Australia FIRE Survey Results 2020

Welcome to the very first Aussie FIRE Survey results!

Firstly, I know that half you guys read this blog on your phone but if you can, please come back to this post on a desktop or something with a bigger screen because the visuals look so much better and the dashboard was designed to be viewed on a desktop.

I’m really keen to run this at the start of every year and release the results along with the dataset for the wider community. I was inspired by the extremely popular Stack Overflow Annual Developer Survey Results that they publish each year for developers. Essentially, you can read where people are from, what technology is used the most in the community, what coding languages are hated the most and a whole bunch of generally interesting tidbits.

I had this idea mulling in the back of my head for years and thought wouldn’t it be cool to run an Aussie FIRE Survey each year and share the results! One of the greatest strengths of this community is that we are willing to share and talk about what is normally considered taboo subjects. I’m probably on the extreme end of the scale of what people are willing to share but the beauty of the survey is that anyone can fill it in completely anonymously.

The results below are both extremely fascinating and interesting. What I also hope that this annual survey can achieve is to give a little bit more help to would-be Firebugs who are trying to start their journey but don’t have a measuring stick.

Think about it, if you read something online about person X saving $30K a year and investing in VTS without any context, you don’t really know if that’s a lot of money for them (they could be earning $250k per annum) and what their circumstances are that made them choose that ETF.

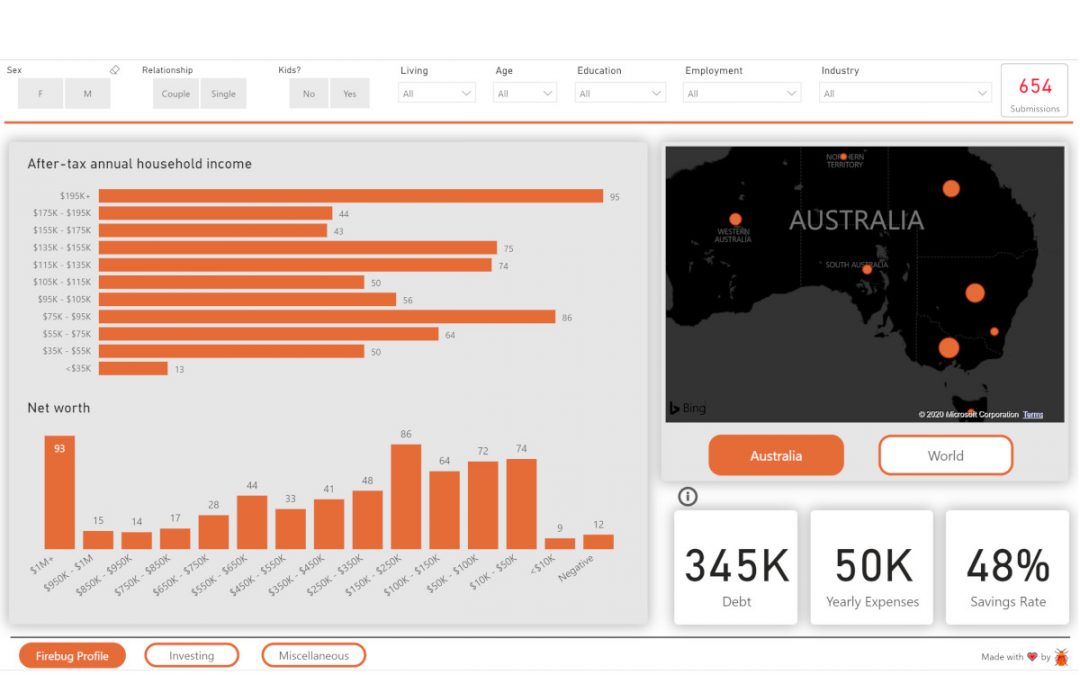

At the bottom of this page is the FIRE survey dashboard where you can slice and dice the data to suit your needs. The richer this dataset gets, the more specific you guys will be able to drill down to your situations and get a feel as to where the rest of the community is at. You might be a 28-year-old single lad from Melbourne that’s earning between $80K-$100K. It might be of great interest to know what others in your situation are doing/are at with their journey.

That’s the idea anyway. I sorta stuffed up the survey when I ran it in March because I forgot to include some key questions (like super 🙈) but I already have a heap of improvements I will make when I open up the survey again at the end of this year.

The survey had 654 submissions across 9 countries and the results are broken up into four sections:

- Firebug Profile

- Investing

- Miscellaneous

- FIRE Dashboard (interactive dashboard using the data from the survey)

- Methodology

Feel free to download the raw data from here (Open Database License (ODbL)).

Please tell me what questions you’d like to see in the future version of the survey and just general tips or recommendations for me 👍

Enjoy!

Firebug Profile

Geography

*This map may not rendering on mobile phone screens

There was no surprise that the majority (621) of submissions came from Australia. I was actually shocked that 8 other countries contributed. I’d love for this survey and the results to become more global in the future.

I was pleased to see my home state of Victoria coming though with the most submissions for the Aussies 🤘

Age Range

No surprises here. I knew from my Google analytics that the majority of my audience fell between 20-40 years of age.

Sex

I'm currently working on some content that's more female focussed because finance and investing seem to be heavily skewed towards a male audience.

Relationship Status

I was thinking about FIRE for singles just the other day. It's definitely possible but a lot harder to do. Take our situation living in London for example. We pay £900 a month in rent that gets us a bedroom with an ensuite. Everyone else in the house pays around £700 and they have to share the downstairs communal shower. All the big-ticket items like living, food and transport costs can be shared between a couple whereas you're paying for everything if you're single.

Kids

Considering the age range that filled out this survey this result doesn't surprise me too much.

Was a bit surprised to see so many maybes tbh.

Education

Close to 70% of the respondents are university-educated 🎓. No wonder so many smart people live in the comment section!

Employment Status

What industry do you work in?

This one is super interesting because there seems to be a lot of people in the tech industry that are drawn to the concept of FIRE (I fall into that stereotype 🙋♂️). But the data is showing a lot of diversity! I probably could have guessed the top two categories but the rest was very interesting to see.

Annual Household Income (after-tax)

Holy moly some of you guys are earning a mint! I'll have to add more upper tiers in income for the next survey since the highest submission was for $195K+ 🤑

Net worth (excluding your home equity)

So the way I interpret the above data is that there must be a lot of people either at the start of their journey building up a solid snowball of around $50K-$200K and also a lot close to the end in the $1M+ range.

Living Status

I would have guessed the renters were going to take out 🥇 place here actually.

Investing

Have you reached FIRE?

How many years have you been investing for?

Financial Planner?

Top 10 ASX listed products owned

DRP/DSSP

I was a little surprised at how many people use DSSP actually.

How do you own your investments

Miscellaneous

Top 10 banks respondents hold their mortgages with

Side Hustles

Please note that the below figures are the annual median income after tax and not the averages. There were a few massive submissions that would have blown out the average completely so median seemed to be more appropriate.

hmmmm I think I need to get into Amazon FBA 😂

FIRE Dashboard

Here is what I believe to be the very first interactive FIRE dashboard generated from user data... ever!

There's probably someone out there that's already made one but I've never seen it. I'm really happy how the dashboard turned out and it's only going to get better each year as I add enhancements and features. The more people fill out the survey the richer the dataset will become which will make the insights and analysis more accurate.

Most things in the dashboard are interactive. You have the filters at the top but you can also click on each visual and it will affect the others.

Here's a quick little video explaining how it works.

I'd highly recommend viewing the dashboard in it's fullscreen mode. If you're on your mobile, please come back to this bad boy on a desktop. Trust me... it's worth it 😁

Feel free to have play with the PowerBI file here. There were some assumptions made in the dashboard but if you're interested in how the data was put together, the PowerBI file has everything you need.

Methodology

This report is based on a survey of 654 Firebugs from 9 countries around the world.

-

- The survey was fielded from the April 5 to May 1 2020.

- Unfortunately there wasn't a timed component in the dataset which means I could not qualify responses. I plan to add a timer for the next survey to fix this.

- Respondents were recruited primarily through channels owned/ran by aussiefirebug.com which included: Aussie FIRE Discussion Facebook group, Aussie Firebug Twitter Account and Aussie Firebug Blog

- All income figures are based on AUD. There will be changes to this in future surveys as I'm aware international salaries should ideally be converted to a base currency

- Net worth figures are in AUD

- Some visuals do not always take into consideration all the answers due to visual issues. There were 87 distinct values for banks for example. Reducing that to a top 10 is more visually appealing. You can always download the entire dataset if you want to know all the submissions.

- An internationally diversified portfolio consisting of 60% Aussie shares and 40% international

- Buying IVV instead of VTS moving forward for DRP and Australian domiciled.

- Buying Aussie ETFs and not LICs due to risks associated with franking credits. ETFs don’t pay fully franked dividends and are impacted slightly less in the event of legislation passing.

- Mindset/sleep at night factor

- Simplicity

- Tax minimisation

- Mitigating legislation risk (something I hadn’t considered before)

- Mindset/sleep at night factor

- Simplicity

- Tax minimisation

- Mitigating legislation risk (new)

- Person A works part-time and grosses $16,000 a year. They are under the tax-free threshold and don’t pay any tax.

- Person B operates a small sole trader business that nets $16,000 a year. They have no tax obligation.

- Person C is retired and owns part of an Australian company through shares that bring in $16,000 a year. Person C receives a fully franked dividend of $11,200. Person C at this point has effectively paid $4,800 in tax on their $16,000 income. Under the current law, the ATO refund the $4,800 to keep things at an even playing field and treat all income fairly no matter how it was earnt.

- Same-sex marriage plebiscite for $80 Million – Clearly a stalling tactic the government used to postpone the inevitable. All good though, getting into power is much more important than using taxpayers dollars wisely.

- Victorian government settles East West Link claim for $339m – Total cost for a road never built, between $800 million and $900 million.

