by Aussie Firebug | Oct 30, 2016 | Classics, Investing, Mindset

What a horrible mash-up of words. Rentvesting? Rent-Investing? Rentvestor?

Yuck!

While the term itself doesn’t sit well with me, the underlying principles definitely do and I think a ton of millennials could benefit from it, so listen up muchacho’s!

What The Hell Is Rentvesting?

Put simply ‘rent where you want to live, while you invest where it makes sense’

If you’re a citizen of Sydney or Melbourne, you may know about the incredible median house prices.

The stock standard formula for buying a house used to be:

- Get a good job

- Save enough money for the deposit

- Buy house

- Pay off the loan

- Live happily ever after

But as the great Bob Dylan once said

The new formula is now this:

- Get Arts degree

- Skip smashed avocado for 6,363 days

- Pay your deposit

- Spend the rest of your life paying off your loan

- Enter death blissfully knowing your financial situation will not follow you to the afterlife

I kid I kid.

But the point I’m trying to make is that the old school conventional way of buying a house in our two biggest cities doesn’t work anymore for the majority of people without financial help from their parents or inheritance.

This is because the game has changed! It ain’t what it used to be when ma and pop were hunting for a house.

Can Rentvesting Help?

Absolutely!

As I have already explained with my Rent vs Buy article, renting is cheaper 90% of the time.

And if you live in either inner Melbourne or Sydney, this becomes 110% of the time.

So instead of taking on a mortgage in either of these two cities, why don’t you rent for a few years and invest where it makes sense to do so.

Rentvesting can get you into the housing market without the financial stress when buying in inner Melbourne and Sydney.

How Does It Work?

One rentvesting example might be ‘Harry Hipster’ from inner city Melbourne complaining that the housing market is rising faster than he can save for a deposit.

Harry desperately wants to enter the property market but cannot save enough for the deposit and is unsure if he will be able to make mortgage repayments without at least a 20% deposit. Caution Harry is also extremely hesitant about the Melbourne market being in a bubble and is worried that prices could come crashing down just after he has bought.

He has been very cautious of a potential crash for more than a decade now and year after year he has seen friends and family around him buy real estate and increase their wealth. He’s sick of being on the sidelines but can’t afford to buy in inner Melbourne.

Harry discovers rentvesting and decides to take his savings and invest interstate where the property market is more affordable. The collected rent would cover the majority of costs associated with the investment with plenty of upside for capital growth.

Rentvesting has allowed Harry to get into the property market without the mortgage stress he would have had if he had bought in inner Melbourne. Furthermore, if Harry’s financial situation changes he can adapt quickly.

If Harry gets a raise, he can move into someplace more luxurious. Maybe he loses his job? No worries, he can move somewhere more affordable until he finds his feet again. None of these luxuries can be had once you lock yourself into a mortgage that you’re paying for. The investment property is an asset, not a liability. The mortgage on the IP is not paid for by Harry, he has tenants that are paying that loan off for him.

After a few years, Harry may decide to sell the IP getting back his savings plus whatever capital growth occurred during the years and use this money as a down payment for an inner Melbourne house. The entire time, Harry was in the property market and benefiting from whatever gains occurred instead of missing out on the sidelines. Harry was also not under financial stress and had the flexibility to live wherever he wanted to based on the circumstances he was in that year.

| PROS |

CONS |

|

No mortgage stress |

|

You won’t be paying off your home to live in. There is a psychological connection to be paying off something that’s yours. Renting can feel like dead money |

|

Ability to save and invest more |

|

No security in renting. Can get kicked out anytime |

|

Exposure to the property market sooner |

|

Rentvesting is for the disciplined! A mortgage can act as a forced savings mechanism. Rentvesting relies on you having the discipline to stick to a budget and not blow the extra cash. |

|

Flexibility to change your biggest expense (living costs) when it suits you. |

|

|

|

Start building your wealth now not later |

|

|

|

Invest on your terms. 9/10 the place you want to live in is not the best investment. Rentvesting allows you to live where you want and invest where it makes sense. |

|

|

|

Frees up cash flow for more smashed avocado on toast ?? |

|

|

Conclusion

With the two biggest cities in Australia being more expensive than ever, more and more Australians are struggling to get their foot into the property market. Rentvesting can be used to get into the market without having the stress of paying a mortgage yourself.

Rent where you want to live, invest where it makes sense.

My partner and I are rentvestors and have no plans to buy a house to live in anytime soon. This gives us the flexibility and freedom that we want this time in our lives. When circumstances change, we have the flexibility to adapt.

Are you currently rentvesting? Why? Why not?

Thoughts and feelings in the comment section below.

by Aussie Firebug | Jul 31, 2016 | Mindset, Saving

Lets talk savings rate for a second. It is in my opinion THE most important factor to FI (financial independence) and determines a lot of things like:

- Whether you actually reach FI

- How long it will take you to reach FI

- Gives you a clear indication as to what your FI number is

It’s really the foundation for the concept of financial independence retire early (FIRE) which is what this entire blog is about.

There are only three things you need to do in order to become extremely wealthy:

- Spend less than you earn

- Invest the rest

- Wait

The very first step in becoming rich enough to retire early is to save your money. The second step is what gets most of the limelight and chatter.

Investing.

But don’t get it twisted. You won’t EVER invest your way to FI if you don’t spend less than what you earn, because that’s… you know…impossible.

And finally the third step is the time you have to let compounding interest dominate for you.

There could be an argument made for the amount of time you have as the most important factor but it’s kinda out of your control as in you 1. don’t know how much time you have (could die tomorrow) and 2. Can’t change it even if you knew you had X amount of years left. You have a lot more control over whether you spend less than you earn.

Savings Rate For Last Financial Year

Let me cut to the chase.

My savings rate for last financial year was…

74.39%

Last financial year I made $72,105.04 (after tax) and spent $18,468.42.

One of my top ten tips (LINK TO TIPS) I suggest to people trying to save money is always, always track your spending.

As the old saying goes ‘A goal without a plan is just a wish’.

You cannot set a plan of attack without knowing exactly how much you spend. You know roughly what your income is going to be, you then need to plan for the amount you want to spend each year to achieve your goal of whatever spending rate you choose.

Breakdown Of Spending

There are two ways you can track your spending:

- The hardcore way = manually inputting ever transaction into an Excel spreadsheet

- The easy way = Using an online service that feeds into you bank account (something like pocketbook)

I use the easy way but there is absolutely no problems using the hardcore method.

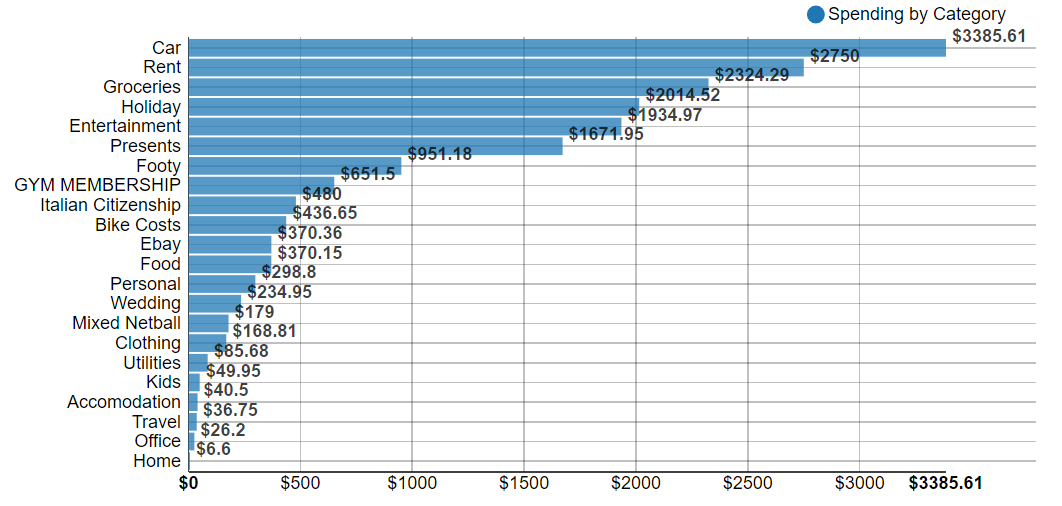

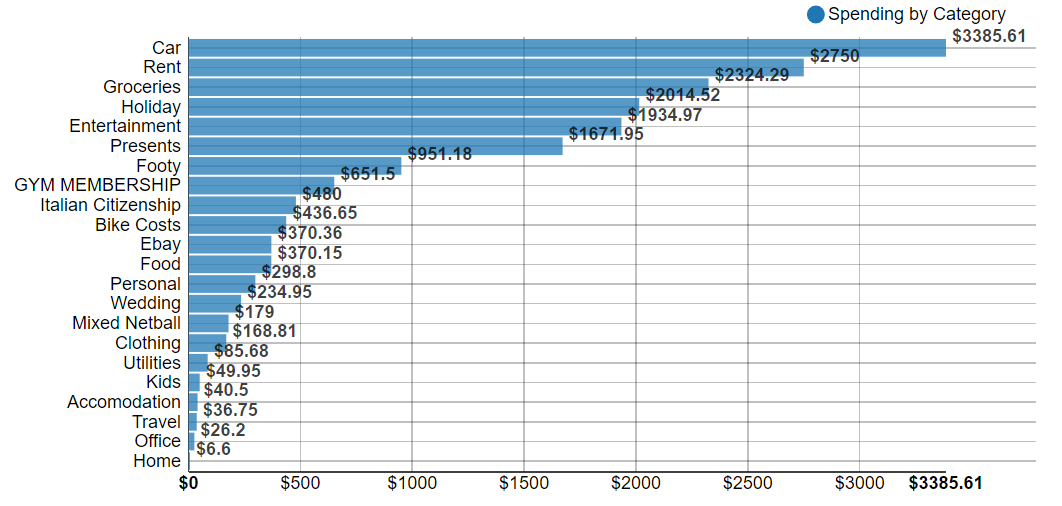

Let’s have a look at where my cash went last year

Below is the same data but represented in a pie chart.

