by Aussie Firebug | Apr 8, 2022 | Investing

In the middle of 2017, a colleague of mine asked the entire IT team if they wanted to buy some Bitcoin. He was pretty into it and had been explaining to us how it all worked. The conversation went something like this:

“Hey guys, my friend is buying some Bitcoin and if you want him to purchase some for you then now is a good time. I can set you guys up with your wallets and everything and then we can transfer some Crypto to each other and I’ll show you the transaction on the blockchain. You guys in?”

Now you might think I’m a sporty outgoing personality type (which is true) but at my core, I’m a massive nerd 🤓. And although I had been reading about Bitcoin for a few years I was still very much intrigued by the blockchain technology that powered it and I wanted to see for myself what all the hype was about.

So nearly everyone in the IT team bought $100 worth of Bitcoin in September 2017 when the going price was $4,763 AUD. I was rather unimpressed that there was a $5.50 transaction fee (5.5% of the investment!) just to buy the bloody thing so I only ended up with ~$94 bucks worth which at the time was 2% of a Bitcoin.

This was just a bit of fun to see how it all worked. We bought enough to muck around, but not enough to move the needle… or so I thought.

The 2017 Boom and Bust

The next few months were crazy!

We would come into the office each week and the first point of call was talking about the price of Bitcoin. It was skyrocketing!

Our $94 turned into $150 in a mere matter of weeks. And then $250, and then $450. We all had a laugh that this was our ticket to early retirement (they didn’t know about my blog 🙈) and we were only a few weeks away from buying a Ferrari.

Bitcoin peaked on the 16th of December 2017 at $25,506 AUD and our initial investment of $94 dollars had turned into $510 in less than three months.

Now I understand that it wasn’t a lot of money because our initial investment was so low but the return on investment was out of this world. Everything is hard to quantify if you don’t have a point of reference. I understood that even though we only made ~$400 bucks, the rate of return over that short period of time with zero effort was likely never to be repeated again in my lifetime.

And then came the crash…

Source: Yahoo Finance

Our tiny slither of Bitcoin which was valued at $510 in December 2017 plummeted back down to earth and bottomed out at $96 dollars a year later in December 2018.

This was my first taste of the Bitcoin rollercoaster everyone talks about.

Post Crash and General Feelings

A few of the guys in the team had actually sold their Bitcoin at around $450-$500 which was pretty much the peak in 2017 so they were very happy.

But I never had any intention of selling mine.

First and foremost, I was curious about the tech. However, I had a lot of reservations about the practicality of Bitcoin as a currency and if I’m being honest, I didn’t really think it was going to take off. I kept racking my brains on what problem Bitcoin was actually solving for me as an Australian. I understood the utility of this Cryptocurrency for other countries where the government was freezing accounts. And there was definitely a utility for criminals to send and receive value anonymously. But I could do everything I wanted to do with Australian dollars almost just as quickly as Bitcoin and with fewer fees.

I just couldn’t see this thing taking off.

I didn’t really understand what Bitcoin was back then. What it could be and what it represented.

But I had this hunch that it might be worth holding onto moving forward and the worst-case scenario meant that I’d lose my initial $100 bucks… not a big deal.

If I’m being honest, I was actually hoping Bitcoin and the other cryptocurrencies would eventually disappear. I was receiving a fair few emails from readers asking me about it and I originally just thought it was a Ponzi scheme. No intrinsic value, hardly any utility for Australians, high transactional fees etc. It also seemed complex and I couldn’t be bothered learning about something that I thought was going to be a relic of the past within a few years. I never included my tiny amount of Bitcoin in my net worth updates because I didn’t want any more emails.

But crash after crash Bitcoin continued to rise from the ashes to reach new heights.

This new ‘thing’ just wouldn’t stay dead…

Down The Rabbit Hole

The biggest turning point for me to do a deeper dive into the world of Bitcoin was when it surged again in late 2020. I was personally getting a lot of requests to do a Crypto podcast as well as a bunch of threads popping up in the FIRE Facebook group.

It was around this time that I read Why I’ve Changed My Mind on Bitcoin by Nick from the ‘Of Dollars and Data’ blog. I really value Nick’s commentary and that article really cemented the idea that there might be more to this Bitcoin thing than meets the eye. If Nick was writing about it, it was worth another look.

I decided to commit to educating myself on Bitcoin so when I eventually booked an expert on the podcast, I didn’t sound like too much of a n00b.

A quick side story….

I actually was in communication with Alex Saunders from Nugget news about coming on the podcast. He was one of the most recommended Australian authorities within the Crypto space and had built up a huge following online. Everything looked legit so I sent him a few emails. I nearly fell off my chair a few weeks later when my mate sent me an article that said Alex was being taken to court for potentially millions of dollars owing to his community 🤯.

Holy cow. This Crypto space was like the wild west.

Another name that kept coming up was an Australian who was living in the US, Vijay Boyapati. Vijay wrote the very popular book ‘The Bullish Case for Bitcoin’ and was very good at articulating his ideas during interviews. I reached out to him and he agreed to come on the podcast last year.

His book really changed what I thought I knew about money.

The mistake I made when I first came across Bitcoin was that I didn’t know the history of money. You need to really understand how money came about in the first place to give you the context of why the invention of Bitcoin was a game-changer. Explaining this could be an entire blog post on its own (or maybe a few posts honestly) but if you’re interested, Vijay’s book is a great starting point.

The history of money is more of a psychological deep dive into how humans interact and trade with each other. It’s super fascinating stuff and it challenged some core beliefs I had previously.

I started watching Michael Saylor’s videos on YouTube and I really enjoyed the ‘Decoding Bitcoin’ series from the Australian podcast The Passive Income Project.

The more I read, the more I realised how little I understood about money. I know a decent amount about how to become financially independent, but the mechanics of where money came from, how it’s created and why it works is an entire discipline.

Risk vs Reward

For me personally, the risk-reward proposition for a small amount of Bitcoin is quite attractive.

And it’s for this reason that we have now allocated 1% of the portfolio to this new asset class (we currently have around $12K of Bitcoin). And I’m seriously thinking about upping that to 2% in the future but let’s start with 1%.

This is the way I look at it – the worst-case scenario is that Bitcoin becomes worthless and we lose 100% of our investment. It’s only 1% of our portfolio so while I don’t like wasting money, it’s not going to ruin us financially. The upside for this investment however is unlimited.