- $4 Billion Victorian desalination plant that’s hardly been used – To add insult to injury, it’s costing the taxpayers $649 million a year to keep this plant open even if it’s not producing water! I personally had a lot of friends work on this project and let me tell you, taking the piss doesn’t even begin to describe how much money was being thrown about on that job site. I’m all for unions fighting for their worker’s rights but c’mon… some of my apprentice mates were clearing $2,500 a week after tax whilst also getting $800 a week travel allowance and living away from home pay plus god knows what other EBA entitlements. Four or so of my mates were renting out a beach house in Inverloch and getting $800 a week each for travel pay… Inverloch to Wonthaggi (site of desal) takes 13 minutes 😐 I’m all for tradies earning as much as they can but when taxpayers dollars are used we need to look at the fiscal management of these projects… some of what was happening was a complete waste of money. This was one desal project, Sydney also have one that cost $1.8 Billion and is currently costing taxpayers $535 million a year to keep it in a state of hibernation. Other states have them too but you get the idea.

- $51 Billion for failed NBN project – Telstra pointed to NBN information that there was $14 billion “of unrecovered revenue … that will ultimately need to be recovered from consumers within the current regulatory and policy framework”.

- Franking credit refunds make perfect fiscal sense. They were designed by an independent body and implemented with bipartisan support

- ALP want more revenue

- They won’t directly tax Super pensions because that would be political suicide so instead, they have gone after Franking credit refunds and are exploiting the general publics lack of knowledge about how they work

- The most likely theory I have is that there is still a decent amount of people in the FIRE community that still don’t quite know how franking works. The refund can be confusing to understand. Combine this with a slightly naive attitude towards how tax dollars are spent and what you have is a genuinely good-hearted person who just wants to spread the wealth around. All I would say to anyone who falls in this category is please consider direct donations to good charitable organisations. I have worked for the government for over 7 years. Trust me when I say that you are 100% better off directly helping out the less fortunate than you are by paying more taxes in hopes that it will be put to good use.

- The FIRE community was once a smallish niche group that all had aspirations of escaping a lifetime of working a job they didn’t particularly enjoy. And then the word got out, and what started off as a relatively small group has grown exponentially. I suspect that there are a lot of people out there that are apart of FIRE groups, forums and pages that have no intention of doing what’s necessary in order to FIRE. Maybe the influx of FIRE phonies are delighted with this speed bump in our road to FIRE. This can best be described as Tall poppy syndrome.

- Some out there have been drinking the ALP ‘Kool-Aid’ and actually think that franking credit refunds don’t make for a good fiscal policy.

- And now it’s time to put your tin foil hats on…Although highly unlikely, is it possible that members of the ALP have infiltrated the FIRE community? I honestly don’t think we’re big enough for any political party to really care about, but maybe there are a few interns out there pushing their parties’ agenda… Stranger things have happened!

- $30,000 – Deposit ($9,000 from me plus $21,000 FHOG)

- I borrowed 91.33% of the property plus LMI. I would not recommend this but that’s what I had and the banks were allowing it back then. I wouldn’t have got that loan in today’s market.

- $4,634 – LMI even though my parents could have gone guarantor (no hands out for me)

- $3,840 – Landscaping. A new garden for the front, back and sides. Plants, pots, mulch, stones etc.

- $12,000 – Built a deck. Materials, building permit, labour help costs

- $1,400 – Concreating

- $4,410 – Other costs. Materials, Skip bins, money spent on food and other things while renovating etc.

- The first year I had to live in the house for 6 months receive the FHOG. This meant that I couldn’t claim all of the expenses for that year. Only for the 6 months I had it as an investment

- I ended the lease with the tenants and cleaned the house up a bit which is why year 5 is so expensive. I had to cover interest repayments for a few months before the house was sold.

- Depreciation is not including in the cash flow because it’s not an actual loss of cash flow whereas the tax refund is money coming into my account

- I used the diminishing value method for depreciation. Don’t ask me why it somehow depreciates more in year 2 than year 1 🤷, that was what was on the report.

- Tax refunds are based on the 37c tax bracket

- $700 – Conveyancing (had a friend do it cheap)

- $2,210 – Used an online agent to sell the property. No way I’m paying 2.5% plus marketing just to list it on RealEstate.com and host a few open days

- $3,850 – Staging. Maybe unnecessary but I like to think it worked

- I’m not 100% sure I can simply plus the two return figures together since one is annualized and the other is just an average rent of $360 per week (maths wizards please correct me). But the overall point still stands that the investment doesn’t look great without leverage.

- The above calculations are assuming that we buy the property outright. This would mean no interest repayments or LMI costs.

- 12.98% may sound like a decent return, but what’s not factored in is the 100s of hours of labour and travel spent on this property to achieve this result. Considering you could have got better returns from shares over the same time period with no work required, you’d be mad to buy an investment property outright.

- I have not factored in the replacement costs as the house depreciates. This hidden bill will rear its head eventually. Something shares don’t suffer from.

- FHOG being available boosted my deposit meaning I only had to put down $9K (crazy)

- The banks lending criteria was completely different back then. No way I get a loan in today’s market only having $9K to put down

- For the majority of my loan, interest rates were being cut. Every couple of months I had to pay less and less in interest which at the time seemed cool but it’s only with hindsight I can truly understand how fortunate of a time it was to be in real estate. It has only been the last 18 months I have seen my I/O loans rise in rates

- Melbourne experienced a property boom basically the whole time I had the property. It was only the last 3 months that the prices started to drop and the loans market really tightened their belt. The property was actually under contract before I sold, but it fell through because the buyer couldn’t get finance. I experience this two more time (not officially under contract though) before I had a buyer who was cashed up. Based on what similar properties were selling for, I estimated that IP1 dropped by around $30K since the start of 2018.

- I actually identified the FHOG as an opportunity not to be missed. I signed my contract on the 29th of June which was one day before they scraped the FHOG all together back in 2012. This opportunity was available to all my friends, but most of them did not take it

- I realised that it was unlikely for me to make a lot of money if I paid for everyone else to do the work for me. I looked to physically add value where I could and since I was full of enthusiasm and energy back then. Countless weekends were spent working on the house. Sacrifices were happily made if that meant I could reach my goal of FIRE quicker

- I sought advice from experienced property investors who knew what to look for when investing…my parents of course! I understand this luxury isn’t available to every but it’s worth seeking one out if you can. There were small things that helped the investment like buying near public transport, schools, amenities, easy access to the M1, in an area with strong employment options and projects scheduled for the future etc.

- Getting out of my comfort zone to learn new things such as selling IP1 online saving over $15K in commission fees. The experience I gained from negotiating the deals was invaluable. Some might argue that a skilled and experienced agent could have secured a better sale price. That may be true but we’ll never know. What I do know is that I saved over $15K doing it myself and I’m choosing to save $15K over potentially getting a higher profit every day of the week!

- The market had gone bananas and I was very keen to lock in that profit and not risk something happening, which sorta happened with the market pullback in the last few months. But I’m very happy with the return we got so no complaints here 🙂

- I would have reached 6 years next year which would have affected the main residence status for tax purposes. This means that I would have had to pay taxes on part of the sale

- There was some upkeep work that I was fed up with. IP2 and IP3 are part of a body corp which takes care of a lot of the maintenance.

- Whilst IP1 had gone up considerably in value, the cash flow was still shithouse! Technically positive cash flow after the tax refund during the last few years (apart from the selling year due to the extra costs). It still was nowhere near as good as what shares could offer for half the investment.

- Check both AFI and Milton’s NAV compared to their share price on the ASX to see if they are trading at a premium or discount (currently developing a web app to make this easier)

- Invest in whichever LIC is trading at the biggest discount

- If both LICs are trading at a premium, buy A200

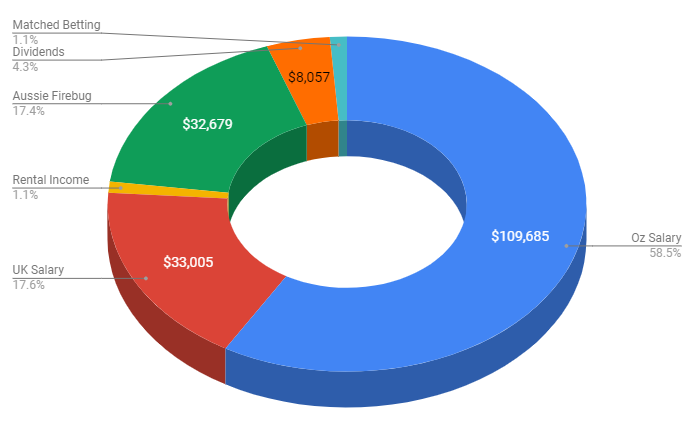

Savings/Income Review 18/19

This years review was a lot more complicated to calculate because we earned and spent money in two different countries which meant keeping track in two different systems. The tax was a bit tricky too and it has taken a lot longer than I would have hoped but better late than never!

You can check out last years review here where we achieved a savings rate of 66%.

So how did we do this year?

Let’s get into the numbers.

Savings Rate For 18/19 Financial Year

Our savings rate for last financial year was… 56% (▼-10% from last year)

We earned $185,441 (▲+$43,944…mostly after-tax*)

And spent $80,817 (▲+$32,818)

Compared to last year we increased our income by $44K, which is great but unfortunately, that was accompanied by a record-breaking amount of expenses which was mostly due to our travels. We spent more than $32K compared to the previous year which decreased our savings rate by a whopping 10%. This further illustrates that it’s the expenses that are a lot more important vs how much you earn when it comes to your savings rate!

I’m pretty stoked about 56% tbh. It’s a fair dip down from 66% but considering our travels this year, we can’t complain at all.

I’ve included a breakdown of our income for this years update too so you can get an idea of where our $$$ come from. But the really important part is still the expenses.

