed much more when you’re older and can appreciate them.

Backpacking through Europe, whitewater rafting and hiking the Inca trail all take a certain level of fitness and stamina to do. These experiences would best be enjoyed when you’re young.

Other experiences like seeing the Pyramids of Giza, riding a gondola in Italy and seeing the northern lights are less demanding and will probably be appreciated much more as you age.

Writing down everything you want to experience in life and putting them into decade buckets helps to highlight the point I’m trying to make.

Here’s an example plan

https://www.diewithzerobook.com/apps

So basically what I’m getting at is you’re going to keep seeing our travel pics roughly every 3 months until we have kids 😅😂.

But back to NZ…

I had actually been to New Zealand before and we really wanted to do Japan instead but the travel restrictions are still a bit weird. I think you can technically travel there but everything you do has to be via a tour guide. So we decided it would just be easier to jump across the pond and check out the land of the Haka, sheep and hobbits 🙂

Here are some pics during our travels.

Incredible views from the top of Queenstown

NZ rocks!

Unbelievable scenery (Queenstown)

Biking fun

Morning walks

We started in the North island and made our way down to Queenstown where we spent most of our time. Milford Sound is amazing and the drive to Wānaka was breathtaking.

I have to say, Queenstown is seriously one of the most stunning places I’ve ever been to in my life. It’s not hyperbole to say it has 360 degrees of incredible scenery surrounding the town. The combination of the three snow mountains and lake is simply phenomenal.

I love what they’ve done from a town-planning perspective too. A lot of walkways and an entire area near the pier that’s open to pedestrians and not cars 👏.

And how could I talk about Queenstown without mentioning their arguably most famous product… the FERG BURGER!

The G.O.A.T of burgers

I’ll also give a massive shoutout to the Ferg Pie too. It would have to be up there with the best bloody pie I’ve ever eaten. Simple incredible.

Is there a Ferg ETF I can buy?

I also caught up with Ruth from the Happy Saver whilst in Queenstown.

Ruth and I enjoying a coffee

It was so cool meeting her and her husband Johnny in real life. We met for a morning coffee which lasted 3 hours!

Ruth and Johnny are some of the best examples of what FIRE and early retirement is all about. They’re the embodiment of being smart with your money and maximising happiness. We hit it off so much that Mrs FB and I actually swung by their home a few days later after coming back from Milford Sound.

It’s always fun checking out another podcaster’s set-up and home office.

Oh and lastly, for those wondering… yes, I did do a Bungy jump. It was 10 years ago when I first went, but I still did it!

Net Worth Update

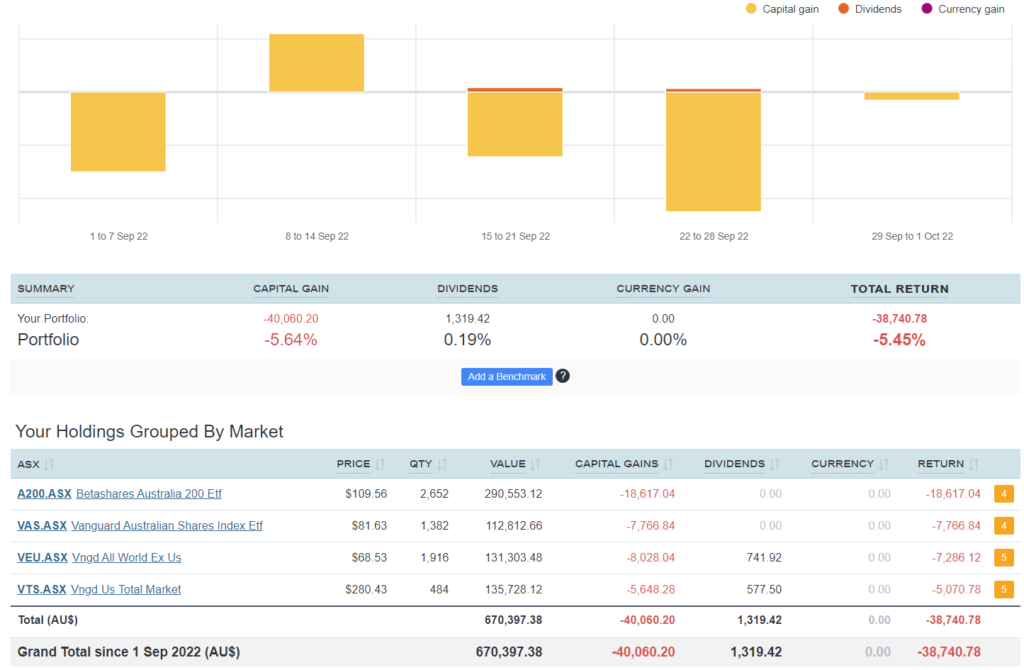

Holy moly.

Pretty much all our assets got smashed except for Bitcoin which was up a bit.

The share market had big losses and combining that with our trip to NZ meant that the old Net Worth took a decent dive this month (our second biggest drop ever).

We bought $1K of Bitcoin at the start of September and we plan to do another $5K into ETFs for October once one of my freelancing invoices comes in.

A few people have been commenting on our unusually high cash buffer lately.

There are a few reasons for this:

- We want to buy a new car in the next 12 months and I leaning more and more towards an EV that doubles as a home battery solution. That might cost $60K+ all up.

- Mrs FB isn’t sure what she’s going to do next year in terms of work. Maybe she won’t work at all… this means our cash flow will be impacted which has resulted in us having a higher cash buffer. It helps our sleep at night factor

- My freelance business is sporadic. I love being a freelancer because flexibility and creative freedom are awesome! But if you need a steady paycheck, freelancing ain’t it. This again means that we just feel more comfortable having a higher cash balance than usual.

I’m finding it hard to allow myself to start harvesting money from the portfolio. I think this is one of the biggest physiological advantages of receiving dividends as opposed to selling shares for income. Receiving dividends just feels better because you don’t have to sell anything. Even if there’s not a mathematical difference between the two, I’m more likely to receive dividends and start to use them to pay for expenses vs selling down my portfolio for some reason.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

