Aussie Firebug: Hey guys, welcome back to another episode of the Aussie Firebug podcast – the Financial Independence podcast for Australians where I interview clever people who have already reached, or are on their way to, Financial Independence and occasionally different products and businesses that I believe can help you reach FIRE sooner!

What do you guys use to track the performance of your portfolio? Do you actually use anything at all? Do you even track the performance of your portfolio?

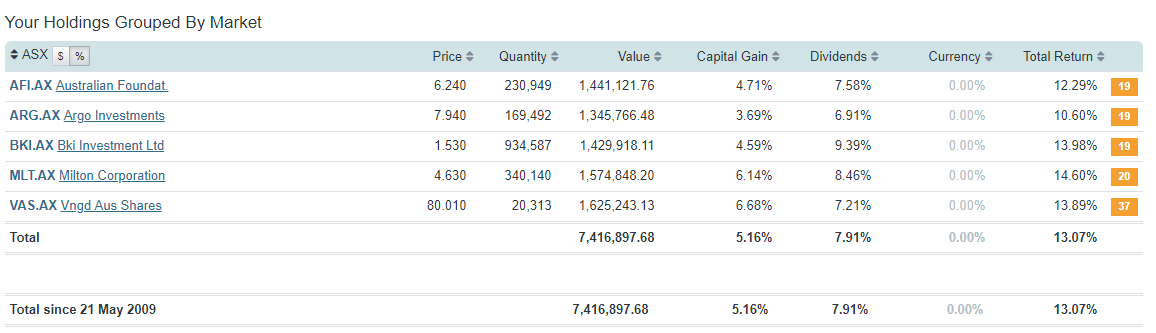

Today I’m chatting to Doug from Sharesight, which is by far the best portfolio tracking software out there. It’s an Australian, actually I think it’s’ a New Zealand, company but like most things we will claim them as Australian. It’s a company, anyway, that does performance tracking of your portfolio and it’s really a must, especially come tax time. It also takes into consideration things like franking credits, things like DRP, share splits over time, currency movements. I believe that every person that invests in Aussie shares should have an account with Sharesight because one of the best things about it, is that it is free for under 10 holdings. And if you have more than 10 holdings, stay tuned for the end of the pod to see how you can get a discount. I’ve got something special for you guys at the end.

Basically, we are going to chat to Doug today and what it can offer investors and how I use it as well. I think it is really crucial come tax time because it makes tax insanely easy and we are going to go into it in the pod, but it really, really is a must have for tax time unless you want to go through it yourself and generate it all. It’s really exciting and there are a whole bunch of features as well, that we are going to talk about in the pod, so stay tuned and we are going to get into it now. Cheers.

Aussie Firebug: Welcome back guys to another episode of the Aussie Firebug podcast. Today I have the pleasure of speaking to Doug Morris, the CEO of ShareSight – the best share portfolio tracker for Aussie investors. But Sharesight does a lot more than just telling you the true performance of your portfolio. There’s a bunch of other useful tools and features available and some of which we are going to cover today. Welcome to the podcast Doug!

Doug Morris: Thank you very much Matt for having me on. I appreciate it.

Aussie Firebug: No worries. Now why don’t we begin with: For those that have never used Sharesight, can you give us a brief description of exactly what Sharesight is and how it can help Aussie investors?

Doug Morris: Sure, so Sharesight is fundamentally a portfolio tracking tool It is cloud based software and we focus on performance reporting but we do so at a really accurate level and as a result of that we can product tax reports for investors as well. So we don’t offer anything like execution, or financial advice or stock recommendations, we just stay very focussed on the administration and the tracking of investment portfolios.

Aussie Firebug: Awesome. When was Sharesight first created mate?

Doug Morris: Yea, we are sort of an old startup. We’ve kind of been around since before the entire FinTech movement took off, so we launched in 2008 actually. We were started by a father and son team over in Wellington, New Zealand. So the father, Tony, was a pretty keen investor – a former accountant. And his son was involved in the tech space, not really an engineer himself, but knew enough about it to be dangerous. So Tony, the father, was basically saying, look I need a way to track my performance. And what he was doing, like many of our clients did before they found us, he was doing it in a spreadsheet. He was going in and updating share prices manually, he was trying to combine things like dividends and corporate actions and build some fairly elaborate macros and formulas to work out annualised performance. He just couldn’t figure out for the life of him, why there was no software out there that did this? Because you don’t get this information from your online broker and he just really wanted a way to kind of distill his investment performance in terms of annualised money rate of returns so it can be practical and sort of transferable to other areas of his financial life. So that is really kind of the kernel of how we got started. The guys then built out a Kiwi version with the local nuances there. But always with the view of going over to Australia, just given the size of the DIY market here and some of the inner complexities of things like franking credits and capital gains tax here in Australia. The rest is kind of history.

