by Aussie Firebug | May 20, 2022 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

It’s been a while since I logged into AFB/recorded any podcasts.

The whole ASIC fiasco got me down a little honestly. It feels like the whole community that has helped so many people are being vilified because of a few bad apples.

I also felt the need to lay low and watch what others were doing in the FIRE/personal finance space. I’ll be dropping a podcast very soon that will cover my thoughts on ASIC’s new interpretations and how that’s going to affect AFB content moving forward.

In other news.

My freelance business is really starting to take off. I’m getting more business than I want (first world problem) and I’m starting to create a data product that I’m really excited about. This influx of work has been the other reason I’ve taken my foot off the AFB creator pedal last month.

It’s usually a juggling act between AFB content, my business and travelling. Some months I’ll record 5 podcasts and write 3 articles and other months I’ll be lucky to produce 2 pieces of content.

Freelancing has been a blast but I’m slowly getting pulled back into the ‘normal’ everyday office politics and BS. There are always going to be boring/pointless parts of the job regardless of what you’re doing but I’m trying to minimise that stuff as much as possible.

I find the greatest joy in building something that creates value with colleagues who are just as passionate. I’ve spoken about it before but I really like the idea of having a small team that can help me build data products/services and foster a kick-ass work environment! I fell in love with the culture when I worked at a few different startups in London during our overseas trip. Trying to replicate that is high on my goals list for the next decade ahead.

Net Worth Update

Not a whole lot to report with the old NW. It was a down month for shares and Super which saw us slide backwards around $10K.

We’re continuing to build up our cash reserve for a new car in the not so distance future. I’m still having a really hard time choosing between a traditional ICE vehicle or a new EV. The longer we wait, the more attractive EVs become. But can we wait another 2-4 years? Probably not 😅

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Our expenses were up a lot in April. The reason for the big jump was us pre-paying for a trip to Bali. We fly out in late June for 8 days of holidaying 🏝🍻

Shares

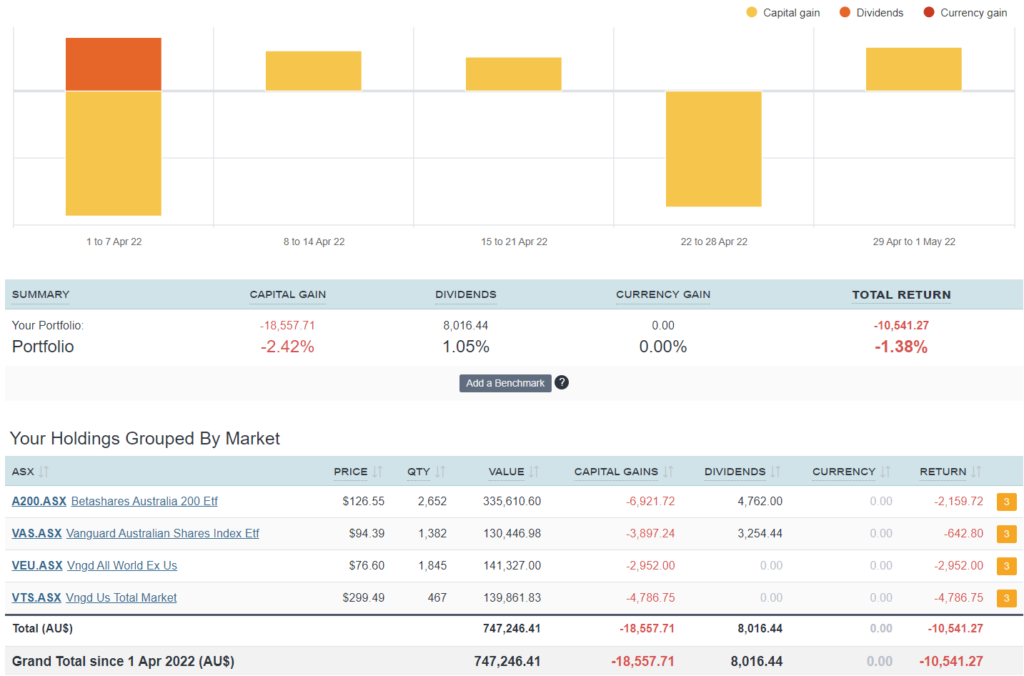

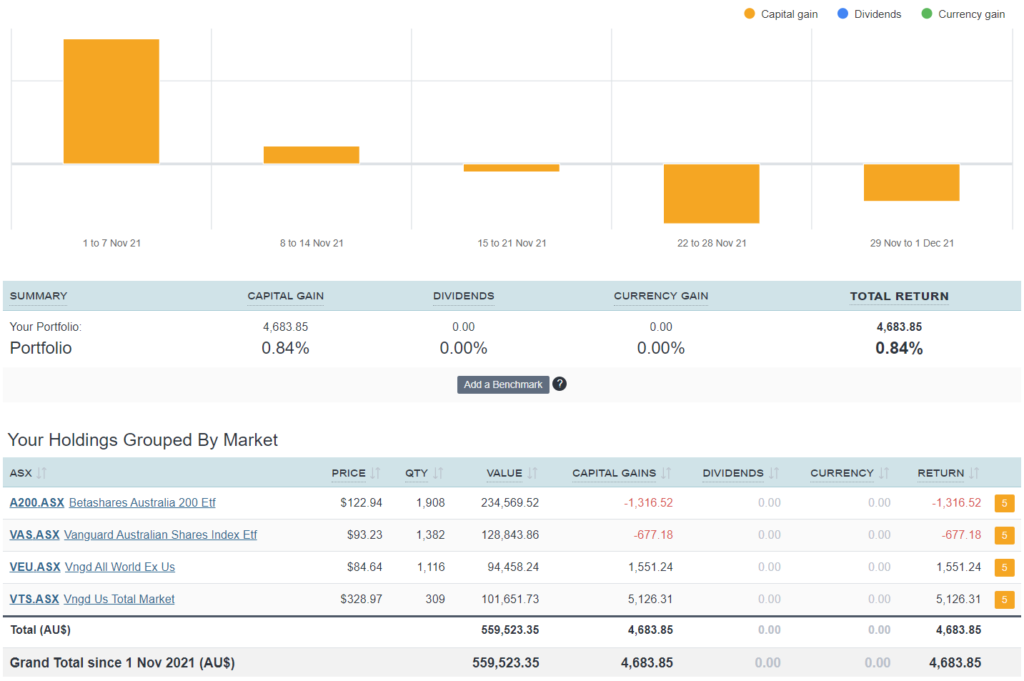

The above graph is created by Sharesight

No purchases in April but I’m publishing this article in mid-May and I just can’t resist the current sale atm so we’ll most likely be putting through a buy order soon.