I don’t know what’s going to happen in the future but I’m fairly confident that Cryptocurrencies are going to play some sort of role in our financial lives moving forward. I don’t know if Bitcoin will be the dominant player in 15 years but it’s the horse I’m backing for now.

I was very close to spreading that 1% across the other top 10 Crypto (by market cap) but I’m just not as educated on them and lacked conviction.

I think Bitcoin has a major ‘first mover’ advantage with its network but its crowning jewel is the decentralised nature of the protocol. I’ve read that other Cryptocurrencies are not decentralised and there are actually a few people at the top running the show. From my understanding, the whole point of using blockchain technology is to be decentralised. If you want to create an app, community, new system or whatever and it’s not going to be decentralised, you’re much better off using traditional technology with a normal database. That would be a lot more efficient as the processing power required to run the blockchain can be quite high.

I’m not an expert though so please if I’ve got this part wrong, let me know about it in the comments. Why would you use blockchain tech if whatever it was you were building didn’t need to be decentralised?

End Goal

I’ve used the word ‘investing’ a few times in this article but I’m hesitant to call anything to do with Bitcoin an ‘investment’.

I’m not even sure I know what to call it.

It’s not really investing but I think it has graduated past gambling at this point. There’s definitely a heavy amount of speculation but every investment in history has had some degree of speculation by definition.

It’s now possible to generate an income from your Cryptocurrencies but this isn’t something I have experience with so I can’t comment on the practicality and risks associated with staking.

The way I see it, we have two potential scenarios that can play out:

- Bitcoin succeeds and is adopted worldwide

- Bitcoin fails and becomes worthless

The goal is scenario 1.

We don’t have any intention of converting our Bitcoin back to fiat currency. This technology either works or it doesn’t. And if it does work, we should be able to use our Bitcoin for future purchases.

It’s more of a store of wealth than anything. Of course, I want the value of Bitcoin to go to the moon now that we own some. But the main strategy behind this purchase is for us to be able to actually pay for future expenses using this Bitcoin.

Think of it like money that buys more the longer you hold it. An interesting concept given the current rate of inflation.

This is different from our shares portfolio which is being built to generate passive income for us.

But Why?

If I’m already living a great semi-retired life and am on track to reach full financial independence within the next few years – why bother with Bitcoin at all?

That’s a great question!

There are a few reasons

- I’m interested in the technology and personally get satisfaction from participating

- I’ve concluded that the upside of Bitcoin succeeding far outweighs the downside of it failing given a small allocation within our portfolio

- It’s a vote for a better system

Points 1 and 2 are pretty self-explanatory but I want to expand on point 3.

When I was trying to think of the utility of Bitcoin back in 2017 I didn’t really understand how inflation worked and how it is used by the government.

I’m not an expert so I’m not going to try and pretend to know all the complexities of our current financial system but it doesn’t take a rocket scientist to know that inflation is rising in Australia. Your dollars are buying less each year even factoring in wage growth.

One of the main problems with the way our democracy works is that politicians are incentivised to be shortsighted. They are constantly slapping on band-aids rather than actually fixing the problem.

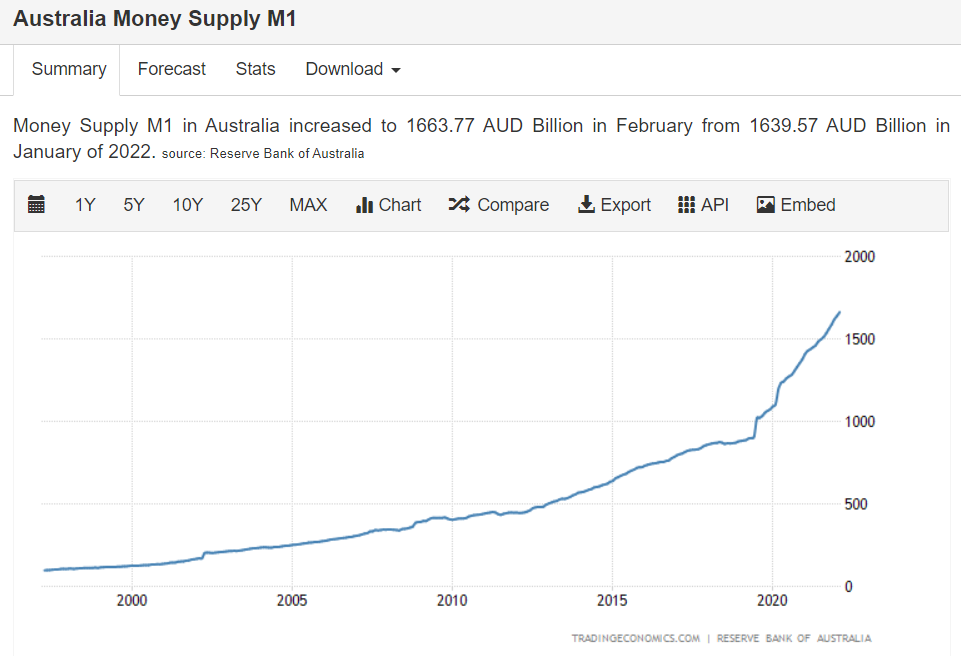

An obvious example of this is how much money has been created over the last few years. But this quick sugar hit doesn’t come for free. Someone always has to pay the bill. And all this printing has started to come back to bite us in the ass.