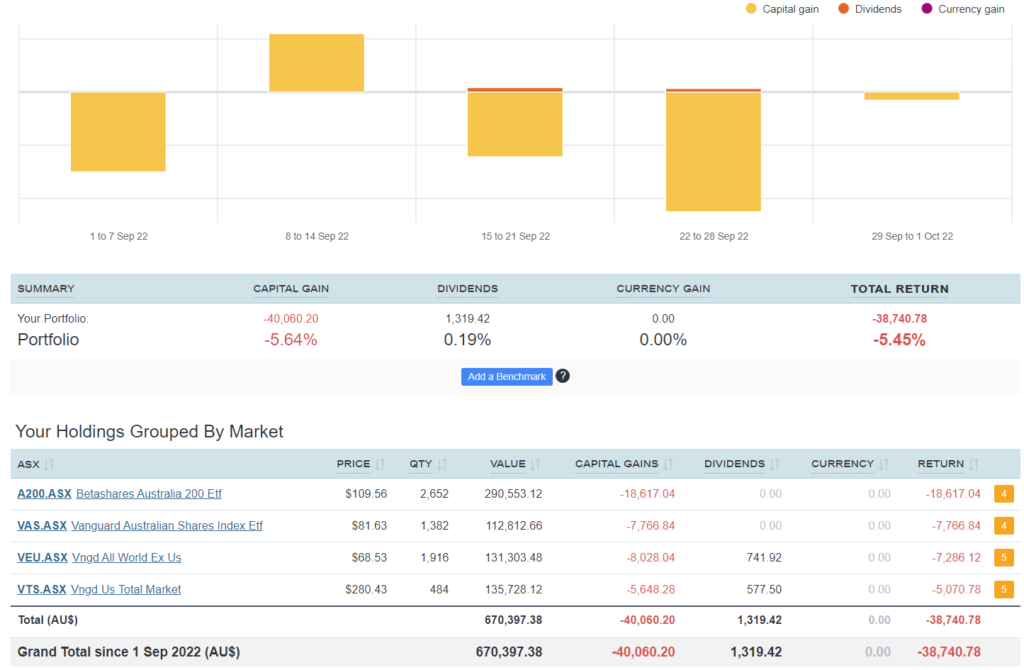

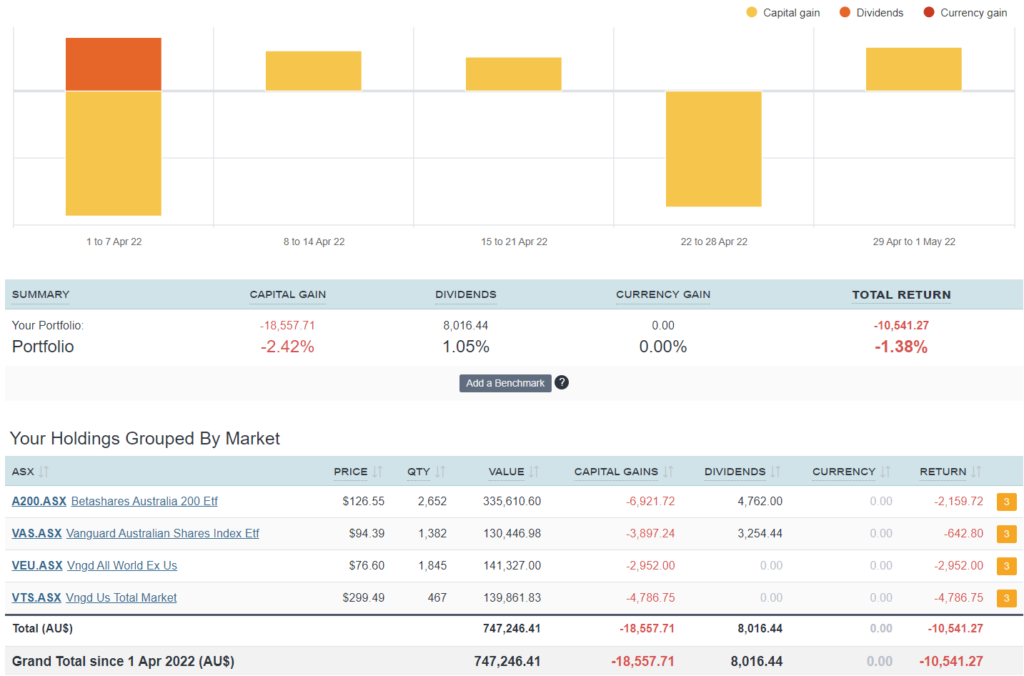

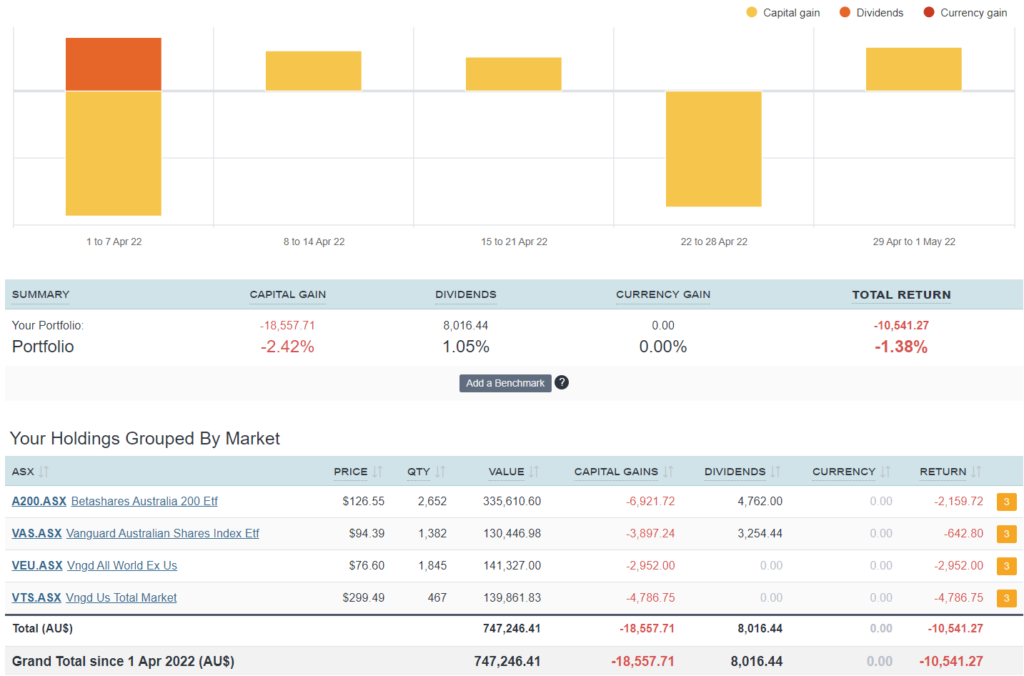

Shares

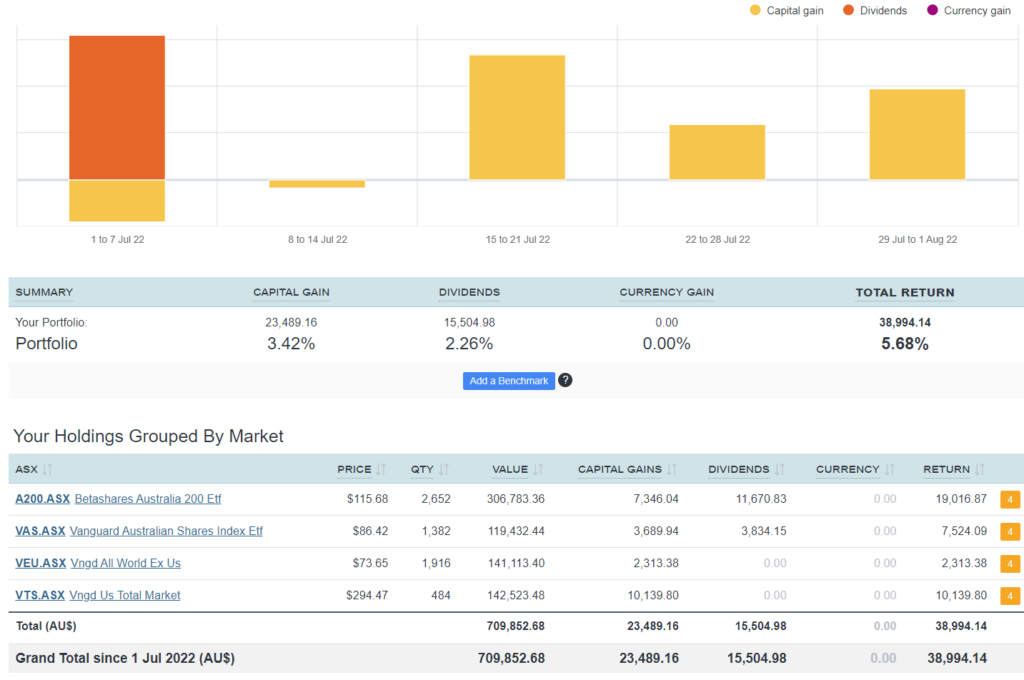

The above graph is created by Sharesight

A lot of red this month.

I’m feeling a bit guilty for not taking this opportunity to pour in as much money as we can. The thing is though, I’m not all as fussed about it as I once was. We’re living a great life at the moment and I know we will get to full fledge FIRE one day anyway.

I keep seeing the market drop and have thoughts about picking up some more lucrative contracting work to get more cash to invest. But this of course comes at a cost of time, energy and stress. I’m pretty happy with where we are sitting at the moment so I’ve just been plugging away with my freelance business and enjoying life travelling around.

It’s so hard to shift out of accumulator mode after being in it for most of your life. There reaches a point where building wealth takes a back seat to other endeavours. Even though we’re not full FI yet, I feel like we’ve reached that point now.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | Aug 10, 2022 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

It wasn’t too long ago that I was complaining about my lack of social interaction because I worked from home.

Well, let’s just say I’ve had a change of heart ever since the cold snap set in during July.

There’s nothing better than wearing trackies and a hoodie when it’s freezing outside and enjoying a cuppa/hot Milo during work. Our solar panels provide free electricity during the day so I’m able to run a little heater in my office guilt-free and I try to get all the washing/drying done when the sun is shining.

Mrs. FB, I, and some friends wanted to escape the cold during the holidays so we ended up booking a trip to Bali in July.

Quick PSA too. Mrs. FB needed to renew her passport and the whole process was a nightmare that took over 5 weeks. We had to go down to the Melbourne passport office TWICE! If you’re thinking about traveling soon and need to renew your passport, I’d suggest you start the process ASAP.

We ended up booking a 7-night stay in Legian, Bali.

Below are some of the pics from the trip.

Bali Mandira Beach Resort

Potato Head Beach Club

Jimbaran Bay Sunset

ATV Fun

I lot has changed since my first visit there as a 12-year-old with the fam.

My memory of Bali was a dirty, busy, and loud holiday destination that heaps of Aussies went to so they could drink cheap beer.

The island of Bali has had a really interesting transformation in the last 24 months. I couldn’t believe how clean everything was compared to my last visit nearly 20 years ago (damn I’m getting old). I spoke to a few locals about COVID and what happened to the place when all the tourists left.

They told me that a lot of people went back to farming. Either starting their own farms or helping other farmers out during the last 24 months. There was also a big push from the government to clean up the streets and beaches.

I was blown away by how nice the beaches were. I swear they didn’t look like that 20 years ago. I’m not just talking about lack of rubbish either. The quality of the sand and lack of rocks were what stuck out in my mind. Maybe I just went to a few crappy beaches as a kid but Jimbaran Bay, for example, had a world-class beach that would rival most Australian ones. And when you’re eating a seafood banquet on the beach for ~$40pp including cocktails in 27° weather, it’s hard to complain.

