Our Investing Strategy Explained

If you follow any online FIRE blogger whether it be an Aussie or international, you might start to see a pattern that emerges more often than not.

The majority of these early retirees are living off an income stream generated by returns from Index Investing.

In this post, I’m going to go into detail about how I first started investing for financial independence and how my strategy evolved over the years.

In the Beginning

I first came across the term and concept of financial independence in a book called ‘Rich Dad Poor Dad’ by Robert Kiyosaki. It really struck a chord with me because it was so simple. You buy assets that make you money and eventually you will get to a point where you have so many assets that make so much money that you don’t have to work to live.

Mind = blown.

Now I was already pretty good at the saving and frugal part. But I had never invested in anything outside of a savings account. This leads me to pick up my next book in my quest towards FIRE, ‘From 0 To 130 Properties In 3.5 Years’ By Steve McKnight. Because if you live in Australia the most popular investing class by a country mile is without a doubt, Real Estate.

It makes sense too, most of our parents have seen/experienced incredible real estate booms without any real crashes in the last 25 years. My parents also invested in real estate so there was a comforting sense of guidance I could draw from when choosing this asset class. Mum and dad had been through it before and could mentor me.

Real estate is easy to grasp too. You buy a house, you rent it out and collect rent, the rent covers the expenses (hopefully), you sell it later at a higher price and make a profit. The other popular strategy with real estate is that you buy strong cash flow properties (where there is a surplus of rent after all expenses) and live off the rent, but this strategy is very hard to do in today’s market because of the low rental yields in Australia.

With time on my side for letting my investments grow for decades, my first investing strategy was to create an income stream through real estate.

Strategy 1 – Real Estate

The very first investing strategy I had, went something like this.

If I could buy 10 investment properties (IP) and hold them for 10 years, I could sell half of them and pay off all my debts. I would then have 5 houses pulling in rent with no interest repayments which would mean the majority would come to me.

The maths roughly looked like this:

| Equity | Loans | Rent @ 5.2 Yield | Expenses | |

| 10 X IP | $3M | $2.4 | $156K | $175K |

And after 10 years, assuming that rent and expenses (but not interest repayments) have increased with inflation @ 2.5%

| Equity | Loans | Rent | Expenses | |

| 10 X IP | $6M | $2.4 | $200K | $180K |

It’s important to note that while some expenses like rates, maintenance, water bills etc. would increase with inflation, the loan amount never changes. This is actually an advantage of leveraging your investments. You take out a loan in today’s dollars but can pay them off years later after inflation has eroded them. Which is often why you hear people say that debt is a good hedge against inflation.

And then I would sell 5 IPs and it would look like this

| Equity | Loans | Rent | Expenses | |

| 5 X IP | $3M | $0 | $100K | $15K |

I was well on my way with this strategy and bought my third IP in 2015 which was around the same time as I discovered MMM and index investing which I will go into later.

This strategy has worked for thousands of Aussie and isn’t anything new.

So why did I decide to change my strategy?

- Strategy 1 relies on capital growth.

- You can see in the first table that there is nearly a $20K difference between the rent and expenses. What is not factored in here is negative gearing. All my properties right now are negatively geared but cash flow positive. Because of the tax refund I receive, the properties pay for themselves. But I could never actually retire off this cash flow which is why the capital gains are imperative. Without it, the strategy simply doesn’t work. And capital gains only works if someone buys your assets at a higher price than what you paid for it. I never felt comfortable breaking even or making a tiny profit each year with the hopes that 10 years down the track it would all pay off. I felt that investing should be a snowball approach where you start with a small trickle of passive income and see it grow into a raging torrent over the years.

- Active Investment

- There’s no way around it. Managing property requires time and effort. When I first started I had all the enthusiasm and motivation in the world and wanted to do everything I could to reach FIRE as quickly as possible. If that meant some sweat equity then I was all for it. But roughly 5 years later my motivation for doing all the extra stuff has fallen off a cliff. I would much rather focus on other things than worrying about and managing my investments. To be fair, my properties aren’t too much of a hassle, but getting to 10 IPs would be a lot.

- Lending conditions changed

- It was around about 2016 when the APRA (Australian Prudential Regulation Authority) really made it hard for investors to withdraw equity and refinance their loans. This was to try and curb risky lending and make it harder for property investors. Interest rates were raised on all of my loans and the number of hoops I had to jump through for my last equity withdrawal was 10 times harder than in 2014 and 2015. Looking back now, I was very fortunate to get into property when I did. Interest rates were being cut and banks were financing loans a lot easier. In mid-2016 I could not get another loan for a 4th property which meant my dream of 10 properties was out of reach.