Networth

by Aussie Firebug | Apr 16, 2022 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

A very quiet March for us this year.

We had one of our best friends tie the knot and I’d almost forgotten how much fun big weddings are 🥳 . The wedding was originally scheduled for 2020 which was when we were overseas, so one of the small benefits (for us 😜) of Covid was that the date was pushed back due to the restrictions. We were incredibly lucky to pull off our destination wedding last year but so many of our friends had to delay/push theirs back. I’ve heard that some of the more popular venues have a backlog of more than 2 years 😱. It’s pretty incredible how Covid has affected so many different industries in different ways.

Another thing that’s been on my mind this year is buying a new car. I know I’ve spoken about it but I’m in a real dilemma of choosing a cheap reliable petrol car that will get the job done or waiting a tad longer to splash out a bit on a new EV (electric vehicle).

This decision is partly financial and partly wanting to join the EV revolution that I think is just beginning.

I’m just guessing here but I reckon fossil fuel cars will be dead by 2030. Petrolhead enthusiasts might still be buying them but just look at the trend of renewable technologies. Solar, wind, thermal, storage etc. are all getting better and cheaper and it’s only a matter of time before it makes sense financially to make the switch. It’s already happened with solar panels and with the amount of new EVs being produced each year, batteries will surely be joining the party soon.

There’s a premium to pay at the moment but I just love the self-sufficient concept of electrifying as many things in your life as possible and harnessing the energy of the sun.

Some car manufacturers are also talking about a Bi-directional charging capability for new EVs. So in theory you could charge your EV at home during the day from your solar panels and use some of the battery at night to power your house. Your car could double as a home battery when you’re not using it. I think this could have enormous potential for old degraded batteries that aren’t suitable for cars anymore. Imagine if you could recycle old degraded car batteries into a home storage solution! But I’m no electrical engineer and there might be technical reasons why this is hard to do/impossible so we’ll just have to wait and see.

Regardless, the potential of EVs is exciting to think about and maybe there will be some kick-ass rebates in the not so distant future.

I’d love to know if you’re stuck in the same predicament and what your thought process is in the comments below 🙂

Net Worth Update

The share market bounced back which was the main contributor to our gains this month.

But the big news from March was our purchase of Bitcoin.

You can read about our decision in this detailed article here, but in a nutshell, we bought Bitcoin for three reasons:

- I’m personally interested in this technology and get joy from seeing how it works and participating

- Speculative play. The value proposition of Bitcoin is favourable IMO

- It’s a vote for a more democratic financial system

There was some talk about the energy consumption concerns of Bitcoin that I didn’t address in my article. And that’s a fair point which is ironic considering how pro-renewables I am.

I posted the below on Facebook which basically sums up how I feel about it:

Bitcoin uses a lot of energy, no getting around that. But what about the energy the current system uses?

Here is a study that suggests that the banking industry uses twice as much.

We still need to address how crypto is powered but most people gloss over the inefficiencies of the current system it could one day replace.

Maybe the energy concerns will be the downfall of Bitcoin, who knows?

But when was the last time a new technology that offers a better solution to a current system was not adopted because it used a lot of energy? And if the report is accurate, it actually uses less than half of the energy it takes for the current system to run anyway! I understand that you can’t really compare the current financial system to Bitcoin just yet but surely you have to acknowledge that the modern-day banking industry uses a shit load of energy to keep the lights on.

Bitcoin (or another cryptocurrency) could offer a superior solution in the future for less overall energy and I think it’s important that the naysayers keep an open mind with regard to this point.

Also, for the pro-Bitcoin/crypto people out there in the FIRE community. For the love of God, can we stop being so bloody aggressive in the comment section when people have valid concerns about this new technology?

It pains me to see how cult-like some of the responses have been. Especially when someone is clearly just trying to learn a bit more.

Dismissing questions and concerns with “WRONG” or “You just don’t get it, HFSP lol” doesn’t help anyone. In fact, if you can’t explain the reason why you bought Bitcoin or another crypto, odds are you’re only buying it in hopes that you can sell it for a profit later.

One of the FIRE community’s greatest strengths is explaining financial concepts in an easy to digest manner.

$12K of Bitcoin has joined the fold.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Another high month for the blue line.