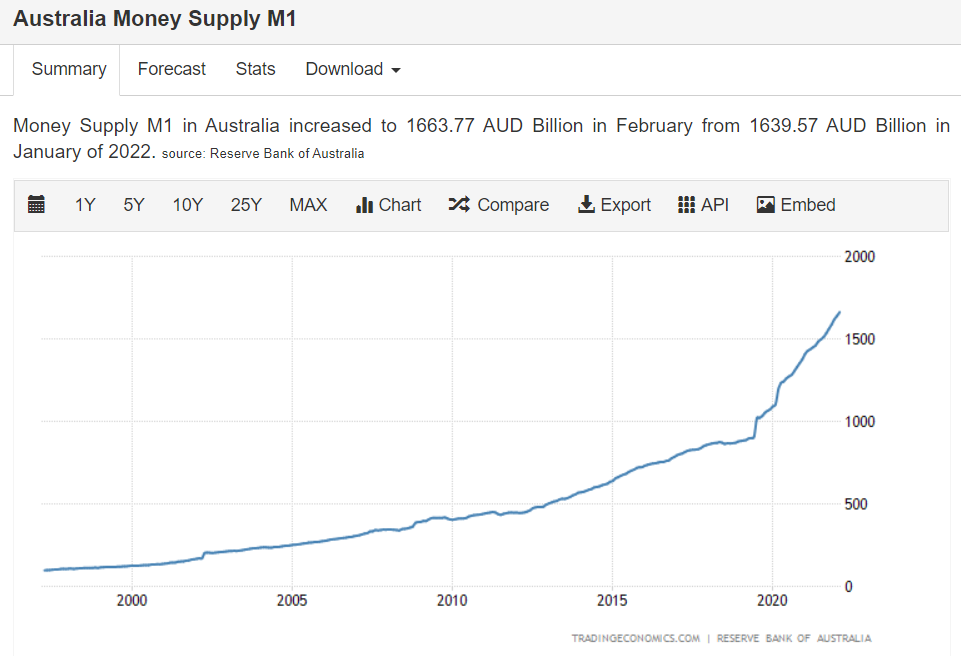

Source: https://tradingeconomics.com/

Inflation is a hidden tax.

People hardly even know it’s happening.

But make no mistake about it, high inflation without wage growth means you’re losing purchasing power. Your hard-earned dollars are becoming less useful and the rate at which they depreciate is out of your control.

I don’t like the fact that short-sighted politicians are happy to fire up the money printer at the expense of fiscally responsible savers that have built up a safety net. Is it too hard for them to maybe tighten their belts a bit in bad times? Why does it seem like every solution these days is to start making it rain at the first sign of the economy slowing?

I’m not saying I have all the answers, I’m just pointing out that the relentless drive for continuous growth is punishing responsible savers through the debasement of our currency and rewarding speculators loading up on cheap debt.

The more money that is created, the less purchasing power we all have.

Bitcoin flips this narrative.

The amount of Bitcoin that can be created is set in stone. It can’t be changed.

Part of me wants this experiment with Cryptocurrencies to succeed because I think it presents a superior financial system that can’t be screwed with by corruption and greed. Both of which are unfortunately innate traits of human beings.

Converting my fiat currency to Bitcoin is a vote for a better system.

Conclusion

We’re officially in the Crypto game (technically have been since 2017 😜).

I’ve really enjoyed learning about Bitcoin over the past few years but it was the history of money that really caught my attention. I find it absolutely fascinating how humans created and used money in past generations and I think the history of money is a prerequisite to fully understanding the utility of this new technology.

Over the last two years, the risk/reward proposition has shifted for me personally and I now consider a small amount of Bitcoin in a portfolio to be perfectly appropriate for any Australian looking to reach financial independence.

You’ll be fine without it of course but I think we’ve reached the point where most people can rationalise someone having a small amount. This is a lot different from years gone by when a lot of well-regarded reasonable voices would have publically shamed anyone who even thought about ‘investing’ in Cryptocurrencies. I must admit that I was secretly judging people who were buying it back in the day too 🙈.

We live and learn and I can admit when I was wrong.

I’d love to know what you guys think about Bitcoin in the comments.

Are you starting to believe? Or is it still a huge Ponzi scheme?

As always,

Spark that 🔥

by Aussie Firebug | Dec 2, 2021 | Podcast

Summary

My guest today is fellow Aussie, Vijay Boyapati who is an Ex-Google engineer and the author of The Bullish Case for Bitcoin. Vijay’s book has been translated into over twenty different languages and is said to be one of the most read pieces of literature on Bitcoin. This is a monster episode and we go deep into so much more than just Bitcoin and the Blockchain.

Some of the topics we get into include:

- Who is Vijay and what led him to start working for Google? (04:28)

- Vijay shares why he identifies as a Libertarian and what he learned from working in Silicon Valley. (08:13)

- Why Vijay left his job at Google in 2007 to work on the Ron Paul US presidential campaign. (11:46)

- What exactly is Bitcoin and the Blockchain? (15:06)

- Why is Bitcoin important and what problem does it solve for the average person? (31:51)

- Gold v Bitcoin (45:27)

- Will Bitcoin be used as money anytime soon? (01:02:22)

- FIRE community Q&A (01:17:57)

Links

by Aussie Firebug | Nov 19, 2023 | Net Worth

I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

My second month of dad life has been going great.

Yes, there are times when getting enough sleep can be difficult. But boy oh boy it’s all worth it when you see your little one’s adorable smile 🙂

I’m not kidding; it’s like black magic. I’m pretty sure evolution has developed this way to give parents an additional gear they can tap into when things get hard haha.