But if I’m not going to reach financial independence through real estate, then how else am I going to create a passive income stream?

Strategy 2 – Index Investing

I think I can speak for a lot of people when I say Mr. Money Mustache has a way of writing that people relate to. I guess it’s why he is so popular. When I read The Shockingly Simple Math Behind Early Retirement it just made sense. And his article about Index Investing really clicked with me and would be what I consider the catalyst for my desire to learn more about the stock market.

It’s quite funny to see peoples reactions when they discover you have 6 figure sums invested in the stock market.

“That’s so risky though. Don’t you ever get scared you’re going to lose it all? One minute it’s there, next it just vanishes. I wouldn’t feel safe having so much money in the stock market, I only invest in things I can see and touch.”

I too once thought like this because of the constant news outlets reporting on the stock market crashes and how billions were wiped out in mere hours. Scary stuff.

But if you actually take the time to understand how the stock market works and what index investing is, I think you would be pleasantly surprised to find out all the positives that come with this investing approach.

What is an Index?

Indices cover almost every industry sector and asset class, including Australian and international shares, property, bonds, and cash. There are companies that conduct and publish financial research and analysis on stocks, bonds, and commodities to create indices. One of the more popular companies that publish these indices is Standard & Poor’s (S&P).

Have you ever listened to the news and heard them talk about the All Ordinaries (also know as All Ords) and wondered what it is? The All Ords is Australia’s oldest index of shares and consist of the 500 largest companies by market capitalization.

Let’s take a look at the S&P/ASX 200 (top 200 companies trading on the ASX by market cap) historic data since 1992:

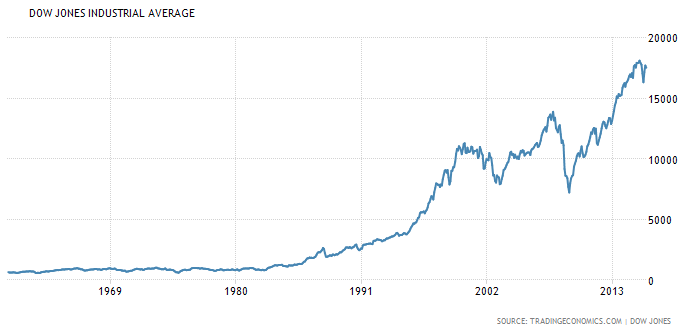

Here is the Dow Jones (US index) for around the last 60 years.

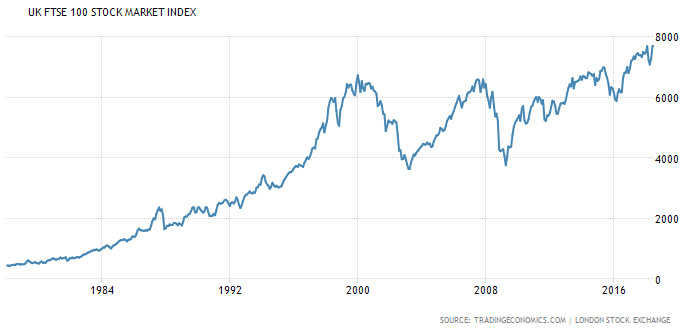

And lastly, here is the Financial Times Stock Exchange (FTSE) 100 Index which is the top 100 companies listed on the London Stock Exchange by market cap.

What is Index Investing?

You might notice a few trends from the above graphs like the dot-com crash around 1999 to 2003, or the GFC in 2008 or the constant peaks and troughs through the years.

But what is glaringly obvious is the overall trend in each countries index is up.

And these graphs don’t include the most important part. The entire time throughout these decades, those companies that are trending up or down, are paying dividends (or reinvesting them) each year! So combine the capital growth from the above graphs with dividends and you get the idea. The overall markets, given enough time, trend upwards!

This is a fundamental principle of index investing.

It’s hard to predict which companies are going to do well over the next 20-30 years. In fact, it’s almost impossible. A lot of active fund managers try to outperform the index and charge you exuberant management fees with the promise of higher returns. The thinking behind this makes enough sense. The fund managers have an army of analysts working 12 hour days using the latest analytical tools and datasets to ensure that they only choose the ‘best’ companies to invest your money in. But as history has shown, only a very small % of investors/fund managers are able to consistently over a long period of time (20 years+) beat the index.

Rather than trying to guess which investments will outperform in the future, index managers replicate a particular market or sector. This means they invest in all or most of the securities in the index.

Indexing is based on the theory that investors as a group cannot beat the market – because they are the market.

ETFs/Vanguard

So how do you invest in an entire index?