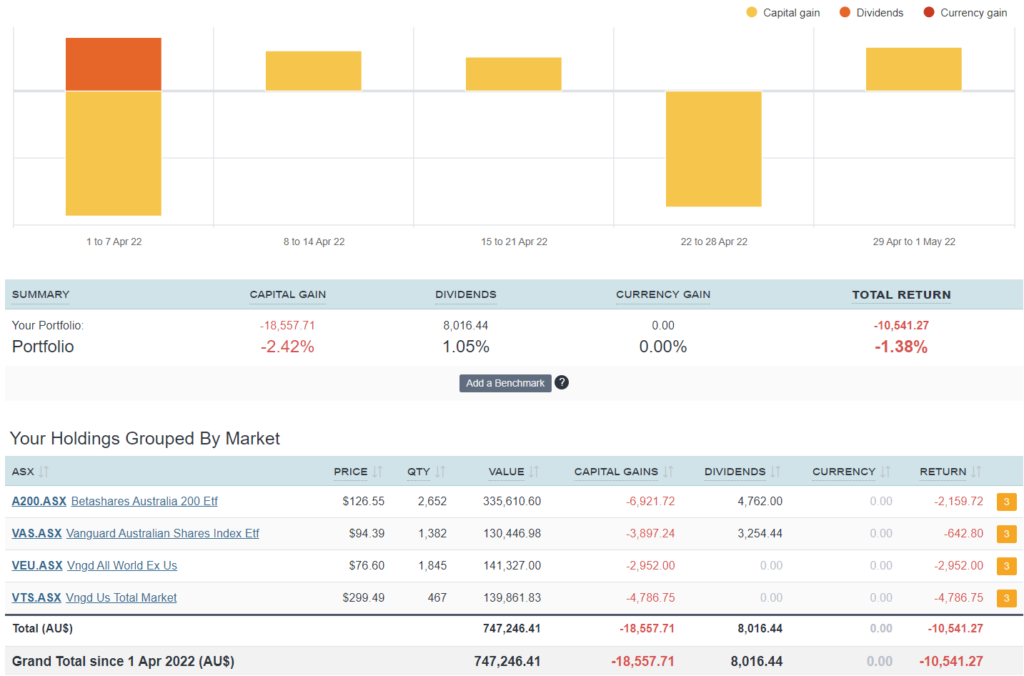

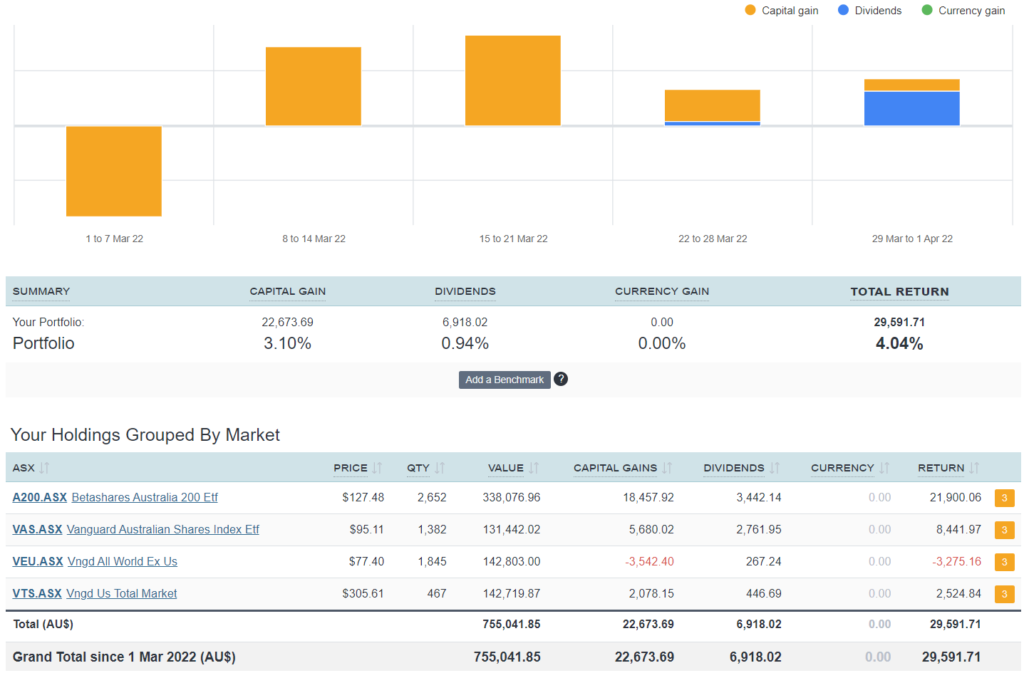

Shares

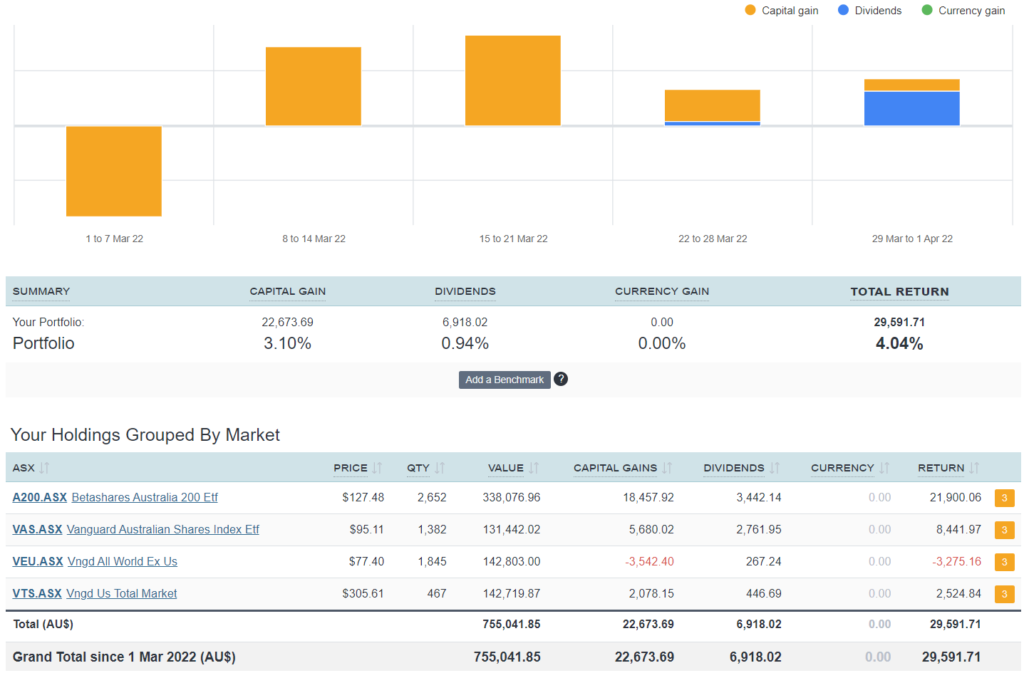

The above graph is created by Sharesight

No new shares in March.

Networth

by Aussie Firebug | Mar 9, 2022 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

The wife and I surprised my parents with a trip to Daylesford in February for the old man’s birthday. It was a bit of a combo trip to also see my sister who has recently moved to Bendigo.

Daylesford

Mrs FB has dropped to a 4-day working week this year and the extra day off has really been a game-changer for her. One of the best parts about having a long weekend every week is being able to plan little 3-day get-aways (I’m ironically finishing up this post on one said getaway). We left Latrobe Valley early on Friday morning and came back on Sunday night. I even managed to fit in a coffee with a Firebug reader in Ballarat which was really nice.

That’s the beauty of slowly scaling it back. Even just one extra day in the week gifts you back 52 days a year (not exactly 52 days with all her teacher holidays but you get the idea). Even if it’s just to book appointments and get some stuff done. Half the time Mrs FB sets aside the Friday to organise and prep for the following week and we wake up Saturday morning with all the chores done. It’s a really nice way to enjoy the weekend instead of trying to cram in everything on Sunday just to wake up Monday morning and start the process all over again.

