Podcast – FIRE & Chill with Pat and Dave

Summary

What a treat I have for you guys today.

I’m joined by two of my absolute favourite bloggers who have been creating Australian FIRE content for years. We’re speaking to Pat from LifeLongShuffle.com and Dave from StrongMoneyAustralia.com.

Both Pat and Dave have already been on the podcast before… in fact, this will be Pat’s third time.

How greedy I know…😜

Today we’re chatting how COVID has effected each of us, has anyone changed their investment strategies due to the recent events but most importantly, they have some exciting news that’s coming to the Aussie FIRE space next week and that’s a brand new podcast they’re starting called FI/RE and Chill.

Show Notes

- [email protected] official email address for the podcast

- Pats Blog

- Daves Blog

Transcript:

Aussie FIREbug: Hey, guys, welcome back to another episode of the Aussie FIREbug podcast. Today, I am chatting to some O.G’s of the Aussie fire scene, two of my absolute favorite Australian bloggers who have both individually been on the podcast before. But this will be the first time that I’ve had them one at the same time. So first up, and making a record breaking third appearance. We have Pat, the shuffler from lifelongshuffle.com and joining Part is the man who starts my Saturday routine with his ever so insightful weekly posts. It’s Dave from Strong Money Australia.com. Welcome, lads.

Lifelongshuffle (Pat): Hey, how are you?

Aussie FIREbug: It is so good to speak to you. I can’t remember the last time I’ve had. David, last word to you ages ago for that podcast that we did. But I think did we speak previous to that or did we speak after that?And then Pat. I think Lossiemouth had you on the podcast was like, yeah, a year or so ago as well. I feel like we’ve we’ve spoken previously, though. Or am I just making things up?

I think we had a couple of email chats.

Aussie FIREbug: Yeah, it may have been. I thought like something to do with the FIRE documentary. What would you guys think of that documentary, by the way?

Lifelongshuffle (Pat): Yeah, I thought it was really good. Dave and I went to the Sydney premiere, so dave actually flew over from Perth and that’s the first time I actually met Dave.I thought was pretty good. Don’t think.

Strong Money (Dave): I think I think it laid out the I guess you laid out the basics pretty well of what’s required.But also I think maybe it went a little bit too far in in maybe leaning towards making it a bit dramatic, I guess, in terms of their level of sacrifice. It doesn’t have to be like a huge level of sacrifice. They put a good occupational spin on it because there is obviously emotions involved, but it didn’t have to be that, that level of sacrifice. But they’re making a movie, so you kind of almost have to be like that

Aussie FIREbug: I was spewing that I couldn’t be there with you guys, like I went to the London premiere of it. Yeah but I missed out on meeting Serena (aka Miss Balance). But it sounds like you had a ball.I have to, I tend to agree Dave. It was pretty good. I thought like as as a overall movie.I enjoyed it, but I definitely felt like if I’d just shown my parents or if I just showed someone, hey, on chasing this fire dream, this is what it’s about and I showed him this movie, they might watch it and be like, OK, you guys are crazy.You know, the way they portray that they live in this, what it seems to be a really great life by the beach with all their friends and then they get ripped out and they move back in with their parents. Like Mr. Money Moustache had on his blog, that “I moved out of this community to live back in my parents to save money”, I might have just stopped reading the blog right then and there.

Strong Money (Dave): Yeah, I mean, if they I mean, if you look at their lifestyle before it was pretty lavish I guess even if they just stayed in the same location and switch to like a smaller place or an apartment and then got rid of the expensive SUV’s that would have gone a huge way into building some sort of savings.

Aussie FIREbug: Yeah and then they move into like some Snowtown that the wife hates. It’s all a bit. yeah. I would have liked them focus more on the people who had already reached fire and like the benefits of reaching fire. But again, they do have to make a story. I have to make an ark and like everyone asks Travis in the questions after it’s like so is there going to be a chasing fire 2 in like 15 minutes time to see how it worked have to say so on. So I have to ask and this is made everyone’s feel and this is the moment. So how are you guys going in your respective states with all these Covid going on?

Lifelongshuffle (Pat): I’m in the construction sector and, you know, I’m considered an essential service, so it hasn’t affected my work whatsoever. I still go into work every day. I still, travel by car there and all that sort of business. My missus is working from home. Traffic has died down a lot. I think there’s a general level of a little bit of fear.I think that might be dying down a bit now as people get sick of staying at home.But, yeah, as you know, that Australia is doing remarkably well. So maybe some complacency setting in a bit. I mean, what’s it like over there as you think people are getting complacent or if people are still sort of really knuckling down and iolating

Aussie FIREbug: We are still heavily lockdown in the UK. Nothing has really opened up. But in saying that BoJo is going to hit the TV, I think Sunday night, and I am expecting him to start opening up the country. You know, the first phase of opening up the country because, one, people are breaking the restrictions anyway, like we had we had a chat before we started recording and, you know, you’re not meant to be in the park and have picnics, to play bowl and all that good stuff. People starting to do it. Now, at the very start it was super strict and you could see a level of judgment on everyone’s eyes in the park if you have seen someone doing something wrong. I would be like, oh, your not meant to be doing that. But now I feel like so many people are getting over it and it’s getting to a point where I could not see it in the UK going on any longer than two or three weeks without them starting to open up a few things over here.

Strong Money (Dave): I think we’ve been one of the luckiest states in that we’ve had, I think, a week or a little bit more now of no new cases each day. So I think we’re gonna have some loosened restrictions coming pretty soon for us. I mean, it hasn’t really changed our lifestyle very much. My partner works from home now, but she’s doing two days a week. So it’s not not that big of a change.We still can go out and exercise take the dog for a walk and garden and go to shops. But I can definitely see that people are getting out more now than they were a few weeks ago. So there’s definitely people are becoming a bit maybe a bit less scared because it feels like we’ve gotten on top of it now.