You could, in theory, buy all the companies within an index at the appropriate weightings. You would get killed in brokerage fees but I guess technically you could do it. But luckily there’s a much easier way.

There exists investment companies that cater to the index investing style and offer investment products that mimic an index with rock-bottom management fees. One of the biggest investment companies that offer these products is Vanguard.

The reason Vanguard and other companies can offer these products at such a low cost is that there is no money spent researching and analyzing which stocks to invest in. Index investing companies simply look at the index data provided by companies such as S&P and remove or add companies from the index plus a bit of paperwork. That’s it!

To put the management fees into perspective, a hedge fund’s fees might be as high as 2.00%. Vanguard charges me 0.04% for my US index ETF that I invest in.

To put it another way, if I had $1M in the hedge fund. They would charge me $20K a year for management fees. Vanguard would charge me $400 bucks. The difference of $19,600 reinvested at 8% over 30 years is $2.4 Million!!!

You can either invest directly with the Vanguards fund or you can buy ETFs which are exactly the same investment products but traded on the stock exchange. There is also a difference in management fees. You can read up a bit more about the difference in this article How To Buy ETFs.

Why We Decided To Move To Index Investing

I joined finances with my partner in 2016 and we made the decision to start investing in ETFs (index investing). After reviewing the two asset classes a year later, we knew that we wanted to continue to go down the path of index investing. Here are the reasons why we decided to move away from real estate:

- Diversification

- With our current three fund portfolio, we have exposure to over 6,000 companies in over 30 different countries. Our three properties are all located within Australia (different states mind you) and while I think it’s unlikely that they would all tank at the same time there is the possibility of a recession to hit Australia. If that were the case, those properties would almost certainly drop in value. And Investing Strategy 1 relies on capital gains to work. If something like that did happen, they have enough cash flow to make it through but who knows how long it might take for them to recover and ultimately gain enough value for the strategy to work. I might be waiting for decades.

The odds of the entire world tanking over a long period of time is not completely out of the realms of possibilities, but it’s a lot less likely than one country going into recession.

- With our current three fund portfolio, we have exposure to over 6,000 companies in over 30 different countries. Our three properties are all located within Australia (different states mind you) and while I think it’s unlikely that they would all tank at the same time there is the possibility of a recession to hit Australia. If that were the case, those properties would almost certainly drop in value. And Investing Strategy 1 relies on capital gains to work. If something like that did happen, they have enough cash flow to make it through but who knows how long it might take for them to recover and ultimately gain enough value for the strategy to work. I might be waiting for decades.

- Liquidity

- If we ever needed the money that was locked in the properties. It might take 6+ months to sell them and go through the whole process. With ETFs, I can put in a sell order and literally have the money in my account within 3 days. This means that selling off parts of your portfolio to fund your retirement is possible.

- Cash flow

- This is probably the biggest reason why we made the move. The path towards freedom is a lot clearer with ETFs. We know that we will need roughly $1 million in the market to generate enough returns each year to live off forever. The high cash flow/liquidity makes index investing a popular choice for FIRE chasers.

- No more banks

- Investing in ETFs does not require lengthy loaning processes. Leverage can have its place but it’s not required.

- Passive income

- Some may argue that real estate can be passive, and to some degree, I guess it is. But from my experiences with real estate, such jobs as collecting rent, doing paperwork, dealing with tenants, responding to emails, maintaining the properties etc. can add up to be a part-time job. You will not find a more passive income stream with the same returns as what ETFs offer. And I also love the fact that the more ETFs you have does not mean more work. More properties = more work. But you will do the same amount of paperwork come tax time on a $50K portfolio vs a $3M one.

- I don’t have to be an expert

- I believe that you need to know your shit when investing in real estate. I wouldn’t be comfortable investing in a property unless I knew the ins and outs of the area like the back of my hand. Where are the jobs coming from? What’s the population growth like? What’s the unemployment rate like? And on and on I could go.

The only thing I have to work out each time I buy ETFs is what I need to buy to rebalance my portfolio. That’s it! I don’t need to keep up to date with the latest trends or what’s the hot stock right now or any of that crap.

- I believe that you need to know your shit when investing in real estate. I wouldn’t be comfortable investing in a property unless I knew the ins and outs of the area like the back of my hand. Where are the jobs coming from? What’s the population growth like? What’s the unemployment rate like? And on and on I could go.