I also had my first BJJ (Brazilian Jiu-Jitsu) tournament in Feb which was such a crazy experience.

For those who haven’t heard of BJJ before, Wikipedia describes it as:

Brazilian Jiu-Jitsu is a martial art and combat sport based on ground fighting and submission holds. BJJ focuses on the skill of taking an opponent to the ground, controlling one’s opponent, gaining a dominant position, and using a number of techniques to force them into submission via joint locks or chokeholds.

Or as I like to explain it to my wife… “You’re basically trying to kill the other bloke without striking” 😂

I first started training BJJ in late 2018 after me and my mate finally decided to pull the trigger and actually go down to a local MMA gym and give it a go. We were huge fans of the UFC and MMA in general but had never trained a martial art (I’ve done a bit of boxing but nothing serious).

I only trained for a few months in late 2018 before Mrs FB and I left to live overseas for two years. I originally wanted to continue my training in London but life and travelling just got in the way. I was lucky to get in a few gym sessions and a run during the week let alone BJJ training.

What attracted me to BJJ was the ‘problem solving’ nature of it. I’ve gravitated towards puzzles my whole life. I love chess, my favourite video game of all time is StarCraft which is extremely strategic and my professional work in data is literally solving technical problems for money.

A lot of people think martial arts can be too violent and just for meatheads but there’s also a softer more spiritual side that’s deeply connected with meditation and yoga (think Shaolin Monks for example). I like to think of meditation as a form of martial arts and struggle against your own mind, yoga is a martial art against your body and BJJ is the physical manifestation against another person. They’re all related and I’ve been told that a lot of top BJJ practitioners are right into mediation and yoga too.

We came back home in 2021 and BJJ training was high on my list to get back into. It took me a few rolls to bounce back to my previous level and other than the lockdowns we had last year, I pretty much have had a solid 12 months of training plus the 3 months before our Euro trip. The next step was to put our training into practice because my mate and I always had aspirations to compete.

It’s one thing to train, but it’s another to actually go out there and wrestle someone giving 100%. To say it was nerve-wracking leading up to the comp is putting it lightly haha.

The day of the tournament was a relief because I had trained pretty hard 6 weeks leading up to it and I had been having a bit of trouble sleeping (probably overthinking everything that could go wrong lol).

We had 4 people from our club in the comp and the way it works is there are different divisions depending on your skill level, weight and BJJ style.

I was competing in both Gi (the pyjama looking outfit 🥋, also called a Kimono in Judo) and no-Gi (tights and rash vest, pictures below) in the 77kg white belt (beginner) division.

It was a round-robin competition which I would highly recommend to anyone looking to compete. I really like the round-robin format because you’re guaranteed 4 matches even if you lose each one. Our coach has told us stories when he was competing that he would drive all the way up to Melbourne, lose the first match in a knockout tournament and have to drive all the way home 🤪.

I got to the comp, weighed in and started stretching and warming up. Our best guy from the gym (a blue belt) was up first and I was in the coach’s chair which is basically a spot for someone to yell out helpful things and let them know if they’ve scored points or not.

There are three ways you can win.

- The match finishes (5-minute matches) and you score more points (points are awarded for dominant positions)

- Your opponents submit from a choke or joint lock (they’ll usually tap or verbally submit)

- You choke your opponent unconscious and the ref steps in

So the match starts and it’s pretty competitive but the guy from our gym eventually loses on points after 5 minutes. I was surprised to see him limping really bad once the match finished and even more surprised to see his foot had turned black and blue… he broke his foot somehow during the match 😱

So this was just about the worst thing to have happened before my first match because you could imagine what that did to my confidence. Here I was, brand new to tournaments and already crapping my dacks. And then our best guy goes out there and breaks his foot… 😐

I helped him to the side where he was ushered off in an ambo, and then my name was called to mat 7.

My opponent and I stepped on the mat and the ref yells:

“Are you ready? Are you ready?… FIGHT!”

I don’t think I’ve ever had an adrenaline dump quite like it before. I know there’s a ref and rules but in the heat of battle without any prior experience, you just forget everything.

There are actually some similarities between holding your nerve in sports and keeping it together during a market downturn. How often do we hear from seasoned investors that buying during a downturn is one of the best things you can do. Buy when there’s blood in the streets etc. But it’s a different story when you’re actually in the thick of it.

I had trained and refined my strategy for 6 weeks leading up to the comp. But when my match started, my opponent gave me a different puzzle to solve than what I had been practising. This threw me off my game completely and I needed to make an adjustment but I didn’t have the experience/confidence to do so. That’s why you always see the best UFC fighters and boxers making adjustments mid-fight. They recognise when something isn’t working and under extreme pressure are able to try something different to solve the puzzle.

I fumbled around for most of the match and then somehow managed to land a double leg takedown to secure 2 points and win my first match. After that first one, I felt a lot more comfortable and I got into my groove during the next few matches.

I finished the comp coming 3rd in Gi (🥋) and 1st in no Gi (🚫🥋). My two mates both took home 2nd in their respective divisions which made it a very successful day for our school (other than our blue belt friend).

Here are some pics from the tournament.

My first opponent had neck tats… I was so nervous lol

Me almost getting guillotined

I’ve also been hitting up the local MTB trails with my nephew lately. It’s such a luxury to be able to go riding during the week when no one is there.

MTB riding at the pines

My nephew sending it!

And lastly, we finally got around to putting in the new front garden. I can’t believe how expensive plants are 💸 but must say that it’s looking 100 times better already. Really excited for the trees and bushes to grow a little.

New garden

Net Worth Update

A pretty boring update for February.

Our shares portfolio went up ever so slightly and Super dropped a few grand. I also had a smidge over three weeks off in January which meant my income for February was pretty low. All of that combined meant that we went slightly backwards in Feb from a financial point of view BUT I feel from a happiness point of view, things have never been better and that’s the important metric 😁

No changes to the FIRE portfolio.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

It’s becoming clearer and clearer that inflation has well and truly hit our tightass household. I’ll probably keep it eye on it for a few more months before anything official but I dare say that we’ll be increasing our FIRE number of $1.25M soon. I’ll write an article about it after a few more months I reckon. Inflation was always included in our numbers but not at the level it seems to be right now. I’m aware that CPI is officially 3.5% (as of writing this article) but our basket of goods has definitely gone up more than that.