Aussie Firebug: Interesting, it’s funny that you mention that. I didn’t know it was created in New Zealand. A couple of things I want to touch on, I’m detecting an American accent from your voice so I’d like to get into how you got involved with Sharesight but before we do I’m not too sure if you are aware but Australia has a history of claiming things from New Zealand as our own, a lot of sporting players and I actually think even Phar Lap is a New Zealand horse and we claim it as ours.

Doug Morris: And of course, the Pavlova debate as well.

Aussie Firebug: Well there you go, I’ve always thought Sharesight was Australian. So I’m sure there are some New Zealand listeners that will now have a bit more ammo in regards to that argument online and at the pubs and what now. So going back, 2008 was an interesting year to launch such a software, considering what happened.

Doug Morris: Yea I know it’s funny, the guys only now reflect on the fact that they were launching a DIY investment software into the teeth of the financial crisis, but I think for markets like New Zealand and Australia, they were certainly affected, but not at the scale of things in the States or Europe. The guys, at that time it was just the 2 of them working away at this thing. These kind of tools should be performance-agnostic – what I meant by that is if the market is tanking or the market is on a really long bull run (which we are seeing both of recently) people should stay on top of their performance but obviously human psychology doesn’t always dictate that.

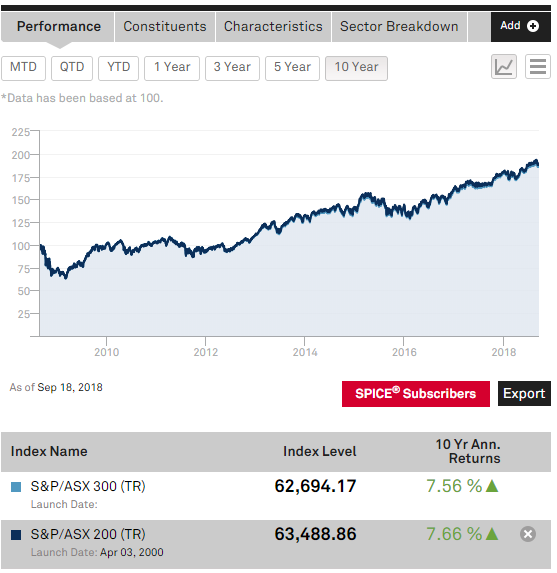

Aussie Firebug: Absolutely, absolutely. And it is so important, you touched on the true performance because that is very critical when determining how well your investments did. Because I know if you talk to 10 different investors they might have…before such such software as Sharesight, maybe not in 2018, but previously and I’m sure the founders of Sharesight can attest to this as well, a lot of people were missing a few things with their returns and calculations. I know a common one, and I see it to this day in articles and things, they might not factor in Franking Credits or something like that. They miss out on the overall true return of investments which is just so important. I remember when I was Googling, before I found Sharesight which I use and I think is the best, for tracking your shares, there just isn’t a whole bunch that does the true reporting especially specific to Australian circumstances. It definitely has filled the need. It sort of took me by surprise when I was doing some research for this podcast, really, was there no other software on the market, back in 2008, that was doing this?

Doug Morris: Yea it is true. So where you’ll find annualised money-weighted calculation methodology really done appropriately at the cost base level, factoring in dividends and corporate actions and all the rest, you’ll find that in institutional realms. So if you’re a fund manager or a quant or something like that, you’ll have access to some of those tools. But of course, those are big software systems that are totally prohibitive, cost-wise, to the average self-directed investor. And even at my previous career at MorningStar, where I spent 8 or 9 years, they had portfolio watchlist tools but they didn’t really capture true performance. And it is so important, because what I hear a lot when I’m at the pub, sorting casually just saying what I do or talking to investors at various events, I say “How do you track your portfolio”, that’s my leading question and often people will say, I just rely on my broker. Which I just cringe, because that is not an accurate representation of your portfolio because in most cases, your broker doesn’t factor in how long you have held the investment, they don’t factor in dividends either. If you look and say I bought these shares 5 years ago and you are up 200%, that might look really good but when you annualise it, it actually comes down quite a bit. You see it in the press all the time, especially with property, a celebrity bought a 10 million dollar property and sold it for 20, doubling their return. Yea but, they owned it for 12 years and they spent 6 million dollars fixing the place up – these are all the things you need to factor in to investing as well. When you break it down into annualised terms it is transferable to other parts of your life. You get paid in salary,m you pay school fees, you pay a mortgage, you think of interest rates. They are annualised and it shouldn’t be any different in your share portfolio.

Aussie Firebug: Absolutely, it is so important, you read articles about performance of asset classes, and property is a popular one, but usually there is a bias on most articles or they are trying to push some sort of agenda or they are working for some different company, so of course they are going to leave out certain things. And I have even seen it the other way, anti-property people will look at a return from a property but they won’t factor in leverage and the actual how much money cash on cash return, they will just look at the overall return of the property and say that shares outperform but if you actually look it cash on cash you get a different story. So it goes both ways, it’s not just one asset class.