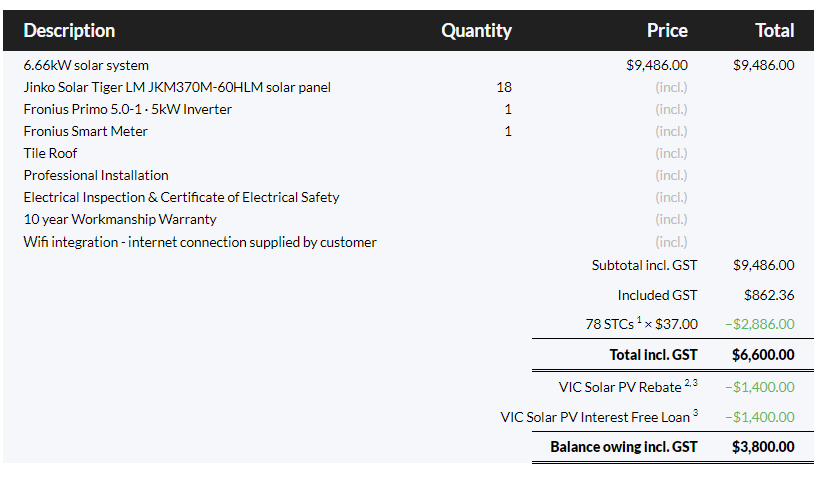

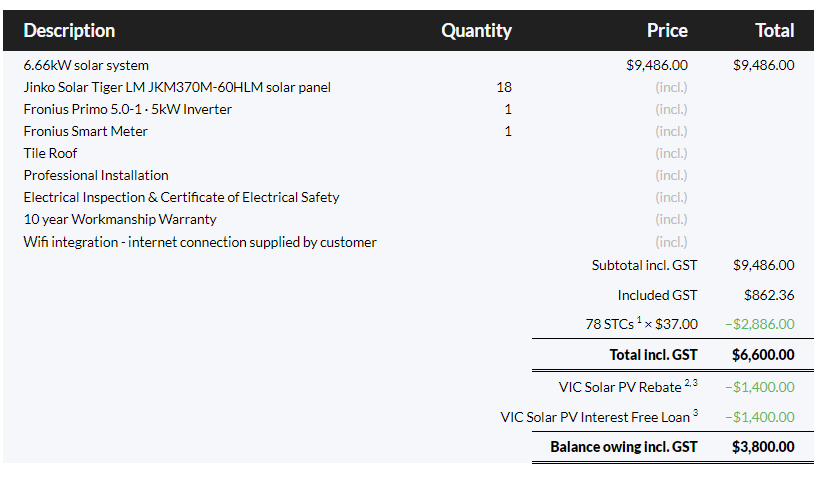

As a data nerd, I’ve been looking forward to seeing how much more electricity we would use when the baby arrives. This was one of my biggest motivators for installing our 6.66 kW solar system in October 2021.

Our out-of-pocket cost for that system was $3,800.

Solar Install

Our usage comparing October last year to October this year has been the following:

| Month |

Grid usage |

Consumed directly from solar |

Total Usage |

Self-sufficiency |

$ Saved (based on 39c/kWh) |

| 22-Oct |

115 kWh |

102 kWh |

217 kWh |

47% |

$40 |

| 23-Oct |

153 kWh |

151 kWh |

304 kWh |

50% |

$59 |

Since the three of us are home most days, our energy usage has increased by over 40%. And I suspect this will only increase as our baby grows up.

The other significant factor is we will be buying an electric car next year (trying to hold out until the new model Y drops). Our solar panel energy consumption will skyrocket from that point onwards and the payback period will significantly speed up.

It’s going to be cool to calculate how much our panels save us in a few years and compare that to how much we would have received if we invested it instead.