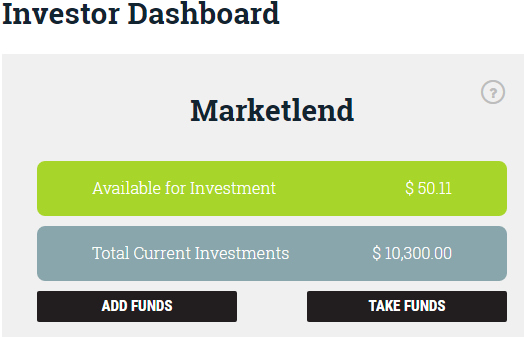

Our Plan Detailed

If you read my monthly net worth posts you can see that we invest in a three-fund portfolio. I’m going to go into details about why we invest in each fund and how ultimately they will enable us to reach FIRE.

Management Fees: I prioritize a low MER (Management Expense Ratio aka management fees) above almost everything else because paying less in management fees is a guaranteed returned and when it comes to investing in general, almost everything else is speculation to a certain degree.

Given my obsession with management fees, you can understand that Vanguard was an easy choice as an ETF provider since they offer some of the lowest MERs in Australia.

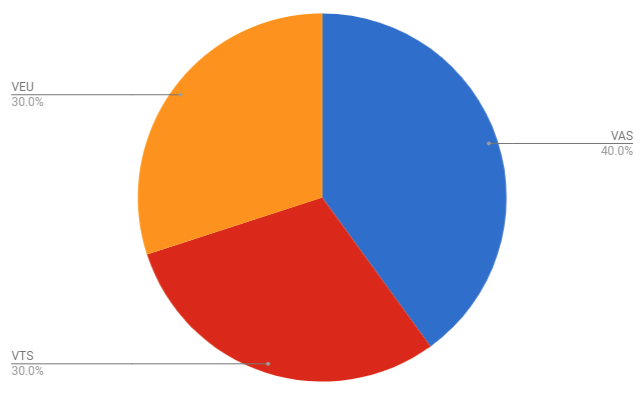

This is what our Strategy 2 looks like in pie form

Let me explain each fund and why it’s in our portfolio

VAS

MER: 0.14%

Benchmark: S&P/ASX 300 Index

Why it’s in our portfolio:

Some people will argue that Australia is such a small percentage of the world’s markets (around 2% last time I checked) that it’s not diversified enough and you’re better off going global for that diversification. I generally agree with that and what’s even worse is that out of my three funds, VAS has the highest MER at 0.14%.

So why do I invest in it?

Two words… Franking credits.

I’m not going to go into the technical details of how they work (Pat wrote a great article about that if you’re interested) but essentially they are an advantage that Australian companies can give Australia investors.

Australian companies for whatever reason emphasize higher dividends vs capital growth. I’m not 100% sure why this is, but please feel free to let me know in the comments for all those smarty pants out there. Anyway, this high dividends plus franking credits means that VAS pumps out a solid stream of dividends each year. The franking credits are too good of an opportunity to pass upon and are why VAS takes up 40% of our portfolio.

**A200**

A few months ago BetaShares released the A200 ETF.

It is essentially the same product as Vanguards VAS ETF except the A200 invests in the top 200 companies of the ASX instead of the top 300. Something to note is that the bottom 100 companies in VAS only make up 2.5% of the total in terms of market cap. So while the A200 is less diversified than VAS, it’s not as bad as it sounds.

The A200 boasts a MER of just 0.07%.

That’s half the price in management fees vs VAS!

I will be moving to the A200 if Vanguard does not respond with a lower MER next time we buy.

No one knows if VAS is going to outperform A200 moving forward. But what we all know, is that right now you will be paying double the price in management fees if you invest with VAS.

I won’t sell VAS moving forward, but I will be buying A200 instead.

VTS

MER: 0.04%

Benchmark: CRSP US Total Market Index

Why it’s in our portfolio:

Diversification? Tick (the US make up around 40% of the entire world market)

Good Returns? Tick

Rock bottom MER? Tick!

How can you possibly go past this ETF if you’re looking for a low-cost diversified ETF? At 0.04%, that’s the lowest management fee of any ASX ETF I can think of off the top of my head. I have often thought about going 100% VTS because I value a low MER with the highest regard. But the franking credits keep pulling me back to VAS and complete world exposure is why we finish with VEU.

VEU

MER: 0.11%

Benchmark: FTSE All-World ex US Index

Why it’s in our portfolio:

VEU rounds off our diversification by giving us the entire world minus the US at a very reasonable MER of 0.11%. And since we also invest in VTS, this means that with just three funds, we have exposure to the largest companies on planet earth.

Think about what would need to happen for us to lose all our money. Companies like Apple, Microsoft, Google, Exxon, Facebook, Commonwealth Bank, ANZ, Westpac, Shell, Samsung, Toyota, GM Motors, Telstra, Johnson & Johnson etc. would all have to go bust. All of them! I just can’t see that happening. And if some of those companies do go down the drain, they are simply replaced in the index by the next company with the highest market cap. And because the index is only giving a small weighting to individual companies (less than 1%), you won’t see it affect your portfolio. The only time a significant drop occurs is when the entire market as a whole is down (like what happened in 2008).