Aussie FIREbug: I listened to a few news podcasts, and I think they’re talking about having like a little Tasman bubble or whatever they call it, ring with New Zealand, Australia and New Zealand opening up the borders between the two countries.

Strong Money (Dave): Yeah, I heard that as wel

Aussie FIREbug: I guess it give people an excuse to, to actually explore your own backyard Like if you, if you do have the urge to travel like Australia’s pretty bloody big , it’s the UK, Germany and Italy and Greece all of those countries put together. So if I was back home in Australia, I think you’d be the perfect time if they start opening things up to do a big trip around Australia if you keen for a holiday.Local tourism could boom.

Lifelongshuffle (Pat): Well, New Zealand could really benefit from this, couldn’t they? All these Australians just like, let’s get the hell out of here. The only place you can go is New Zealand.

Aussie FIREbug: So that is that that is true. Definitely. Now there are two two main reasons to have this podcast today. Firstly it’s always nice to chat to you.And we have great conversations. But secondly, you guys have some exciting news about a new podcast called Fire and Chill. I’d love to know the backstory about had that podcast was founded and then we could get into what it’s all about.

Lifelongshuffle (Pat): Yeah. So that Playing with Fire, a documentary premiere in Sydney. What was it like a year ago now or half a year ago? Dave and I were both there, we were both on a Q&A panel at the end of the show and it was the first time we met each other and I don’t know, we just sort of looked at each other and had a bit of a quick chat, maybe half an hour or something. And we just like on the spot like. Let’s start a podcast.

Aussie FIREbug: Sounds very romantic.

Lifelongshuffle (Pat): We just looked at it and gazed into each other’s eyes and we just knew

Strong Money (Dave): It was like, have you considered it? I think I asked Pat, have you considered doing any other type of content, you know, like YouTube videos or podcasts or something like that. And I think your answer was like or maybe a podcast. I thought maybe a podcast. But to do it with someone else, maybe like it with yourself or something like that and I thought, oh, maybe he’s just joking. I went to the back of my brain and then I think a couple of months later I said, oh, you know, that’s not such a crazy idea and then we started talking from there and it kind of grew. We researched it a little bit more and we thought, oh, actually, let’s do this. This is a good idea.

Aussie FIREbug: Excellent. Yes because i love yoir content. Pat, you need to start writing some more night. Like I haven’t seen any articles from you in the last 12 months. But even if theres just a podcast it is much appreciated. What should the audience expect when they download the first episode of Fire and Chill?

Lifelongshuffle (Pat): Dave, I’ll let you go.

Strong Money (Dave): They should expect a damn good time.

Aussie FIREbug: Is there a specific genre or is it just you guys having having chats? And it’s a it’s a fortnightly podcast. Is that right?

Strong Money (Dave): Yeah, it’s going to be once, once a fortnight. We’re going to, I guess, launch the show on May 19 and it’s going to be three episodes like one intro one and then two topic related shows. And then after that, it’s gonna be one a fortnight. And it’s basically gonna be may impact diving into all sorts of fire related topics and having discussions around that, that basically we can go a bit deeper than we can in a blog post because we can talk for, you know, a good half an hour and get really into it, whereas no one wants to read a blog post that’s like ten thousand words long.

Aussie FIREbug: Yeah, Okay. Excellent. Yeah. And it is launching on the 19th of May. Is that right. Yeah. Ten days away. We are recording this on the 9th of pain now. And where is it going to be available? Where can people get these podcasts?

Strong Money (Dave): Basically everywhere.So it’ll be on iTunes, on Spotify, Stich Google, Google podcast

Aussie FIREbug: So you’re gonna be speaking about different topics. If people want to get involved or want to submit a topic question like is there any any channels that you guys are going to have set up to get people involved in the podcast?

Lifelongshuffle (Pat): Yeah, absolutely.

Strong Money (Dave): We set up an email address for topic suggestions, feedback, maybe questions, because we’re going to answer a couple of reader questions at the end of the shows. So we set up an email address and that’s [email protected]. Oh, can you put that in the little chat? Because all all include that in the show notes for sure so when this is published so people can I’m sure you get bombarded with topics and questions and stuff like that. Excellent. I’m really looking forward to it’s going to be straight on my podcast list.So just to be clear, I think I know the answer to this, but you’re still going to have a weekly post that you do, Dave. You’re not going to take away any production from your blog. This is just going to be on top of the work that you already do on the blog.

Strong Money (Dave): Yeah, that’s right. So I’m going to be working a bit harder

Aussie FIREbug: And what about you, Pat? How are you? Because like I did mentioned that you’ve you’ve been a bit light on on the blogging side of things. Where is that? Is there a reason that you have me blogging so much or you want to focus more on the podcast side of things? Or can we expect more articles from you coming up in the future? Is on on. I’m hoping that you’re going to.

Lifelongshuffle (Pat): Yes.Now, you can definitely expect more articles from me.I don’t. I have no excuses, Matt. I’m just slowed down a bit. I’ve gotten a bit lazy. I suppose I should probably spend more time on it, but I’ve always got like a backlog of three or four posts that I’m sort of working on in the background and eventually I sort of get get to finishing them and posting them. But I’m definitely not nearly as consistent as Dave is there.

Aussie FIREbug: I know on that issue all too well, Pat. I know that all too well. But you are working. That is our excuse. You know, we haven’t retired yet. So I think we can use that excuse compared to Dave.

Strong Money (Dave): I was just gonna say so that’s the thing I can’t believe you guys. I mean, especially yout Pat, back in the day when you running red hot on the blower. I cant believe you guys have time and energy to do that? I mean, I don’t think I would have a blog at all if I was still working. I just couldn’t be bothered like after work hours I just don’t want to do it anyway. It sounds I’m impressed that you guys even gave out the content they did well.