*I’m still in the process of completing the tax obligations for the trust and AFB. I’ll update this article when it’s done

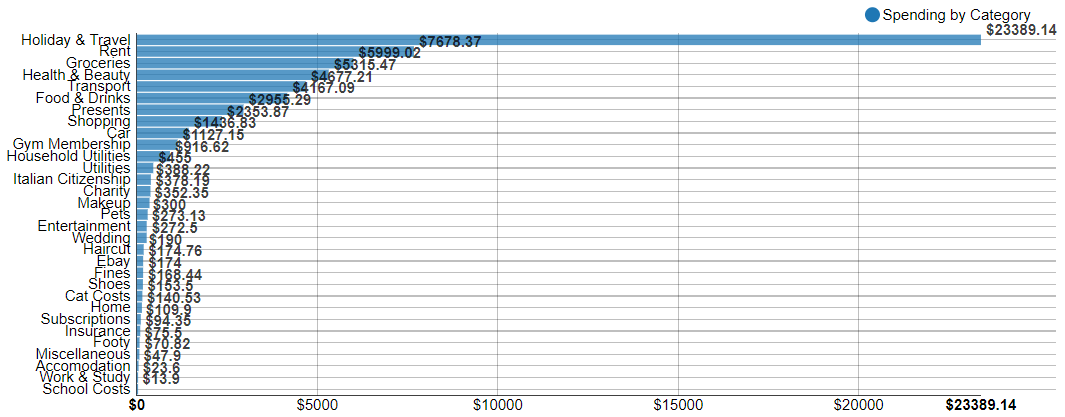

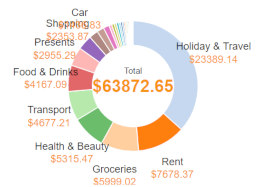

Breakdown Of Spending

Below is our Australian expenses for the last FY.

And in pie form

Holy Mackerel our ‘Holiday and Travel’ category exploded into our number 1 expense which isn’t all too surprising really. Majority of that $23K was the costs of flights, accommodation, food/drink and cash out for activities. It also covers some of our London setup costs when we were still using our Australian Money to pay for things before we set up our UK account. It’s a lot of money and it’s crazy how it all adds up but this trip (that we’re still on) was never about saving money. It’s not something we plan to have in our yearly budget once we FIRE though.

Not surprisingly, rent and groceries come in next which was our number 1 and 2 expense for last year.

‘Health & Beauty’ came in 4th because Mrs. FB had a toothache about 4 months before our trip which resulted in an operation to remove her wisdom teeth. We went private because we needed it done ASAP but it cost around $3,500 💸. If we had more time to plan properly, I would have liked to research how much it would have cost in Maylasia or somewhere similar. I’ve heard stories about how dental care there is just as good as in Australia but 1/5 the price.

‘Transport’ was the new category instead of our ‘Car’ one for last year. It went down a little because we left Australia in January and only had ~7 months of Car expenses instead of 12.

‘Food & Drink replaced ‘Entertainment’ and went slightly up.

Our ‘Gym membership’ went way up because I started to train Brazilian jiu-jitsu twice a week but I absolutely love it! I’m still a white belt and haven’t found a gym to train in London unfortunately.

Those were the main ones with the rest of the expenses being pretty similar to last year. Nothing else really jumps out at me.

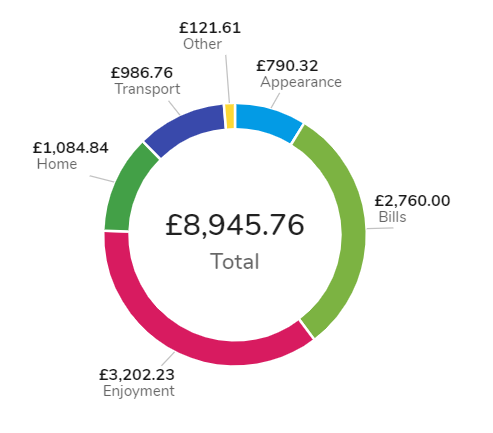

And here is our break down for the UK

We use an awesome money management tool here in the UK called Money Dashboard which works very similar to Pocketbook but it’s actually a lot better. For one, you can split transactions! This has been a feature request I’ve wanted pocketbook to do for like 3 years but they just won’t bloody do it!

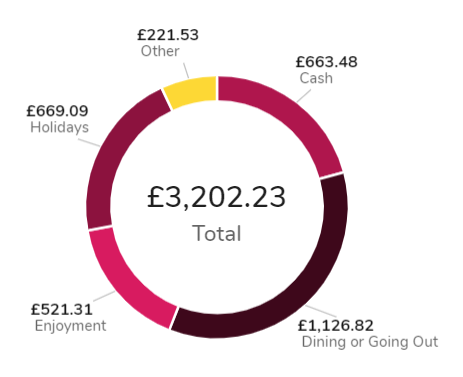

Anyway, our ‘Enjoyment’ category has been our biggest expense while being in London and it drills down to look like this.

To say we have been ‘treatin’ in London when it comes to our ‘enjoyment’ category would be an understatement. Part of experiencing our new city has been taking advantage of what it offers in terms of sporting events, restaurants, concerts, activities and nightlife. The funny thing is, we don’t actually spend that much compared to our friends over here. We still take a packed lunch, get the bus/train, look for things second hand on GumTree etc. It’s just that if I compare how much we spend on doing ‘stuff’ in London vs back home in country Victoria, it’s been a blowout!

‘Bills’ has been mostly made up of our £900/m rent costs and ‘Home’ covers all our groceries home set-up costs.

Breakdown Of Income

A new addition to the yearly update. I thought it might be helpful for people to see where we earn our money and how we have built multiple streams of income that contribute to growing our snowball.

No surprise that exchanging our time for money (a job) generates the bulk of our income. A combination of our Australian and UK salaries equate to over 70% of our income. But the remaining 30% is a little bit more interesting and is part of the pie that we are aiming to grow over time.

This blog generated an astonishing ~$33K during the last F/Y (excluding taxes). That was through a combination of sponsorships on the Podcast and affiliates. I only started to seriously monetise this site last year with companies I was already using. I actually pioneered a few affiliate programs that you now see being used by a lot of other bloggers/authority figures. It’s amazing what a simple conversation can do.

I approached some of my affiliates with something along the lines of

‘Hey, I use your service and love it. I often recommend your product on my website if people ask. Would you be interested in buying some adverting space on my podcast or maybe an affiliate where my audience gets something that’s not available to them now? What do you think?‘

Sometimes I don’t hear back from them, but other times it works out better for everyone. I end up getting paid for my work, my audience gets a better way to sign up with a company I use and recommend, and that great company gets a new customer!

A lot of people have mixed feelings about monetising a blog. I’m a huge sceptic myself whenever anyone receives a financial incentive for recommending a product and there’s really nothing I can say or write that will convince some people otherwise. I’m pretty transparent on this website and I would like to think that I’ve built up a certain level of trust amongst you all, but I understand that there’s always going to be people who don’t dig it.

Having a side hustle can be a huge accelerator towards FIRE. But let me tell you straight up, if you’re thinking of starting a blog with an intent to monetise it later, you’re probably not going to get far. And even if you do, I’d doubt you’d make anything worth your while if money was the sole intent. If I was to divide the money made from this blog by all the hours I’ve put in, I’d be much better off working at Hungry Jack’s on minimum wage. This site is about money but was never intended to make any, I simply love creating FIRE content for Aussies and will continue to do so with or without the sponsors/affiliates.

You can see every company I’m affiliated with on the resources page.

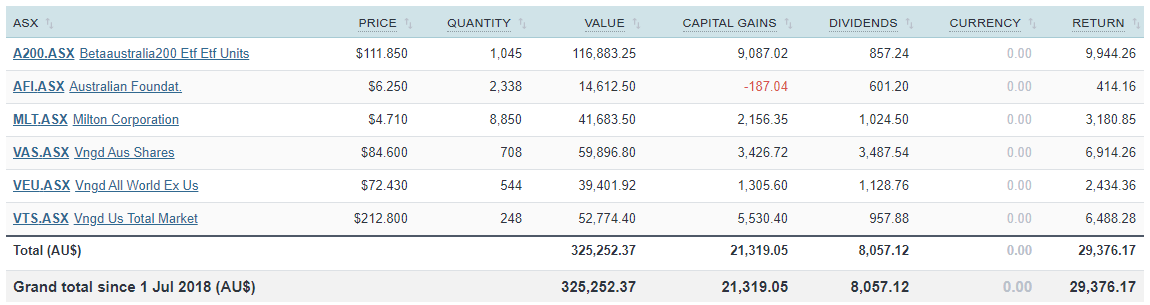

Dividends were broken down like so

I’m stoked with $8K but am really looking forward to seeing the results of this report next year. A200 only returned $857 mostly because it was a new fund. Considering we currently have over $150K in that ETF as I write this now, the dividends should be closer to $5K-$6K assuming there’s not a crash or bear market. This is the slice of the pie that we want to grow as much as possible and will become the foundation for our financial freedom. It’s so exciting seeing the income grow each year especially now it’s starting to add up to a considerable amount.

I mean shit, even at $8K a year, that’s a kick-ass yearly holiday for the rest of our lives! Not to mention that even if we never added another dollar to the snowball, it would continue to grow faster than inflation and consequently raise the income without us having to do anything!

We ended up making just over $2K from matched betting which came mainly from the signup bonuses of the bookies. While it is possible to continue making money through matched betting, it takes time which I didn’t think was worth it for me personally after we had exhausted the sign-up bonuses. A Family On FIRE documented her experience using matched betting as a side hustle which is a fantastic case study and well worth reading if you’re considering trying it.

And last but not least we have the good old rental properties generating us a measly $2K. I’ve said it before but I’ll say it again, Australian residential property absolutely sucks at cashflow. The amount of time and effort I put into our two remaining properties with all the banks, conveyancing, tenant issues, chasing rent etc. makes it laughable that they only returned ~$2K cash last year. Now we all know that the real reason most people invest in Aussie property is for that sweet, sweet capital gainz gravy but eh… I won’t know how much that turns out to be until I sell and it doesn’t help me until then.