I have been religiously tracking our expenses for over 7 years now and have a pretty decent dataset I could use. It would be interesting to see how much certain areas of our spending have changed throughout the years. I swear we only use to spend around $350 bucks a month on groceries. Now it’s closer to $600.

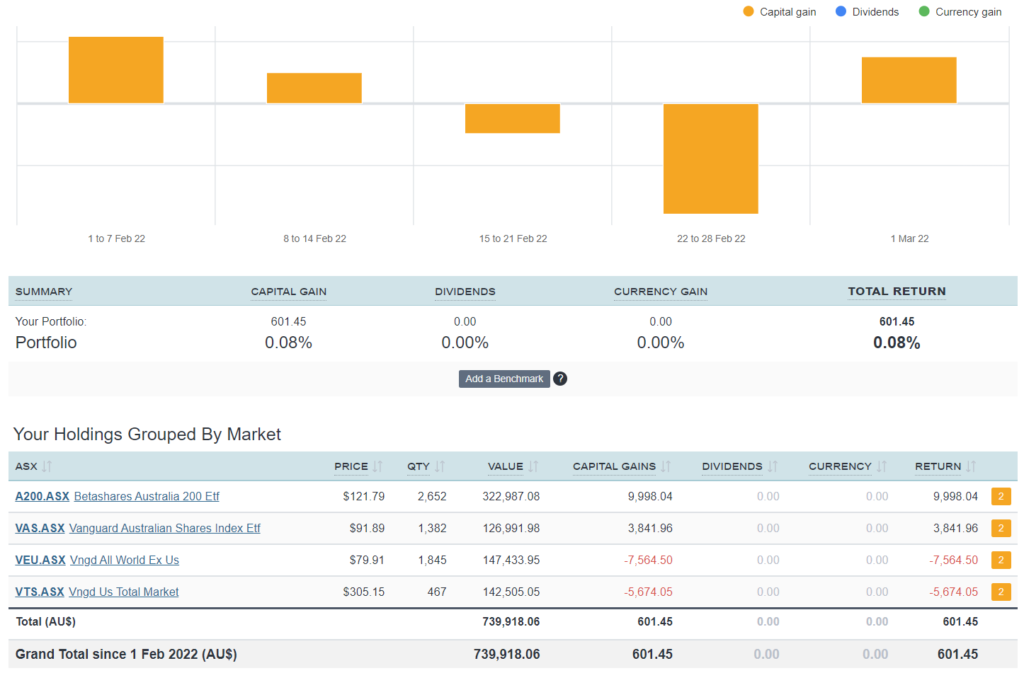

Shares

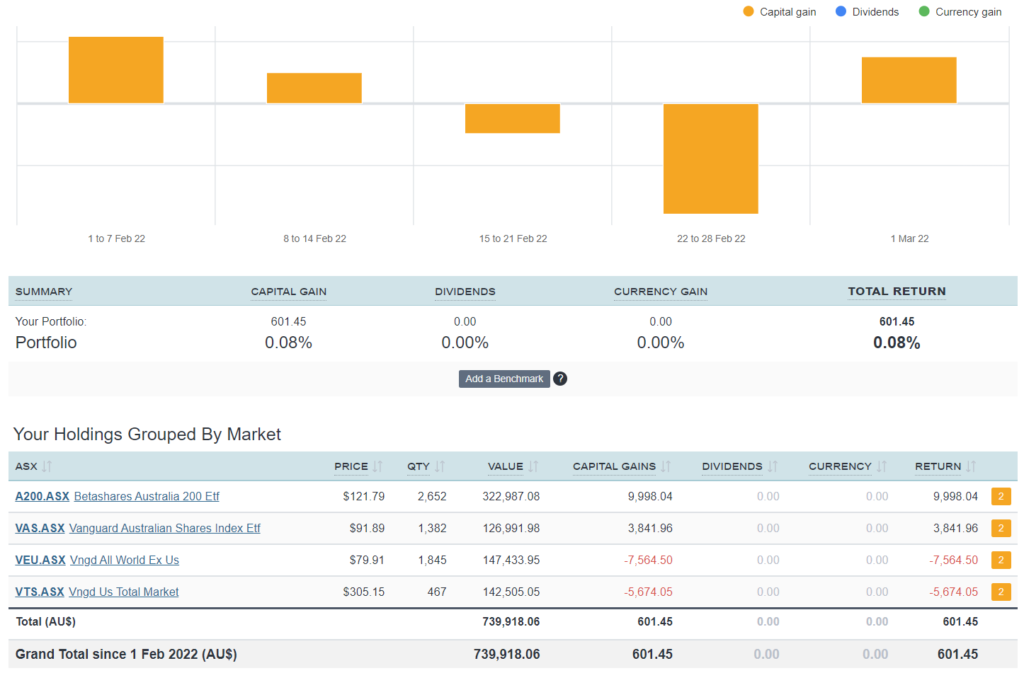

The above graph is created by Sharesight

No purchases in February. Building up a bit of a cash buffer for a new car atm

Networth

by Aussie Firebug | Feb 16, 2022 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

We kicked off 2022 with some travelling which almost didn’t happen.

Mrs FB and I are aspiring parents and basically, everyone has told us to get in as much travel/activities/sleep-ins as possible before a future newborn comes onto the scene (we’re not currently expecting atm). The original plan back in August last year was to get in one more overseas trip before the potential avalanche of responsibilities from parenthood hit us 😂.

It was originally going to be Japan because we missed it due to Covid in 2020. But as the months went by, the restrictions weren’t easing up enough for us to risk it plus Omicron went bananas later on in 2021. There’s was the whole ‘getting stuck’ over there risk, hotel quarantine (already paid that once 🙃) and probably the most likely risk of them all… getting a half baked Covid experience.

I’ve been thinking about what the world is going to be like after Covid for a while now because it doesn’t take a rocket scientist to know it’s not going to be the same.

Think about how much airport security changed after 9/11. A lot of the world was affected by that event. And whilst 9/11 was unprecedented, Covid is really on another level in terms of impact and severity which is saying a lot.