Aussie FIREbug: Well, I have there’s a good reason for for mine. I’ll go first. But when I first started the blog, I was working for the government. Now I know that there’s a bit of a meme that if you work for the government, you do no work. That’s 100 percent true. And let me tell you, when I was working for the government, I had so much free time at work, like I could knock over all my life admin on the job. So I would literally be, you know, all my emails, any accointing work, investing in properties. I was doing a lot of, like, you know, work for them at work and it allowed me to just get so much stuff done. And I often I do think back and I wonder, especially now working in London where it’s such a go, go, go work style and I’ve worked hard here in the private industry than I ever did in the public sector back home, that if I’d going into the public sector straight out of uni, would I have would I have had time to start a blog and a podcast? And I’m pretty confident that the answer would be no, I wouldn’t have. It goes to show how how much free time is important to create stuff like you. If you’re just working, you gotta earn notice by your mentally and physically drained after a job. You’re probably not going to have time to sort of do your best work and do stuff that is really important because you just spending all your energy at your job and any other while being in London, because I’ve already had those processes and habits already in place, I can turning enough blog content. I haven’t I haven’t posted like a proper blog article in ages. I’ve just been doing podcasts which as you guys have known or will get to know, it’s a lot easier to get out podcasts than it is to like research a well a well researched article and put it all together nicely and to do it all to the standard that you want. It’s easier just to get on taught him sheit with a couple guys and outsource the transcription and then post the podcast. So that that’s sort of the reason that all was able to provide as much content as I did early on and still keep it flowing over in London. But yeah, I’m not too sure. I’m not too sure about you, Pat. Did you have like some spare time back in the day?

Lifelongshuffle (Pat): I don’t even know how I did it. Like, I think at the very start of my blog, I was almost pumping out two a week, like for at least a couple of months and doing that with full time work. I think it was just all of that energy and invigoration I had from discovering fire and wanting to really get into it and just wanting to learn as much as I could and get get my voice out there.

Aussie FIREbug: You had that initial excitement. Like you have so much stuff you want to say. And we thought that once. Yet you do hit sort of well for me anyway. Yeah. To a point where it’s mostly like the stuff I had sort of burned inside me up.And now, like, there’s so many topics to cover because there’s new topics like everyone, you know. I guess some people like you just told me the same thing, but that hasn’t been my experience. Like there is there’s new stuff to it to cover with all the changes, with the laws and everything. And then there’s just different stages in life that you eventually get to that you don’t run out of topics to talk about, especially with such an interesting topic like fire and finance and investing in Australia.

Lifelongshuffle (Pat): And life always throws a pandemic your way and that that screws everything up again. You know, I have some more to talk about. Absolutely.

Strong Money (Dave): And even content that’s been written about like 50 times, everyone still thinks about it and approaches are a little bit diffeent. Our message will be different to how Pat will write it and how you will write it. I say I think other people will learn from the way that each of us, I guess, expresses that that thing that we’ve learnt that we’re passing on just because of the way that we’ll explain it.

Aussie FIREbug: Absolutely. Now, I did throw it and this was this is a pretty quick podcast. And, yeah, I usually have a lot of questions lined up for my guests that I email like a week before that. This these podcasts, like I say, we’re just basically was like, hey, you guys are starting a podcast. This is awesome. Do you want to jump on back? We’ll just talk to shit. I didn’t have like a whole bunch of questions, but I thought it would be good to have the community ask a few questions if they wanted to, especially having you guys on, some of the OGs of the FIRE game in Australia. I put the questions out there on the Facebook group. And a lot of people have written in. I’m just going read out some of those questions and talk about it, because a few of them are quite interesting and a few of them are repeating the same sort of stuff, which we spoke about it before we recorded. So if you submitted a question like what is the best investment to do? And you should combine your investments to make the perfect portfolio. It’s sort of impossible to do. And we spoke about it a lot and I’d almost say if you did a quick Google, you could find you could read articles from both of these guys that explains exactly how they invest. And I might put a link in the shadows, but we won’t be speaking too much about that. But I do have a few good questions I thought were good to ask. So, first of all, do either of you use the NAB equity builder a product? And for those who don’t know, it’s like a a loan. It’s it’s leveraging into equities is the product that NAB offer. It’s quite popular in the forums. Do either of you use it?

Lifelongshuffle (Pat): No,

Strong Money (Dave): I don’t use the data.

Aussie FIREbug: Would you consider using it or as a reason that you don’t use it.

Strong Money (Dave): I say it depends.I mean, if you’re a renter and you really want to grow your portfolio as fast as physically possible, you could consider using something like Nab equity builder because I do kind of work like I guess it kind of it’s designed to be like a home line. But for shares. So you borrow money, you pay, you pay a principal and interest loan and you can, you know, ideally earn a return that’s higher than your interest rate.But given we have enough debt and too many properties I don’t think we’d be able to take out more debt. And I couldn’t be bothered with that in any way, to be honest. If I mean, later down the track, when we have very low debt or whatever, I might consider using some of our equity in our house or something like that to invest into shares, which would be like a cheaper interest rate than using the NAB product. So I don’t use it and I probably wouldn’t be using it anytime soon.

Aussie FIREbug: Yeah. Pretty much the same. Like. I’ve got investment properties debt as well. And I’ve used that in the past, like pull debt, equity to invest in shares. And I feel like that works a little bit better. But I understand people don’t want to invest in property, like just to do that. And most people are not suited to be property investors anyway. I really haven’t looked into with that much as well, like it’s really like firstly not necessary to reach fire. That’s that’s the first point. And secondly, it’s there is a bit more risk you take on if you want to do such a thing.

Strong Money (Dave): It’s not a lock.If you look at the numbers and work it out it’s not going to be a huge extra return you’re going to make anyway by getting out of there.The difference between the interest rate over the next four or five percent and a sharemarket return about seven percent, it’s not gonna be very much unless you’re going to borrow by many hundreds of thousands of dollars. And I don’t know if it’s worth the risk.