Doug Morris: People misquote stock market indices all the time as well. You hear all the time, the NASDAQ is up 38% on the year. Yea great, but how are you, the investor, investing in the NASDAQ. Are you buying an ETF, are you buying some shares in the market? When you kind of break it down, are you actually going to execute on that. That’s where tracking becomes so important.

Aussie Firebug: Yes, absolutely. Now I wanted to ask before we got off on a tangent, how does a, I’m guessing you are from the States with that accent?

Doug Morris: That’s right, yes.

Aussie Firebug: How does a yank come across to Australia and get involved with a company like Sharesight?

Doug Morris: I’ve been in Sydney for about 10 years and I originally came down with MorningStar. I got my first job out of uni with them, working in their asset allocation research division and I wanted to move more into the client-facing and sales and product realm. And they launched a program where they trained us up and sent out to various international offices. I was given the choice of Toronto or Sydney, and being from Chicago I said I’m not going to move to Toronto, it’s even colder and it’s close so send me down to Sydney. It was supposed to be a 1 or 2 year stint and I ended up falling in love with the place and staying. So I worked here for a number of years with MorningStar. Then a former colleague of mine who invested in Sharesight and was a power user himself came along and asked me if I wanted to join the team. From there I sort of worked away and became CEO after a couple of years. The basis of my interest in Sharesight though was always in the product area in MorningStar where I worked on software products for self-directed investors and financial advisors. I always thought that there was a lot of opportunity out there in terms of helping people look at their real data with these software tools and empowering them to make better investment decisions, really.

Aussie Firebug: Excellent, excellent. Now I guess it sort of depends what weather you prefer but yea, Toronto… I have been to Toronto before, sub 15 with wind chill versus the hot beaches of Sydney, eh might have been an easy decision for you. Although Toronto has the Raptors and the NBA so I do like that.

Doug Morris: They do. No, Toronto is a good city. Nothing against Toronto

Aussie Firebug: And do you know I’m actually from Victoria and they say Melbourne and Toronto are very similar so and I always have liked Melbourne. Yea, Toronto, I’ve got family there it’s really a nice city but the cold, man! It’s freezing when I went and I only went in the winter and it’s bloody cold although I do snowboard. Although there aren’t really mountains near Toronto, you gotta go west to get to the snow but yes, it’s a good city. Moving on, I wanted to talk about. We know that Sharesight has awesome, kick-ass reporting, true performance of your portfolio, but the other thing I use it personally for is for tax and tax work. It makes tax work an absolute breeze. Now recently, you made some changes to the way that Sharesight does the tax admin work for ETFs especially. And from what I’ve read, I haven’t used it yet, it makes it a breeze for Aussies to do their tax returns, can you go a little bit into these changes and why Sharesight makes tax returns super easy for Aussie investors?