Net Worth Update

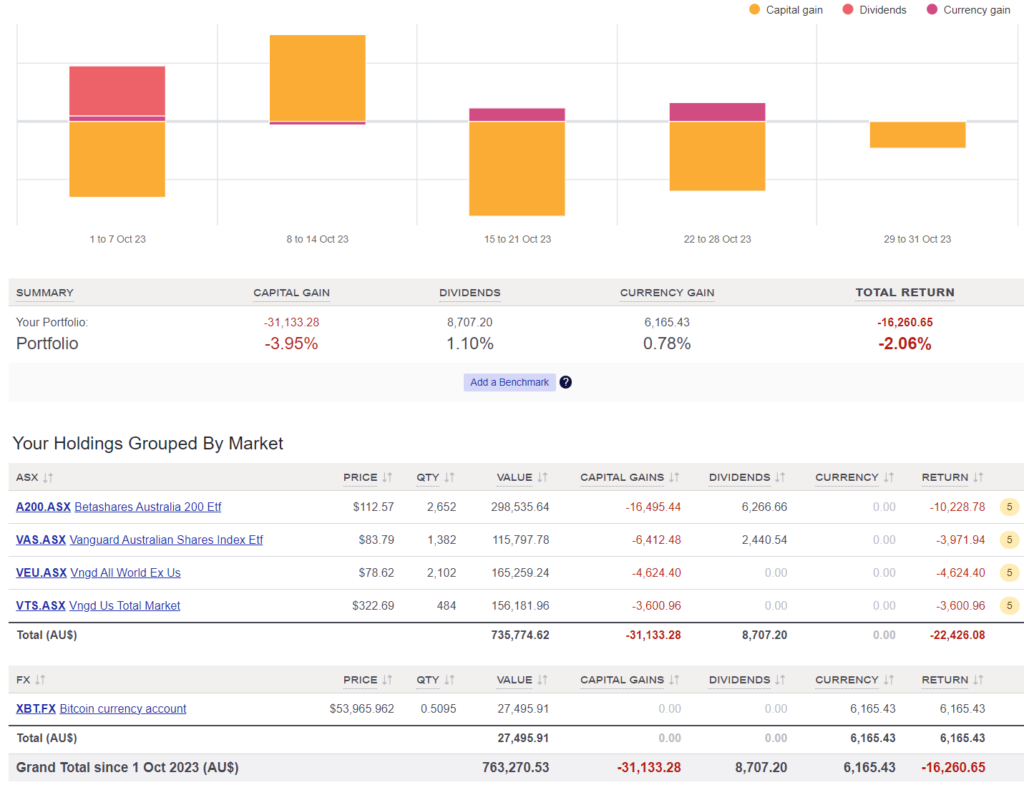

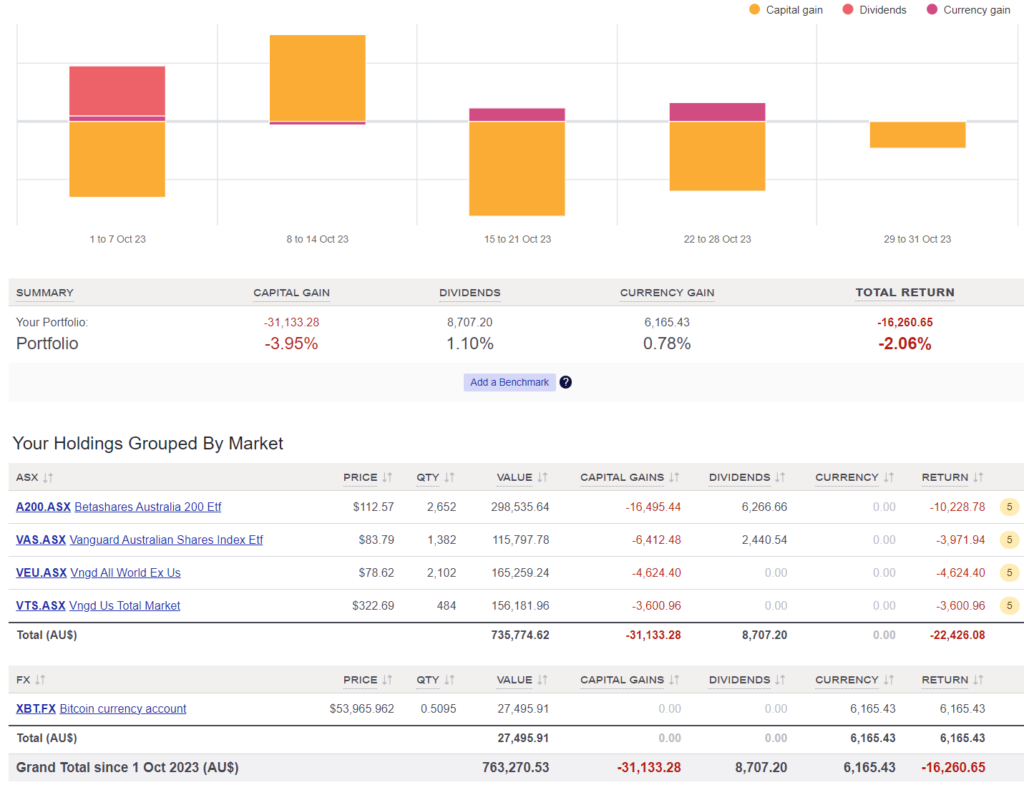

Another brutal month with our shares and Super being hit the hardest.

On a positive note, Bitcoin increased by 30% in October!

I haven’t used my Bitcoin yet, but I’m interested in finding out where I can spend it. Does anyone know of any cafes or stores in Melbourne that accept BTC or are on the lightning network? I’m curious to see how easy the process will be.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Another quiet month on the expense front. We’re really not spending a lot of money at the moment.

Shares

Monthly Performance

The above graph was created by Sharesight

$8.7K in dividends slightly softens this bad month from a psychological point of view, but still, not great.

We made no purchases in October. We are still keeping our cash position high until I secure some contracts that will be landing in the coming months.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | Oct 23, 2023 | Retire Early

I’ve been thinking about this post for the past 18 months, and to be honest, it’s long overdue.

So much has changed over the last 11 years since I first stumbled across FIRE.

And if the article’s feature image wasn’t obvious enough, I recently became a father. So, now is the perfect time for a big update/recap on life at the Firebug household.

Are We Still Chasing FIRE?

A few people have noticed we haven’t invested in shares since October 2022 (over a year ago!). Some community members have been commenting on my net worth articles and emailing me directly, asking if we’re still actively pursuing FIRE.

The short answer is yes.

The long answer is more interesting.

For the first time since we started our FIRE journey, we have switched from accumulation to consumption. We’ve been dipping into our portfolio (spending some of our dividends) every now and then for the last two years.

And believe me when I say this was not a simple task to accomplish. When you’ve dedicated over a decade to pursuing a goal and have structured your life around constant optimisation and channelling every available dollar into investments, it goes against your instincts to spend rather than save.

Old habits die hard.

Imagine asking a seasoned marathon runner who has spent years training for endurance races to suddenly become a professional weightlifter.

But what’s the point of investing if you never switch from accumulation to consumption?

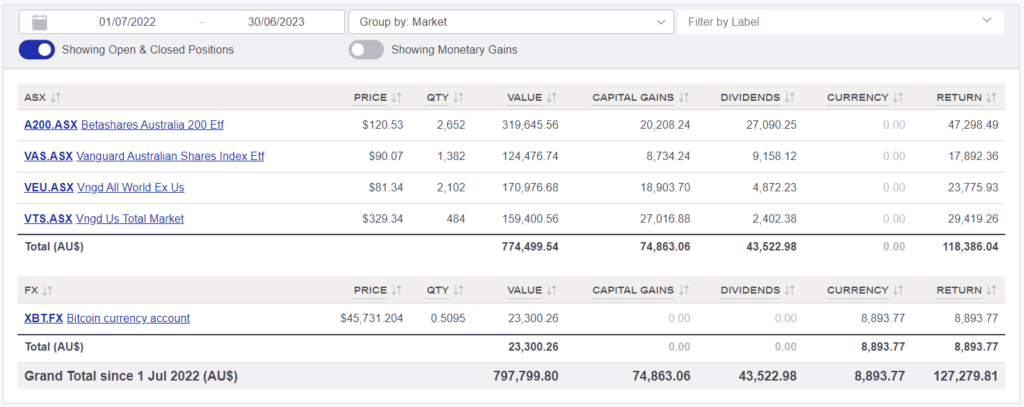

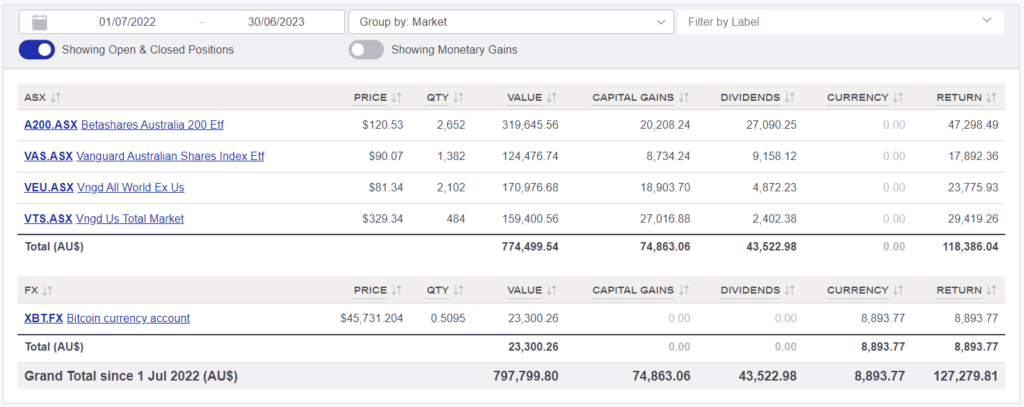

We earned ~$43K in dividends last financial year.

Last F/Y performance

Even though the markets had an above-average return last year, $43K is not enough for us to live off completely. However, it’s a fair chunk of change that allows us to buy back our time now rather than waiting to hit some arbitrary number in a spreadsheet.

During our FIRE journey, our priorities changed, and the race to financial freedom no longer seems so important (more on this below).

Side note: This is a major consideration point that many Excel spreadsheets neglect to model for. Super is a fantastic vehicle to save for financial freedom. However, if your priorities change halfway through your journey, that money is locked away until your preservation age. Looking back, I’m really pleased that we decided paying extra in taxes was worth the added flexibility.