Lifelongshuffle (Pat): Yeah, well, I don’t know if I’ve ever mentioned this before on my blog or not, but a few years back, I actually had a margin loan with CommSec. And it was an interesting experience because I found that even though it all sounds great on paper, having the loan changes your behavior in terms of investing a lot. So whereas, you know, right now during Corona virus and the market downturn, I’m just continually pumping in and trying to find more money to pump into investments. Whereas when I had the margin loan, I was more concerned with maintaining my LVR So instead of being able to buy when the market’s down, I had to, like, just lower my LVR. by any means possible, miss out on the market downturn. And then when the market’s going up, all of a sudden you have more and more equity to invest. So it kind of distorts your market timing almost If I if I can call it that.

Aussie FIREbug: Yeah, that’s interesting. That’s a very good point. I usually didn’t know that. So you don’t have the margin line anymore.

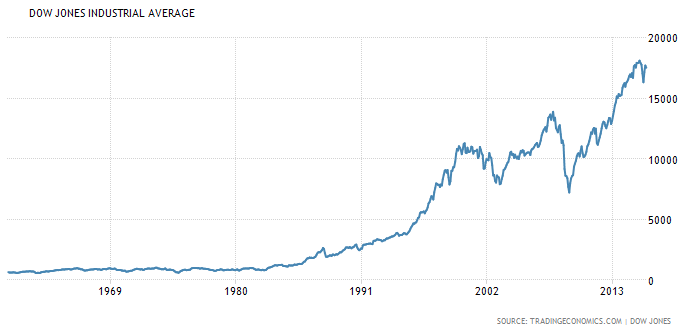

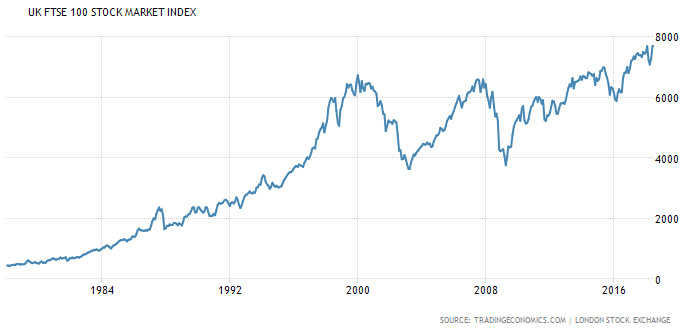

Lifelongshuffle (Pat): It’s sitting in the background. I can draw on it whenever I want, but I just find these days my I don’t know, my risk tolerance isn’t high enough to take on debt, to invest in anything, really I just I don’t want debt. I don’t want how it affects my behavior. And if you think about like with sharemarket, I think once you posted it on your blog. Dave, the number of positive sharemarket years in Australia was like 70 something percent. And so if you look at that in a different way. So seventy two percent of the time, the Australian share market produced more than zero percent across that year. Then when you’ve got interest on top of that, you’ve got like four percent. You raise the bar before you make a profit. And I just I didn’t like that. So I’d like to see the statistics, like the number of the percentage of years where the share market has returned more than four percent, which is probably the NAB equity builder rate at the moment.I haven’t looked it up and I know. Could I really let’s say it’s 50 percent. Could I really tolerate 50 percent of year’s of me not making more than I’m paying in interest on those shares. I don’t know.

Strong Money (Dave): That’s funny, because some people some people live in a spreadsheet. And I say, well, according to this I make an extra, you know, X percent per year. And its like one percent or two percent. Yeah. It’s like markets don’t work like that. No, I don’t run on a spreadsheet.

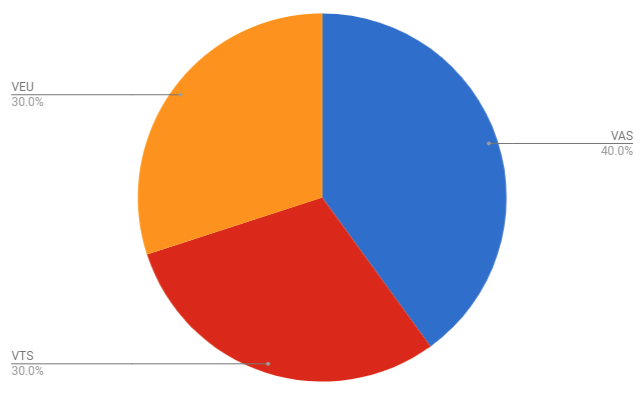

Aussie FIREbug: And it’s that classic thing as well of so many people. Majority people especially and I was like that at the start. I guess as well, they concentrate on the investing side so much and they do everything that’s so much analysis and time and everything on how to get that few extra basis points or an extra percent or whatever and so much more bang for your buck is made on the saving side. And if you actually just shopped around for a competitive home loan or did stuff on the savings side it would be so much more beneficial to your journey. And I’d even go as far to say, especially the last couple of years, like I’ve discovered, probably in order of importance to reach FIRE obviously, the savings rate is the number one thing that ought even say that once you get like the index investing,LICs some something of that nature is pretty suitable for reaching fire in Australi, in my personal opinion. But if you want to if you’ve got your savings fully optimized, I’d even say that trying to make some extra money is probably going to get you further than spending an extra few hours a week crunching the numbers in a spreadsheet, but trying to figure out is VAS better than A200 or is this margin loan going to help me out more like that. The the side hustle is something that has opened up a lot in the last couple of years of what’s possible in the side hustle space and how much that can supercharge your journey towards financial independence as opposed to, you know, Optum. Absolutely optimizing your investment is important. But I feel like it’s the last step. It should always be, save more than you earn, optimize your expenses, earn a bit more money, and then invest the rest like the very last step as long as you’re doing it like, okay, it should be should be pretty suitable.

Strong Money (Dave): And I guess like if people stopped looking into side hustlres and that sort of thing, it’s hopefully going to be in a in a space or in an industry or something like that, that dead that they’re really interested in. And I might not might not come with a huge financial rewards, but it can help them out, give them ideas and I guess motivation and inspiration for when they start reaching FIRE or towards the end of their journey.And I can transition into that new that new job as a part time gig or whatever, because it’s something that they’re gonna be really actually enjoying.