I also noticed that the island is becoming a lot more ‘westernised’. There were a lot more cafes and eating spots that cater to Australian tastes more so than Indonesian. This is either a positive or a negative depending on the type of person you are but we thought it was nice to have that option.

My mate and I did a bit of surfing which was awesome. I’d love to dedicate a few weeks to get a decent base because riding across the wave looks like so much fun (I can only do the white water for now).

The wife and I were so impressed by Bali that we’re thinking of heading back during winter again next year. Hopefully for a bit longer that time around. I would love to incorporate some sort of east Asian trip once a year where we live somewhere hot for a few weeks. I’m lucky enough to be able to work out of a laptop so I don’t see why not.

In other news, I sold my first data product in July which is a big reason for the big bump in this month’s net worth.

I can’t go into contractual specifics, but this is a bit of a milestone for my business. It signals a move away from consulting and more into product delivery. I think I’ll always consult to a certain degree, but I’ve had dreams about building this product for years and it was awesome to see there was a demand for it in the market.

I signed a three-year deal with my first customer 🥳

And lastly, I’ve been talking about it for years, but I’m finally coming up to Sydney and I’m going to organise a FIRE meet-up.

I’m heading up to FinFest on the 15th of October so I thought I’d kill two birds with one stone and organise a meetup for that night.

The event is on Facebook here.

All details and updates will be posted there. I’m really looking forward to meeting some of you guys in person 🙂

Net Worth Update

The share market and Bitcoin all had healthy gains in July but it was our cash balance that received an out-of-the-ordinary bump.

The cash injection came from the sale of my first data product being sold on a three-year deal (the first year being paid for in full).

Without going into specifics, I’m basically selling ready to consume data models to the customer. It’s a DaaS (data as a service) business model where I’m taking care of all the data engineering, architecture design, ingestion, modeling, and serving for a fixed cost. The customer receives the models via an endpoint and away they go.

I’ve had this idea for some time now but it wasn’t until I worked in London and dealt with companies there were running this exact business model did I know it was really viable. I’ve been tweaking the product for over a year and it’s really exciting to land this first deal.

The plan is to sell the product to a few more customers so I can have enough recurring revenue to justify hiring someone. I have a dream of running a small Analytics company of 5-8 amazingly talented and fun individuals where we can solve fun problems. I want to foster a similar working environment that I was lucky enough to have experienced overseas. That’s my dream for this decade, work-wise.