The 4% rule

The 4% rule is based on the 1998 paper called the Trinity Study and to put it simply, it means you should, in theory, be able to live off 4% of your portfolio. It’s an American study and is meant to last for 30 years so it’s not full proof by any means. But this is what we are using when calculating ‘our’ financial independence number.

So if we have a portfolio of $1M, we could live on $40K a year and never run out of money (it also factors in inflation).

How Much Do We Need?

We are currently on track for this F/Y to have spent a touch under $50K. That’s absolutely everything we spend to live our current life. It also factors in rent.

We do plan to own our own home one day which means that factoring in a fully paid off house, we spend about $38K a year.

Which would mean that we need a fully paid off house plus $950,000 in ETFs to generate enough income each year (factoring in inflation) to become financially independent! But being on the conservative side of things, I think a cool one million will be the target.

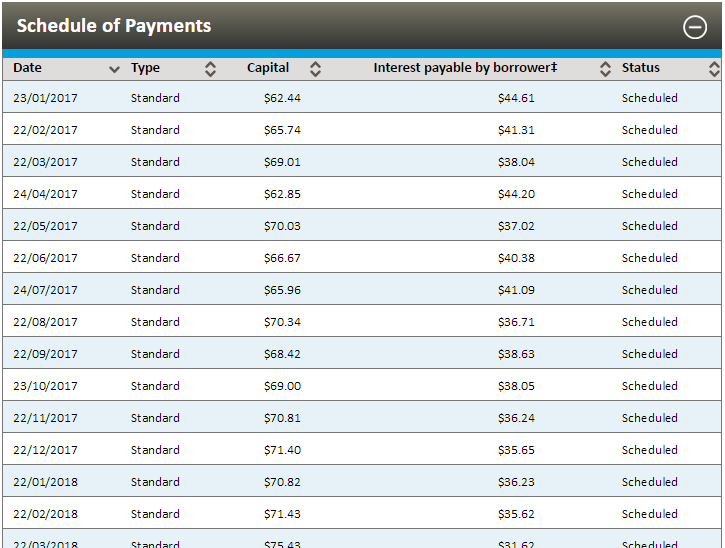

How It’s Going To Work

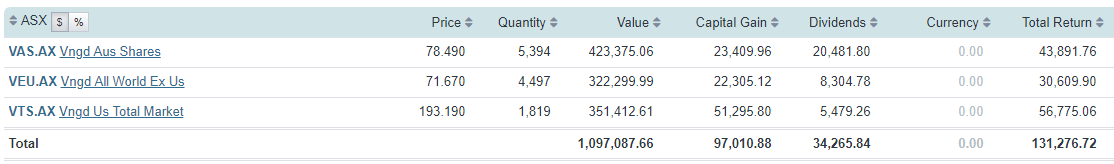

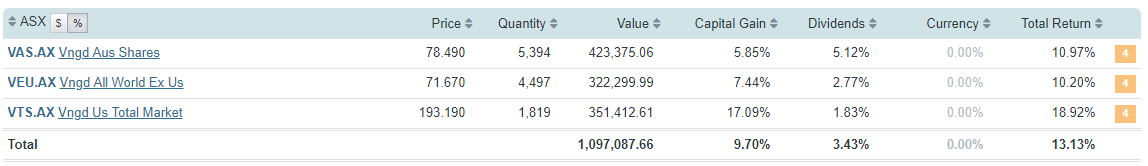

Let’s imagine, for argument’s sake, that we had reached our $1M portfolio goal with all the appropriate weightings for VAS (40%), VTS (30%), and VEU (30%) exactly one year ago (19/06/2017).