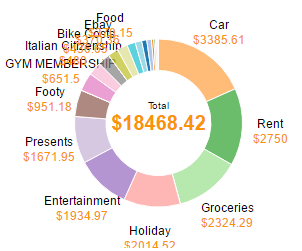

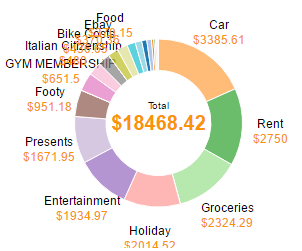

One of my favorite features of Pocketbook is its ability to create sub categories. My biggest expense is my car for example. I spent a total of $3,385.61 dollars on it last FY. But that’s a little vague isn’t it. Luckily I recorded sub categories for it and can dig deeper into the overall ‘car’ category to see it.

Pretty cool huh.

The software lets you see where the costs came from and even what months you spent the most amount on. The above are screenshots only, but this graph is actually interactive which is pretty cool because you can un-select multiple sub categories from above and the pie will change and you will see the spending per month change on the fly. This sort of stuff really excites my inner finance geek (what a sad existence I live lol)

Before You Ask

There are a lot of things missing or not quite right with my above spending, so before anyone points it out let me set the record straight!

- I only moved out of home at the start of this year hence why my rent is quiet low and overall expenses

- Everything above is only my income and expenses. I do however pay for me and my partner some times (like for dinners and what not) but she also pays for things too so it’s hard to keep track of that. We have not yet joined finances

- My rent ($110 a week) covered gas, electricity , internet, and water. This was a room share deal in the county (cheap as chips)

- I don’t pay a phone bill…sorta. I pay the minimum which is around $20 bucks I think, every six months so I can keep my number from Telstra, this small expense falls under utilities. This means a don’t have credit and can’t call people when I’m out and about. It usually blows people minds when I tell them I don’t pay for credit and am not on a plan. But with the availability of open wifi’s increasing, it is my opinion that we will see less and less people buy cellular data/credit unless they’re in a remote area. Nearly all calls and messaging will be done through the internet in the future

- I have not included the costs (or incomes) of my investments

- I have not included my accounting fees because they are a deductible expenses associated with my investments. In the end I plan to transition completely to index funds and will be doing the accounting myself. Anything investment wise I keep off because I would then need to include the income generated by those investments to be fair and that would get tricky

- Costs associated with this blog are not included

- Going out to eat as an activity fall under ‘Entertainment’, food is where we had to eat somewhere but not as an activity (like at a petrol station) and groceries are anything bought at the supermarket

- I group ‘Holidays’ as one big expense and than create sub categories for each holiday. Anything that is spent on the holiday falls under that sub category holiday. If we buy groceries during a holiday, it will be categorizes as the holiday and not as groceries. Gives me a better indication about how much the holiday costs me

- ‘Presents’ covers gift to myself and others (Christmas, Fathers day, Valentines day etc.)

- ‘Personal’ covers health related things like physio, dentist, ambulance insurance etc.

- And no I don’t have any kids. The one expense for ‘Kids’ is because I recently became an Uncle

How Do You Compare?

I like to compare the savings rate to the nutrition for a professional bodybuilder. Some people say that Bodybuilding is 80% nutrition and only 20% the other stuff (training and sleep). You can’t out exercise a bad diet. Period.

You can train the house down 6 hours a day 7 days a week, but if you’re not fueling your body with the right amounts nutrients it needs to function and repair itself then you’re not going to see results.

This is the same for those striving for FIRE. A healthy savings rate enables you to invest capital. The better the savings rate, the better the results are going to be.

It’s a rookie mistake among first time gym goers. They concentrate so hard on their routine and make sure they put a solid 2 hours in, only to swing by McDonald’s on the way home from the gym thinking they have improved their health.

You would have been better off simply eating a healthy meal and NOT going to the gym!

Optimism your savings rate first, and then concentrate on the investing part.

A dollar saved is a dollar earned. Where as a dollar made isn’t really a dollar, it’s more like 0.70c because of tax. Think about that for a moment.

I would love to know what your savings rate looks like. Have you optimized your expenses so much that my measly 74% savings rate pales in comparison? Maybe this was an eye opener and now you have something to aim for?

Thoughts, feelings and emotions in the comment section below.

by Aussie Firebug | Feb 2, 2016 | Financial Independence, Investing, Mindset, Podcast, Real Estate

[soundcloud url=”https://api.soundcloud.com/tracks/281465926″ params=”color=ff5500&auto_play=false&hide_related=false&show_comments=true&show_user=true&show_reposts=false” width=”100%” height=”166″ iframe=”true” /]

Subscribe on Itunes Subscribe on SoundCloud

Subscribe on SoundCloud

In this episode I chat to Ben Everingham who was able to retire from full time work at the age of 29.

Ben knew he was not wired the same as everyone else when he started working full time and quickly discovered that the ‘normal’ working life was never going to make him happy. After a Euro trip at 19 and finishing Uni, Ben was able to land a great job in Sydney earning over 6 figures. Most would think that they have it made with a great job straight out of Uni but after working a while Ben knew that this job was never going to satisfy him long term and whilst the money was great, he was miserable.

After reading Rich Dad Poor Dad, Ben’s eyes had been opened up to the possibility of investing and business ownership. Eager to get started, Ben was able to purchase 6 properties within 4 years and started his own business, thus achieving his goal of quitting full time work before the age of thirty…

Transcript:

Aussie Firebug

Welcome to the Aussie Firebug podcast where we talk about finical Independence in Australia

Today’s guest is Ben Everingham who managed to retire froem full time work at the amazing age of 29

Welcome to the podcast Ben

Ben

Thank you so much, excited to be here

Aussie Firebug

I guess we’ll start with, lets just go back to the very beginning

When did you know you wanted to be financially independent?

Or when did you even discover the concept of being financially independent?

Ben

That’s a really interesting question, so there is probably two key stories for me that really stand out from things that have happened over the last ten years that were really meaningful

One was when I was 19, we were sitting around having some beers with about 20 of my mates at the times at the age when you still have the big crew of people that you hang out with at the weekend.

We were sitting around and someone suggested that we book a trip to Europe in a couple of months, so the next day four boys and myself went and booked the trip and two months later we were over there.

It was the exact sort of trip that you would imagine a 19 year old would sort of do and that was sort of the partying and having a fun time.

I got to this point actually it was probably 6 weeks into the 8 week trip and I’m sitting watching the sun set on my own in Paris watching the sun set behind the Eiffel tower and I was sitting there and I know this may sound a little strange but as I was looking at the Eiffel tower and I was looking at the sky and at that time the sky looked extremely chaotic to me and all of a sudden, I looked up again and it was almost like it was…this is really odd especially for me…it was almost like the starts had become straighter and align themselves and it was like my future was opened up to me and I knew at that point I had to do something difference it was a massive transformation experience for me

Aussie Firebug

Wow that’s quite the epiphany

Ben

Haha I don’t even know if I believe in this stuff. but it was one strange moment that, like it was literally like it was my future was mapped out in front of me and I knew not at the time what I needed but I knew that was on my way and so I came back and moved to Queensland from Sydney. I thought that in that time of my life I needed to get away from lot of influences in my life that were, you know a lot of party people and not a lot of people that were really going anywhere and so I started fresh and that was the first major experience

Aussie Firebug

Wow that’s crazy

So let’s just rewind a bit, so you were 19, were you working full time at that stage or at Uni?