Heavily inspired by the book ‘Die with Zero’ by Bill Perkins, we knew that in our late twenties, we had a brief window of health, financial stability, and free time to explore parts of the world we had always wanted to visit.

And that’s exactly what we did.

We have travelled to over 30 countries and visited every continent on earth (except for Antarctica).

I’ve found that many people in the FIRE community tend to be a bit cynical about the whole ‘Travel the world while you’re young’ cliché.

“Sure, it’s cool and all. But you know what’s really cool? Never having to work ever again!”

I held a similar belief for quite a while and often wondered whether those who splurged on travel were trying to convince themselves it was all worth it because they spent a fortune.

But living overseas and visiting so many different cultures changed my point of view.

I’m not saying it will be as transformational for everyone as it was for me, but travelling dramatically broadened my horizons, particularly regarding my relationship with meaningful work.

Spending god knows how much we spent during those two years abroad was, in some ways, more of an investment than saving our money and buying shares.

There’s a good quote that sums it up for me.

“Travel is the only thing you can buy that makes you richer.” – Anonymous

Retire From The Rat Race, Not From Work

When I reflect on my journey towards FIRE, it’s crystal clear that my desire to escape the rat race was largely motivated by a job that left me unfulfilled. I wanted to create a passive stream of income so I could pursue other interests without worrying about paying the bills. Financial freedom was my ticket out of the monotonous 9-5 grind and onto eternal Happyland.

I think many people are attracted to the idea of FIRE because they either hate their job or are left unfulfilled after spending most of their time there (that was me).

My professional work life has had two distinct phases. Pre-London and post-London.

I worked for various levels of government in regional Victoria for eight years before my wife, and I jetted off to the other side of the world for a two-year adventure.

Pre-London, Matt enjoyed the people he worked with and found parts of his job fun and interesting. But it was extremely rare for him to get ‘excited’ about work. Work at that stage was 95% about making money so he could live his life outside of it. Public sector culture tends to be sluggish, bureaucratic, lacking energy, and occasionally downright wasteful.

I never had a problem with any of that because as long as I was cashing my paycheck, it’s all good.

However, an unstimulating work environment can gradually destroy your creative spirit.

Subconsciously, I was checking out. Towards the end of my first job, I just didn’t care what was going on. I had no passion for the work I was doing. No pride or excitement. Just rocking up to collect money, talk with some of my mates and bounce.

If you put up with this long enough, you may lose sight of, or simply stop searching for, the enjoyable aspect that meaningful work can provide which is a terrible outcome.

Or as Dr Robert Doback so eloquently says at the end of Step Brothers, “Don’t lose your dinosaur”.

Fast forward eight years, and I started my first consultant gig in one of the busiest cities in the world.

London is like a vibrant melting pot filled with diverse ideas, talented people, and innovations. It’s filled with folks who are passionate about changing the world. I was working alongside some seriously talented people with incredible energy and an ambitious spirit that rubbed off on everyone they worked with.

It took me until I was 29 years old before I got my first taste of kick-ass, motivational, and inspiring work culture with world-class leaders.

I had a really interesting conversation with Carl Jensen (AKA Mr. 1500) in July, and we spoke about sliding door moments and how fulfilling, purposeful work has the power to inspire you to leap out of bed each morning.

He asked me a thought-provoking question that went along these lines.

“Would Aussie Firebug be a thing if you moved overseas straight after uni and were genuinely inspired by your job?”

I’ve been thinking about that for a while now, and the honest answer would be no.

Why would I need to reach financial freedom and escape the rat race if I was in a job I really liked? If I had been truly satisfied with my job, I wouldn’t have been driven to explore other paths.

That being said, even if someone enjoys their job, there are still legitimate reasons to aim for financial freedom. However, in some cases, the burning desire to make necessary lifestyle changes may not be there, and it’s really hard to change your lifestyle if you don’t have a strong ‘Why of FI’.

So What Now?

In some strange way, I feel like I’ve skipped the ‘Financial Independence’ part and gone right ahead to the ‘Retire Early’ portion. My version of RE has always been ‘Retire Early’ from the rat race. It’s never been about not working.

And financial freedom isn’t binary, either. There are levels.

From an Excel spreadsheet point of view, we have not reached financial freedom. But from a real-life point of view, I’m as free as a bird. I know that our portfolio will continue to compound over the years and eventually hit our FIRE number.

But that part is kind of irrelevant to us now. I already feel like we have conquered our first mountain (FI), and now it’s time to shift our attention to the next phase of our lives (RE).

Another sidebar: Some people never get off their first mountain. They make all sorts of excuses to keep working another year and saving and investing and saving and investing. They drop their safe withdrawal rates from 4% to 3.5% and then 3% just to make sure. A lot of people in the FIRE community have drifted away from the movement’s initial objectives and principles. Live a happier and more satisfied life by buying back your freedom through intentional lifestyle choices and common sense investing. But if you never dare to take that initial leap from that first mountain, you’ll remain stuck in the daily grind, even if you accumulate immense wealth.

I’m not kidding when I say that I feel thankful for how my life has turned out almost every single day.

The life I’m living right now was something Matt could only dream of in 2015 (when I first started blogging). And I’m not just talking about all the travel either. I’m mainly talking about having complete control over my time during the week. Some days are spent travelling back and forth to Bunnings doing home renovations with my dad. Some days, I’ll walk with my sister and little nephew for a few hours. Some days, I’ll catch up with Mum, and she’ll tell me all about her and Dad’s next trip over a cuppa.

Some weeks, I’ll spend 40 hours working on my business if I’m in the zone. Some weeks are dedicated to getting AFB content out there.

Having absolute control over your time is a blessing, yet it can also present challenges.

It’s kinda like going to a restaurant offering over 100 different meals. It’s overwhelming at first. You feel the need to look at every option in case you get meal envy after you order. Sometimes it’s really nice when they only offer 3-5 dishes.

Having a job to go to gives people structure. And I’ve rarely appreciated that structure until I stepped out of the 9-5.

It took me about two years to actually figure out what I wanted to do work-wise. I don’t care who you are, everyone has a vice. We all need to engage in some form of meaningful work, even if it doesn’t necessarily result in earning money.

In this net worth update, I wrote about my aspirations of bringing some of that vibrant work culture from the UK back to my hometown in Victoria and my dream of a co-working space.