Aussie FIREbug: Yeah, it goes back to that building life at the very start of the journey, how you want to live it at the end of the journey and then sort of optimize around that. And if you do have a side hustle that you absolutely love doing. Yeah, definitely. Like more often than not, actually, it turns out to be something that most people that retire early pursue. And that’s the, you know, the career or that’s the creer that they do in their spare time once that they reach financial independence. So probably, yeah, it’s it’s very important because you don’t want to be in a situation where you reach financial independence just for the hell of it, just to say that you’ve got it. You sort of want to use that to live a better life. I have have all those options and freedoms.All right. Next question. And this is a good one, I thought, and relevant to today’s climate. So, first of all, how much do you guys keep as an emergency fund? You can either give a dollar amount or percentage and. Are you increasing it or decreasing it during the course of it?

Lifelongshuffle (Pat): I keep a basically a zero dollar emergency fun. The only money thats like liquid is just like the amount I need. So the next the next shop or the next bill that comes in doesn’t send me bankrupt. So it’s only ever a couple of thousand at a time in my bank account and everything else just gets shuffled straight into my investments.

Strong Money (Dave): Mr. Efficiency over here.

Lifelongshuffle (Pat): Do you have what do you have some sort of plan that I like if. So obviously you can sell your investments, though that’s the last thing you want to do in a downturn. Do you have can you withdraw from like a redraw account or something or is there something in the reserves?

Lifelongshuffle (Pat): Yes, I feel like the everyday sort of emergencies people think of. It’s like, oh, your water heater or your car or whatever, and you just throw that on the credit card and that’ll be paid off in the next two paychecks. So that’s not a problem. Let’s take it to the next level up. And that’s like all you’ve lost your job or you’ve lost your income. That’s sort of an emergency. And I’ve also got like my CommSec margin loan just sitting in the sitting in the wind to draw upon if I really need to, until I get my next job or bout of dividend’s anyway, which is just coming out of the portfolio automatically. So being a renter with no children and minimal lifestyle expenses it doesnt cost much to be pat the Shuffler, I just see it’s like why, why do I need twenty thousand sitting on the sidelines.How long do I really expect to be out of work and why can’t I just cover that with a margin.Mind if it ever comes along instead of having all that money not earning. You know, if I kept thirty thousand not invested since I started this journey over three four years ago, I would have lost maybe that much again. It’s already paid off for me. That gamble. Even if I do lose my job right now and have to draw on the margin.

Aussie FIREbug: What about you, Dave?

Strong Money (Dave): So our situation’s a little bit different in I don’t know if your guys might be aware of how we’re transitioning off from property to shares over time. And so what happens is we sell a property and we’ve got a big chunk of cash that sits in the offset account. Now we live on some and we invest the rest into shares each month. And so we have quite a lot of cash. But it’s not really I mean, it’s not really what we want to have long term. So I wouldn’t use my situation as like a guide. I would just I guess in normal time/ term, I would expect us to not keep very much in an emergency fund at all. I mean, we’re retired and we’re both adding some income. So, I mean, the portfolio plus that that bit of income is more than enough to cover our expenses and if something popped up, we might keep maybe a maximum of five percent in cash. But that would be it would be at a maximum.

Aussie FIREbug: Yeah, right. I don’t know if you guys have read like some of the articles. It’s funny to to read online to their credit but It’s like the US articles, but there’s a few like gotcha articles, It’s like, oh, they had this grand plan and they retired and then COVID comes along and thier screwed. Isn’t it funny to to read those and be like, well, actually, the people that have retired probably have about 100 times the wealth of anyone not fired. So they put me in that position. Well, they can pretty much guarantee they’re in a better position than 99 percent of the people out there. So I fail to see how this is a sort of give up.

Strong Money (Dave):.Oh, very. We had this exact conversation the other day when we were recording a podcast on one of our podcasts. Like when I first read something ridiculous,

Aussie FIREbug: What was your what was your summary

Lifelongshuffle (Pat): You know, crazy 35 year old retired with a million dollars and now the thirty five year olds only got half a million dollars for thirty five year old.It’s like this what you’re saying that it’s ridiculous.It’s like the thirty five year old who now ONLY has half a million dollars isn’t in a spot of trouble. It’s outrageous.

Aussie FIREbug: I don’t know how they like publishing these articles, but, you know, they’re going to sell some clicks. The next question actually. Sort of is in a similar space to the previous one. But has the current downturn made either of you change strategies at all? And I guess with me and pat still in the accumulation phase is a bit different from your diet. But I am interested to hear from you, Dave, especially considering you are retired and like we always do hear about that the worst case scenario for someone that wants to retire and a hundred percent not earn any income, which, by the way, pretty much never happens. But the worst case scenario is that you retire and the market crashes.So I am interested to hear what you say. But we’ll start with you, Pat. Like I’m assuming nobody has has this downturn to change your strategy at all. The people want to know, though.

Lifelongshuffle (Pat): Not whatsoever. I’m still accumulating. My plan has always been to throw everything into equities for as long as possible while I’m still working. And then when I decide to retire. I’ll have another look at my bond allocation or my safe allocation. But to be honest, I’m still doing more research around bonds. And there’s a lot of really conflicting information, I feel, from even the fire community around how useful bonds are and whether they really handy in a day accumulations phase. So I’m the jury is out for me still, but it certainly won’t be like, you know, 20 or 30 percent safe assets. If anything, it might be zero to 10 percent in safe assets once I retire. It’s not going to be anything crazy.

Aussie FIREbug: And what are you buying, if you don’t mind me asking? In terms my all my equities.

Lifelongshuffle (Pat): The latest. Yeah. Sorry. The latest purchase has been VGAD a day, which is the hedged version of VGS. If you don’t know and I know you’ve been paying attention to the Australian dollar. So I think maybe about a month ago, the Australian dollar dipped to like fifty five cents, which is below its long term average. So I’ve always sort of thought, you know, not really being a lot of firm information around the whole currency hedging space. Again, it’s sort of a bit of a grey area which needs a lot more research. But being below its long term average, I thought it made sense to go hedged instead the unhedged virgin.