Ben

Yeah I dropped out of Uni about 6 months into my course and it was my second gap year. I took two gap years basically. So I had been working full time for about six month saving for the trip

Aussie Firebug

And was that an eye opener? Because I know for me when I first started working full time, it was mind blowing. I always knew the hours and I know people went off and worked 8-5 Monday to Friday but it’s not until you actually start doing it I think…it’s such a full on experience…OMG it’s just so much time I’m at work. And I quite like my job. I don’t know if you went through a same experience. But I remember my first year that I was just like “this is crazy!” and I don’t even work that many hours.

I have mates that do the fly in fly out work and their working 4 weeks straight with one week off. This is mental! It’s wasting so much life?

Did you have a similar experience in them 6 months when you were saving for your trip?

Ben

Absolutely I knew from the first day I started my first job that I wasn’t wired the same way as the people I was working with. My first job was with the major elevator company as a laborer or a laccy one of the electricians and I just realised I was wired differently straight away like I wasn’t interested in taking breaks I was just interested in interested in getting the job done as quickly as possible and getting the hell out of there. I worked in that job for the six months before a left and I used to have this guy who was about sixty years of age who used to ride me every day and the day that I left he said sorry to see you go, you were the best young employee we have had here and I really thought you could have gone a long way. And I was like your half the reason I was bailing on this job because you are such an ass to me for that period of time. Ha ha hah. It’s funny how, how things come around like. It was definitely an eye-opener and it is something I would definitely never want to do it again.

Aussie Firebug

Right so you knew that you didn’t want work full-time for the rest of your life. And you go on this trip and the stars align and your like something is happening here I need to change my path so then how do you then, from that moment… because a lot of people don’t realise that financial independence is a thing. I remember reading about it, I was like my mind was just blown, I was like you just keep buying these things that make you money assets, and if you buy enough assets they can replace your income. My mind was just blowing when I read that I was like that so simple why hasn’t anyone told me about that before or why haven’t I heard that before. Then I had my doubts, I’m interested to know your experience with that. Was that something that you’ve always been around all is their family members that had reached it would do you discover that on your own?

Ben

No unfortunately I had to discover that my own not a lot of people that I grew up with all their families or my families had a huge amount of surplus money at the end of the week or the months so fast forward from Europe four years I was finishing a university degree in about six months before finishing the degree I picked up this book by Robert Kawasaki called Rich dad poor dad. I’m sure a lot of people listen and have read that book it such a foundational book for a lot of people as well. And I read this book and I just said, holy shit. It completely opened up my eyes to what is possible and from that moment forward I knew that assets and businesses were better than wages and jobs. I focused on buying assets as soon as I finish university with the intention as soon as I have the right skill set to go out to succeed to leave full-time work and start a business.

Aussie Firebug

Yeah I almost had an identical experience. Rich dad poor dad was actually the second financial book but I ever read. I originally read Stephen McKnight’s book 0 to 135 properties in 3.5 years. That’s an awesome book. I remember the same sort of thing, just reading that and your like this is like so up my alley and why isn’t everyone doing this. Rich dad poor at is a really good mindset one I think, gets you to think about things differently. It just makes so much sense, when I was reading that I was like this this is exactly what I wanted to do. You know trading your time for money for 40 or 50 years and relying on the government to help you out with retirement just seemed crazy to me. I always have in the back of my head, that people were actually retiring early and that just blew my mind. And I just had to get there as soon as possible. Yes that book was a big eye-opener for me as well

Ben

I remember something that happened to me post university. I was lucky, I got accepted into one of the big companies in Sydney’s graduate programs, for a lot of people that’s a fast track way to make a career. I realise that once I finished high school, done the degree gone and worked the big corporate job I still was never going to be fulfilled doing that. It was at that point I went on a trip with my girlfriend who is now my wife to Bali after working with IBM for a couple of years. She said your miserable and you’ve got to leave and at that point again we packed up a second time and moved from Sydney to Queensland and from that moment forward I didn’t make a single decision again based on fear or lack or something that wasn’t in alignment to where I truly wanted to be. And I just decided from that point on I would actively gain the skills required to actually be a business owner as opposed to an employee long-term.

Aussie Firebug

Right so you knew that working for someone else and doing the normal 9-to-5 day grind career sort of thing wasn’t for you. So you read Rich dad poor dad, was investing or businesses your first preference. Where did you sort of go from there?

Ben

So investing was definitely my first preference because I came from mindset which is probably like a huge amount people in your audience which is you have to follow a certain path to achieve a certain result and that path is School, University, great job paying a huge amount of money, and maybe investing in a couple of properties and retiring.

For me I listen to this guy a huge amount when I exercised called Jim Ronan who talks about financial independence and achieving financial independence. His first goal for every employee is to replace their full-time wage while their working in their job. And then he goes on to say that he replaced his full-time wage by three times before he left his job. That was always my goal, so I was earning good money over six figures by the time I was 23/24. And I was looking to replace my wage by three times which was a ridiculous goal. I don’t know why I had that goal, it was probably because I was listening to him so much and I thought that was financial independence. Where it ended up being someone further down the track that convinced me to leave my job because I replace my basic living expenses and I was ready to move on and do what I love full time.

Aussie Firebug

Right so you went down that investing road first and you discovered property, why properties what attracted you to property?

Ben

I think the number one attraction to me was that I understood it. I have met people during university that were millionaires through property and I knew that they weren’t smarter than me, I knew that you didn’t have to be a rocket scientist. And I just love it, I love the concept of buying something of average quality with potential and manufacturing potential into the deal. And I also thought the one thing you can do with property was use leverage. I only had a $20,000 deposit within the first year of leaving uni and I knew that 20 grand leveraged in shares might have only been about $40,000 I could buy whereas with property at the time I could buy a 400,000 asset using first home buyers grants and things like that. So for me that was extremely attractive because leveraged and compound interest to me is what it’s all about

Aussie Firebug

So what sort of property investor would you say that you are? Are you buy and hold sort of guy or are you into developments or renovations?

Ben

I’m all about buying and holding now but by buying and holding I develop or renovate. I will never just buy and hold something and hope that the market goes up I will make sure I can manufacture at least $100,000 plus into the deal before I even buy.

Aussie Firebug

You retired from full-time work at 29 do you work at all these days?

Ben

I actually work harder than I have ever before. But I actually work doing what I love every single day which is helping other people buy property. It’s my passion I am absolutely obsessed with this stuff it’s all about contribution now as opposed to making cash though.

Aussie Firebug

It’s funny that you say that work harder than you ever have before because I read a lot about people that have made it to the end goal. They’ve reach financial independence… because some people do it without ever starting their own business. They just work their 9-to-5 today job and they slug it until they have enough investments to cover their living expenses which is totally Ok way to do it. It’s interesting to read about those people into a like that is a lot of say that when they get to the end of the journey, like they only have six months to go and theoretically should be able to retire really soon. Suddenly working this job is a lot better and waking up to go to the job is suddenly not as difficult and not so much doom and gloom as it was before like it was 10 years earlier and couldn’t see the light at the end of the tunnel. Is that psyche sort of in your mind, you could turn around tomorrow and say hey I don’t want to do this I have enough money from my investments to retire and not work whenever I want to. Do you think that plays any part of it in what you doing now and why you work as hard as you do?

Ben

For me I would never be content it’s just not my nature. I come from a competitive sports background type, I can’t help it I love being involved in the game. I don’t want to be a spectator to life. For me I get a lot of my needs for significance and contributions through my day job now. For me those basic needs like survival and basic living needs are met and those things that are a little bit further up the chain to me get met through work. I’ve tried to sort of kickback, saying that. We have taken at least 12 weeks off in the last 12 months to travel and holiday and spent time the family. We will work extremely hard but will work extremely focused as well. It changes the way you work from 9-to-5 to working extremely hard for stints and then playing or relaxing extremely hard to stints as well.

Aussie Firebug

That’s awesome that you have the flexibility to do that and is one of the main things that attracts me to strive for financial independence so it can give you just that, the independence to do whatever you want and go on holidays and spend more time with your family. I know now I’m working full-time and it’s crazy, like I have a partner and I play footy, I swear I hardly have any time as it is now. I commute now each way to work which doesn’t help that but still, I’m thinking down the track and see people having kids now and am thinking how am I going to get the time to do everything I enjoy, seeing I already don’t have enough time as it is now and I know what people do when that happens they have to give up something, they drop the gym they drop the footy they drop something they like doing this just like work kids and there is very little fun time in between for yourself. And I just did not want to be in that position which is why am trying to get to where I’m going. Having children now yourself, you have two kids, that must be an absolute pleasure to you and your wife to know that you have that flexibility.

Ben

absolutely to me a huge part of our motivation now comes from our kids. Kids changed everything. One thing growing up is that my dad worked really really hard he come from absolutely nothing. From the time I was one half to the time I was four and a half we literally lived in a caravan while they saved for their first property. They bought their first property when interest rates were at 18%. My dad couldn’t buy a beer at the end of week that how hard it was. I learn’t from observing them that one, I don’t want to miss those early stages which is why I left work when my daughter was a year and a half, I’ve already felt like I’ve lost more than enough time in her life.