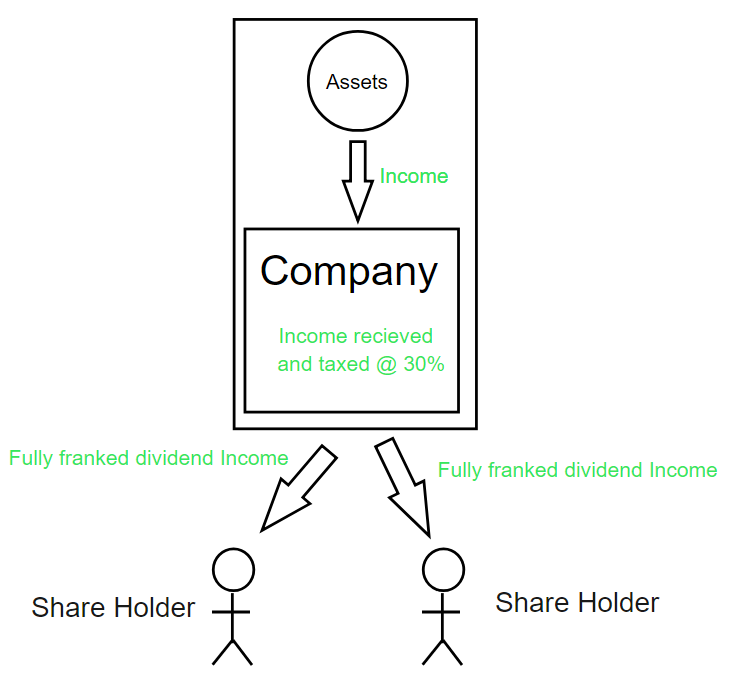

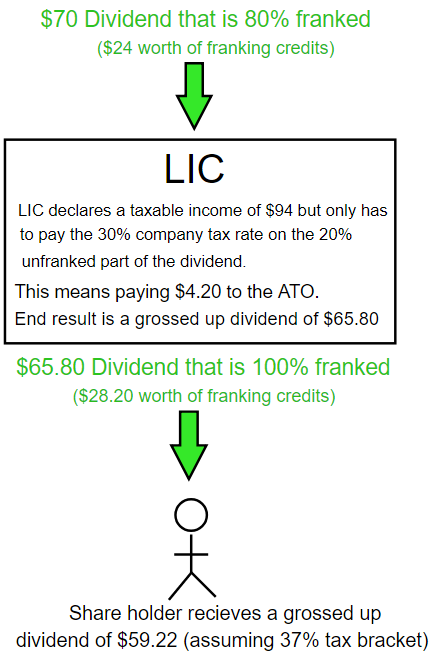

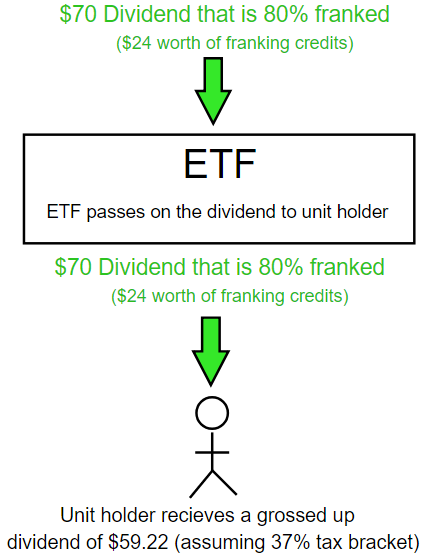

Doug Morris: Sure, so because the way Sharesight works is we actually get the cost basis for all of your investments, we go down pretty deep in terms of the data in terms of the data that we require to get your portfolio set up and running and as a spin out of that we offer our clients, capital gains tax reporting, unrealised capital gains tax reporting and also, taxable income (i.e, dividend income) reporting as well. Our aim with these reports is to give you a really good steer on what your actual tax liabilities are, without going as far as having a seamless way to lodge those taxes. What kind of happens/the way this kind of develops is that it was always, i’m not going to say easy, but more straight forward to calculate tax, be it movements in capital or taxable income, on listed shares. So you bought or sold shares in a company, you receive some dividends – yes, there are some complexities around the franking credits but once we built for all that, it kind of took care of itself. There’s always a few nuances here and there with various corporate actions but those tend to be kind of a manual, off-market sort of transaction anyway so we can help our client base as they popped up. But then what we saw happening was the rise of ETFs. This wasn’t a surprise based on how popular ETFs, and similar vehicles, have become overseas. For example, when I actually interviewed with MorningStar which is all the way back in 2002, I was interviewing for an internship at the time. A piece of advice that I received was Do your research on ETFs and I didn’t even know what an ETF was. At that time they were in the realm of institutional investors, they were using ETFs to park some cash or to hedge, institutional strategies but as we know ETFS have become mainstream because their low cost, liquid and now-a-days there is an ETF for everything; active ETFs, passive ETFs, there’s really esoteric things out there like crypto ETFs.

Aussie Firebug: I was just about to say, is there a Bitcoin ETF? I didn’t think there was yet.

Doug Morris: There are, it depends what country and I’ve seen a lot of stuff in the press about how they kind of get close and the regulator will knock them back. I would exercise extreme caution when it comes to those, and definitely do you due diligence.

Aussie Firebug: Yea, I just don’t understand. I guess it would be easier for most people, I don’t know why you wouldn’t just buy the Bitcoin yourself? Why you would have to go through and ETF?

Doug Morris: That’s right. You always are going to need a way out of buying the underlying asset itself, and if you can versus buying a sort of packaged investment around it. Just to give you an example of popularity, we offer a Self Managed Superannuation function inside of Sharesight so you can apply that tax setting to your account. And we looked at the data recently and I think it was back in 2008 if you looked at the trade inside of SMSF portfolios, ETFs only accounted for 2% of those buy and sell trades, in those portfolios. Fast forward 10 years, I think the number is 22% of trades inside of SMSF portfolios are ETFs. Which is just a huge increase and if you assume that people are buying and holding ETFs, they aren’t trading them, certainly not on a day trading basis AND if you think of your average SMSF trustee you are going to be doing a lot of buying and holding. I suppose from a lion share in a portfolio, those ETFs are making up more and more of the overall dollar composition of those portfolios.

And so we started to get feedback from our clients, via Twitter and our client forums and from various places, that our tax reporting just wasn’t quite rich enough for ETFs specifically. So we said alright, this is something that we have heard before we’ll just go back to our data providers and huddle internally and figure out if we can do something about this. The problem really turned out to be a lot more complex than we anticipated and we were actually given a lot of help in this regard via our partners at Six Park, who are a robo advisor that uses Sharesight as a platform, so we sort of teamed up on this one. What we did is we went door knocking, we knocked down the door of the ASX, we knocked on the doors of various share registries, we went to the actual ETF providers themselves such as Vanguard and it was just really difficult to get a straight answer on the components of these distributions.