What About You?

That’s it for another year!

My number one tip has always been to track your expenses. You won’t ever know how much passive income you’ll need to FIRE unless you do and it creates good financial habits. I hope this post was helpful to you as it’s always interesting to see what people spend their hard-earned dollars on.

What about you? Do you have a category you really need to rope in? Or maybe it’s time to look into a side hustle to boost your income?

Let me know in the comment section below.

Election Results & Strategy… 2.5?

In case ya missed it, earlier this year I published what turned out to be my most controversial article of all time (and it’s not even close). The Curious Case of Franking Credits and the FIRE Community of course.

The thing is, I actually really don’t like talking about politicians and what they say and plan to do at all. That piece was never meant to be political but after reflecting for some time now, it was always going to be that way due to the nature of the subject matter.

So why the hell would I ever go near it again?

Because even though I don’t like those 🤡, politicians do affect us in the journey to FIRE and I need to set the scene first in order to talk about how we come to the conclusion at the end and where we’re heading moving forward.

And the beauty of having your own blog is you get to write and publish whatever you want. I create content from my point of view and never claimed my writing was balanced. This site isn’t the ABC or some neutral FIRE outlet. I presented facts in that article with my opinion which I understand everyone isn’t going to agree with.

However, that topic was interesting to me (and a bunch of others) so if I’m offending you or you don’t like what I’m writing, maybe you should follow another FIRE blogger ✌

Franking Refunds Survived…For Now

Like Steven Bradbury before him, ScoMo and the Coalition skated past the ALP for a come from behind victory and with it, the franking credit refunds will remain for the foreseeable future.

This was a hot topic amongst the FIRE community and now that the election has passed, it seems like things should proceed as per normal right?

I mean, franking credit refunds didn’t get the chop so fully franked dividends are safe to retire on yeah…?

Well… about that

Whilst I think that the result of the election speaks volumes to where the majority of Australians priorities lie, I strongly believe that a lot of the policies the ALP were trying to win votes on will not be touched for a very, very long time. They were aggressive with their tax reforms, franking credit refunds being one of the smaller changes (CGT and trust distributions being a lot bigger).

This was supposedly the unlosable election for the ALP. Every poll in the country had them winning by a landslide. Sportbet even paid out on them winning two days early to the tune of 1.3M 😮

For them to lose in the fashion they did, especially after all the shit the Coalition has done during its previous term tells me that the majority of Australians did not agree with the policies they were proposing.

And it’s my opinion that aggressive tax reforms played a huge part!

Now I’m definitely not an expert on this subject and don’t know for sure (no one really does) but I doubt we will see such aggressive policies proposed by any party for some time. I’d almost bank on it that scraping franking credit refunds will not even be thought about in the next election. They’ll go after something else, that’s a given. But it won’t be the same policies that contributed to them losing the election this year.

Sidebar: I’m not here to talk about the policies or politics so for the love of God don’t @ me in the comments about it.

But that’s enough about the election.

Again, I really don’t like politicians in general and try to avoid talking about them as much as possible. I only bring them up because it’s important to set the scene for the decisions we’re making in regards to investing for financial independence which is what this blog is all about.

Which brings me back to the point about the franking credit refunds.

Whilst I truly don’t think any political party will go near them for a very long time. I also learnt something very valuable from that campaign policy.

The legislation risk associated with franking credits in general.

I was completely naive in thinking the government would not pull the rug out from underneath us and the refunds would be here to stay.

What a fool I am!

I’m just thankful we’re still in the accumulation phase and have a chance to mitigate this risk a bit moving forward (more on this below).

But wouldn’t it have absolutely sucked if you’d worked your whole life and built up a retirement fund utilizing franking credit refunds only for the government to turn around and change the rules on you!

The refunds are safe for now. But I plan to be retired for 50+ years. That’s a long time for people to forget what happened in 2019 and if I were a betting man, I’d wager that sooner or later, franking credit refunds will be back on the chopping block!

Are Aussie Shares Worth It Without Franking Credits?

The thing about franking credits for those who are chasing FIRE in Australia is that without the refund, they are worth a hell of a lot less and in some cases, will mean that you don’t receive any benefit from the franking credits at all.

Let me give you an example.

Mrs FB and I know that to fund our current lifestyle in Australia, we spend around $48K over the course of 12 months.

We plan to own a house one day, so if we remove our rent and add on a bit to cover rates, maintenance on the property, insurance etc, we get to around ~$42K at a guess.

The plan before the election was for us to split our dividend income 50-50 and pay ourselves the $18,200 (tax-free income threshold) each from Aussie franked dividends. Let’s assume that the dividends are fully franked.

We each would receive $18,200 in cash throughout the year plus $7,800 in franking credits each. This means that the ATO would look at us having a taxable income of $26,000 for that year (dividend plus the FC).

Here’s the math behind the grossed-up dividend.

Dividend % Franking Franking Credit Tax Before FC Tax After FC Grossed up dividend $18,200 100% $7,800.00 $1,482 -$6,318 $24,518.00 The franking credits soaked up the owed tax of $1,482. This will still happen if the refunds were ever removed.

But more importantly, the franking credits refunded us $6,318!

Because we, as the shareholder, have already pre-paid tax @ 30% that was removed from the dividend before it hit our accounts. It’s only fair that this is recorded (the franking credit) and the ATO is aware of us pre-paying the tax so we can be refunded later if we paid too much tax for that year which in this example, we did.

This was always the intention of imputation credits. Not to only stop double taxation (which consequently it also does), but to ensure that income is taxed once by those obliged to pay it.

So the end result is around $24.5K each to fund our life after retirement.

That’s almost $50K! More than enough for us to live comfortably forever whilst factoring in inflation.

But if we remove the refund. We only end up with $36K between us.

That’s a whopping $13,036 dollars difference and means we need to head back to work.

Or let me put it to you another way. You’re losing 28% of your return 💸

Tipping Point

I was on the fence for a long time before moving towards an Aussie dividend approach with Strategy 3.

A lot of people out there don’t realise that a major part of the dividend approach for me was not about total return. In fact, I even mentioned it in Strategy 3 that if I were to guess, I’d wager that Strategy 3 would slightly delay my FIRE date because of the less efficient tax method of income (dividends are less efficient vs capital gains) and less diversification.

We moved to Strategy 3 predominately because of the psychological aspect of receiving income that was not affected as greatly by human emotion (share prices) and is more anchored to business fundamentals (income of a profitable business that is passed to the shareholder via a dividend).

There have been great Australian based articles written that objectively looks at retiring on dividends vs capital growth and I constantly receive messages that link to studies showing superior returns for an internationally diversified low-cost ETF portfolio.

Guys, I’m a die-hard FIRE fanatic,

I’ve come across most of these theories and articles before! What’s missing here is the human element. We’re not investing robots. I’m not too fussed between minor differences in returns and place great value in simplicity and sleep at night factor.

I thought the trade-off of less international diversification and a slightly delayed FIRE date was worth retiring on dividends vs dividends + capital gains.

But everyone has their tipping point.

Without the franking credit refund, Aussie shares just don’t cut the mustard IMO.

The difference is just not worth it for us. But everyone’s circumstances are different.

For instance, those looking to retire on FATFIRE will not be as greatly affected by this change since they will have more of an income to soak up those credits.

And many people have rightly suggested to me that there are a lot of alternative strategies to generate unfranked income such as REITs, Bonds, P2P lending etc.

These are viable alternatives for some, but we want to continue investing in companies for now.

Mitigating Risks

Let me be quite clear.

I’m still a massive fan of the dividend approach.

But placing such an enormous amount of faith that politicians won’t change the rules around franking credits over the next 50 years just doesn’t seem logical to me.

I want to mitigate the legislation risk of a potential franking credit refund axing as much as possible but at the same time, continue our overarching investment philosophy of investing in great companies.

We want to reduce our portfolios franked dividends and take advantage of a more diversified portfolio again. Which means…

I kept the international part of our portfolio when we decided to focus on Aussie shares. And when the very real news of potential changes in franking refunds was mentioned, I felt such a huge sigh of relief knowing we still had some international exposure. I guess this just goes to show the power of international diversification. If one country stuffs something up, there’s plenty more out there so you’re covered… doesn’t really work if you’re all in on the one country though 😅

Given that I don’t think franking credits refunds will be there over the next 50 years (no refund for us basically means no credits at all). I would like to receive some income from international companies along the way. It’s not going to be as good as the Aussie yield, but it helps the situation and my sleep at night factor.

Also, with the help of capital gains, an internationally diversified portfolio according to almost every major study done of the subject, will reduce risk, volatility and increase safer withdrawal rates!

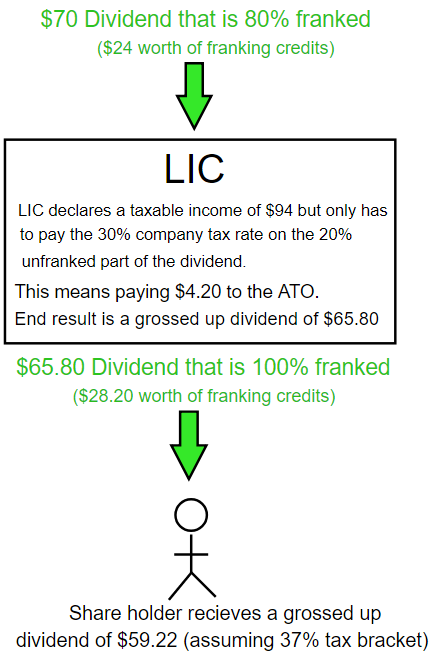

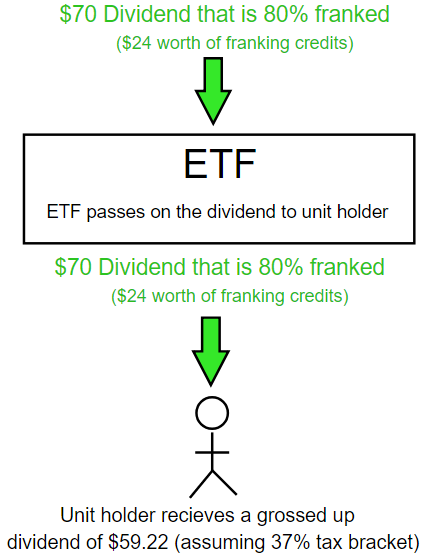

To LIC or Not To LIC?