Cash is really high atm. It’s a combination of saving for a car and having money on hand for my tax bill. We also purchased around $3K worth of Bitcoin in July.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

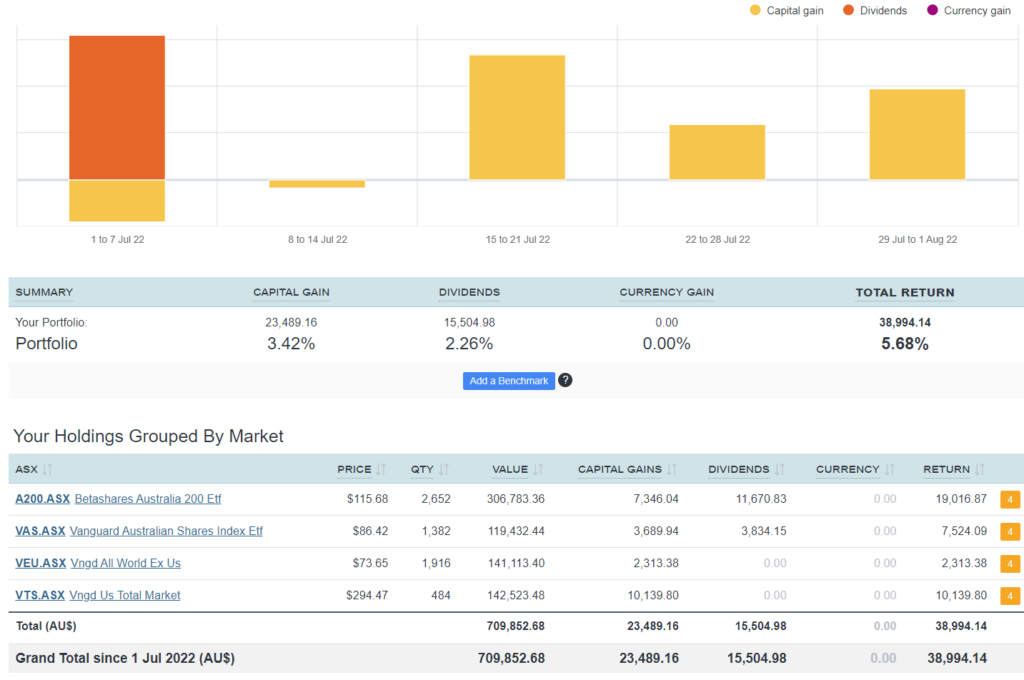

Shares

The above graph is created by Sharesight

Ohhhh Eeeeee!

$15.5K of dividends baby, plus some strong growth from our international shares. If only every quarter was as good as this.

Our overall portfolio is still down from the all-time highs at the start of the year so it’s all relative but you’ve gotta celebrate the wins when you get them.

We purchased $5K worth of VEU in July because that was the most underweighted split.

Networth

by Aussie Firebug | Jul 13, 2022 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

An old neighbour from my childhood neighbourhood (where my parents still live) passed away last month.

I don’t know the exact details but my understanding was that it was very quick (less than 6 months from diagnosis), unexpected and has left a big hole in their family.

The man that passed away was around 10 years younger than my dad.

People always tell you to spend time with your aging parents, but sometimes you need a wake-up call.

A major reason my wife and I came back to country Victoria was to spend more time with our parents and extended family and I’m so happy we did.

My wife and I are so lucky. All four of our parents are still with us and even better still, are fit and healthy to enjoy experiences.

Being able-bodied is so important. What’s the good of living till you’re 100 if you’re hospital-bound from 60? You can still enjoy some experiences but the bulk of them are gone at that stage. It’s one of the biggest lessons I took from reading ‘Die with Zero‘ the other month. Allocate your bucket list items to certain decades throughout your journey because life doesn’t always pan out like a movie. The vast majority of people are not going to retire at 60 and then pursue all their grand plans. You run out of energy. A snow trip to Japan is going to look and feel a hell of a lot different when you’re 50 as opposed to 25.

The entire goal of becoming financially independent is to free up our time to live a happier and more fulfilling life. And one of the greatest joys of claiming our time back is to spend it with loved ones.

My dad asked if I wanted to go with him to the Footy in June. It was an afternoon game on a Sunday at the G and he was heading up to meet some mates and cousins.

I’m pretty sure he asked me to come to a game last year but I just had too much on and was trying to get my freelance business off the ground so I declined.

If I was still working full time, my first instinct would be to think about the 2+ hour train ride and how buggered I’d be for work on Monday morning after getting home late on Sunday.

But I don’t work Mondays anymore 🤘

We headed up together on the train and watched with glee as our beloved Magpies dismantled the ladder leaders, the Melbourne Demons.

You can say what you want about Melbourne, but it has to be one of the best sporting cities on the entire planet! And there’s nothing better than watching a big game at the G!

Collingwood vs Melbourne at the MCG

We made our way down to Swan Street in Richmond for a feed after the game and the atmosphere was electric.

The magpie army had taken over Bruton Avenue as the poor Melbourne supporters were subjected to our famous war cry…

“COOOOOOOOOOLLLLLLLLLLLLIIIIIIIINNNNNNNGGGGGGGGWOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOD”

One of dad’s best mates is a Dee’s supporter which made the victory all that much sweeter.

We ended up at the Corner Hotel in Richmond for a pint and to talk about Collingwood’s path to an inevitable 16th premiership.

And as I was downing my Guinness beer, talking to dad about the game, arguing that De Goey doesn’t do enough or that Cox needs to be more consistent, I couldn’t help but think… this is what it’s all about.

Net Worth Update

Mamma Mia!

All of our assets got crushed in June to give us our second-worst monthly drop of all time. I keep sounding like a broken record but luckily we’re still in the accumulation phase so depressed asset prices are a good thing.

But if the market continues this decline, I’ll have to retract our millionaire status 🙈

We also bought around $2K of Bitcoin in June even though I personally think it’s going to drop further. There are talks about the SEC (Securities and Exchange Commission) in America finally regulating cryptocurrencies. I think this could be a huge step in its adoption. If the SEC (and consequently other commissions around the world including ASIC) come out and say that Crypto is an official financial asset, it will give this new technology legitimacy in the eyes of a lot of people. It could also start the process of consumer protection and eliminate thousands of scams that have infiltrated this technological breakthrough.

I’m a free-market libertarian at heart but I don’t think even the most staunch Bitcoin maxi would advocate for zero regulation.