Aussie FIREbug: Yeah, nice. You do look at like some of the unhedge stuff like VTS and VGS. So if you look back at like, VTS, which is the US market and like you look at the returns from like 2010 are just crazy. And half of those returns are because the Australian dollar is so bloody high. Was it was over parity at one point and all was actually in America. And also, like I was holidaying there, if I can, 2013.And I remember I’m like, hindsight’s 20/20. But man, if that ever happens again, I know I know what I’ll be shifting allocations to.

Lifelongshuffle (Pat): Yeah. I’ve always thought the same thing. Yeah. Back in 2012, it was like a dollar 12.

Aussie FIREbug: Yeah. American one Aussie dollar was born over a dollar ten U.S., which is just insanity. Think about it, I got Very lucky with that holiday. Yeah. And even like I said, I’ll be keeping an eye on the Aussie dollar to the sterling. I sent back a fair chunk of money when it was over two dollars. But now it’s like I think it took a dollar. Ninety, one sterling gets you only. So it’s men. The fluctuations in the stock market, the currency market, the oil market, like it’s just crazy, crazy times at the moment. And so what about you, Dave? Strategy changed at all. And any thoughts on, like, someone that, you know, you are retired and the market has gone down a lot. So can you just speak a little bit about that, how you guys are handling not.

Strong Money (Dave): Yes. We’ve only got about a third or so of our total wealth in our personal share portfolio. Just because we are in this kind of transition stage, I suppose. So I guess when you look at it in terms of networth, it hasn’t been such a big drop as it would obviously if we were all shares right now. So it hasn’t been hasn’t been all that scary. I’ve been excited to actually put more money into the market, to be honest. Yeah. So maybe if we were all shares that we’d feel a little bit different. But in terms of strategy change, Not really. I mean, we’re still putting putting money to work, still buying shares. Only anything that I’m thinking more about lately is like international diversification, because I know you guys will know that I started like hundred percent Aussie equities for our shares and so over the last like year or so, I’ve been thinking more about that. And we’ll probably add. Our Super is currently set up as a 100 percent international shares. I’ll probably add some international shares to our personal portfolio as well, just because, like, the more I read and experience and learn, the more I come to appreciate diversification. So we’ll probably startYeah, that’s it, that’s it. That’s about the only change. I mean, everything’s pretty much the same.

Aussie FIREbug: I’m in a similar boat to you, Dave. Like off we’ve got the two properties that we want to transition out of Eventually and be 100 percent equity. I was Literally going to list one. I was talking to a few agents. I had the one I wanted to I was like as if we had to list a boom covered. It’s like we can’t even see the property anymore. It’s just, oh my God. So that’s sort of on the backburner as well at the moment, which is super annoying.

Lifelongshuffle (Pat): And you know that it’s back open. You know, it’s back open this weekend.

Aussie FIREbug: I don’t. Is that I’ve got the two in Queensland, so it’s hot.

Lifelongshuffle (Pat): I don’t know about Queensland and New South Wales. Open homes and auctions were allowed. Today was the first day.

Aussie FIREbug: I think that’s good to hear. But I still it’s hard for me to think that it wouldn’t take a hit just with the current climate. Even in Queensland. So I guess I’m going to have to wait and see. It actually could play out in our favour a little bit because we are wanting to buy a family home back home where we’re from next year. But I am watching the property market like a hawk at the moment over all the alerts turned on and everything. And even if a property comes out that way that we like and it looks good at like a discount or a nice price, I think we’re just gonna pull the trigger and buy it because it’s so hard. I have being burnt before with property. My first one that I sold, I actually had a higher offer that I waited on and then like waited a few weeks and then the market started to go down. I ended up selling for like it was like 20 grand less than that first offer that come in. And like I say, hindsight is 20/20. What I’ve decided on with property moving forward, if it’s a price and I’m happy with and it’s a good, good house, we’re just gonna have to pull the trigger. Like, you cannot wait white and you cannot be I could go lower. It’s like not happy. Just do it. And the same goes with property, even if it’s a price you both agree upon.Just pull the trigger because you it can work out better, but you can get a lot of the time waiting for something to happen.

Strong Money (Dave): How many people do that in the share market? So, I mean, it’s gonna go lower. Just wait. Oh, just wait. Yes, exactly.

Aussie FIREbug: Right. Yes, that’s. Yep. It’s the same. It’s really it really is the same, the same mindset and psychology behind both of those. Which is why the strategy of simply buying every month is so powerful. Right. Like you don’t have to think about have to get worked up, you know, like this psychology’s taken out of. It’s just like Matt. That’s just what I do. I bought the end of the month. I buy this. I buy this. The waiting is, you know, I buy the the lowest weighted split in our strategy. And that the thinking, my dumb thinking is taken out of the equation. And it’s Semi automated in the process. Next question. So I’ve only got I’ve only got two more. Don’t like this one. This one’s interesting. So do either of you invest in Bitcoin?

Lifelongshuffle (Pat): I think that’s an invalid question. You can’t invest in Bitcoin. You can buy Bitcoin. NO

Strong Money (Dave): No

Aussie FIREbug: Oh, now, this is an interesting one. And I’d love to know your thoughts on this, Pat, as you’ve had a pretty strong view on Super.So assuming that your eligible are either of you withdrawing from your super. Hypothetically, would you consider withdrawing from your super and that’s obviously the new the new laws that the government come out with the new COVID laws that you could withdraw 10000 in this financial year and another 10000 next financial year.