This one’s quite straightforward. A LIC has to pay a fully franked dividend. An ETF does not. VAS, for example, has a franking % of around 70-80 % which means that part of the income is not franked.

As I detailed in my ETFs vs LICS article, they are so similar that we are basically splitting hairs when comparing the two. As such, the greater legislation risk associated with LICs to me has shifted my favour towards ETFs.

I want to make myself clear again. I’m still a fan of LICs. I love the dividends they produce and the two companies I’m invested in (Milton and AFIC) have goals that align with my own (to grow their income over time).

It’s just that A200/VAS are so incredibly similar but have the key difference in utilizing a trust structure and not a company. The legislation risk has tipped the scales in favour of ETFs for me moving forward.

This is purely a tax minimisation decision. It has nothing to do with changing the overarching investment principles (investing in great companies) or a shift away from Aussie dividends.

The FI Explorer wrote a great piece on a sceptical view of LICs which some of you out there have emailed me about. I agree with what is written in that article, always have. I never invested in LICs expecting a superior return. What I go back to is the mental aspect of investing. A lot of people who retiree will feel more comfortable living on a relatively stable smooth flow of dividends vs more volatility but a slightly higher return.

Strategy 2.5

Okie Dokie.

So here she is. The new…ish strategy moving forward.

It’s called 2.5 because it’s extremely similar to strategy 2 just with a few tweaks. It’s almost like we’re going back to strategy 2 and I didn’t think enough has changed to honour it with strategy 4.

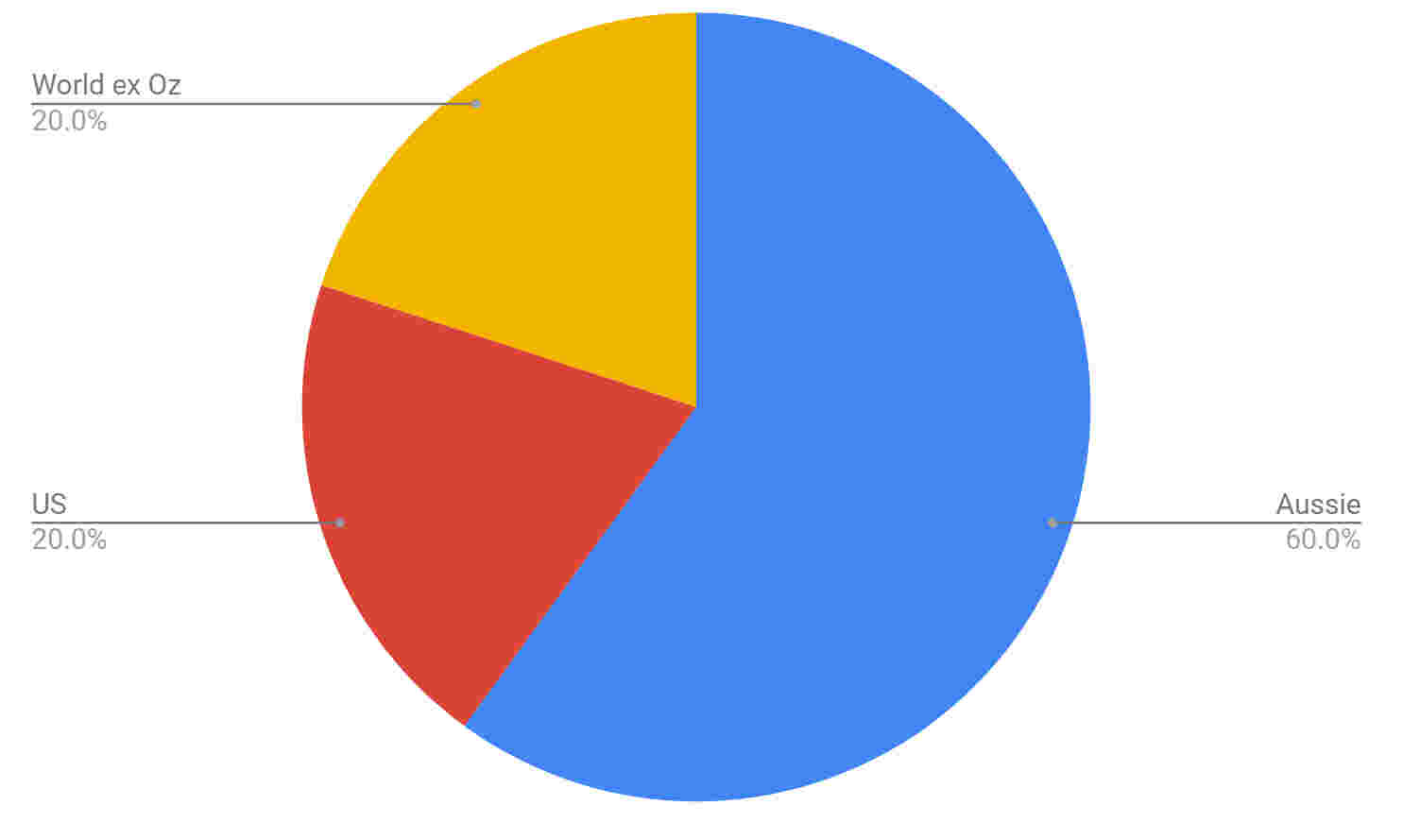

Change 1

Firstly, with the addition of buying more international shares back in the plan, we will move back to a ‘split’ approach.

Our splits have changed slightly from strategy 2 with more of an emphasis on Aussie shares as the dividends are still attractive regardless of franking credits refunds.

We will be looking to maintain a split of

60% A200/VAS/LICs (Aussie)

20% IVV/VTS (US)

20% VEU (world ex US)

We’ll keep our two LICs in the portfolio but won’t buy any more units moving forward.

The plan when buying new shares is a lot easier than looking at when LICs are trading at a premium or not.

Before we buy each month, we will look at the current splits in the portfolio and purchase the shares which have the lowest targeted weighting.

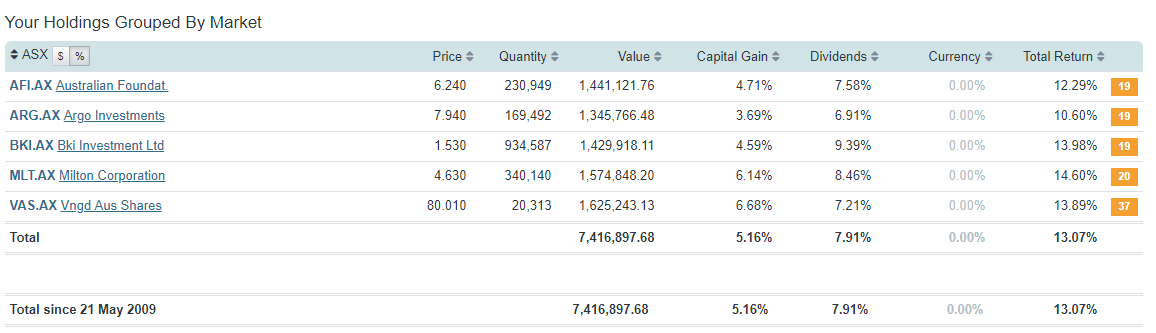

For example, this is what our portfolio currently looks like.

So next time we buy, it will be to ‘top-up’ the lowest split, which in this case will be World ex US or VEU. The splits are all out of wack because we focussed on Aussie equities during the last 12 months. Ideally, you want to be as close to your splits as much as possible. When your portfolio reaches a certain point however, the market movements will be so great that you might find it hard to maintain your splits even by buying the lowest weighting split. But this will be a good problem to have since your portfolio at that stage will be in the 7 figures.

Something really cool about this strategy is that you’re always buying the split that is down. If one split booms but the others don’t, you won’t be purchasing more of that booming split.

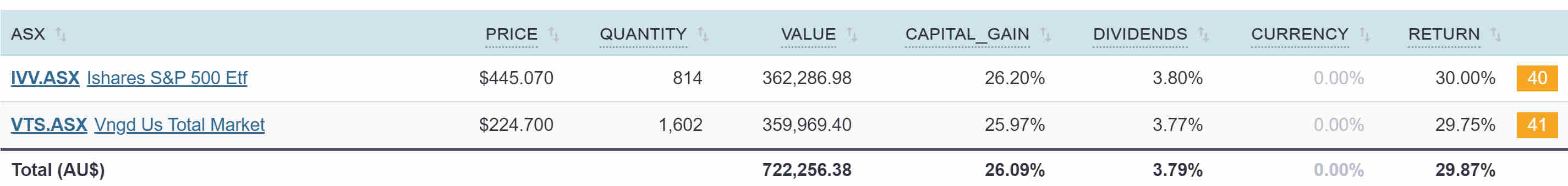

Change 2

The second change we will be making is switching from VTS to IVV.

iShares Core S&P 500 ETF is extremely similar to VTS with a few differences but no major ones we’re concerned about. VTS is more diversified and 0.01% cheaper but is not domiciled in Australia and does not offer DRP. This means that we need to fill in the W-8BEN-E form every three years or so.

The W-8BEN-E form is literally 10 minutes of your time every 3 years and is often overblown in terms of effort, but nonetheless, the two funds are so similar that it’s worth saving the extra admin plus having the DRP option available which I’ve been looking to use as of late.