Our cash holdings are way too high for my liking but I still have a few big tax bills plus we’re saving for a car. Not much I can do about it for now.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

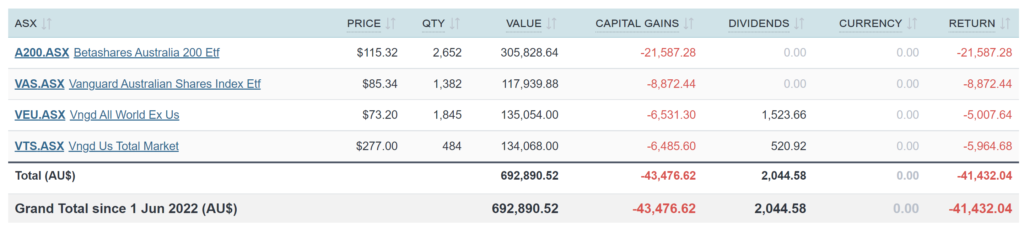

Shares

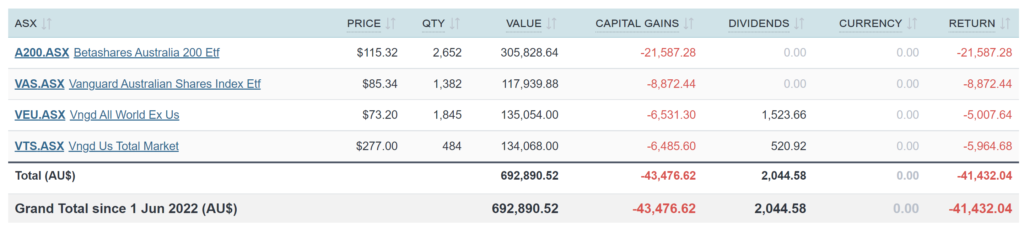

The above graph is created by Sharesight

Big drops all around.

We didn’t purchase any shares in June but I’ll be topping up in July for sure.

Networth

by Aussie Firebug | Jun 6, 2022 | Classics, Investing, Tax

We’re on track to increase our wealth by $100,000 dollars over the next 20 years by strategically changing the use of our home loan.

Not by taking on more debt.

Not by changing our asset allocation.

Not by increasing our risk tolerance.

2 transactions were all it took for us to start deducting interest repayments on part of our home loan.

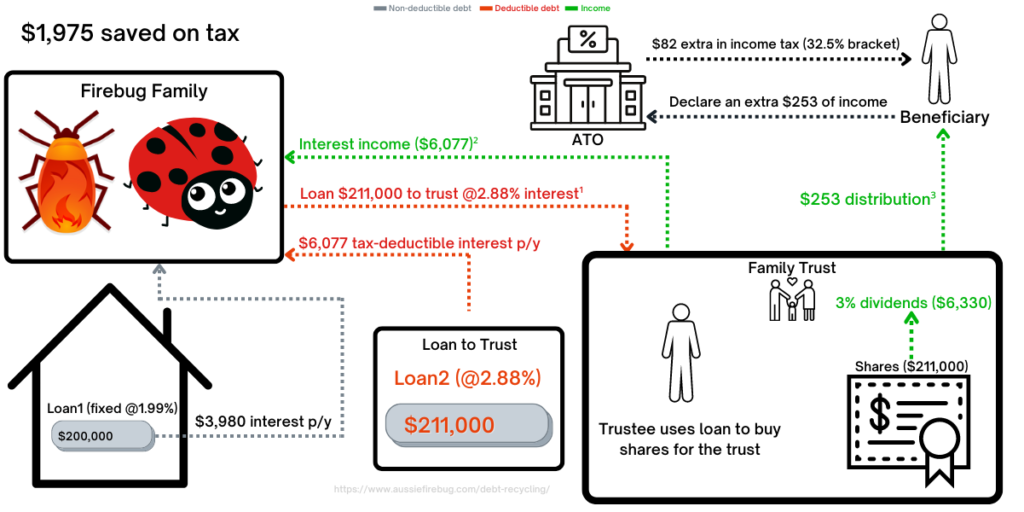

This is a strategy known as ‘Debt Recycling’ (DR).

This article has been on my mind for a while but I really wanted to go through the process firsthand before writing about it. There are a few different ways to do DR but I’ll just be covering how we did it because I don’t know all the nuances with the other methods.

So let’s break it down!

What Defines Debt Recycling

DR = Turning non-deductible debt into deductible debt.

In our case, we wanted to be able to claim our PPoR (Principal Place of Residence) home loan interest as a tax deduction.

Without DR you can’t claim interest from your PPoR loan like you would with an investment property (IP) loan.

How We Did It

*Please note that all the examples in this article will be simplified. Things like rate changes throughout the year, loan repayments and when we officially started DR will remain constant to make it easier to explain.

For simplicity purposes, I’m going to explain our method of DR without our Family trust. I’ll add in the family trust later so everyone who does have a trust can see how we did it but I want to make it simple to start with.

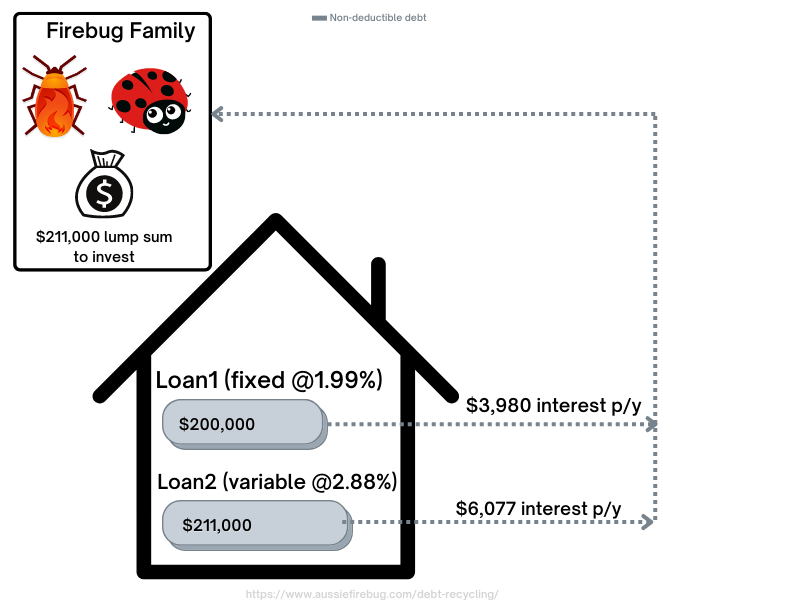

IMO, DR works best when you have a lump sum that you’re planning to invest anyway. That was the position we found ourselves in after we sold IP2 and had over $200K in cash.

We also bought our PPoR last year and I was planning to DR part of our home loan so I made sure that we split it into two parts.