And secondly my dad ended up turning his situation around by turning around buying some great investment properties and starting some really successful businesses that are still running 15-20 years later. Listening to them and seeing the things that they missed out on that if they have made decisions at the age that you and I are their time now would be completely different. I don’t want to trade time for money and I don’t want to miss out the most important things which is being able to say yes to most of to the things that you really care about and to find time for the things that inspire you to do your best work and not to just exist there for a pay cheque.

Aussie Firebug

Sounds like he was a bit of an entrepreneur himself. Sounds like you’re a bit of a chip off the old block. Sounds like your old man had some influence on you.

Ben

Yeah sure he showed me it’s possible and he didn’t have a businesses that failed. I never looked at business is a risk as I could see how it could work.

Aussie Firebug

Absolutely and I think it’s a big thing about it to see people who have actually done it. Before I knew any about anything to do with financial investing and financial freedom and all that. Once you discover it, I went to a heap of property conferences and I’m meeting all these people and it’s like whoa they’re actually out there, these people actually doing it and now I’m interviewing yourself that retired from work at 29 its crazy. It’s awesome, you have that the back your mind that this might be possible, you read about it but when you meet someone who is actually doing it that puts it into perspective and it really validates it that this is the actual thing. You manage to retire from full-time work at 29. Your parents managed to buy a property when interest rates at 18%. Do you think properties in the two capital cities are unattainable and what would you say to people for people looking to buy properties in the two capital cities where the prices are very very high at the moment. What are your thoughts on that and that current situation.

Ben

I wouldn’t touch Sydney or Melbourne personally with a 10 fioot pole. I mean if you paid me to invest their down there now I wouldn’t even considerate it. And that’s because something that I read by Warren Buffett a long time ago is don’t rush into markets that are at their peak and don’t buy markets where everybody else has just bought. Like the successful people in Sydney and Melbourne are the people that have own properties the 10 years and have cashed out or made equity through this boom. They are not the people who have just bought in the last 12 months. My thoughts is that there are parts of both of those markets that of extremely affordable and extremely attainable now. But you’re probably got to be a little bit more creative in the product that you’re buying. Maybe the dream of buying the four-bedroom two bathroom home on a 600 m² block for a lot of people in our age group is completely unattainable now but there is still plenty of value in the right sort of town houses in the right sort of suburbs. I think that the good buying in areas like that will be in 3 to 4 years times where you have these people that earning 100 grand a year who now own million-dollar properties and interest rates go up to 7 or eight or 9% and all of a sudden these people can’t afford to service the interest let alone the principal repayments on their loan and a huge amount of distress property comes back on the market. That will be a good time to buy if you can financially put yourself in the position to capitalise on that.

Aussie Firebug

Sure

Ben

It’s all about timing. Right now doesn’t represent good timing in the market.

Aussie Firebug

Your talking about an investment point of view, what about someone who just wants to buy a house to live in. So there not looking to invest. What advice would you give to people that are looking to break away from that renters, not trap…but that renting for the rest of your life. Do you have any tips or tricks? If you were a young man in Melbourne right now earning around $80-$90,000 dollars what would you sort of do? Would you move to an outer suburb or look to advance your career? How would you tackle that?

Ben

Through my businesses I to get to speak to a lot of young motivated people. So what I generally suggest is that, put ice on trying to buy the property that you want to live in in Melbourne for the next five years, and over that five-year period focus on the building of a fantastic business is that’s the way you orientated which most people aren’t. If you’re not orientated that way focus on making on making as absolutely as much money as you can over the next five years through better in yourself in your career. The great thing about Sydney or Melbourne is that you can live a 1,000,000 dollar life style for about $700 in rent.

And owning your own home only works if the market is consistently increasing during the time that you own it. There is nothing to guarantee that Melbourne or Sydney because it’s had 8 years of growth in the last three are going to increase in value over the next five years at all. So you would be far better off if you are not making money through your principal place of residence, renting the lifestyle you want a lead now and forgetting about buying and then investing in other areas or other states that can provide you.. say you buy one two 3 properties over the next five years that can make you let’s say make you $300,000 in equity over that five years, redrawing that equity as a larger down payment on the home that you want to own once you’re earning the income that you are able to justify that and when the marketplace is isn’t as ridiculously hot as it is now. That’s my thoughts on that.

Aussie Firebug

It is a really interesting topic. It’s funny those two markets you know, as I have said I know people in Melbourne who are trying to buy and it’s so expensive and Sydney is even worse like you said, renting just seems like such the logical choice now because you break it down into rental yield, if you rent a joint in Sydney it’s so much cheaper for you to do that like if you were to actually buy the same place that you rent your repayments would be double, triple of what you currently renting it for.

And if you just saved the difference if you’re discipline enough to save the difference between how much you pay for rent and how much your leftover savings you can clean up you can totally become a lot wealthier by renting and investing the difference then you can by over stretching yourself with this massive mortgage and having to make these huge repayments each month. I guess it’s sort of ingrained into a lot of people in Australia that your home is your castle and everyone hasn’t made it until they buy their own home. Which is properly not true, but it’s definitely an Australian mantra. I met someone once at a property conference, he was a multi millionaire, financially retired years ago and he rents, he still rents! He still rents his place of residence too, and it is exactly same thing that you said. I live in Sydney I can rent this $1.7 million apartment on the bloody waterfront or wherever it was, why would I buy a place and pay all that money repayments when I could happily rent it and live in a much better placed than if I bought.

Ben

Like I can understand psychology of people wanting to own their own home and the pressure that mum and dad’s and people in the community place on that. I tell you what, if I knew that my million-dollar house that I just bought was going double in value in seven years like it has done historically then I would be owning my own house in Sydney or Melbourne and making it work. But those old days are gone. The best you can… When I look at the numbers my properties the best I can hope for is a growth rate of 4% and if it’s not going to give me at least 4% I won’t invest. I think anything above 4% vote these days is definitely cherry on top of the cake because I don’t think need a 400,000 or place leveraged to increase in value by 10% every year like you did $100,000 how house because you’re still getting the same dollar for dollar return out of it.

Aussie Firebug

It’s funny because you would probably be of similar age, in terms of property life cycles. Have you ever seen a major crash in Australian property because I haven’t since I’ve been alive, my parents may have, but I don’t think there’s been one for a long long time, they have had that massive surge between 2001 to 2004 2005 and then it slowly slowly increase and then Sydney’s gone bananas in the last couple of years it’s almost you know due for a bit of flat line or a bit of a decline some would think?

Ben

Well Sydney market was in correction from 2005 basically through to 2013 and I suppose Brisbane sat flat for five years Gold Coast sat flat for nine years, Melbourne’s consistently sort of ticked along. All the markets have done what people projected they would do, there is no way that the sort of growth that they saw between 2001 to 2003/04/05 will occur again like it’s almost impossible for that to occur again. That’s why I’m so into that manufactured growth and having multiple strategies on properties and options now. Because the old days of just hoping you are going to make 100 grand on a property are over unless you’ve got a huge amount of time which I don’t think any young person really wants to wait 30 or 40 years before they retire these days.

Aussie Firebug

Australia was pretty much largely unaffected by the global financial crisis in 2008. I don’t know you’ve watched the movie, there was a new movie it just came out it’s basically about that financial crisis and a whole bunch of blokes betting against that. I’m trying to think, it’s… The name escapes me.

Ben

Is it the one with Brad Pitt in it?

Aussie Firebug

Yes that’s the one

Ben

Yeah I haven’t watched it

Aussie Firebug

Yet it’s a really good movie. But it’s really scary. Their property market just went completely underwater, like it wasn’t exactly the same as Australia. I invest in property myself and do you, does anything like that scare you or does anything like that come on your radar in Australia that you worry about that?

Ben

Is the movies called the big Short is that the one?

Aussie Firebug

Yes that’s the one! did you just Google That?

Ben

Yes I did ha ha ha. I’m constantly driven by risk and fear from the upbringing I had I still am always preparing for a rainy day I suppose. The way that I prepare is to overcapitalise for example a revenue stream in my business that is recession proof which is a property management business. So you’re going to have your high sales value which is the business I’m into which is buying agency but than you can buffer that with let’s say a million-dollar property management business that regardless of what happens in the world people are still going to need to rent and maybe rent will decrease by 50 bucks a week but you’re still going to get your 7% eveyr single week for the year for those properties.

I’m always concerned with that as well, like if I can’t manufactured growth into my portfolio, if my LVR is ever below 70% and I’m seriously concerned and won’t proceed with that property at that time. I’ve seen a global financial crisis I’ve brought five properties. I bought in Sydney a property which was 20% below which what the same property was worth 12 months before so there was a slight correction in Sydney. You know I read about the stuff that happened in Japan for example they lost over 50% overnight and their economy was as stable as Australia and that sort of stuff scares the shit out of me. It’s all about trying to create an income stream that generates income regardless of the marketplace. So that when things happen, and they will, you’re in a position to capitalise on that you’ve got cash funds and liquid funds that you can go out and buy the distressed assets that other people need to move. I look at something like a GFC now as an amazing opportunity. Where five years ago I would have been seriously concerned about it. I, like every investor, look forward to those opportunities where I can pick up distressed assets.