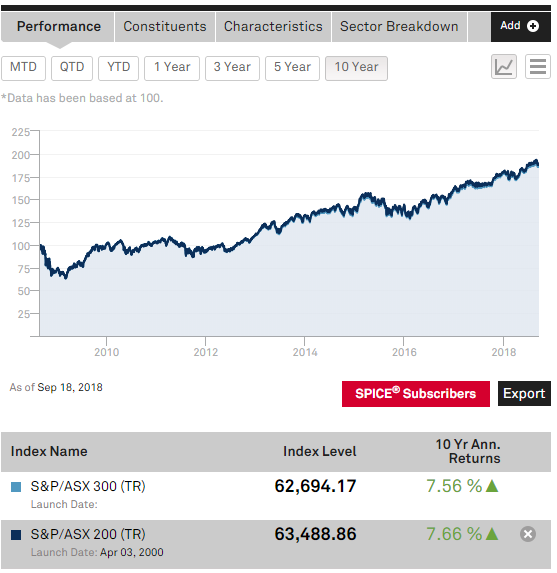

Here are their 10-year returns to just show how similar they are.

Change 3

The third part of the plan is a hybrid approach between relying only on dividends vs dividends and selling parts of the portfolio. IVV and VEU don’t pay a lot of dividends, but they still pay them.

IVV has returned 3.27% over the last decade and VEU has done 2.85%. Not great, but still cash flowing into the account. And more importantly, those dividends are unfranked income!

We will aim to not touch the portfolio and use the dividends from both Aussie and international shares to live on. If it’s a bad year, however, we will look to sell-off some units to cover the shortfall.

I’ve already gone into why selling parts of the portfolio is perfectly ok if you allow for it to recover in strategy 2. In fact, from a rational market point of view, there’s really little difference between selling units for income and having the company pay you via a dividend. In theory, both should have the exact same consequences. But markets are not rational so they vary to some degree and is a prime reason why we like the dividend approach more.

How It Works

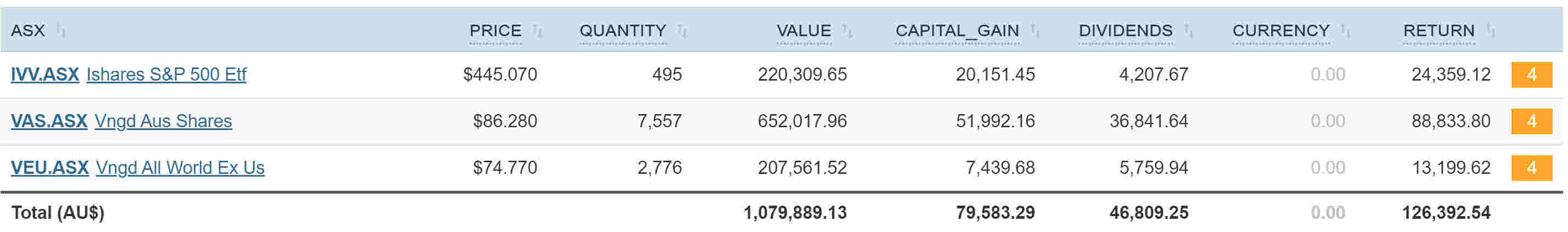

Let’s look at how the newly allocated portfolio would have done during the last 12 months. Here, I have created a dummy portfolio with all trades done exactly one year ago with the total of the portfolio’s value being a cool $1M which is what we’re aiming for.

Aussie equities (I had to use VAS to go back far enough) @ 60%

US (IVV) @ 20%

World ex US (VEU) @ 20%$46,809 worth of dividends ain’t bad and is more than of FI number of ~$42K!

Bumping up the weighting of Aussie shares to 60% (it was 40% for strategy 2), plus the lower dividend payments of our international shares have actually generated enough income for us to live off during the last 12 months.

But this was a particularly good year for Aussie shares and it won’t be this good all the time. We will save any extra income during those good years to create a cash buffer in preparation for the bad ones that will no doubt come.

If it’s a particularly bad year for dividends, we will look at selling off some units to cover our expenses.

The other thing is that the likelihood of us not earning any money in retirement is extremely low. I’ve covered this in what retire early means to us in the context of FIRE.

I’m extremely confident that the dividends from a $1M portfolio that is weighted to 60% Aussie shares plus any additional income will be more than enough for us.

Selling off units is there as an option but I don’t think we’ll need it tbh!

Time will tell.

To summarise strategy 2.5

Stop Changing Strategies Dude!

This is you

“Man, you flip flop more than my thongs! Stick to one strategy mate and stay the course. If the axing of the franking credit refund caused you to change strategies, you were never in it for the right reasons.”

And this is me

“Yo! The overarching strategy of investing in great companies has never changed. There was definitely a major difference between strategy 1 and strategy 2. But the fundamentals from strategy 2 to 3 and now to 2.5 are exactly the same”

The thing is, investing in great companies should always be the number 1 goal. All this other shit comes later.

The issue with picking the good companies from the duds is that it’s really hard to do. Which is why index investing is so cool.

The tweaks between our strategies are really fine-tuning our portfolio to meet our specific needs in the following areas:

I think everyone should be a bit flexible with how they invest to a certain degree. Picking one strategy and literally not changing anything during your whole life seems unlikely. Franking credit refunds are a great example of this.

And what’s to say the government won’t impose some stupid tax on other asset classes or something else within our life?

It would be ridiculous to suggest that if the government turned around and started taxing Aussie shares an additional 30% that everyone should just ‘stay the course’ and not look at alternative methods.

Everyone has their tipping point when enough is enough. And even though the refund remains, for now, I’m looking at protecting against this potential rule change without drastically upheaving everything.

I think strategy 2.5 is a nice balance between everything that’s important to us in an investing strategy.

Conclusion

I’m still learning as I go.

Judging by some of the emails I get, you’d think that I’m some sort of investing guru which couldn’t be further from the truth.

This years election taught me a valuable lesson that I hadn’t considered as much as I should have before.

The legislation risks for investing in general but particularly the very real possibility of no more franking credit refunds one day.

For us and I assume a lot of people chasing FIRE, franking credits without the refund in retirement won’t be worth the concentration risk or the ~4% yield (still pretty good) when you consider that you’re losing up to 30% of your return due to the additional tax that you otherwise wouldn’t be paying had you invested in something other than franked dividends.

Although not completely, Strategy 2.5 mitigates this potential change by re-introducing international shares back in the portfolio which reduces our reliance on Aussie dividends. It also makes other small changes as mentioned above.

When we made the shift away from property to focus on shares, the number 1 goal was to invest in great companies. None of this other stuff is as important as that. Index investing means we don’t have to research which companies are going to be good or bad. It filters that stuff out for us.

Because we don’t have to worry about choosing the good companies from the bad, we can instead spend our time to tweak our strategies so they align with what’s most important to us.

Mrs FB and I optimise the portfolio to improve these areas:

Strategy 2.5 improves on all of these areas whilst not uprooting our investing fundamentals which is what any good tweak should do!

That’s it for now.

Let me know what you think in the comment section below 🤙

Spark that 🔥

The Curious Case of Franking Credits and The FIRE Community

Something bizarre is happening and I have no idea why.

It’s to do with the Franking Credit changes that Labor are proposing to make if they win in this upcoming election.

This article is not going to go into whether the changes are good or bad, or even a technical breakdown of the franking system and how it works. In fact, the target audience for today’s article are people who understand the franking system and what the changes propose to do.

What I’m going to cover is the strange phenomenon I’m seeing more and more of as we inch closer and closer to the election.

Let me introduce you to ‘The Curious Case of Franking Credits and The FIRE Community’

What’s Being Said

Assuming that you’re up to speed with the debate at hand, I’m going to go over the most common arguments I’m seeing online and give my take.

“Franking was introduced to stop double taxation not to give refunds. Howard–Costello changed it in 2000. It was never meant to have refunds”

The reason that the franking system came about in the first place was from an independent review into the Financial System in the 1979 commission by the Fraser Government. This resulted in the ‘The Campbell Report’.

The fundamental principle behind dividend imputation is to ensure that income is taxed once by those obliged to pay it.

If someone does not receive the franking credit when their tax obligation is zero, they have paid additional tax when they should not have. This means that they have paid more tax than others who earn the same amount but through other means of incomes such as rental, PAYG, sole trader business, bonds etc.

For example:

If you remove the refund, Person C has to pay $4,800 in taxes when they are only receiving an income of $16,000.

Now back to the point.

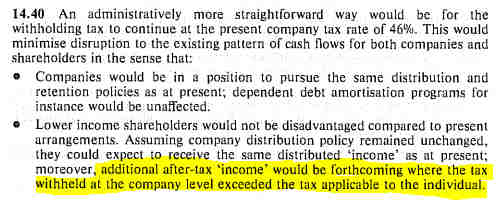

The Campell Report did, in fact, have refunds included in it!

“Lower income shareholders would not be disadvantaged compared to present arrangements. Assuming company distribution policy remained unchanged, they could expect to receive the same distributed ‘income’ as at present; moreover, additional after-tax ‘income’ would be forthcoming where the tax withheld at the company level exceeded the tax applicable to the individual.”

AKA a refund!

What actually happened was the Hawke-Keating Government in 1987 implemented the ‘interim’ recommendation of the Campbell Review. This was not the original recommendation and ended in 1999 following the Ralph Review which introduced the refund of excess franking credits under the Howard Government.

The current system we have (which includes franking credit refunds) was designed by an independent body and was implemented with the support of both houses!

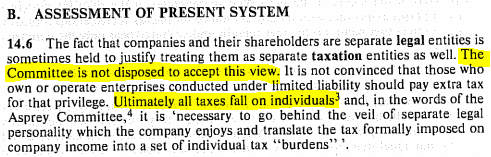

“A company and an individual are separate legal entities. A profitable company should always have to pay some tax. The franking credit refund is a loophole where the share payers can potentially pay no tax”

This is very clearly addressed in the Campbell Review.