I mean… what sort of restrictions are going to be sticking around post-Covid? Will masks become the norm (people voluntarily wearing them)? Number restrictions on large gatherings?

I remember how much fun I had at Octoberfest back in 2019. Will that be the last Octoberfest of its kind… ever? There’ll be more festivals in the future but I’m not sure they’ll be the same. Our descendants might be able to look at photos of our generation and easily know if the picture was taken pre or post-Covid.

It’s a bizarre thing to think about really.

Anyway, back to our travel struggles…

So we axed Japan because things were getting worse, not better and I’m pretty sure Australia wasn’t even on the ‘allowed’ list to enter the country 😅.

We flirted with the idea of New Zealand but they didn’t want us either 😢.

So we ended up deciding that we’d have a look around our own backyard instead. Having never been to Western Australia, I was a bit disappointed that the borders were still closed because it was our preferred destination… oh well, next time I guess. South Australia and Tassie were next up and we were in luck with these states coming from Vic. I remember getting a slight scare in mid-December when the SA/VIC government started to mandate a combined total of 3 Covid tests before entry. It was originally 1, then it went to 2 and then 3 and I thought “Ahhh man, it’s just a matter of time before they lock us out”. Thankfully that didn’t happen and were able to cross the border to start our January holiday.

We hit up Adelaide first and I was really impressed by the city. Beautiful gardens and parks, great spots to eat and drink, plenty of recreational activities, world-class beaches just up the road and affordable housing from what I’ve heard. It’s no wonder that Adelaide always ranks highly in those ‘worlds most livable cities’ studies.

I really enjoyed hiring the orange bikes/electric scooters to see the city. Was a lot of fun.

Adelaide Gardens

Adelaide Riverbank

Adelaide Open

Gorgeous winery just out of Adelaide called ‘Down The Rabbit Hole’

I also caught up with Loch aka Captain Fi.

The Cap’s Sky Garden

Co-Captian FI aka Angel

He was kind enough to help organise an impromptu FIRE meeting in Adelaide with less than 48 hours notice 😅. I think we had around 10-15 people come and go throughout the night and it was one of my highlights of January. Getting out there and meeting Aussie’s from the FIRE community has been one of my goals since returning home. Last year was hard with all the restrictions but I’m really hoping 2022 can be the year of FIRE meet-ups! I’m planning on hosting a few in Gippsland and maybe even Melbourne 🙂

A big thanks to everyone who attended the Adelaide FIRE meet-up. I’ll be back one day for sure!

We headed to Kangaroo Island (KI) next but unfortunately had caught a bout of bad weather and couldn’t do everything we had hoped. It was still a lot of fun though. Here are a few shots.

Remarkable Rocks

Admirals Arch

After SA we headed to Tassie to meet up with our family and do some sightseeing.

I had already been to Tassie about 7 years ago and I remember being really impressed with Hobart’s Salamanca markets and Mona museum so I didn’t mind going there again. Plus we were exploring around the island to heaps of places I hadn’t been to before anyways.

Here are a few shots.

Royal Tasmanian Botanical Gardens

Enjoying a Frothy @ The Hanging Garden

Wineglass Bay

St Helens MTB Trails

We had such a great time sightseeing around Tassie.

I also managed to have another small impromptu FIRE meet up at Preachers in Hobart. It was such a cool little bar with a great bar garden and I really enjoyed meeting more people from the community. A big thanks to everyone who came out and had a drink with us.

We got around on more of those orange scooters in Hobart which I really liked. Seeing a city on those scooters or a bike is 100 times better than driving around IMO. One of my favourite things about Hobart and Adelaide is that you can get anywhere in the city on a bike/scooter within the hour. Having lived in a bigger city like London I really appreciate the smaller size of our Australian cities. Even Melbourne and Sydney are a lot more compact compared to New York, London, Tokyo etc.

I remember being a bit shocked when we went to a friends place for drinks in London once. We punched the address into City Mapper and the designated route said it was going to take over an hour to get there 😐. That’s a crazy amount of time to get from one place to another in the same city. I still maintain that riding a bike is the quickest way to get around in London but even so, you’d have to be pretty fit for some return trips around the city and most people aren’t going to ride their bike to a party lol.

Speaking of bikes, I had no idea that the MTB scene in Tasmania was so prevalent. I’ve recently started to hit the trails with my nephews and it’s been an absolute blast! I managed to get Mrs FB on a bike and the trails at St Helen’s were awesome. I’d love to come back one day and hit up Blue Derby for sure.

Net Worth Update

The cruel mistress of market timings punished me in January after I obviously angry her by holding onto our lump sum for too long 😂

After lump summing > $200K at the start of Jan, the markets started to dip and went south pretty quick with a slight recovery towards the end of the month.

This dip in the markets is the main reason for the drop in our net worth this month. Our share portfolio took a beating along with Super.

It was also a really expensive month again (inflation maybe?) and we didn’t save that much money.

Man, I forgot how much holidaying and eating out can really add up quick. A key difference these days is us having a mortgage whilst holidaying. When we were in London, we could sub-let our room before heading off on an adventure for a few weeks. But these days, it’s a double whammy of expensive accommodation plus our mortgage 💸. It’s still been worth it IMO but just reinforces my point of view that owning a PPoR is bloody expensive and can really clamp you down financially and geographically.

No changes to the FIRE portfolio.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Expenses continue to be really high for the second month in a row. This is mostly accounted for by our holidays but I’ve noticed our grocery bills have been insanely high over December and January. This is partly because I bought a new BBQ and have been hosting a lot of dinners with my mates. Playing host is super fun but can be really expensive too. Inflation has definitely had an impact on our expenses though.

I remember back in 2018 we would consistently spend around $4K – $4.5K a month for everything. It’s been hard to know what our baseline is atm because last year had so many one-off purchases (wedding, PPoR). It might take another year to see what it will look like. Will be interesting to see how this graph changes over the coming months.

Shares

The above graph is created by Sharesight

We didn’t make any purchases in January. We are saving a bit of extra cash in preparation for buying a new car later this year. The 2nd hand car market is still crazy and I’ll like to put it off for as long as possible but it’s something we’ll have to buy eventually.

Does anyone have any recommendations for a solid family car (SUV or wagons are preferred)? I’d love to hear about them in the comment section 🙂

Networth

by Aussie Firebug | Jan 7, 2022 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

And that’s a wrap for 2021!