Aussie Firebug

It’s like what Warren Buffett says, be greedy when people are fearful and fearful when people are greedy. I think that was a famous quote or something along those lines and it’s definitely true. Only a few people know what I’m trying to do you know, I’ve got three properties myself. There are two people and I find I come across, one of them is supportive and want you to succeed and are all for it, but I just find that there’s a lot of people that are just Doomsdayer’s. People who have absolutely no idea about property and who have never invested in a single property in their entire lives and then suddenly they are telling me how just made the biggest mistake of my life. Just naysayer s. Did you ever come across those on your journey and how did you deal with them?

Ben

Yes absolutely and it’s really sad because most of those people were good friends and most of the people in my life still think I’m ridiculous and crazy but now they seem in living on waterfront house without having to work now like maybe if I did stay along for the journey. They have kind of come back around and gone Ok dude what are you actually doing because I’m on the train commuting two hours every day to work and you’re sitting in your house and… I don’t mean to be a dickhead and sound like an arrogant person but the difference is I made choices from about four years ago based on happiness and what was on in-line with my value system when a lot of people in my life make choices based on fear. With a lot of those naysayer’ s, I think about this a lot, I think as you begin to… I don’t know you could call it vibrating on a different frequency or getting yourself in a different mental head-space, like you’re going to attract hundreds of thousands of amazing people to this POD cast over time and your community will become people that are just like you. When I started my journey I had a goal for eight years which was to sit down with five people worth between one and $50 million per week and to sit with them for an hour and interview them and learn and try to find a pattern and it’s very simple what the pattern is and it’s about replicating that.

Aussie Firebug

And I think as while you have to take a risk to get somewhere in life like if it was easy everyone would be doing it so it doesn’t matter what you’re doing. Even if you put savings into a savings account to earn money through interest that’s a very small risk but it still a risk. It slightly annoys me when people have a go at something and that so many people around that are trying to pull them down, you see it all the time not even in investing but also in sports, tall poppy syndrome. Like you said I guess you just have to focus where you want to be, make the plan and just go for it and hey if it doesn’t work out it doesn’t work out. I’m sure this can be bumps along the road but at least you can say you had a go. Even if you fail, even of it all comes crashing down you can say that you had a crack and you’re not going to…

Ben

I think you know the one thing you have is the skill set to rebuild it. If it all comes crashing down and you don’t have the skills to get back on your feet that’s where you see these poor people with marginalised loans that end up on the pension.

When you talk about risk it’s really funny because I used to think about risk as buying a $400,000 property now I see risk as not making that decision because I see that the long-term impact of what not achieving financial independence does and that is less time doing things you love that means less time with your family that means less time doing you know things that you’re passionate about less time contributing to the world. Money comes and it goes, you notice that the people that spend the most time focusing on money are the people that have the least. The people that have the money are pretty happy with everything sort of just it’s really weird that I suppose just been in flow with money and also having the skill set to make it and it is a skill set it’s not something that anyone’s born with unless you come from a family that is worth over $15 million and it’s then brought up to you through family.

Aussie Firebug

Yeah absolutely and I could agree with you any more. When I was younger you think that the guy with the flashy car or the guy that dresses really well they are the ones that are wealthy. But when I got older all my friends whose parents that I know do really well who have businesses in everything, they’re wearing 10-year-old trackies and the driving just normal cars, like what’s going on here? Movies have lied to me my whole life and everything I thought about rich people has been the opposite. Have you ever read the millionaire next door?

Ben

I have actually and that’s an awesome book as well.

Aussie Firebug

Yeah it’s so true though. The people that have to have the latest Mercedes-Benz every year they don’t own any growth assets some of them do. But I know a lot of people in my life that have the latest car and the latest this and the latest that but they don’t actually own anything, they’re not actually wealthy. They have all the latest toys and gadgets and stuff. It’s almost like their living… not a lie. But their portraying themselves as something that they’re not. Because the really wealthy don’t need to do that and half the time they are very simple people and they porbably spend less than most people spend on themselves.

Ben

I don’t think I’ve ever met someone with serious money that cares about too much of things like that. Because most people that have got money realise that those things aren’t what make you happy. Relationships, contributions, doing things you’re passionate about and fulfilling whatever it is you want to do with the world makes me happy personally. I’ve talked to you know, I get to speak to a lot of people and I would say like the high income earners that are earning wages between 200 to 500 grand per year and I probably speak to about 30 of them a month through our business are the ones that may own one property that have the most personal debt, that have the most car debts, that have the most credit card debts. Whether they are earning 80 grand or 500 K a year they still spend that. And their friends think they are absolutely killing that and I look at those people and go why the hell didn’t you retire 5 to 10 years ago and what are you still doing working? And they’re complaining about their job and they could have a way out of that job within two years if they were smart.

Aussie Firebug

That’s crazy. Time is just about wrapping up so my final question to you is if you had to start again let’s rewind back to when you are 19, the stars are aligning in Europe. You’re sitting there in front of the Eiffel tower. What would you do differently knowing what you know now to reach financial independence as quickly as possible?

Ben

I would have not gone to university I would have gone and got a job straight away in real estate and I would become a property investor from that exact moment. The other thing that I would have done is to have the belief in myself that I didn’t need the approval and I didn’t need all these skills that I thought I needed and that I already have those to do what I need to do. Like all that stuff in already in you already like every single person has got unique ability and anything you need to learn along the way you can. Like to have just taken the plunge earlier like I probably would have been ready to start the business five years earlier like but I just didn’t have the confidence and I had all these expectations and limiting beliefs that was stopping me from doing what I was really meant to be doing which is what I’m doing with my life now. Jumping into property straight away and having belief in myself would have been the two biggest things.

Aussie Firebug

That seems to be a common theme with a lot of successful people and businessmen and investors. I wish I had done it years earlier. I think the guy that started KFC in America, he started that franchised at 60 or 65 I think. He has a quote that says, why didn’t I do this 30 years ago! That’s is crazy. I’m sure that a lot of people that are successful that have the same regret, but hey you’re super young so it’s not like you miss the boat by that much. It’s certainly something I think of. You just have to do it, you have to have a go at something because you don’t want to be nearing 60 and having to rely on retiring on the super and have in the back your heard what if I tried something and why didn’t I do it sooner.

Thank you so much than for being on the pod casts and I wish you all the best in the future I hopefully see you again soon.

Ben

Thank you so much and I really appreciate the time and I’m so excited for what you’re trying to do and I can’t wait to continue to listen in and see who else you get to interview.

Photo credit: Colleen AF Venable via Foter.com / CC BY-SA

by Aussie Firebug | Dec 24, 2015 | Mindset, Real Estate

Lets talks about Melbourne and Sydney Real Estate for a second because it pops up in my life at least once a week.

I have a lot of friends renting in Melbourne who are at the age now that they are starting to look at buying a house.

They look around and quickly discover that the prices are outrageous. The median price for a house is Melbourne is well over $700K! Using the common 25% rule for a deposit and closing costs, this would mean that my mates would have to fork out $175K to buy one of those bad boys… That’s a LOT of money to depart with.

As you can imagine, there are plenty of people who can’t afford these prices and they are crying out for something to change. But can something really be done here?

I don’t think anyone can honestly say that prices in Melbourne and Sydney are affordable to the middle class. You either have to be a high income earner or wealthy to buy in these cities.

Sure, the average working class family could take out a huge mortgage but they would be a slave to debt for the rest of their life most likely.

So what’s the deal?

I have been reading COUNTLESS articles and reports for years on why there is a housing bubble and how it’s going to create the mother of all corrections in 2004, 2005, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013 ,2014, 2015, 2016.

There are a lot of theories being thrown around:

- Negative Gearing

- Capital Gains Concessions

- Foreign Buyers

- Speculative Investors

I’m not going to pretend that I know exactly why the prices are the price they are or how to bring them down to a more affordable level. But it doesn’t take much to understand the most basic and fundamental rule in economics.

Supply and Demand

It’s so stupidly simple to understand yet so many go looking for more complex answers to justify their reasoning as to why this is happening.

If there are a lot of buyers (demand) and there is only so much land/property available (supply) the price for the land/property soars. And the same can be said if you switch it around. What do you think would happen this very weekend at auctions if no one turned up? The prices would plummet. No doubt about it. If there are less buyers than sellers the price of real estate goes down. This is proven economics 101.

So the question people need to be asking is not how the government can stop the buyers (demand), it should be about how they can free up the land (supply).