“The fact that companies and their shareholders are separate legal entities is sometimes held to justify treating them as separate taxation entities as well. The Committee is not disposed to accept this view. It is not convinced that those who own or operate enterprises conducted under limited liability should pay extra tax for that privilege. Ultimately all taxes fall on individuals and, in the words of the Asprey Committee, it is ‘necessary to go behind the veil of separate legal personality which the company enjoys and translate the tax formally imposed on company income into a set of individual tax ‘burdens'”

Pretty straight forward. They might be separate legal entities but all tax eventually falls on individuals!

The company is simply prepaying tax for the shareholders.

If you accept that franking credits can offset an individuals income to $0, you must accept the refund as the shareholder has prepaid more tax than they should have.

If you want to still argue this point. I’m assuming that you’re in favour of completely eliminating imputation credits altogether right…? Tax will be paid twice, once for the company and once for the individual. They are separate after all, right???

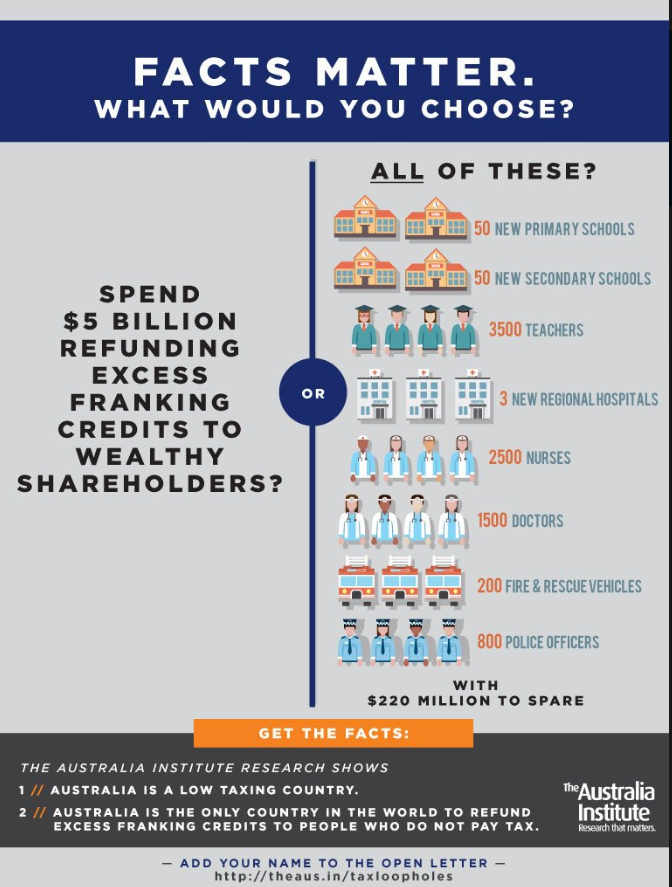

“These refunds are costing taxpayers billions each year. That money could be spent on schools, hospitals and roads. Why should the rich get a refund from the taxpayers?”

This is one of the first arguments from people who don’t understand how franking works. To be fair, most of the FIRE community-related arguments on this matter don’t raise this point. Because we fully know that the refund has absolutely nothing to do with other taxpayers and is simply returning money that is rightfully owed to the shareholders from which the money was earnt in the first place through the company!

I’ve yet to see anything that specifically stipulates that the ALP will use any revenue received by these changes on schools/roads/hospitals etc. What most likely will happen is any extra revenue will be added to the Federal government’s coffers where god knows what it will be allocated to.

Let’s take a little look at the fiscal management of the Government, shall we?

So what are we at now… around $20+ billion of wasted taxpayers money without even really trying (I’m allowing for some actual value of these projects to be returned).

Seriously.

These projects were off the top of my head and I did a bit of Googling to fact find. I’m sure there’s plenty of others out there that cost even more.

I have worked for the government for over 7 years and trust me when I tell you, we are not good at managing money/projects.

The late Kerry Packer summed it up best in 1991:

‘I am not evading tax in any way, shape or form. Now, of course, I am minimising my tax, and, if anybody in this country doesn’t minimise their tax, they want their heads read because, as a Government, I can tell you you’re not spending it that well that we should be donating extra.’

“Australia is the only country in the world that have franking credit refunds”

My response to this one has always been… so what?

I actually think it shows a sign of weakness from that side of the argument. I mean, what has that got to do with anything? There’s plenty of things unique to Australia.

Does that make us wrong?

No!

In fact, I’d wager that Australia must be doing a lot of things right as we are consistently ranked as one of the best countries to live in on the planet and our citizens are some of the richest in the world. There’s plenty of factors to attribute to these claims but it just strikes me as odd when people bring this point up as if it’s a bad thing 😕

The Propaganda Machine In Full Swing

The ALP are clearly trying to win votes from the working class by exploiting on their lack of knowledge around a policy they want to change (franking credits this time around) which is how politics have worked since the beginning of time.

They are spinning this debate into:

‘The rich aren’t paying their fair share’

Check out some of their propaganda.

I have no idea who ‘The Australian Institute’ is but they call themselves a ‘think tank’ but are clearly a propaganda machine.

I really enjoy the play on words with the poster insinuating that the taxpayers are somehow ‘spending’ $5B to refund franking credits whereas we know perfectly well that the taxpayers don’t have to pay for anything. The refund is simply returning the tax paid by the shareholder if they paid too much tax that year…like … you know… how it works with every other form of income.

But hey, good job PR team! Nothing is more likely to get votes than if you pretend you’re fighting for the working class and trying to get the rich to pay more tax so you can fund more public services.

So Robin Hood of you. In fact, Robin Hood is almost a perfect analogy because this policy is indeed stealing from the rich but I’m not sure about giving to the poor. As I’ve covered above, the government sorta sucks with money and to quote Mr Packer again, if you think that the money that is retained by this policy (assuming they are able to retain any money, which is highly debatable) will be going to these public services … ‘You’d want your head read‘

There are also other countless articles written by prominent financial figures with large followings that also raises eyebrows about the sincerity or purpose of some of the content that’s published.

The Real Reason Behind This Policy

It’s pretty obvious (to most) what’s happening here.

The real issue with this whole debate is the tax-free pension with Super. When you start to receive an income from your Super (pension mode) you don’t have to pay a single cent of tax on that income up to $1.6M. This means that because your taxable income is $0 if you receive Aussie dividends with franking credits attached… you guessed it, you will receive a refund!

The unsustainable tax-free pension mode of Super has been debated countless times and I’m not going to go into it.

But make no mistake about it, the ALP are targetting this and the FIRE community is getting caught in the crossfire.

‘But why wouldn’t they just change the law so there’s not a tax-free pension mode’

Because that’s not smart politics!

Does anyone honestly think that this move to axe franking credit refunds wasn’t strategic? Hell, half of the FIRE community doesn’t understand it well, how are we to expect that the general public will get it? The answer is they probably won’t. And I don’t blame them, it’s complicated and confusing. They are sold the dream that the wealthy will have to pay more tax (which will be 100% true) and that money will be used to fund public services (lol).

That’s a great PR campaign if you ask me. And incredibly hard to argue against because it’s so confusing.

Nevertheless.

Everything I’ve covered so far is pretty stock standard on the battlefield of the political juggernaut trying their best to win all of our precious votes.

But there’s something else afoot that I can’t figure out…

Where It’s Getting Weird

To summarise everything I’ve covered so far:

Here’s my beef.

The entire reason this article exists is that I’m noticing a trend amongst the FIRE community where an uncomfortable number of members are not only in support of this change but are actively campaigning for it to go through.

This change directly affects the FIRE community!

If you are planning on retiring from Aussie dividends, you could be set back years until you reach freedom if this goes through.

Yeah yeah yeah I know you can tweak your investments to get around it and people did just fine without franking and all that but that’s not the point I’m making here.

My point is that a lot of the community is not taking an IDGAF approach. They are trying to argue for the changes that will directly disadvantage them and it’s doing my head in.

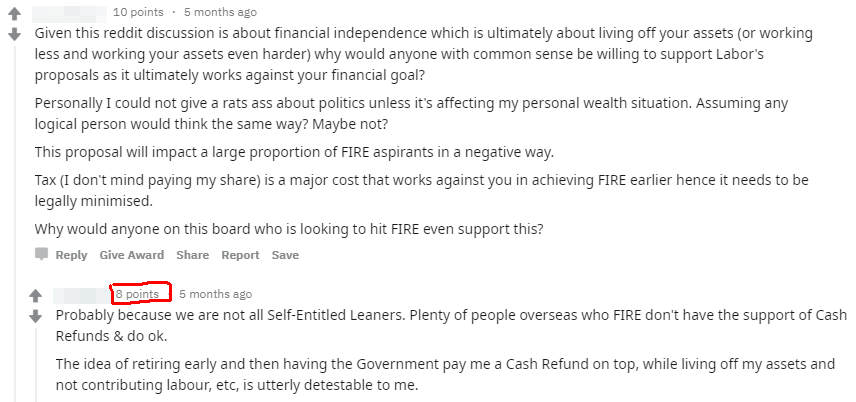

Here is what I’m talking about and I want to preface this by acknowledging that every single one of the screenshots below is from a FIRE or financial independence community group (Facebook, Reddit, forums etc). I have not included the whole quote or comment in some of the screenshots FYI.

The first comment pretty much sums up view spot on. I’m glad to see it sitting on 10 points (basically an agreement for those who don’t use Reddit). But the response has nearly the same number of upvotes which would indicate that a significant amount of the sub (which was small when this was posted) would disagree.