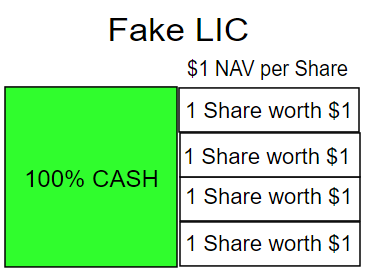

And before I get too far into the weeds and this is kind of the ways it worked, if you buy and hold ETFs you receive distributions. You receive 2 a year or 4 a year depending on when you receive those payouts. Each distribution is actually comprised of hundreds, if not thousands, of dividends and other payments from all the underlying companies in the ETF. And a lot of those ETFs are investing locally, but some of them are investing overseas as well and some are investing in other asset classes like fixed interest, cash, bonds and all that. And you are left with this this sort of mess of a distribution every time you get paid, and that’s all well and good over the course of the year because Sharesight was displaying the gross and the net dividend. But then what happens at the end of the financial year is you get a tax report, an annual statement, from the registry. And if you’ve seen one of these, from say Computershare, you’ll know how complex they have become, especially since the ATO has now rolled out a new taxation treatment to these things called AMIT, which is just another layer of complexity that I won’t get into right now. But basically, and you’ll have dozens of components in there that you’ve been paid over the course of the financial year. So our client base is basically coming back to us and sayings, look, I’ve got all these dividends, how are these selected in Sharesight? So this is what took us on the hunt for this data and what we ended up doing was, Computershare came to the table and they were able to deliver us accurate breakdowns of these ETF distributions throughout the course of the year, so we plug those into Sharesight, retrospectively. But for the ETFs that we were not able to get data for, we built kind of a pro-rata tool so that you can actually take your statement and can whack in the end of year figures and Sharesight will automatically cascade those back in time, to give you accurate breakdowns.

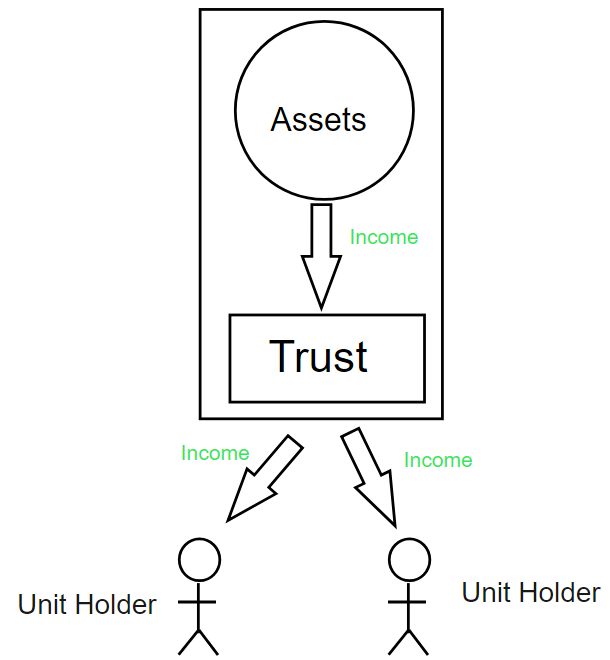

I think the crux of this problem is that investment trusts, like managed funds, they were really designed to be like here, take my money and then send me a report at the end of the year because I’m going to trust you with my funds and you do your thing and just post me a statement. But ETFs, from a technical standpoint, are trusts, people like you and me are buying them and selling them all the time and are using tools like Sharesight and so their expectation is that they have this always on mentality where they want to know performance and dividends in real time. They are looking at our mobile app and are logging in a few times a week and relying on a paper statement at the end of the year, just isn’t good enough for the plugged in investor who is using ETFs in their portfolio. So at the end of the day, we were really able to make a huge improvement to the accuracy of our ETF distribution tax reports and based on the feedback we have received we have hit the mark but to be totally honest, we still don’t know what the correct answer or way to do this and there is really no guidance from anyone out there on this So we feel like we may be setting a bit of a standard for the industry so it has been really interesting, and I would say, nerdy, but we are proud of the work that we have done and the investors seem to be pretty happy with it so far.

Aussie Firebug: So I’ve got a question about that because last year, I had a relatively complicated tax return just with a few things, because I invest through a trust myself and I went through an accountant because I have an accountant, and my goal eventually, when I reach FI and I move into the retirement phase, is to sell my properties off and just be 100% passive income via ETFs and LICs. When I’m at that stage, I plan to do my tax returns myself which is where a tool like Sharesight really comes in handy, but my question was, last year I used a combination; I had reports from Sharesight that I forwarded to my accountant but I also used the Vanguard reports that you talk about, that distributed a few months after the end of the financial year. Are you saying that you have access to that data once it is released from Vanguard, you know exactly what it is or the investor still needs to have that tax report from Vanguard and plug it into Sharesight to make it 100% correct? Can you just clarify that part?