Carve it in stone, demand for Melbourne and Sydney real estate will NEVER cease for as long as I live. It would have to take such a colossal implosion of Australia for these two cities to suck. Not completely out of the question, but I will eat my shoe if there is EVER a time where you can’t sell real estate in either Melbourne or Sydney.

They are world class cities. Melbourne was ranked the NUMBER 1 most livable city in the entire world last year and if memory serves me correctly it has been number 1 or 2 for a few years running. Sydney is no slouch either coming in at number 7. I just want to highlight this point because it’s important. If you’re trying to buy a house in Melbourne you are trying to buy real estate in THE MOST LIVABLE CITY IN THE WORLD! The world… not just little old Oz. The entire planet.

What do you think this does to Melbourne and Sydney real estate when they are some of the best places to live in on the planet?

Demand goes through the roof.

You have got to be realistic here. You are trying to compete with not only Australians but the rest of the world when you buy. Throw in limited supply and you have a recipe for exuberant house prices.

I don’t see any measure the government can put in place to stop demand enough for the prices to go back to an affordable level.

The focus is always on the demand, but little gets said about the supply.

Is it unreasonable to assume that if municipalities changed zoning and planning laws and released more land to pave the way for new development that this could potentially deflate some of the house prices? To me it makes sense. If you increase the supply in the market, the current supply will be worth slightly less.

The truth is I don’t really know (no one does), but I’m a realistic person. And when I look at Sydney and Melbourne I don’t see the demand slowing, in fact, with population forecasted to more than double by 2060, if anything, I see demand rising.

If the supply cannot keep up with the demand then it’s only going to get worse.

There may be a correction around the corner, I think there should be. But I doubt that Melbourne/Sydney real estate will ever be cheap, EVER!

Photo credit: szeke via Foter.com / CC BY-NC-SA

Photo credit: CAr Photographies via Foter.com / CC BY-NC-SA

by Aussie Firebug | Nov 30, 2015 | Classics, Investing, Mindset

“Are you still renting? Why don’t you buy yourself a house already. Rent money is DEAD MONEY!”

If you rent, I’m sure you have come across one of these people at least once in your life. And it’s most likely coming from a loved one who genuinely cares about you. It’s easy to understand how they come to this conclusion too. At the end of every month you have to fork over hundreds (sometimes thousands) of your hard earned dollars for nothing more than the privilege of having a roof over your head. If you were to buy a house however, at least your payments are going towards something you can call your own. That’s the common theory amongst 99% of Australians (especially parents) at least. If you have the deposit ready, is it always better to buy than to rent?

Why You Should Buy

*Let me just make one thing clear before we delve into this debate. I’m going to be looking at this purely from a financial point of view. There are many intangibles that come from buying a home that you can’t measure in dollars. Your home is your castle that you raise your family in. There is an emotional attachment when buying a home which varies greatly from person A to person B.

I personally only really see one major benefit from buying a house to live in.

Security

It’s a pretty major benefit too. When you rent you are always at the mercy of the landlord. Rent could be raised at the end of your lease. Leaky pipes may never be fixed. You’re not allowed to buy a cat because it’s against the rules. And what happens if the landlord decides to sell to home owners who want to move in and kick you out? You have to find another place to live, and anyone who has ever moved or helped move someone can attest to how they would rather take a bullet than do that shit again. Ok it’s not quite that bad but it sucks trust me (have been involved in 10+ moves).

Forced Savings

Some people just can’t save money.

If it’s in their account and disposable, they just can’t help themselves and must spend it. I don’t have this problem personally but I understand that for many people it’s an issue. So how can you save money when you spend every spare dollar you earn?

Forced savings.

Unless you’re on an interest only loan, you will be paying some principal in your repayments each month. It’s the principal that actually pays off the home, the interest is just how the banks make their money.

The principal payment therefore are sort of like a forced savings mechanism. I say ‘sort of like’ because it’s a bit more complicated than thinking about it purely as savings. Theoretically if you bought your house for $X amount of money and sold it 30 years later for the same price after paying it off, then yes you would be essentially receiving a lump sum of all your principal repayments you have made during those 30 years (not factoring in buying/selling costs and inflation).

But! What happens if you never sell? What happens if the house goes down in value? What happens if no ones wants to buy your home?

It’s is extremely unlikely that you’re are going to have your house go down in value over 30 years but it could happen (see Japan). And it’s for this reason that savings via equity is not as straight forward as you think.

Regardless of these situations though, for people who struggle to save when they have disposable income, a forced savings plan might be a good thing for them. And the banks do a mighty fine job of making sure you ‘save’ every month. They are even kind enough to visit you if you miss too many ‘saving’ payments.

Why You Shouldn’t Buy

LOCKED IN!

Since already establishing what I consider the single and biggest pro when buying to be security, if find yourself in the dilemma of choosing between renting or buying you must ask yourself, why do I need security?

There is merit for people who need the stability that buying comes with. If you have pets, children, elderly parents who you take care of or something else that would be greatly disrupted if you ever had to move. Then I could 100% see the importance of security.

BUT! With security there also comes restrictions!

When you buy a home, suddenly you can’t just pick up your things and leave. You could rent out your house but that’s a pain in the arse. You could sell your house. That is also annoying and it costs money to do so.

Really, really expensive

Buying a home usually means taking out a mortgage. Having debt on something that does not produce any cash flow is a liability. Some people say your home is an asset, I disagree.

But lets push aside some negatives for the time being and imagine that you are someone who needs stability and believes that they are not going to want to live anywhere else for the next few years. Now you actually need to buy the house and pay it off over the next 30 years. Lets crunch the numbers.

How much does it actually cost to buy a house?

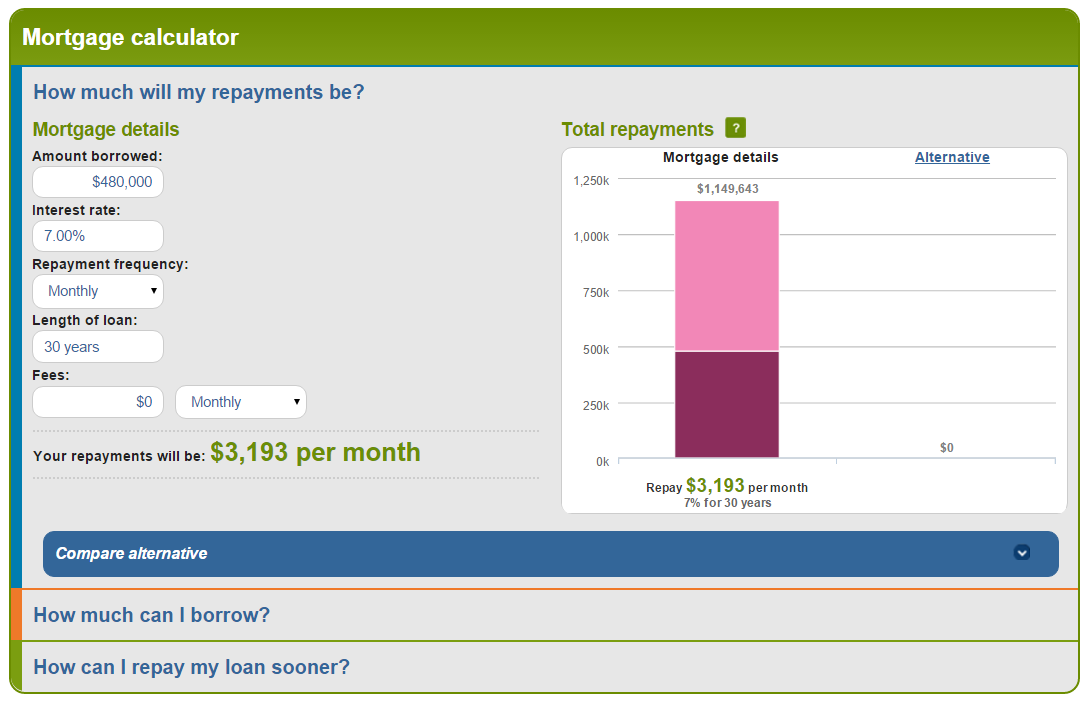

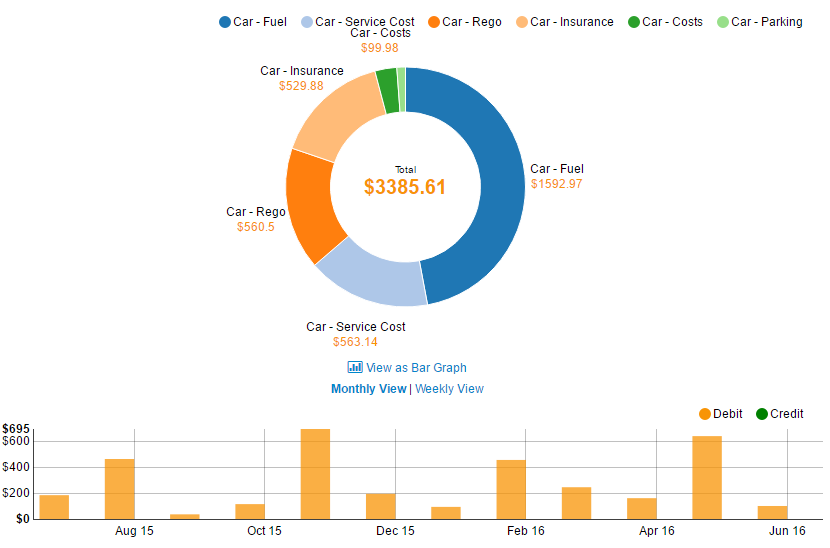

Everyone is different but lets just go with the standard formula of 25% of the purchase price (20% deposit and 5% buying costs). On a $600K house this works out to be $120K for the deposit and $30K for buying costs. The loan amount is $480K and even though interest rates are at historical lows now, they will eventually go up so lets just go with 7% fixed interest rate for the entire 30 years of the loan.