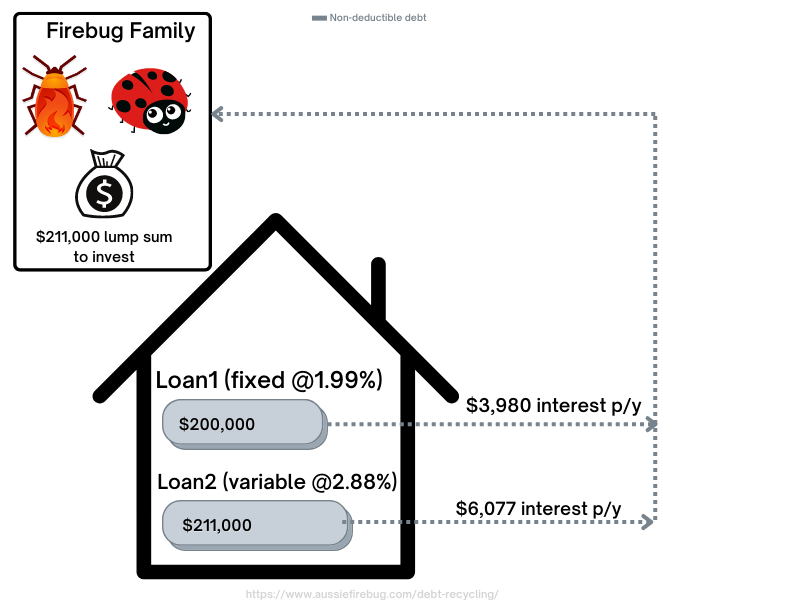

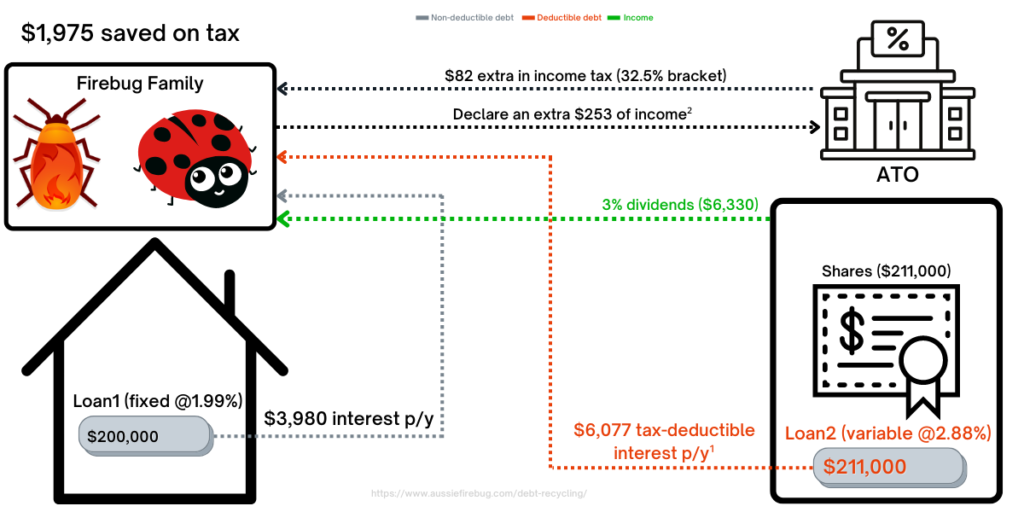

Here is how our situation looked before DR.

Before DR

As you can see in the above picture, Mrs Firebug (Ladybug in the picture 😂) and I have to pay ~$10K of interest a year for both our home loans (which are secured against our PPoR). These are real numbers (sorry Melbourne and Sydney folk 🙈) when we first settled on our home.

We can’t claim that ~$10K as a deduction because the use of the borrowed funds were for our PPoR and not an income-producing asset.

We also have a lump sum of $211,000 from the sale of our investment property that we would like to invest.

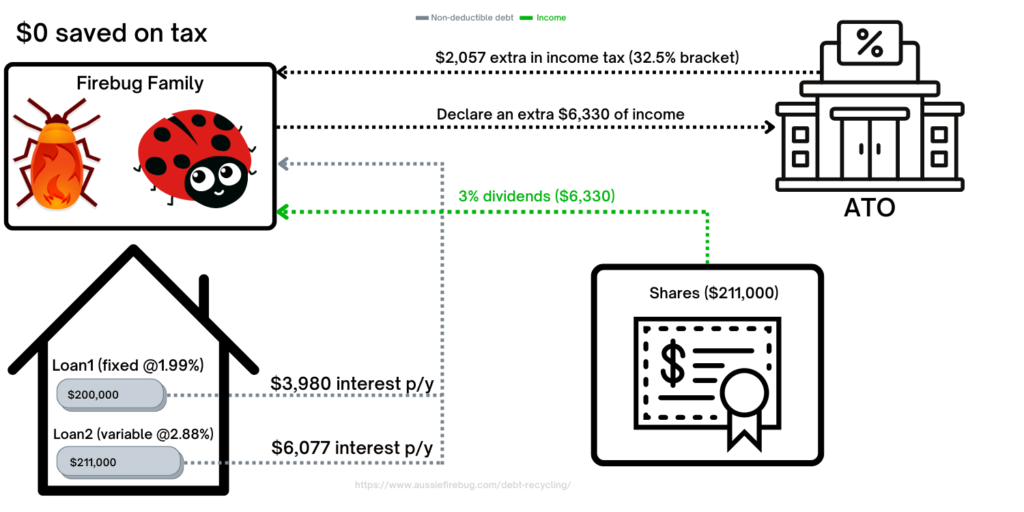

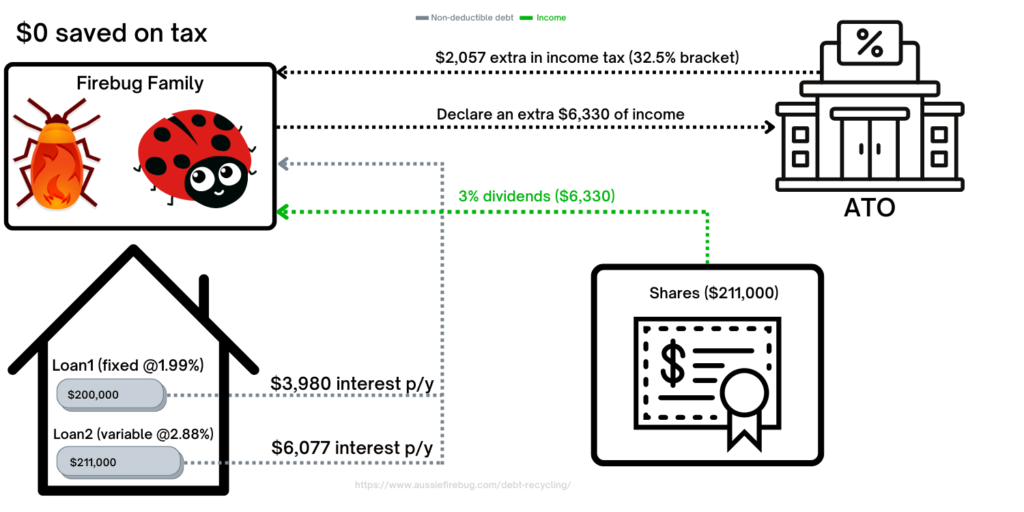

For illustrative purposes, below is how it would have looked if we skipped DR and just invested our cash in shares.