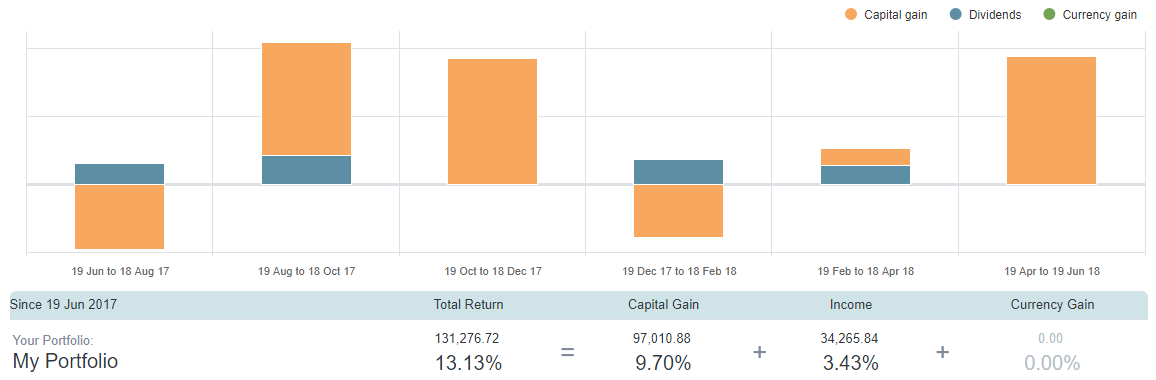

After one year, this is what the performance of that portfolio would look like thanks to ShareSights amazing ability to create dummy portfolios with historical data.

And if we look at how each fund performed for the last 12 months we get this.

Total Return for the 3 funds was $131,276 for the last 12 months!!!

A few things to remember though:

- We need to factor in inflation. If we assume 2.5%, that means that our real return was $127,964.

- The last few years have basically been a bull run for the whole world. This portfolio is not going to return these numbers every year. But that’s ok, what we need to do in the good years is not spend extra, but keep that surplus in the portfolio so when the bear market does come (and it will) there is enough to carry us through to the next bull.

- By looking at the total return, it would appear that VEU did really bad and VTS did really well. But how we actually should measure the returns is in percentage. Which looks like this

VAS and VEU are a lot closer when comparing % returns. VAS has a higher weighting which is why it returns more dollars when it’s very close in percentage terms. - We are aiming to achieve around an 8% return on average from the stock market. So 13.13% is a fantastic year!

The Dividend Part

You can see from the above graph that we received $34,265 from dividends in 12 months…  This is pretty good but you can clearly see from the fund breakdown where the majority of the dividends came from. VAS of course. Australian shares just pump out those juicy franked dividends like no other which is great.

This is pretty good but you can clearly see from the fund breakdown where the majority of the dividends came from. VAS of course. Australian shares just pump out those juicy franked dividends like no other which is great.

But what’s probably even more important to note, is how low the dividends were for VEU and especially VTS considering VTS made an overall gain of 18.92%! You won’t get much better than that and it still only paid out a lousy 1.83% yield.

We needed $38K last year. But this year inflation (2.5%) adds another $950 dollars. So we now need $38,950 to maintain our lifestyle.

The dividends cover $34,265, which means we’re short $4,685.

The Captial Gains Part

You know how I was just bagging out VTS because of its putrid dividend yield? Well, boy does it make up for it in the capital gains department!

VTS alone smashed our FIRE number of $38,950 and returned a whopping $51,295 (17.09% Gain!!!). Combine the other two funds and last year well and truly exceeded the 4% rule.

But how do we harvest these capital gains to actually live? The dividends are straightforward because they are paid directly into your account without you having to do anything. The capital gains part is a tad different.

We need to sell off units from our portfolio and realize a capital gain.

This is the part where a lot of people either don’t fully understand or are not comfortable with.

“Wait, I thought we reach a certain size portfolio and it pumps out a passive income stream we can live off? I don’t want to sell part of my portfolio. What happens if I have to sell it all”

It’s perfectly fine to sell off parts of your portfolio as long as it has the time to recover those losses.

For example, in the above scenario, I need an extra $4,685 which I must get from selling some units from one of the three funds or parts of all of them.

The most obvious fund to sell some units is VTS because it had the best return in the capital gains department and we can lock in those profits by selling. Each unit is now worth $193.190. So a bit of quick maths means I need to sell 24.25 units. Rounding it off and factoring in brokerage fees lets just say we sell 25 units.

$193.19 X 25 = $4,829

We have now made up what we needed to live for that year.

“But we are now down 25 units right?”… Technically right, but the wrong way to look at it.

Firstly, the portfolio grew by $131,276 dollars. We took $38,950 out of that growth to live on which leaves us still up $92,326. When next year rolls around, because of the power of compound interest, it doesn’t matter that we are 25 units down. Assuming we get the exact same returns in percentage terms, we will make more money next year because the starting value of our portfolio is higher than last year even factoring in 25 fewer units.

“But what if I run out of units?”

Highly unlikely. Each year you will have less and less units, but those units should be worth more unless it’s a bad bear market. Even so, we will have over 11,000 units spread across the 3 funds. Every few years they will be worth more and more meaning we will have to sell fewer units each time to make up the difference.