Helping foster a local community of like-minded people is really important to me. It’s part of what I’ve been missing since returning home from London. I haven’t found my ‘work people’ yet, but I know they’re out there. I just need to bring them together 🙂

Feel free to follow our Co-Working Facebook page to follow along.

I guess the main point is that I march to the beat of my own drum these days.

I’ll always be a finance nerd, but I have completely lost the obsession I once had with investing, budgeting and tax minimisation strategies. I’ve even put a pause on consuming FIRE-related content, except for those I’ve been following for a while and have a deeper connection with as individuals, rather than simply using it as motivation for my own journey.

I’ll continue posting our net worth updates until our passive income exceeds our expenses (based on the 4% rule). Once that happens, I don’t see a need to continue to publish those articles.

As far as our strategy is concerned. We are still aiming to build our passive income mainly through shares, cash and a little bit of Bitcoin for some speculative fun.

Our core mix of A200, VAS and VTS remains the same. Our current target weightings for each market are 20% US, 20% world and 60% Australia.

I know plenty of people will say that’s weighted too much towards Australia. However, I want to stress the significant psychological power of using dividends to cover your expenses rather than selling shares.

We still haven’t cracked open VTS or VEU even though that was the original strategy. And I’ve come across countless members of the FIRE community who have suffered the same fate. Many find it much simpler to use dividends that land in their bank account, as opposed to selling down their portfolio.

We must be pragmatic about these sorts of things. Efficiency is important, but there are times when it’s wiser to choose the strategy you’re most likely to execute.

I’m a Dad Now!

The biggest change of all has been a recent one.

Mrs FB and I welcomed the newest member of the family in September, marking a moment that forever changed our lives.

I won’t get into all the details of how our little bundle of joy has transformed our world because it’s an emotion that only other parents can understand.

But what I will say is that from a FIRE point of view, having a child hammers home how important controlling your time really is.

And to be fair, this is something I’ve been speaking about since I started this blog. I knew all the way back in 2011, when I first started working, that having a kid really chews up your time. One of my biggest motivators for reaching FIRE was to be able to do everything I loved doing while also being a committed father.

I just couldn’t see how that was possible working 40 hours a week since I had so many extracurricular activities I enjoyed.

I had seen this story play out a bunch of times before. People have kids, and suddenly, they can’t find the time to look after themselves, or they start forgoing activities that make them happy.

They might be unable to focus on their health and fitness as much and become unwell. They begin to see friends and family less frequently than they used to. They start skipping social outings because they’re exhausted from the week etc. etc.

From what I witnessed growing up, it appeared that new parents often set aside their passions and self-care to invest more time and energy in raising their children. A noble goal, but I selfishly wanted to put myself into a position where I could do everything that made me happy and be a kick-ass dad.

FIRE was going to give me my time back when I needed it the most.

And it’s pretty much worked out that way now.

Friends and family have been asking me when my paternity leave finishes, and I’m like:

“I work for myself. I can have as long off as I want”.

I feel incredibly fortunate to have the best of both worlds. I’ve kicked off some projects that fulfil my desire for meaningful work, yet I also have the freedom to relax and spend entire days with my lovely daughter if I feel like it.

This is what FIRE is all about IMO.

Conclusion

Our FIRE goal from the very start was always to ‘Retire Early’ from the rat race. It was never about not working altogether or amassing the biggest fortune.

From my experience, once we had around 50-70% of our expenses covered in passive income, that was enough to give me the confidence to quit the stable 9-5 and have a crack a something else without worrying about the money.

For me, that’s starting a co-working space in my hometown, helping build a community of like-minded people, and addressing my love of all things data through a business idea I’ve been cooking up.

When you have autonomy over your time and start to work on projects that ignite your passion, you look forward to working almost every day.

There is also a really important concept that I hope you’ll consider too. Similar to the unwritten rule of not starting another book before finishing the current one, it might feel like you’re cheating if to jump ahead in the journey and begin enjoying the benefits of RE before reaching FI. However, not only is it perfectly okay to do so, but I also believe it’s the better path.

I consider myself extremely fortunate that my partner and I found ourselves in a situation where I had to resign from my job to fulfil a bucket list item (living abroad). That incident became the catalyst for stepping one foot off the FI mountain and starting to climb the RE one.

But I’d like to be crystal clear, Mrs. FB and I are still on the journey towards FIRE, but we’ve decided to start enjoying the fruits of our labour sooner rather than later.

We’re now drawing down part of our portfolio after devoting so much time and effort in our 20s to building it.

Life’s short, and I want to be as present as possible to watch our beautiful daughter grow up.

That’s what it’s all about. Buying back your time to enjoy special moments (like leisurely sleep-ins) with the people you love.

As always,

Spark that 🔥

by Aussie Firebug | Jun 10, 2023 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

Not a lot to report for the month of May.

I’ve been working nonstop on my business and preparing for a big conference at the end of June.

It’s amazing how fun work is when you’re in control and have a personal goal to work towards. What’s equally amazing is how many different hats you have to wear to get other businesses to buy your product.

In the month of May, I’ve been a:

- Marketer

- Developer

- CIO

- CEO

- Graphics designer

- Data Engineer

You’d think that building a product that’s better than anything else in the market would be enough.

But it’s not.

So much of what drives business is relationships. I remember when adults use to tell me that networking was one of life’s most important skills.

“Get out there. Meet people. Get to know them”.

It’s hard for a teenager to fully grasp what this means.

But as I’ve gotten older, it’s become crystal clear that developing relationships is paramount if you want to do business.

Another slightly annoying thing is how much authority LinkedIn has.

I’ve never posted on LinkedIn before. I had a profile years ago but it’s been sitting dormant because I just didn’t see the point. The whole website seemed like a showoff extravaganza.

But it has a level of authority in the niche that I’m selling to (government). Potential clients were telling me it was a red flag that my company didn’t have a LinkedIn presence 🙄.

So I had to put some effort into building a company page and posting some content.

This social media peacocking is part of the game you have to play when you’re new. It just is what it is. And if I want to reach my goals, I can either play the game or give up and try something else.

Wearing these different hats for the company and learning different skills is fun. It’s not what I want to be doing all the time but I absolutely love learning about the human behavioural science of commerce.

I’d wager that 90% of the deal comes from marketing and your reputation/relations in the industry. If you have a good rep and are known to produce exemplary work, half the battle is won. When you’re the new guy on the block, you have to establish authority by building brand awareness and offering a competitive advantage.