Investing without DR

There’s nothing wrong with the above picture but the Firebug Family doesn’t save any tax on their PPoR home loans.

The point of DR is to change the use of the borrowed money for deductions.

We were able to change the use of loan 2 by completely paying it down and then redrawing it out to invest in shares.

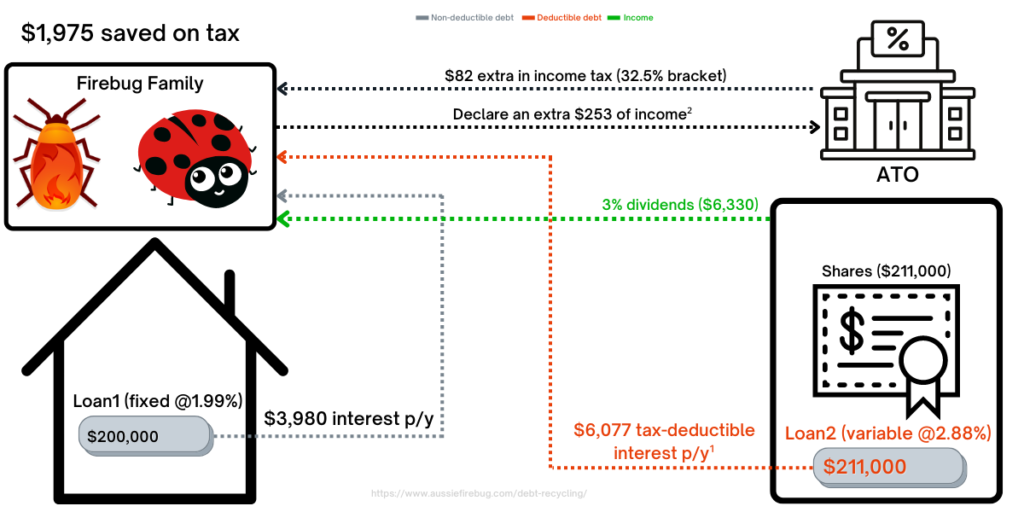

This is how it looked after DR Loan2.

DR

¹ Loan2 was paid down and redrawn to purchase shares. Loan2’s interest payments are now tax-deductible

² The Firebug family received $6,330 in dividends but can deduct $6,077 in expenses from Loan2 and thus only need to declare $253 in additional income.

As you can see in picture 2 we were able to change the use of Loan2 to become an investment loan.

We then used this new loan to buy income-producing assets (shares) and are now able to claim a deduction on the accrued interest saving a total of $1,975 on tax.

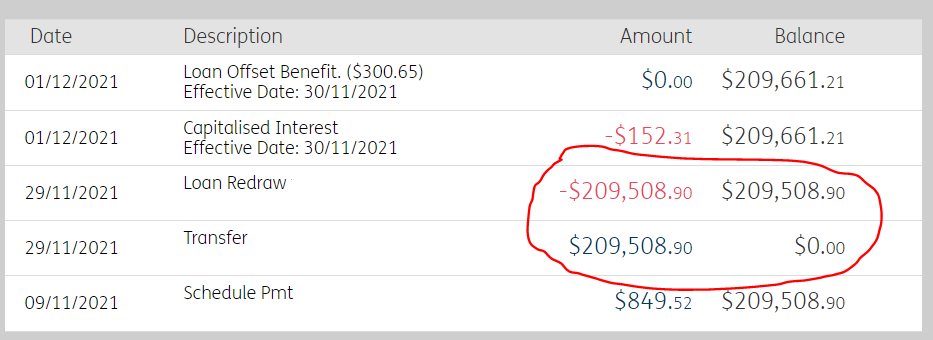

But how exactly did we repurpose the loan?

In one word… redraw.

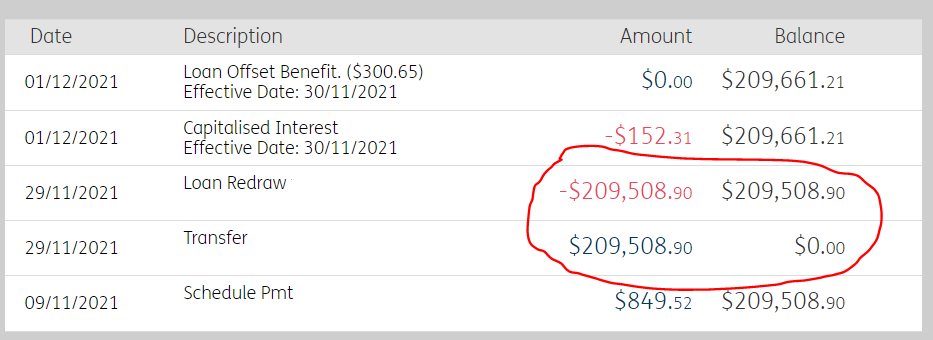

Once we sold IP2 and had the large lump sum, I simply paid down Loan2 completely and then redrew it back out.

The above picture shows the balance for Loan2 to originally be $209,508.90 on the 9th of November 2021. I paid it down to $0 on the 29th and then used the redraw facility to pull the $209,508.90 back out straight away. Redrawing from a loan is considered new borrowings by the ATO.

I was very worried that the loan would automatically close so I went down to an actual branch to ensure that it didn’t. The girl that helped me actually knew what DR was which helped a lot.

And that’s basically it.

We essentially are in the exact same position we would have been without DR but now Loan2’s debt is tax-deductible.