What Happens If We Retire And Another GFC Hits

This is the worst case scenario for our plan. Because it relies partly on capital gains, a huge downturn in the market straight after we pull the pin would mean we potentially would have to sell units at a rock bottom prices. And it’s possible that our portfolio might shrink too much in the early years and never make a full recovery when the bull markets come back around.

In this situation, I think the answer is pretty obvious.

At absolute worst, I’ll pick up some part-time work. Shit, even 200-300 bucks extra a week would dramatically reduce our reliance on ETFs. $300 a week for a year is over $15K which is 40% of our expenses!

Retirement

When our portfolio reaches $1M and we have the house fully paid off, I will at that point, declare financial independence.

But what will we then do?

If we are enjoying our lives to the fullest, then there would be no reason to change anything. But what I most likely will do immediately is drop my working days down to 2-3 days a week. From there the possibilities are really endless. Do I want to continue working at my current job? Maybe I only want to do part of my job 2 days a week? Maybe my boss won’t like that, but since I have reached FIRE I will have the power to quit my job without worrying at all.

I don’t plan to ever stop working, to be honest. It will just be 100% enjoyable work and probably not full time unless it’s a passion project. So the odds of neither Mrs. Firebug or I receiving some form of income post retirement is extremely low. This blog is even pulling in some $$$ now and I absolutely love working on it. I couldn’t imagine where it could go if I worked full time on it!

We will always have the portfolio there knowing we are financially independent, but there’s a good chance we will still earn some form of income from something fun 🙂

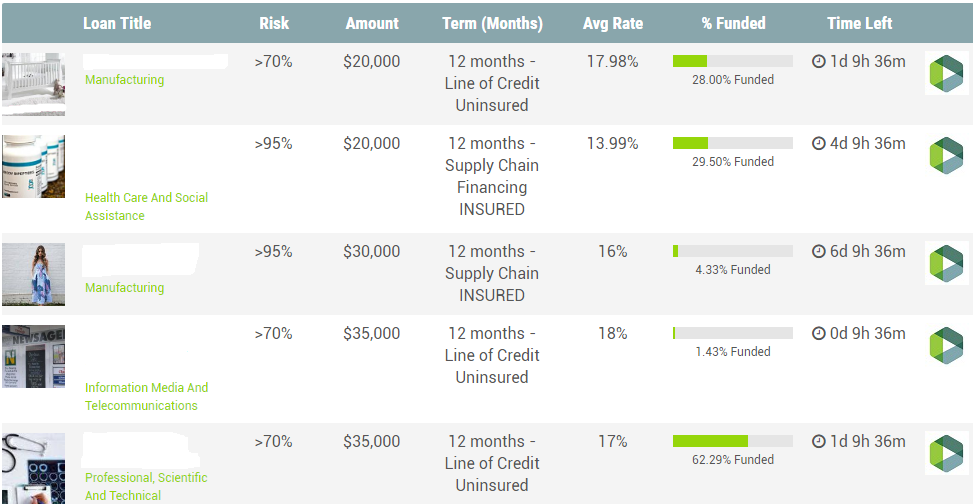

Strategy 3..?

Ok, long read so far I know. But we’re nearly there.

I’m a big believer in the following quote:

I’m constantly looking for new ways to invest, reduce our spendings, find tax efficient methods etc. It’s half the reason I started this blog. So a whole bunch of people way smarter than me could critique my strategies and explain better ways to do things. And it’s worked an absolute treat so far. The Australian FIRE community is the best for sharing information that will help you get wealthy a lot quicker than if you had gone at it alone.

So when I come across something that makes sense to me and is even better than what I’m currently doing. Why wouldn’t I adopt it?

Enter Thornhill

The entire reason I invest money is to reach the end goal of financial independence.

To have my assets generate enough income for my partner and I to live off forever.