This is something I’ve always wanted to have a go at and it’s been a lot of fun so far. I’m hoping that I can land a big contract or two after the conference and hire someone.

My dream of the co-working space is on pause until early next year.

Net Worth Update

Everything went done this month with Super being the only asset class in the black.

A lot of cold hard cash went out of our accounts in May too.

The two big reasons for this were a big tax bill for the company and the cost of the June conference.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

I don’t include company expenses in the above graph because we don’t rely on them to maintain our lifestyles. I’ll probably remove company assets (cash) from these updates eventually to make things clearer too.

Shares

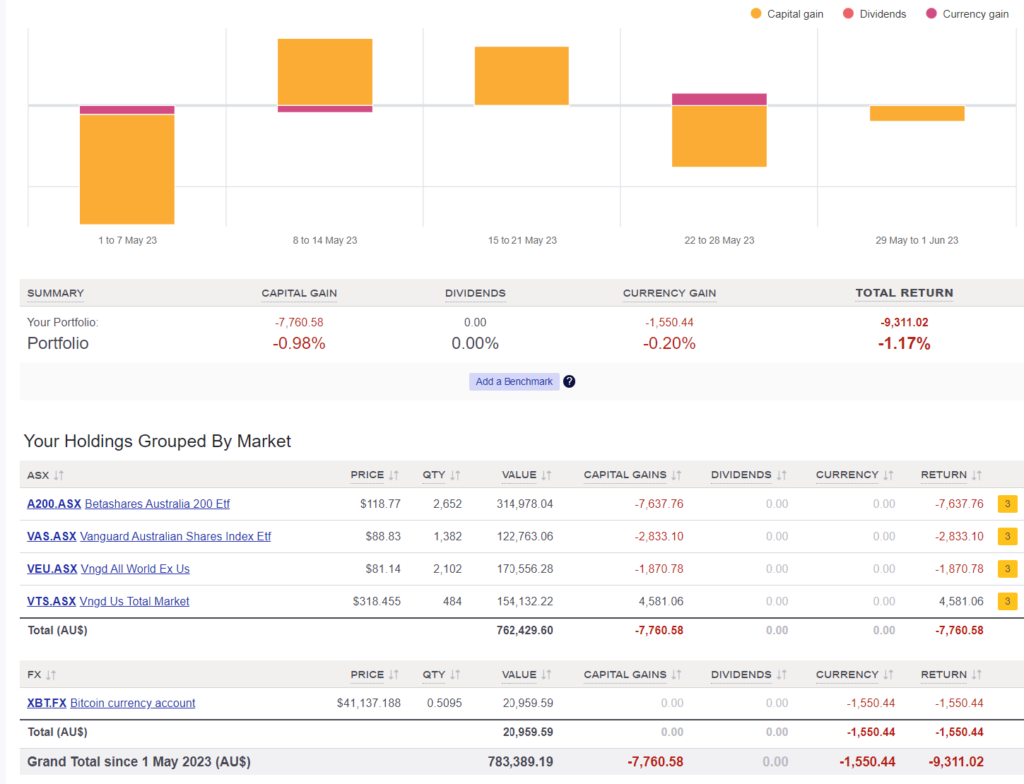

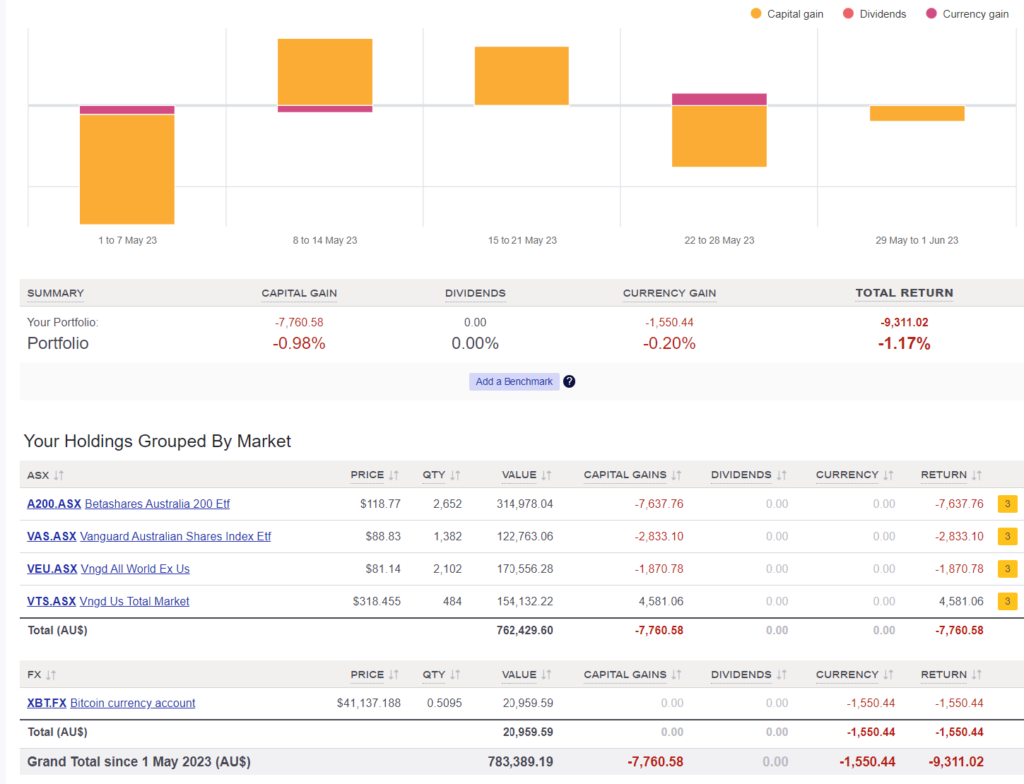

The above graph is created by Sharesight

I’ve added our Bitcoin holdings to our Sharesight portfolio!

This was really cool because I’ve never worked out the total return we’ve made since 2017. As I type this out today, we’ve had a total return of 4.44%. A lot of that has to do with buying the bulk of our Bitcoin last year and the price of BTC going down a fair chunk since then.

I’m still waiting for businesses to offer the lightning network so we can use our coins in day-to-day transactions. Maybe that day will never come but I’m hopeful for now.

No new purchases again for May. Most of our spare cash is going into the business.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Networth