Lifelongshuffle (Pat): Now, you’ve got me in a pickle because I don’t know honestly what I would I pull it out if I were eligible because I’m as I said before, I’m still in full time work. So I’m not at all eligible for it.So it hasn’t really come to the forefront of my mind.Yeah. I honestly, it may surprise people, but I probably wouldn’t take it out. I probably just leave well enough be. It’s money that I haven’t accounted for. It’s money that I don’t really I almost don’t believe it’s there.It’s like it’s just kind of there.

Strong Money (Dave): You have so little faith in the system and I’ve already written it off!

Lifelongshuffle (Pat): So I just I don’t even think about it too much. But it’s also. It is nice to just have something that I am not considering as part of my Main numbers as sort of a backup plan, and I just. I’ve got my main plan. And if that ever goes to health, whatever reason, then, you know, when I hit 60 or whatever it may be, I’ve got, you know, however many hundreds to thousands just waiting for me in another account that I’ve long ago written off.

Aussie FIREbug: Fair enough. Dave?

Strong Money (Dave): I’m a little bit like pat in the sense that I think of super mostly as a backup plan. And that’s really just because we didn’t think about it earlier, just because it’s so far away where we’re all roughly the same age right now. All three of us I think early 30s. So it’s just so far away. But.I actually think I mean, I don’t know the exact rules around this.I think if you have to be affected by COVID or just not working. I don’t know if I would qualify as not working. So maybe I don’t I might be eligible. I’m not really sure.

Aussie FIREbug: I think it’s a view. If you’ve been if you’ve lost your job, you’re definitely eligible. Have you had your hours reduced by 80 percent? You’re eligible. And there’s a few other criteria. But I think the bulk of people that are going to apply for it have been hit by those two things, like basically lost a job or had their hours reduced by 80 percent. But there’s a lot of gray areas in the law because it was rushed through. It’s like it’s self-assessed as well. So you can just apply for it, get the money out and if the ATO come knockin, which, you know, like how many millions of people have already done it.So the odds of you even getting audited would be pretty low anyway. Then you’ve got to sort of prove that you lost hours or you lost your job or something like that. But it’s it’s very gray, but it’s gonna be interesting.Mrs. FIREbug actually is eligible for she lost her job and because she’s eligible for it I did a bit more research than I otherwise would have. We’re at this point in time things could change, but we’re leaning towards taking it out just purely because of the whole you have to wait to your preservation age to get it so you can take it on tax free. And there’s actually is a whole bunch of little.Like, this is a trick you can do, which is sort of against the spirit of the law. But it’s perfectly legal. We can put it back into super.But I don’t know of the idea is going to plug that. I actually have a podcast specifically about this coming up. Yeah, it’s an interesting one. And I feel in that situation, I would rather have I’d rather have all our money. Like, if I could deplete super completely and put it into our personal accounts, I would purely just because we can get to it before the preservation age. But ten thousand dollars this financial year and 10000 dollars next from Mrs. Firebugs account. We’re leaning towards taking it out even though it’s going to be taxed in a higher tax environment for the time being. I still think it’s valid for our situation, but I’ll go heavy into those details in another pod.

Lifelongshuffle (Pat): I was just going to say maybe it won’t be taxed in a high tax environment for the time being because you’re not aware to get it.

Aussie FIREbug: Yeah, I know exactly what you’re getting at. Yeah. That that’s the that’s really the only the only argument against it. And like from a fire point of view, it makes sense. Like everyone that’s written these articles, like Scott Pape, the Barefoot Investor, everyone’s like, no, no, no, don’t touch it. Don’t touch it. They’re all assuming that one you’re not going to invest that money back into. You’re not going to put that money back into investments, which, to be fair, the spirit of the law is really it’s not intended for rich people to take money out of this super to reinvest it. It’s what people that are financially distressed to live off it. So I understand that like the barefoot investor is saying do everything you can to not touch your investments. Don’t take it out and buying a car or something. But for the fire crowd, it could be it can actually be beneficial depending.And as as we always talk about, it depends so much on where you are, the journey, what how old you are, how close you are to preservation age, what your goals are. Do you want to retire early? Are you happy to workto Fifty, fifty five.It all plays a part in the decision, but for our situation, yeah. It’s looking like we’re gonna do it now.

Strong Money (Dave): I mean you say star is like yeah if you take out ten thousand dollars you’re gonna miss out on one hundred and sixty thousand dollar.So you’re insane. But like to fire a crowd. Oh you’re really doing is moving money from an inaccessible account to an accessible account. It’s just that it may be taxed at a higher rate or a lower rate.

Strong Money (Dave): And obviously the benefit You get that money right now, which can help you in terms of, you know, ridging bridging financial independence. But it’s not a massive amount of money, so.

Yeah. Interesting topic. Oh, and speaking of interesting topics, this next question. So very you know, a lot of people have different opinions about these, but how are kids if you are going to have kids in the future going to affect your phone number? And is that factored into your goal? Dave, I’ll start with you. And I believe that you’re not planning to have kids in the immediate future. So this might not be valid for you. But I’ll let you answer.

Strong Money (Dave): Yes, I yeah. We’re not having kids, so it wasn’t part of the plan. I mean, if we were to I don’t see it as being insanely expensive as people think it is. I mean, I did a little bit of research because people have asked me, you know, about kind of a question like this and talking to parents and reading in forums and different places.And it’s like, wow, it depends. You know, you can spend this much, but you can also spend just this much. So it really seems to be down to personal choices on how much you spend.And so I don’t think it’s as expensive as people claim that is. I mean, it can be but Doesn’t have to be the case. So I don’t think it would blow out the number to fire All that much.

Aussie FIREbug: What about you pat?