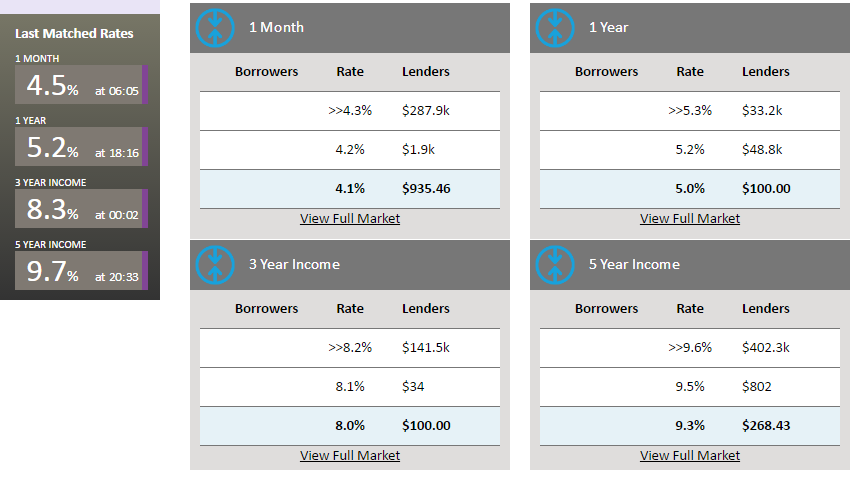

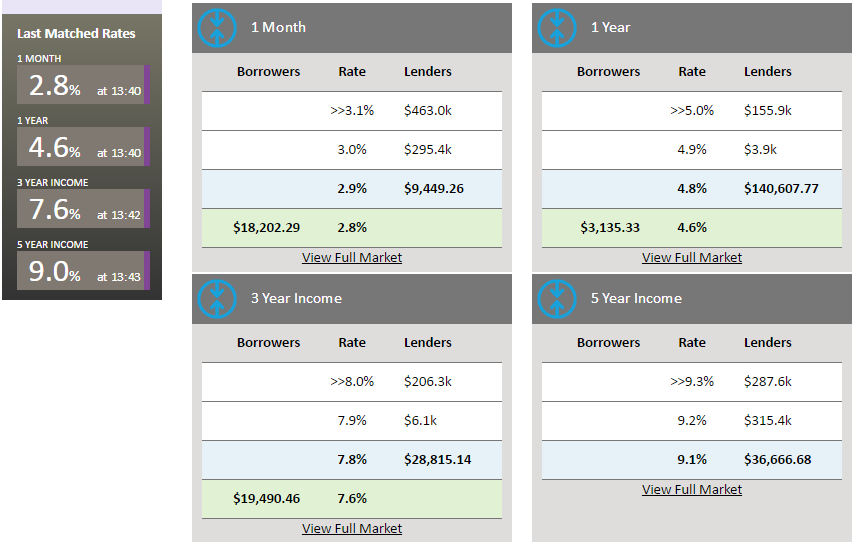

The key word here is income. In Strategy 2, capital gains are still required because VTS and VEU predominately return capital gains vs dividends. VAS is the cash flow king out of the three because that’s the Australian index and Australia has a high rate of dividends.

Peter Thornhill is the author of the best seller ‘Motivated Money’ which details his investment approach to investing for dividends (mainly in the industrial sector) and not for capital growth.

He explains in his book that dividends are a lot more stable and less impacted by market swings as opposed to the share price. Something that really struck a chord with me is the way he explains intrinsic value. In a nutshell, the real value of a company or any investment, in general, should be determined by how much income it is able to produce over a long period of time. It’s the income that is key. And it’s the income that will either pay the investor (you) the dividend or be retained by the company and consequently have the share prices go up.

This is how it should work, but as we all know. Humans tend to speculate a lot and you end up with assets that have potential but no solid foundation of cash flow being traded for ludicrous amounts of money (BitCoin, Sydney Real Estate etc.).

I’m not saying these assets don’t have value, but the only way that an investor can make a decent return is if they find someone that is willing to buy it at a higher price than what they paid for it.

If the goal is income, why don’t we focus only on investments that yield the best dividends?

Why not go 100% Australian stocks?

Australian shares yield the best dividends AND they give you the bonus of franking credits. These two reasons make a very appealing case for any Aussie investor.

I encourage everyone to read Thornhill’s book ‘Motivated Money’ because he explains the dividend approach a lot better than I can.

Here is a little video of Peter explaining why he looks forward to a GFC event.

The more I listen to this guy, the more convinced I am with his approach to investing in Australia.

“Watching the share prices drop is a totally different thing to the cash flow that’s coming out of the portfolio. That is what we are living on, we are not living using the capital as the source of income, it’s generating the income for us” -Peter Thornhill

UPDATE: We have since officially moved to strategy 3 a few months after this article was published.

Conclusion

Hopefully, you can come away from this post with a much clearer understanding of how we are planning to reach FIRE in the next coming years. I really wanted to include as much detail in this as possible and try to convey our thoughts behind the investment decisions we are making.

I think it’s common for a lot of Australians to start with real estate but finish with shares. I feel like that is the natural progression that as we get older and don’t have the time or energy required for active investing, the share markets offer a fantastic passive alternative with many other benefits. We are on track with strategy 2 at the moment. But the more I think about strategy 3, the more I’m liking it.

$1M is our official FIRE number. When we reach that plus a house paid off, the goal will be reached. It’s still a few years away no doubt, but we are enjoying the journey and each month we move closer to our destination.

What about your strategy? Are you on a similar path? I would love to hear about how you’re going to reach financial independence in the comment section below.