Doug Morris: Sure, it’s a great question. Where we are up to at the moment, the Vanguards of the world or the Aus Shares or the Beta Shares, the providers themselves (the fund managers, if you will) they only do this exercise of the tax reporting/dividend reporting at the end of the year. So as we get that we will backfill that information inside your share portfolio

Aussie Firebug: So that’s automatic, you guys know about that?

Doug Morris: Yes, that’s right. So we know about that at the end of the financial year, we won’t know about that though for each dividend that has been paid throughout the year, if that makes sense. We are only as good as the data that we can get from the provider themselves and if you think about how complex this must be for Vanguard, right? You’ve got millions of investors in these really complex structures, they must have, quite frankly, some hellish process to go through and figure what you (individual investor) are actually liable for, on a distribution basis. Because what we’ve actually seen, is that, even if I hold, say, VAS (Vanguard Australian Shares) and you own VAS as well, and we’ve owned it for a similar time period if we have remarkably different balances in that particular ETF, our payouts might be different because of the way that the cash is actually distributed to investors via the registry. So, that’s actually quite interesting, it’s a big end of year process and what you’ll find in Sharesight is that around hopefully September (although this particular year, since it was our first go at this it was October) you will being to see the breakdowns added to your portfolio automatically.

Aussie Firebug: Ok, so October/November. Will Sharesight users be notified of that or will you just see it in the tax reporting report?

Doug Morris: Indeed. So what we will do is in the platform itself, we have a messaging capability. We will push a message saying, hey we’ve updated the end of year tax details for you.

Aussie Firebug: Great, awesome. That’s very good to know. If you are concerned about your tax liability throughout the year, it might not be 100% accurate (that’s sort of what I am getting) but at the end of the financial year, come October/November it should be all good for the previous financial year once you have received those reports and put them into the system.

Doug Morris: That’s right. So throughout the year it will be accurate or very close to being accurate for performance reasons which is kind of the most important things as you go. But then come tax time, there is a bit of a catch-up period and then we backfill the tax information.

Aussie Firebug: Awesome, for me, I like to lodge my personal tax return as soon as possible and for those people that do invest in shares in their own name, it might be annoying to wait a few months but I have no issues with waiting a few months and having the reports come out and then just having one place where I can either generate the report and send it to my accountant or I can generate the report and fill in my tax return myself. It’s all my investments all in one report and I’ve seen a few articles as well that you’ve posted, which I will link in the show notes, about the step by step where abouts in your tax return in the ATO form, where you fill out and what data you need to enter here and there. It’s really good. Is there any work to integrate directly? Like if you are doing a tax return yourself, can you integrate directly to myGov, or anything like that, is there anything like that in the works?

Doug Morris: We haven’t actually progressed that in any kind of seriousness, we’ve definitely talked about how cool it would be. Because at the moment, what we find that most of our clients do, they file themselves using our reports and in fact, even on our taxable income report now, you’ll see the alpha-numeric codes that you need when you are filing the tax that you know this is field 10A and this is your total for that, so we make it really easy, honestly kind of a two tab solution. But the alternative to that, is that if you are working with an accountant, and they are using Xero, who we have a linkage with, they they can be filed straight through there so that is the alternative but unfortunately, no direct sync from Sharesight at this time. Which is also a function of the fact that we are operating in several global markets, and so, prioritising one tax integration verse another is tough stuff.

Aussie Firebug: Nah, that would be next level. Yes, as I said I will link the article in the show notes, and it is very straight forward. It shows you exactly where you need to go to when you are launching your return and what data needs to go in where…it is really cool. So we know Sharesight has awesome performance and awesome reporting and tax reporting which are the two main purposes that I use it for. Are there any other awesome features that I am missing out on that I don’t know about?

Doug Morris: Yea, it is a pretty deep product. I mean, the nice thing about Sharesight is that it is simple enough for your beginner investor to use, but it is complex enough for your sophisticated investor as well. So I put myself in the middle of those two spectrums. What I use personally quite a bit is custom groups. Custom Groups is a lesser known feature in Sharesight. What it allows you to do is build your own kind of worldview of your investments and so throughout the product you can choose to group by market, or country, or sector or industry, which is all kind of stock standard stuff. But Custom Groups allows you to come up with your own classification system and then literally drag and drop the companies or ETFs or whatever you own into those classifications. And so my worldview as an American living in Australia, takes a core satellite approach, who favours tax; who likes ETFs; there is really no standard asset allocation that works for me, so I build my own. I have, like I said, a core satellite approach where I have my blue chip tech stocks that I know I am not going to sell, I have a few more speculative tech stocks that I want to keep a closer eye on. I’ve got some retirement savings in The States and I’m in some Super here so it allows me to customise exactly how I look at the world and then therefore I can apply that to other parts of the product. So, obviously, you want to look at how you are performing in each one of those customised groups and you can look at your exposuress as well. You can apply the Custom Groups feature to reports, like the Diversity report, which shows you how your exposures change over time based on how you view the world.