Lifelongshuffle (Pat): So we are planning to have kids and it is worked into our FIRE number.No, I sort of advertise on my Web site is just my number.So it doesn’t include Stephs Networth. And, you know, the goal that we both want to reach as a as a combined unit.But as a combined number, which is sort of opaque to all of our readers and my readers, even we have considered it. I think there’s a lot of hysteria around kids costing a lot of money. And it’s it’s almost like the hysteria around retirement costing a lot of money. It’s like you see all these numbers just thrown out there. It’s like all you need 10 million to retire. You need five million to retire. We know that’s nonsense. I feel like it’s a bit the same with kids. Like it will think it will cost a million dollars to raise a kid from zero to 18.And that’s that is actually nonsense. Like I’ve done looked at research done. I forget which government agency in Australia did the research, but it it shows like kids can cost anywhere from zero dollars, literally zero dollars, because the government gives you more money than you actually spend on your kids up to two hundred thousand or four hundred thousand or whatever it may be. And. It depends on the decisions you make and what you value out of life, whether it’s violin lessons or taking your kid bike riding.

I think it’s a little bit sad because I think there’s almost like a judgment that’s put on people. If you think if it’s said that while you only have to spend this much on your kids, it’s. Oh, yeah.But I want to like I want you to ask for my kid. I want to give my kids this.It’s almost like a judgement thing.Like I’m a better parent because I spend more on my child. Yeah. I don’t really believe that.

Aussie FIREbug: Yeah. My partner’s sister has gone pram shopping, it’s absolutely ludicrous. How much do they cost is what the first thing it’s like. Holy hell, is this a car or my buying a new car or buying a pram? Secondly is the the absolute like the guilt trip that some of these sales they will do. It’s like, well, you know, we got this we got the deluxe two and a half thousand version. Like, you want the best for your baby, right? Like you want the best. This is so, such a like tactic to make people spend more money. And it works.

Lifelongshuffle (Pat): My friends bought a pram maybe a year ago, and they had Pay like an extra one hundred and twenty dollars for the coffee cup holder that attached to pram. The whole pram should cost one hundred and twenty dollars. Not the coffee cup. Hold up. This is crazy.

Aussie FIREbug: I like the safety features as well. Like Ali safety features. I will that that model isn’t as safe as this one. And like that, that gets a lot of people to like. We need to be 100 percent safe. We need to be so safe. Like, would we be bad parents everywhere, the safest possible parents we could possibly be.And yeah, I don’t want to put my baby at risk. Yeah. Yeah. Three thousand dollars on a pram. It’s like, oh, my other flatmate works in marketing and like you and I are so smart. So these of the strategies I honest to God. They really tugged at all the emotional heartstrings of people. And yeah, you spend a shitload of money on something that’s like Yeah pretty sure people made do back in the day without, you know, taking out a mortgage to buy a pram.

Strong Money (Dave): That’s a big deal.You have to remember what people used today or what people do in other countries don’t have as much disposable income generated and people manage just fine.

Aussie FIREbug: Yeah. Yeah, it’s definitely yeah. That they’re very clever of how they suck. you in. But I agree that’s it’s a status thing. Yeah. Yeah. Oh yeah. my sister’s a wedding photographer but she also does like kids’ birthdays if their parents are crazy enough to hire a professional photographer. But she does all these other like events. And yes, some of these melburne moms that, you know, drop fifteen hundred dollars on a professional photographer to be at a two year old’s party. And then she goes there and there’s like a jumping castle. It’s full on. they spend more money than some people spend on their weddings for it.It’s crazy. It’s disposable income. And it’s just crazy. But yeah, we personally like we want to have kids. I don’t really like I’ve said ballpark, you know, a million dollars, but that’s not factoring in kids. And I don’t sort of like to plan too far into the future, like too much into the unknown. Like we are planning to have have kids, but we don’t have kids. So this is the FIRE number as of right now based on our saving rate and their estimation right now. So when we do have kids, it will obviously change. And I feel like that’s almost another like Gotcha.Some people like, ah, you know, kids like that.I am very interested as well to see how much it actually costs to have kids with someone being from the fire community. Because we all know that, you know, people in this space usually Hunt around to and get the best deals. We’re not afraid to use secondhand prams and secondhand and everything like that. So there are a few blogs out there. But are we completely honest because we haven’t had kids yet? I haven’t taken like a great deal of interest consuming all that content yet. And I guarantee that will probably change the day I became a father. How do you like absorbing all that information? But I really just haven’t gone down that rabbit hole just yet.

Strong Money (Dave): I think from memory, I think Mr. Money Mustache has a post about how much it actually or how much I spent raising their kid. And I think it was something like it was under five grand. And I think it might have been like about four grand a year or something on average, which was like, what’s that gonna cost…. An extra hundred grand to your fire number?Yeah, I mean, that’s that’s not a massive amount really. No, I think I think some people also use it as an excuse. Oh, that’s why you can retire. Yeah. Good luck trying that if you have kids, you know.

Aussie FIREbug: Yeah. That that’s that’s a bit. Yes. One hundred percent like oh this this fire thing is only for people that don’t have kids. It’s like I how true that is, it’s so new as well. Like it’s gonna be very interesting in the next couple of years. How many people actually reached the financial independence and then, you know, how many of us can sustain it. I think it’s going to change the concept or change a lot of people’s views. Yes. Only you only need to be in a certain demographic. You can’t have kids. You need to be earning, you know, a million dollars a year for for it to be plausible. But we know that’s not sure. And I think that’s gonna be proved in the next five or so years when we’re we’re all still kicking around, you know, hopefully. if COBID has wiped out the planet.

Strong Money (Dave): I guess as time goes on, there’ll be more and more examples of people from different backgrounds, different life circumstances back, and will now have achieved their own version of financial independence.On different incomes and everything, so it’ll give the people who are new to the, I guess, new to the scene and each beach person will have an example to look up to like, oh, that person’s like many of these persons like me.

Aussie FIREbug: For sure. All right. Well, I’ve exhausted all the Facebook questions, so I think it’s nearly an hour that we’ve been recording. So, guys, it’s been an absolute pleasure having you both on fire and show podcast.I’m going to have a link in the show notes. Put it in your calendar. It’s gonna be fantastic. I can’t wait for the first episode. And thank you so much for coming on, both of you.

Lifelongshuffle (Pat): No worries. Thanks. Thanks. Thanks for having us. Matt.