Using money smart’s mortgage calculator we can graph the repayments.

A few things instantly pop out at me.

Firstly you may notice that the total cost of servicing this loan amount for 30 years equals $1,149,643.

Wowzers.

Secondly, the dark pink area represents the principal amount of the loan ($480K) and the light pink is the interest. You end up paying more in interest than you do for the actual loan amount… Just think about that for a second. Some say rent money is dead money, well the same can be said for interest too. YOU JUST SPENT $670K ON ‘DEAD’ MONEY!

It’s hard to even think about. If we break up that interest over the 30 years it works out to be $429 a week or $1,861 a month. You could rent a really nice place for that kind of money.

But because you have chosen to buy you have to pay the interest repayments PLUS the principal, which comes to $3,193 per month. That’s a shit load of money leaving your account each month. I don’t know about you, but that would severely impact my lifestyle if I had to make those repayments each month for the next 30 years.

So far we have $120K for the deposit, $30K buying costs and $1.15M for servicing the loan over 30 years. That comes to around $1.3M!

So far we have covered how much it’s going to cost you to buy the house, but we haven’t covered how much extra it’s going to cost you to keep it running.

Here are just some extra items that come with the privilege of buying:

– Rates

– Home Insurance

– Water Fees

– Body Corp Fees

– If anything breaks in the house (plumbing, electrical wires, air con etc.) YOU have to pay to fix it

In a publication from the RBA, they estimated that on average the running costs for a house is 1.5% of its value.

That’s $270K over 30 years to keep a $600K house up and running.

Combining the buying costs with the running costs comes out at a whopping $1.53 MILLION DOLLARS to buy and maintain a $600K house for 30 years.

Forget about Equity!

The other big benefit that a lot of people seem to bring up in this debate is that buying a home will make you money somehow? Last time I checked, buying a home TO LIVE IN does no such thing. You can’t collect rent when you live in your home (unless you have kids). And even if the house goes up in value, it is irrelevant because you can’t live in your house and sell it too. If you withdraw equity then I am of the opinion that you’re selling yourself short of the major benefit of buying a home in the first place (security). You could sell and buy another home BUT this was not the original purpose of buying. If you INTENTIONALLY bought a home only to sell it later in life for a higher price then you are actually investing and the ATO investigates these occurrences where couples may buy and sell every couple of years and take advantage of the CGT exception.

When you buy a house to live in, your goal should not be to sell it later for a higher price. Factoring this into account, I stand by my statement that you will not make money when you buy a house to live in. This removes any investment type gains home owners might be privy to when trying to compare to renters. We want to compare apples to apples as closely as possible. When you start talking about how much the house went up in value it should not be factored into the equation because if someone is happy living somewhere and never sells, then the equity gain is void.

Why You Should Rent

Flexibility

Other than your lease period, renters are free to jump from one place to another.

Don’t like the cost of rent? Move.

Don’t like the location anymore? Move.

Landlord not fixing things around the property? Move

I know that moving is a pain in the arse but do you know what’s more of a pain in the arse? Trying to sell your home AND moving.

It seems to be a growing trend among young people to spend their 20’s travelling around the world, studying and trying new experiences. And that’s awesome! I think that your youth, particularly between the ages of 23-29 is an extremely precocious and unique time in your life when you’re not tied down and most likely have finished your trade/degree and working full time.

You have full time money coming in, are young and can do what you want. Why would you want to tie yourself down by buying a house? You are in such a unique position to be able to drop everything and move/explore/discover the world.

Renting can provide you with the flexibility needed to live this kind of lifestyle.

I personally don’t intend to buy a home to live in until I’m ready to have kids, but that’s me and everyone’s different.

Usually Cheaper

If you think rent is dead money, then you must certainly see interest repayments on a home loan to also be dead money. You can work out the percentage of interest repayments quite easily because they are set by the bank. But comparing that to rent repayments is a bit trickier at first but is easy once you realise how to compare the two.

To work out if you are better off renting and saving money than you are buying and forcing savings (through principal repayments), you must know the rental yield of the property. To calculate this you have to know two things;

- How much the place you want to rent is worth?

- How much does rent cost?

For example:

The place you want to rent is currently being advertised for $400 a week and you think it’s worth about $600K because the place next door is nearly identical to it and is for sale for $600K. Rental yield is calculated using the following formula:

Rental Yield = R/PP

Where R = Rent (Per Year)

And PP = Purchase Price

In our above example this would be

Rental Yield = $20,800/ $600,000

Rental Yield = 3.5%

Can you find a bank with a lower interest rate than 3.5%? Right now the answer is no. The average interest rate for a standard variable loan is 5.1% and that’s with today’s historically low cash rates.

Considering today’s rental yields are 3.5% and 4.4% for houses and units respectively in all Australian capitals, you would either have to be paying above market rent or find a killer bargain for it to work out cheaper to buy than to rent.

It’s simple, is the rental yield you’re paying more than the interest rate you would have to pay if you bought? For the vast majority of Australians I would say the rental yield is going to be lower. There are a few places I have seen in the country where the rental yield is quite a bit higher but I have yet to see it in the capital cities, especially Sydney and Melbourne.

And this is not even factoring in all the other crap that comes along with buying (stamp duty, rates, insurance Etc.)

To compare to our example above. If we rented at $400 for 30 years and factoring in inflation at 2.5% we end up paying $913,176 in rent. This is being pessimistic too because I didn’t factor in inflation for the rates, insurance, body corp etc. above so it would have actually been even more to keep the house running over 30 years.

Still, this means that renting over 30 years come out over $600K cheaper than to buy.

However, the person in the above example now owns the assets outright and at worst is sitting on about $1.23M of equity ($600K over 30 years at 2.5% inflation rate) where as the person who rents has no equity.

** 27/03/2018 EDIT **

There seems to be a lot of comments about me using 2.5% in the above calculation. Australian property (all of Australia not just Melbourne and Sydney) has risen by 2.8% (real rate of return) during the last 30 years (SOURCE)! You could even put the return @ 5% and renting would still come out ahead.

I can’t account for all rates of returns. These are the numbers I have used with a source to back them up. Obviously if the return for properties increases in the future the results are going to be different.