Aussie Firebug: Awesome, have you got an article about Custom Groups that I can link to on the site?

Doug Morris: Yes, sure we can find you one.

Aussie Firebug: Awesome, I’ll put that in the show notes then. And I’ll check that out myself because that is something that I am not using which sounds awesome. What’s next for Sharesight? Anything else being cooked up in the kitchen that we can look forward to?

Doug Morris: The product is never done, we are always building out the product. A couple of things that we are focussing on. One is just more broker connections, there are so many online brokers out there and there are a lot of these international brokers moving hard into Australia, as well. They are really low cost brokers, so if you indeed looking to cut down on your fixed cost for investing I would encourage you to take a look at some of these. One that we are working hard to integrate with right now is Interactive Brokers, and they are huge. I mean, they would be bigger at a global scale, they are much bigger than a CommSec even. And they offer access, low cost access, to any asset class you can imagine. If you want to trade US shares, you want to trade European ETFs, they even have support for cryptocurrencies in their platform. That is a really popular broker for hardcore DIY investors so we are looking to integrate with those guys. Which really just means that the flow of trades will be automatic with a Single Sign On. Apart from that, we are brainstorming some ways that we can do a bit more to leverage our user base. We have really grown the user base to a pretty large scale now and building a community of investors is something that would add some real value and some benefit. One idea that we are workshopping is, what if we had something like “Investors like you”. So based on anonymous data, that we could glean from you and your portfolio. What if we could connect you to other investors who had similar investment appetites as yourself, and build a community around that. We are looking to leverage our own scale to provide some value for our client base.

Aussie Firebug: Interesting. Maybe like a social media aspect like a forum or something? I have to say, I didn’t have this as one of my questions but I gotta say it now because I use them – Selfwealth is the broker that I use and the last time I checked, you didn’t have native integration. The way I integrate SelfWealth with you guys, for my trades, is I send an email. I have an automatic rule that when I get the trade through SelfWealth, it sends an email to that special email that you set up in Sharesight and the trades come through semi-automatically. Is there anything in the works to get SelfWealth integrated natively?

Doug Morris: What you’ve described is we support their contract note. If you make a trade, you can set it up to where Sharesight will automatically process your contract note and store it against the trade. But we do not have a facility for automatically importing the historical trade, at this time. The way we make those decisions is if you get on our customer forums and you vote it or you post about it, we definitely look at that for the stuff that we build next. That would be my encouragement to anybody that wants that deeper level of integration with SelfWealth to do that. A stop-gap measure in the meantime is, you can export your trading history from SelfWealth; it will come out as a CSV or an Excel file. You can easily just upload that into Sharesight as well, and it’s really the same process with a couple more clicks, rather than that API.

Aussie Firebug: It’s not a dealbreaker or anything, but I just had to say it out. I think I’ve tweeted you guys a few times like, “Hurry up with the SelfWealth integration” but I’ll get on the forums, I’ll get the Aussie Firebug community to help out.

Doug Morris: We are pretty democratic about what we build, even in my position as CEO, if I say, “Hey, you know what would be cool to build?”, the developers often come back and say, “Here is the stuff we are already working on and you need to prove the case”.

Aussie Firebug: That makes 100% sense. I work in IT myself so I agree with the developers but I’m just being greedy. Anything else you want to chat about Doug, or anything that we haven’t covered?

Doug Morris: No look I really appreciate the opportunity and again, circling back to ETFs and look, I’m an ETF man myself. And what I love about them is the diversity and the exposure that they offer. Because this world was locked away from aussie investors for a long time and really keen to see where they take our portfolios and it will be interesting to see what happens here, especially with the Share Markets as they are getting a little unsteady at the top.

Aussie Firebug: Absolutely, it’s going to be interesting the next 24 months, but I don’t like to time the market that is not what we do on the race to Financial Independence to Retire Early. Time in the market beats time in the market, so we stay the course but it’s going to be interesting, we’re going to see who can hold their nerve in the next few months maybe but that’s another story. Look Doug, it has been an absolute pleasure chatting to you, thank you so much for coming on the show. Sharesight is a fantastic product, I use it. It’s free for your first 10 holdings and then there’s pricing after that but recommended to anyone. It’s the best reporting tool that I’ve come across by far. So thanks for coming on and chatting today mate.

Doug Morris: Thank you very much mnate, I appreciate the opportunity.