It’s wild to think that we are already in 2022, just like that meme, I feel like I am still processing 2020 🤯

December was here and gone in a minute for the Firebug household. So many Christmas breakups, family gatherings on both sides, friends coming back to town for the festive season, birthdays, NYE events and so on.

We hosted the annual Christmas day breakfast at our new home this year too. I recently bought a new barbie (I’m obsessed) and really wanted to put it to work.

This is living 🙌😍

I basically have started to barbeque just about everything now. And when the weather is good, it’s damn hard not to crack open a beer. I’m usually pretty strict with alcohol on work nights but I don’t know what it is about barbequing that makes me break the rules. I might have to start buying some non-alcoholic beers to lessen the effect 😅

Mrs FB had a hectic finish for the school year (as is always the case), but is super pumped about dropping down to 4 days a week starting next year 🎉🥳.

2021 was such a whirlwind of a year and I’m stoked that we managed to tick off all the major items we had on our list like buying a house and tying the knot.

Thanks a lot to everyone who reads the blog/listens to the podcast. I’ve got some great ideas for AFB and the Aussie FIRE community in 2022 that I can’t wait to share with you all 👊

Net Worth Update

So we lumped summed ~$210K into the markets in late December/early January. This was surprisingly difficult for us to actually pull the trigger.

The general consensus in the FIRE community is to not get caught up in timing the market. This is easier said than done.

I’m human just like the rest of you and I also read a fair bit of finance mumbo jumbo content too. It’s fun to read opinion pieces and I’ll watch the occasional YouTube video of some doom and gloomer who has put together a pretty slick video with nice editing on why the next recession is about to drop.

The hardest part mentally was the markets being at an all-time high (or close to it). No matter how much I read that it doesn’t matter if you’re in it for the long term, it’s still bloody difficult not to wait for a dip.

So I waited right until the end of December before we invested our lump sum. And right on cue, the markets had a slight tumble afterwards 🙃🔫.

We would have been so much better off if I had just invested that money straight away but such is life. And the downturn right after we invested $210K is a major reason the net worth only grew by $2K in December. The other reason was a pretty expensive month.

The FIRE portfolio actually went down slightly in December due to the market dip after our big investment. December was really expensive for us too with Christmas/holidays.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Shares

The above graph is created by Sharesight

We’re all in baby!

$769K all in shares which blows my mind!

Man… it wasn’t too long ago that I was in my mid 20’s and reading US FIRE blogs on a daily, dreaming about reaching financial independence someday in the future. I can’t remember whose blog I was reading but they had just hit $700K in shares and I remember being awestruck by the figure.

It just seemed like so much god damn money to have invested. I thought it was going to take me forever to get anywhere near that amount.

So to see $769K on the screen is a bit surreal to be honest.

But on the flip side, finally investing all that money felt like a weight off our shoulders. It’s in the market now so whatever happens, happens. If there’s a huge recession in 2022… well… that would suck but we’ve just accepted that and it’s back to business DCA’ing each month which is so much easier to do.

We made three huge (for us) purchases in December/early January.

- $53K into VTS

- $62K into VEU

- $95K into A200

This brings the portfolio into the following splits

60% Aussie 40% International

and

43% Betashares 57% Vanguard

Some of you hawkeye readers may have noticed that this is slightly different to our latest strategy explained article (2.5). I’m actually going to write another updated strategy explained article because our investing strategy is very fluid and changes based on our current circumstances and priorities.

There are no major reasons why we went with the splits above, it’s just what we feel comfortable with atm. We also like to spread the management risk around by having a decent chunk of our portfolio in Betashares and not just Vanguard. It also helps that A200 is cheaper than VAS atm too.

Looking forward to hitting the $800K mark in the not so distant future 😁

Networth

by Aussie Firebug | Dec 11, 2021 | Net Worth

I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

We finally hit it…

November was the month the Aussie Firebug household joined the two comma club and recorded a net worth of over a million dollars! I’m pretty sure we actually hit it in September but since I only record our net worth on the last day of every month, the market pullback at the end of September meant we missed it.

It’s a bit of a pointless milestone but something to celebrate nevertheless. I always knew I wanted to be good with money growing up but I never had an overarching goal that helped guide me in this endeavour until I discovered the concept of financial independence and then FIRE later on.

The concept of money is actually quite abstract if you think about it. I had a really interesting chat with Vijay Boyapati on the AFB podcast the other day which made me really ponder such thoughts such as what is money? And how does anything come to be a medium of exchange in the first place?

I made a connection early on in my life that everyone wanted more money and I thought people who had lots of it must be doing something right. I wasn’t really aware of the different circumstances and advantages that some people had which enabled them to get more money easier than others. Things like connections into good-paying jobs, a stable household that fostered learning and development, or sometimes just straight-up rich parents giving their kids everything.

I simply thought money was desirable, and those who had worked out a way to get a lot of it were smart… and I aspired to be one of those smart people. I had a secret money goal of becoming a millionaire before 30 in high school after reading countless articles on moneymag.com.au, Yahoo Finance, realetstae.com.au etc. They glorified the status of millionaires so much and really emphasised that if you were to obtain this elite financial achievement before 30, you were very special.

Our consumerism culture partly relies on the glorification of wealth to an extent. The marketing machine constantly pushing money, wealth and exorbitant lifestyles down our throats in Ads, Music videos, reality TV etc. Endless consumption is the fuel of a capitalist society which also drives the growth of assets which plays a huge part in why we are able to retire early. If everyone lived a FIRE lifestyle, none of us could retire early.

Oh, the irony!

Modern-day consumerism culture definitely had an effect on me growing up. I just kept correlating wealth with life progression which is funny because I live by a completely different life philosophy these days. The million before 30 was nothing more than a dream that didn’t have any tangible outcomes associated with it, I just wanted to get there.

So I fell a bit short of my meaningless high school dream but Mrs FB is still 29 so I can live my goal through her at least haha.

But wrapping this point up, whilst the status of millionaire is nothing more than an arbitrary term (that’s probably lost a lot of meaning in recent years anyway due to inflation), it’s still a decent achievement and one that the wife and I stopped to celebrate.