** /EDIT **

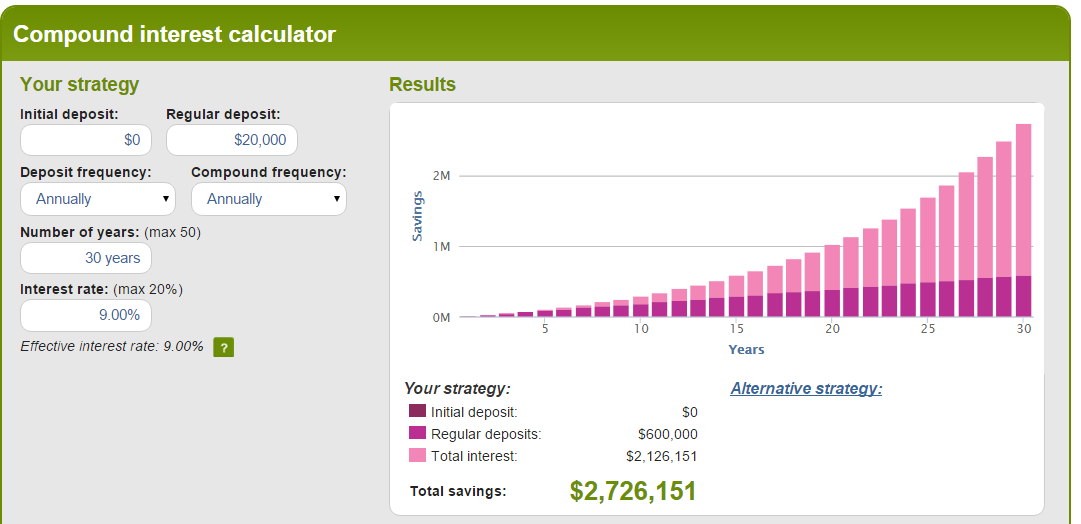

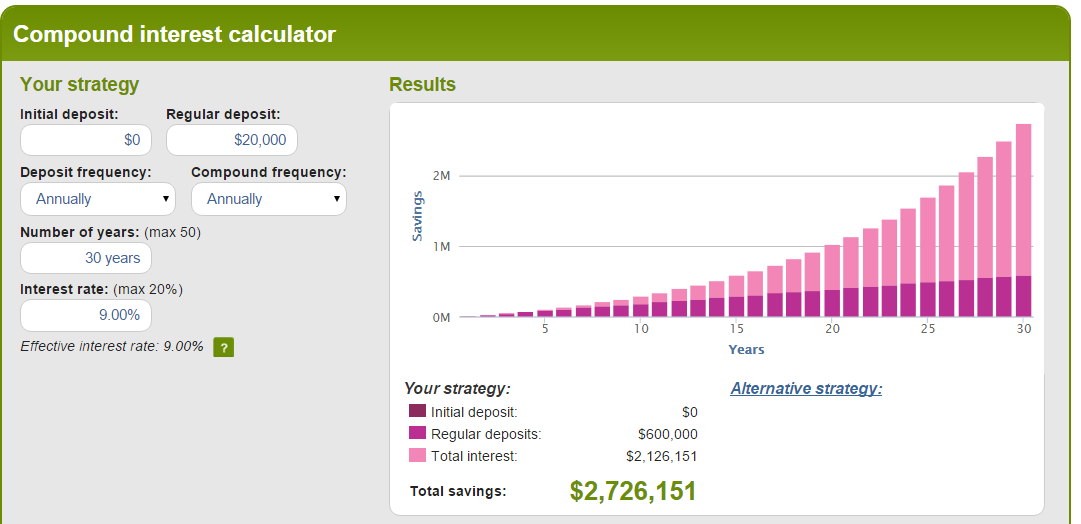

BUT! The person who rents has a far greater cash flow position than the person who buys. The renter should have just over $600K (total cost to buy over 30 years minus paying rent for 30 years) extra over 30 years if they managed their money and saved the difference. This works out to be an extra $20K per year the renter has up their sleeve.

Lets assume that the renter realises this advantageous position and instead of blowing the extra $20K, they invest it yearly in a diversified portfolio. Suddenly something strange happens.

At $20K per year over 30 years with a rate of return of 9% (historic average) can you believe that the renter can amass a net worth position of $2.7M!!!

Sweet baby Jesus.

I don’t know about you, but I would much rather have $2.7M invested in income producing assets and have no house to my name than having a money draining house paid off with around $1.23M of equity that you might never tap into after 30 years!

Why You Shouldn’t Rent

Landlords, Leases and Leaks

Have you ever had that real asshole of a boss that is always checking up on what you’re doing, invading your privacy and never fixing the things that are broken at work?

This can be what it’s like when you rent. There are good landlords out there but there are also terrible ones.

Since you are sort of borrowing their house to live in for a while (renting), you can’t make changes to it as you please. For some people this is not an issue but for others (my old man included) it can be hard because they like to tinker, fix things and customize their home to their liking. You can’t exactly knock down a wall to expand your living room without receiving some sort of angry letter from your rental agent. Even if you’re helping to fix the property you can get into trouble. This sucks when there are issues with the rental, like broken heaters, leaky taps, out of service hot water systems Etc.

I hope you didn’t have your heart set on this place either. Because the landlord has just decided to sell the property when your lease period ends to the higher bidder. There is a chance that the next owner could want to rent it out too but there is also the chance that it’s a new family who want to move in straight away. Which means you will have to move out!

Luckily the new owner does intend to rent this pace out. You have lived there for 3 years and have a great history looking after the place. The new landlord offers you another lease and at first you are very happy, that is until you read the fine print which says they have just upped the rent per week by $20 bucks!

Ouch.

Might be time to move places, which of course means attending multiple open days, submitting application after application in hopes that you land one that suites. When you finally find one that you have been offered it’s now time to have a weekend from hell carting all your crap around town to the new place.

FINALLY settled you now sit back and relax in your new abode. 10 months pass and you receive another letter saying that the owners wants to sell… FFS!

No forced savings

If you have a hard time sticking to a budget than renting might not be the smartest move. It’s definitely possible to come out ahead when renting if you are discipline and can invest the money saved while you rent. But not all people can do this.

They see spare change in their account like an expiring gift voucher becoming invalid on Sunday afternoon. They MUST SPEND IT on the weekend with no time to spare! And even though it may be better financially to rent and invest the savings, not everyone has the will power to do this.

Final Thoughts

I think too many people (especially younger people) get caught up in what is ‘normal’ and buy homes young when they don’t even know what they want to do in life. If rent money is dead money than so is interest repayments, which are much higher than rental yields for the majority of Australians.

You do not make money when you buy a house to live in. You may get lucky and sell it at a profit later in life, but you never hear about all the people that sell at a loss, only the ones that triple their money in 4 years (bullshit artists). You shouldn’t be thinking about making money when looking at a home to live in anyway. It’s first and foremost your home to make your own and to raise a family in. If you want to make money, look at actually investing into income producing assets (stocks, bonds, rentals).

Don’t get caught up in the stigma and shame on renting, break down the numbers and work out what actually costs more. If it’s cheaper to buy then by all means go ahead and buy, if it’s cheaper to rent, ignore the misinformed who try to make assumptions that you can’t afford to buy or that you must be doing it wrong.

Try to break out of the Matrix and look at what is best for YOU not what others think is best for you.

Please feel free to share this article around if you know someone who may be tossing up between the two, it may help them decide.

Photo credit: Phil Sexton / Foter.com / CC BY

by Aussie Firebug | Nov 11, 2015 | Investing, Mindset

Over the past couple of years I have discovered a growing trend that a number of people seem to be doing. It goes something like this, “We only want to invest AFTER we have finished paying off our house.” Fair enough. I can see that some people want the security that comes with owning your own home outright without a loan.

What I don’t understand is what some people do next. “OMG Brad isn’t it so fantastic that we have saved every penny for the last 10 years so we can now say we own our $500K house outright without a loan?” “Certainly is Jenny, such a relief that we don’t have a loan, I think it’s time we looked into investing outside our Super to build a nest egg to retire on.”

They start to talk to friends about investing and of course because they live in Australia the topic of investing quickly turns to real estate and how everyone knows someone who bought a house that doubled in 7 years blah blah blah.

Intrigued, they do a bit of research and ask family or friends how they can get started. They eventually book an appointment in with a broker to assess their borrowing capacity and what’s involved with getting a loan for an investment property. The broker educates them that they would have to save X amount of money to put down as a deposit OR they could use equity in their home and could get a loan straight away. “Wow, you mean we wouldn’t have to wait and save a deposit?”

“Yes, that’s right, just pull out some equity in your house and use it as collateral for your investment property.” Brad and Jen are amazed that they don’t need to save anything and can get started right away. The spur of the moment excitement causes them to go through with the process and they are now the proud owners of an investment property after pulling out $80K of equity from their home. A few years pass and they get the property revalued. To their amazement, their investment property has risen in value by over $70K. They are so excited that they could make so much money just by owning the house that they want to have another. They have plenty of equity their broker explains so this shouldn’t be an issue. After 3 or 4 properties they start to run out of equity as they approached 80% LVR for their own home.

[pullquote align=”full” cite=”” link=”” color=”#ffa500″ class=”” size=””]My problem is that if you are intending to use the equity in your house you might as well not pay it off to begin with[/pullquote]

When I hear people utilise this strategy I cringe. I mean what’s the point of paying off your own home just to withdraw the equity to invest with? You’re just wasting time doing this. As I’ve mentioned in a previous post, the earlier you start investing, the better. I have no problem with people using equity from another investment as I do it myself. And I have no issues with people wanting to pay off their home.

My problem is that if you are intending to use the equity in your house you might as well not pay it off to begin with. All you’re doing is delaying the process. The 10 years that your dollars have been locked away in your house have essentially been wasted because there’s only two ways to make money in real estate, rental income and capital appreciation and you’re doing neither when you buy a home (unless you sell).

A home should be bought and paid off for security and peace of mind. When you withdraw equity from it you are no longer debt free and your home could be repossessed (worst case scenario).

Either invest before you start paying off a home, or, if you already have paid off your home please think back to why you wanted to pay it off in the first place and realise that when you withdraw equity from it, you no longer own it debt free. As tough as it sounds you need to start building your portfolio from scratch BUT it should be a lot easier to save for those who have paid off their home compared to most people since you have don’t have any house repayments to make.

Try to work out at the start what you want to do. Do you want to own your home outright, or do you want to start investing early. Pick one and then go after it! Do you know anyone that has paid off their home only to withdraw equity from it to invest with?