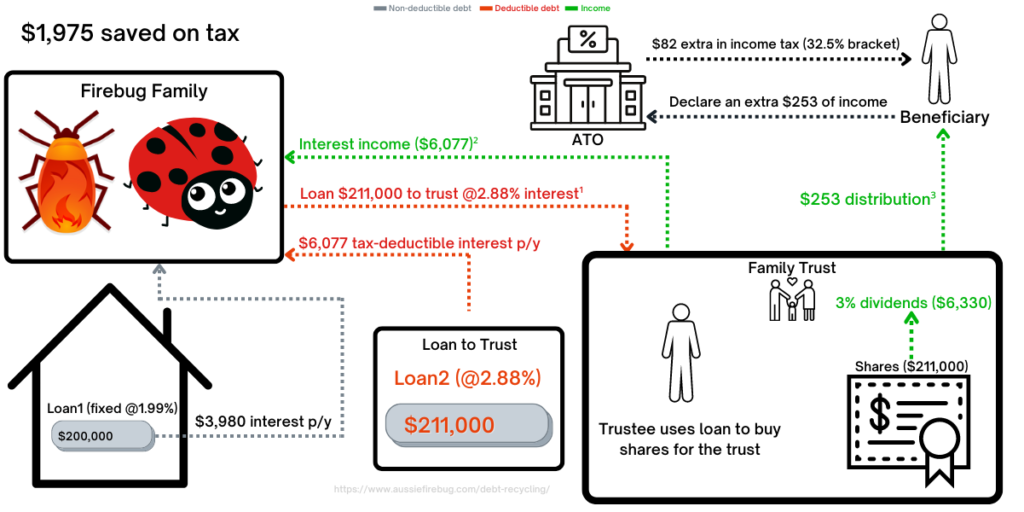

How We Did It (With The Trust)

The concept of DR remains the same, it’s just more complicated with a trust. (like a lot of things 😅)

Here’s how we did it.

DR with a Trust

¹ You need to make sure that the terms of the loan allow for changes in interest rate to be the same as what the bank is charging you. In this example, it’s constant at 2.88% when in reality the interest rate would fluctuate. The loan agreement between the Firebugs and the trustee needs to be in writing and on arm’s length terms too.

² The Firebug Family pay and receive the same amount ($6,077) so their tax position is nill.

³ The distribution is only $253 because the trust had to pay $6,077 in interest to the Firebug Family. The distribution will be taxed at the marginal rate of the beneficiary.

There’s a lot going on in the above picture but I hope it makes sense. Leave me a comment below if you need something explained in more detail.

What If I Don’t Have A Lump Sum?

Not everyone will have a large sum of money to completely pay down a split of their loan. We implement a dollar-cost averaging strategy which means we don’t save up large amounts to drop in at once. The sale of IP2 presented a rare opportunity for us to execute our DR strategy but I understand that won’t be the case for most people.

Annoyingly, I actually had some examples and financial products that are suitable for people who want to do DR whilst DCA’ing. But since ASIC doesn’t let people like me talk about those sorts of things without paying them money, I unfortunately had to delete this part out of the article :(.

Terry W Tips and Future Podcast

I reached out to one of if not the best SMEs (subject matter expert) for DR in Australia for his top tips. I’m also teeing up another podcast with him to do a DR specific episode. Please let me know in the comment section what you want us to cover and I’ll try to add it in 🙂

If you want to know more about Terry, check out the first podcast we did together here. He also has his own podcast which you can check out here.

Terry’s top tips 👇

- You can only claim interest if borrowing to buy income-producing assets

- You need to avoid mixing loans as this will reduce tax savings

- Split loans first before repaying

- Repayment needs to be done once in full

- Redraws can be done in stages

- If borrowing to buy non-dividend paying shares the interest could be a cost base expense so it would still be worth splitting and recording the interest as it will reduce CGT.

- Written loan agreements on arm’s length terms are needed if the borrower and the investor are different

- Never redraw into a savings account with cash as it will cause a mixed loan

- Avoid paying into a share trading account with cash in there as this will cause a mixed loan.

- It is possible to debt recycle with any loan that has redraw, but some loan products are better than others, so see your broker about this.

- Debt recycling is a tax strategy so only registered tax agents or tax lawyers can advise on it.

- Advice on what to invest in would be financial advice if it involves shares or super as these are financial products so only an AFSL holder or authorized representative could advise on this.

- It is possible to debt recycle with investment properties too.

Conclusion

It’s important to note that DR didn’t change our investments, amount of debt, asset allocation or anything else really. We simply changed the use of the borrowed money.

I used the 32.5% tax bracket but this strategy would save you even more money if you have a higher marginal tax rate (I forgot to include the medicare levy too which would have made the tax savings even more impressive).

There’s also a pretty good chance that interest rates are going to rise in the next couple of years.

More interest = more deductions for us.

Oh, and if you’re wondering how I came to that $100,000 number in the intro. I simply punched in $1,975 into a compound interest calculator for 20 years at 8 interest. There are a bunch of assumptions right there but it’s impossible to know how the interest rate will move over that time period and we plan to redraw equity out of Loan1 and Loan2 which will mean more deductions. Essentially, we don’t ever plan to pay off our PPoR loan. I eventually want to DR Loan1 and then continuously redraw equity for the foreseeable future (Thornhill style!).

This strategy is something that took less than a week to sort out but will be saving us money for as long as we have debt against our PPoR.

Pretty cool if you ask me 🙂

Are you doing DR? I’d love to know why or why not in the comments section below.

As always,

Spark that 🔥

by Aussie Firebug | May 20, 2022 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

It’s been a while since I logged into AFB/recorded any podcasts.

The whole ASIC fiasco got me down a little honestly. It feels like the whole community that has helped so many people are being vilified because of a few bad apples.

I also felt the need to lay low and watch what others were doing in the FIRE/personal finance space. I’ll be dropping a podcast very soon that will cover my thoughts on ASIC’s new interpretations and how that’s going to affect AFB content moving forward.

In other news.

My freelance business is really starting to take off. I’m getting more business than I want (first world problem) and I’m starting to create a data product that I’m really excited about. This influx of work has been the other reason I’ve taken my foot off the AFB creator pedal last month.

It’s usually a juggling act between AFB content, my business and travelling. Some months I’ll record 5 podcasts and write 3 articles and other months I’ll be lucky to produce 2 pieces of content.

Freelancing has been a blast but I’m slowly getting pulled back into the ‘normal’ everyday office politics and BS. There are always going to be boring/pointless parts of the job regardless of what you’re doing but I’m trying to minimise that stuff as much as possible.

I find the greatest joy in building something that creates value with colleagues who are just as passionate. I’ve spoken about it before but I really like the idea of having a small team that can help me build data products/services and foster a kick-ass work environment! I fell in love with the culture when I worked at a few different startups in London during our overseas trip. Trying to replicate that is high on my goals list for the next decade ahead.

Net Worth Update

Not a whole lot to report with the old NW. It was a down month for shares and Super which saw us slide backwards around $10K.

We’re continuing to build up our cash reserve for a new car in the not so distance future. I’m still having a really hard time choosing between a traditional ICE vehicle or a new EV. The longer we wait, the more attractive EVs become. But can we wait another 2-4 years? Probably not 😅

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Our expenses were up a lot in April. The reason for the big jump was us pre-paying for a trip to Bali. We fly out in late June for 8 days of holidaying 🏝🍻

Shares

The above graph is created by Sharesight

No purchases in April but I’m publishing this article in mid-May and I just can’t resist the current sale atm so we’ll most likely be putting through a buy order soon.

Networth