Net Worth Update

The share market was decent in November and we weren’t hit too badly by Christmas spending either which made for a sold month in terms of savings. But the real needle mover for the net worth came from the sale of IP2. The reason we had such a big jump was due to the fact that I hadn’t updated its valuation ($205K) in some time and the price we sold it for ($250K) was more than I thought we were going to get.

This should theoretically be the last big jump the net worth every sees since we’re 100% passive now in index funds.

Spending is higher than usual due to Christmas and a few bits and bobs for the house.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Properties

IP2 has officially been sold which means we’re officially 100% passive investor now🥳🎉

We were extremely happy with the price we got and the selling process was a breeze (markets still hot in SE Queensland). We did pay a fair chunk in selling fees but there wasn’t much I could and tbh, the price was so much more than I thought we were going to get that I decided to just take the convenient option and just pay someone else to do it.

I’ve had a few people ask me why we sold and it really boils down to simplifying our life. I have a limited amount of mental bandwidth each week and whilst IP2 (or any of the other properties for that matter) wasn’t that much work, it was still more work than what our share portfolio requires. We just have shifting priorities these days.

The investment properties were 100% about making us money. I use to really enjoy researching and investing in property but those days are long gone. We’ve reached a point now where I don’t feel compelled to hustle for every buck like I did 5-10 years ago. I’m focussing more on lifestyle design these days. And managing the properties were a small drag on this lifestyle so we struck whilst the iron was hot and exited our last IP in November.

Property has been an amazing asset class for us and I’m still a big believer that it can be an incredible wealth-building tool for the right investor… we’re just ain’t the right investor these days and that’s all there is to it!

I’ll be removing this PROPERTY section in these updates from now onwards.

Property 1 was sold in August 2018

Property 3 was sold in April 2021

Property 2 was sold in November 2021

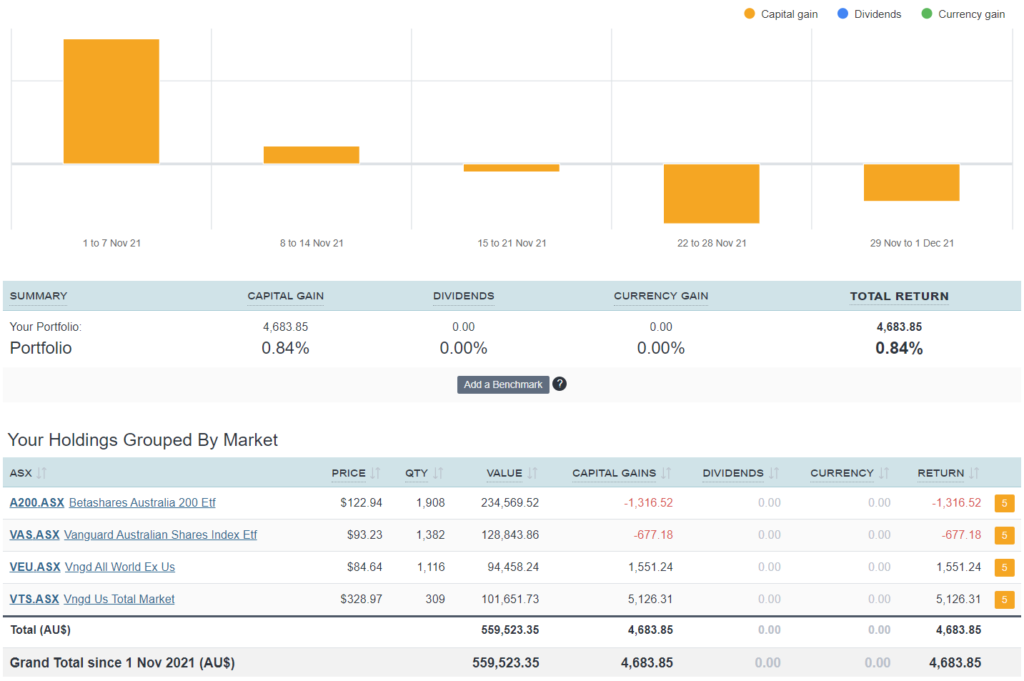

Shares

The above graph is created by Sharesight

SOL was officially sold in November for three reasons.

- SOL was originally Milton before the merger and with our exposure in A200 and VAS, I thought there was too much overlap and wanted to simplify our holdings. Selling Milton (that turned into SOL) was the obvious choice because we didn’t have that much money invested in it.

- The concept of legislation risk hit me like a mac truck when franking credit refunds were on the chopping block back in 2019. It turned out that Labor didn’t get elected but I remember thinking how pissed off I would have been if the rug was pulled out from under me during retirement… I decided that ETFs pose a slightly lower risk profile compared to LICs because of the structural differences between the two. I wrote more about this here if you’re interested.

- We wanted to execute our debt recycling strategy and needed a bit more cash to fully pay down the first split of our PPoR loan. Once IP2 settled and we had a decent chunk of cash, SOL ended up proving the rest of the $$$’s we needed to fully pay down our first loan. This wasn’t really a reason for selling SOL per se, more of a convenience and good timing.

With the sale of SOL we are now back down to 4 holdings. But now comes the hard part…

dropping ~$210K into the markets 😬

I swear the older I get the more I realise that good money habits and solid investing is 95% psychological.

I know what I should do. I have mountains of research and studies to comfort me in my decision and it should be made quickly with conviction… but I just can’t help and fall prey to the dangerous game of trying to time the markets 😅

The money has been transferred to our Pearler account for a few days now and I just keep checking the markets thinking how nice it would be for a dip. A 10% drop would be ideal, 5% would be lovely… hell… I’ll even take 2%!

ANYTHING!

No one wants to buy at the top and the decision is extra hard when it’s a lump sum. I’ve even answered questions like this a bunch of times on various AFF podcasts on what I would do in their situation but I’m telling you guys… when push comes to shove and you’re faced with the decision yourself… it can be difficult to execute the gameplan lol.

I’ll probably drop it in sometime this week but it’s so hard for me not to try and find the bargain. I’m often fighting my inner monologue that goes something like this:

“There’s always another crash Matt… just wait a little bit longer… Bitcoin had a crash the other day… Have a quick Google on what the experts think are going to happen… wow, so many of them are predicting GFC 2.0… yes… yes… keep going down the doom and gloom rabbit hole”

😂😂😂 it’s a brutal feedback loop.

Networth