Aussie Firebug: Wow what a podcast, I hope you guys enjoyed it as much as i did creating it. Sharesight really helpful software, really really good performance portfolio. tracking software and the fact that it’s free for 10 holdings or under is just insane i think. The time and efficiency you get generating those reports for tax time is so so good. And a lot of people in the firte community will have 10 and under holdings just because we tend to invest in a few ETFs or LICs and we don’t have an array of holdings. The value that you get from that free plan is just insane. I love that they offer that. For people that have over 10 holdings and would like to sign up with Sharesight which I totally think is worth the money, especially if your having just a starter or an investor plan. I did mention at the start of the pod that i have something special for you guys, and I do. I actually have a special link and if you sign up you get the first 2 months for free. So the link is aussiefirebug.com/sharesight. If you use that link and you’re a new account, or you’re coming from a free account, and you want to move to a starter or investor plan, you will get the first 2 months off the price and you’ll get those first two months for free. That’s only for Aussie Firebug listeners so aussiefirebug.com/sharesight. Check it out, since we’ve recorded the pod I’ve upgraded to the investor plan, so I get a few more features now and I really, really enjoy it. The ability to create the dummy portfolios so I can have as many different portfolios and I can do historical planning, it really helps me write my articles and if I’m ever thinking what would a portfolio of this mix look like, or have looked like or would have performed in the last 20 years and I can seriously just whip it up, and spin it up and have a look at the performance of that portfolio in a matter of minutes. It’s really really powerful and there’s the whole custom grouping things, it really solid software and the tax reporting of it is just next level. Like I said at the start and during the pod for aussie investors that invest in the share market, really a must have, it’s the best reporting software that’s out there and it factors everything in that’s unique to Australia which I really, really like. So check it out, it’s got the free plan but if you need to do the investor plan not the starter you can use my link, and that’s Sharesight. I’ve been using these guys for over a year now and I really, really like them. Now moving on before we wrap up this pod, I of course like every single podcast will read out the iTunes comments that you guys have left me.

I’ve got a few here since I last read these out, but starting on the first one I’ve got… Oh I cannot pronounce this name rat-rat-ratsnatag, I have no idea how to pronounce that, they gave me five stars anyway, and they write: “Thanks Mr. Firebug for the crisp and real life interviews, especially for Aussies, very helpful”. Thank you, the name I cannot pronounce. Thank you for that five stars.

Our next submission, or our next review comes from ‘Fire Fields’ – “Five stars, must listen, i can’t put this down. We are so lucky to have such great local fire content available”. Aw, thank you very much.

Next comment comes from sarafxds, hard names to pronounce this week – “just one thing, five stars. Just one thing, i love, love, love your podcast but please stop saying ‘aks’ – a k s, your knowledge and passion is fantastic but I can see my grammar teacher wincing everytime you say it”. Ah, do you know what Mrs. Firebug had a chuckle at this one because my grammar is horrible, it always has been. I’m borderline dyslexic, i get pulled up, i get emails nearly every single week about spelling mistakes on the website or in my emails or something, so i will try my best. I feel like i know I’m saying that incorrectly, and everytime i say it i i think to myself i should edit it out, but I’m just going to try and avoid the word so i’ll just stick to ‘they write in’ or ‘they write’ or something that avoids ‘aks’ which just sounds wrong doesn’t it? Anyway moving on, thank you for the five stars anyway, Sarah .

Our next review comes in from ‘Jjz71’, all these bizarre names this week – “Great podcast, five stars. This podcast should be compulsory for every adult in Australia. Way too many people spend 40 plus hours a week making money for someone else and neglect their own finances”. Oh look, I don’t know if it should be compulsory but I thank you for your review I do think that finance, in general, should be taught a lot more in school and should be its own subject, that is something I strongly believe in and I hope one day something like that happens, so I guess we’ll just have to wait and see.

The next comment, “5 stars, very well done”, comes from Clarkernucci, “I’m making my way through your podcast, and I think they are really great, full of a lot of really insightful tidbits, such as PocketBook, etc. My only bit of constructive criticism, and you made have already fixed this, would be to invest in a better quality microphone” Thank you for your review and the 5 stars, and I definitely upgraded my microphone and I am getting better at editing the audio quality so I cringe whenever I hear my first episode, or even my first 5 episodes, because the quality is almost unbearable but I’m getting better and I feel like they are better quality these days so just get to the later episodes and they get better, or as you continue to listen they should get better. Thank you for your five stars anyway.

Our next review comes from, Orielton Investor, “5 stars, love your work.Love the podcast Aussie Firebug, looking forward to future learnings and the LIC and ETF journey”. Cheers, thank you very much.

Our last one today, comes from Trent. “Absolute must listen. Hands down one of the best finance podcast. Excellent that it has an Australian perspective on the FIRE movement. Thanks.” Thank you Trent and thank you everyone that puts in a review. It really makes a difference to me when I see a review, I really, really enjoy reading them.Thank you so much for everyone that has put in a review. If you want me to continue to make more, please drop me a comment and a rating on iTunes. Just search for Aussie Firebug on iTunes and you will find me. I’m on all the podcast app and I’m actually on Spotify now – that’s actually big news. I need to update my website but I am on Spotify now so please add me. You can also find me on SoundCloud at soundcloud.com/aussie-firebug. Show notes for this episode can be found on my website, at aussiefirebug.com.

Thanks a lot guys and I will see you next time.