*(this edited screenshot is not the whole post, just the part I’m highlighting)

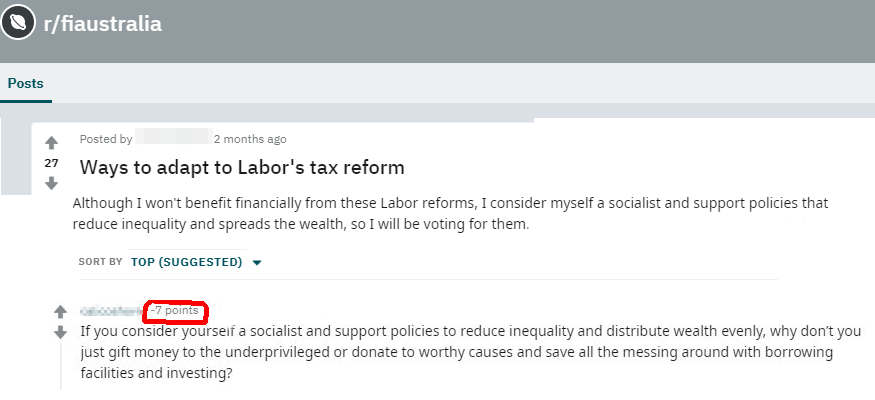

Same sub as above. 27 upvotes for a post that clearly states that they won’t benefit financially from these changes but will be voting for them anyway. This was posted on a financial independent specific forum. When another member replies with what I would consider a pretty reasonable response, they get downvoted and are currently sitting on -7 points.

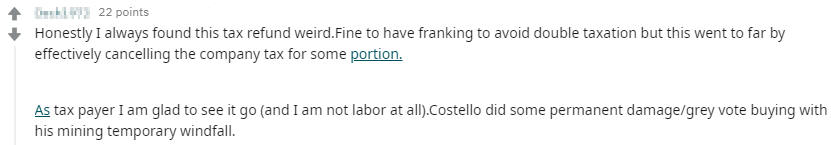

Another forum member glad that these changes will go through. But the community is really getting behind this comment with 22 points.

Some ALP propaganda posted on the ‘Mustachians Australia’ group.

19 Likes and 3 Loves.

The first comment is even a clapping hands emoji.

PEOPLE ARE CLAPPING ABOUT THESE CHANGES IN A FIRE GROUP.

Australian Facebook group specifically geared towards reaching financial independence has the ALP propaganda we seen posted above… And wouldn’t believe it… It has 10 Likes and 2 Love reactions. People who are trying to reach FI are loving the fact that they will have to pay more tax… 🤔

Excuse me…

But what the actual fuck is going on?

I fully expect to see these sort of posts and more importantly, responses from any other group in Australia. I think it’s unrealistic for the general public or anyone who these potential changes won’t affect to give two shits. But a good percentage of the FIRE community actively promoting and wanting these changes to go through is… confusing me.

Why Is This Happening?

I don’t really know but I have four theories.

Conclusion

Guys, I get it.

You should never base your strategy around tax laws. The most important rule for investing should always be to invest in great assets (whether that’s locally or internationally). Tax strategies should come later down the track and we shouldn’t get too upset when they change or are abolished. This is to be expected at some point after all.

I’m not saying we need to band together to fight this (I’ve got better things to do), but for the love of God, we don’t need to be actively campaigning to disadvantage ourselves.

Maybe I’m missing something here, but I can’t work out why so many of us are happy to pay more tax to a government who has consistently shown its incompetency to spend money wisely.

I’m really interested to know what the community thinks.

Are you picking up what I’m putting down? Or maybe I’m just out of touch and need more faith in the government?

Please let me know what you think down below 👇.

Spark that 🔥

*Credit to these two Cuffelinks articles for most of my research around the history of franking. Article 1, article 2.

Investment Property 1 Has Been Sold

The first of our investment properties (IP) has officially been sold 🎉👏

This is part of our strategy for creating a passive income to fund our lifestyle in retirement. The investment properties had a different purpose in our original strategy for reaching financial independence, but they now will be sold off over the next few years when the time is right.

What Was The Return?

I’m so glad I can finally crunch all the numbers for you accurately now it’s been sold because you never quite know how much your true return will be until you actually sell your investment property.

Without a doubt the most interesting question on most peoples minds would be:

‘So how much did you make?’

To cut a long story short, we had an annualized after-tax return of 36.48%.

If you’re interested in all the finer details of how we arrived at that figure please read on.

The Numbers

This IP was built in south-east Melbourne for $340K in 2013. I lived in it originally to receive the FHOG.

Buying expenses

I built this house so there were no expenses for conveyancing or stamp duty. All the loaned money went to the builder who was selling land and house packages.

I had a loan of $319,815 (the LMI got attached to the loan plus some other expenses).

Actual money spent so far: $9,000

Sweat Equity

I spent countless weekends with my old man and mum going up to the house to add value to it. This not only saved us money, but I also learnt a bunch of new skills. Win-win.

Total: $22,061

Actual money spent so far: $31,061

Cash Flow/Holding Costs

Cash Flow Year 1 Year 2 Year 3 Year 4 Year 5 Rent – All Expenses -$7,590 -$3,929 -$2,744 -$3,047 -$5,841 Depreciation -$8,228 -$8,283 -$7,445 -$6,858 -$6,641 Tax Refund $2,654 $4,519 $3,770 $3,664 $4,618 Total -$4,935 $589 $1,025 $617 -$1,223 Total cash flow over the 5 years = -$3,927

Notes:

Actual money spent so far: $34,986

Selling Costs

Total Selling Costs: $6,760

Total money committed to this investment over 5 years: $41,746

The IP was sold last month for $512,500

I invested $41,746 of my own money and received $197,697 in return over a 5 year period.

ROI vs ROI On Money Invested

Way too often when anti-property commentators are trying to convince investors that another market has had superior returns over the last X amount of years they usually leave out the most important part of the equation.

Property investors use leverage to buy their investments.

Without factoring in leverage, I don’t understand how anyone can make blanket statements about the true returns of real estate. It’s not comparing apples with apples.

With that said, I want to provide you with both returns numbers so I can further illustrate the point that the only real return number you should be measuring is how much money you put in and how much you get out.

ROI

Capital Gain = (gain from investment – cost of investment) / cost of investment

= ($512,500 – $386,821) / $386,821 = 32.49%

Annualized Capital Gain = 5.79%

Gross Yield = Annual Rent / Purchase Price * 100

= $18,720 / $340,000 *100

Gross Rental Yield = 5.51%

Net Yield = (Annual Rent – Annual Costs)/ Purchase Price * 100

= $15,985 / $340,000 *100

Net Rental Yield = 4.70%

Total Annualized Return

8.28% + 4.70% = 12.98%

Notes:

ROI On Money Invested

This one is a lot easier to work out and the true measure of the investment, not an assumption.

ROI = (gain from investment – cost of investment) / cost of investment

= ($197,697 – $41,746) / $41,746 = 373.57%

Annualized Total Return = 36.48%

Tax?

In an extremely fortunate turn of events, IP1 became my PPOR after I first moved in to receive the FHOG.

Even though I rented it out, I never bought another house to live in which was not specifically planned but worked out incredibly well. There’s a special rule where you can treat your dwelling as your main residence after you move out for up to six years even if it’s used to produce an income.

Believe it or not, this means that I don’t have to pay a single cent of tax due to the CGT exemption for main residence rule 😱🤑.

My Experience With IP1

Investment property 1 taught me more life lessons than any investment in the future ever will.

It was the first house I ever bought, renovated, sacrificed countless weekend adding value to it with my old man helping me out and a whole raft of issues that I had to figure out along the way. From dealing with tenants, discovering how many hoops you have to jump through with banks, lodging insurance claims, rushing to finish the concreting in 38-degree heat (would not recommend), hosting open days and so much more.

Some say property investing can be passive. IP1 was definitely not passive!

It was hard work which did eventually pay off in the long run. Now, how much of its success can I take credit for? That’s a very good question.

Looking back in hindsight I can point out a few key things that happened that I had nothing to do with and was 100% luck

I fully admit that all of the above was unforeseen, I was just hoping for the property to keep up with inflation and use leverage to amplify the gains.

One of my favourite quotes of all time comes from the Roman philosopher Seneca.

I’m a big believer that you can create your own luck. Whilst I still think that the majority of the return from IP1 came from an uncontrollable event (market boomed), there were things that definitely helped bolster the profits that were in my control.

Why Did I Sell?

The strategy moving forward is to sell all the investment properties and transition to a more cash flow portfolio of ETFs/LICs. IP1 was the first cab off the rank for the following reasons

Conclusion

Overall IP1 has been a very successful investment in terms of both return and life skills obtained. I was very fortunate to be in the market during the time I was and I’m pretty confident in saying that I’m most likely never going to make as much money in any other investment ever again.

This may sound like a bummer but the truth is that IP1 was a hell of a lot of work! I can’t be effed doing all that again and I doubt I will have as lucky timings with the market twice. It’s a risk I don’t have to take and Strategy 3 suits our current lifestyle better being so passive.

What’s really hard to measure and has not been factored into the above return is all the physical work required. It was essentially a side hustle I did on weekends (not every weekend but a lot). If I deducted the hours worked * an hourly rate, the return would be less.

I’m still a fan of property investing for the right investor, but I am no longer the right investor and will continue with our strategy of selling off the other two IPs when the times right. It’s my opinion that there are more problems to solve with real estate and more opportunities for those who seek the challenge vs shares.

How has your experience been with real estate? I would love to hear from others positive or negative in the comment section below 👇

ETFs vs LICs and Strategy 3 Revisited

Okay, so if you’ve been following me for any length of time you probably know that I’m a big fan of ETFs.

You know, those little exchange-traded funds that grant instant diversification with rock-bottom management fees to provide a great return for extremely little effort. It’s no wonder that famous investors like Warren Buffet and Mark Cuban (US billionaire) are also big fans.

Buffet has been quoted as saying:

“Consistently buy an S&P 500 low-cost index fund. I think it’s the thing that makes the most sense practically all of the time.”

I wrote about the benefits of index investing briefly in ‘Our Investing Strategy Explained‘ post.

I’ve been a big fan ever since reading the Bogleheads Guide to Investing about 3 years ago. And I put my money where my mouth is and currently have over $160K invested in ETFs.

“So if ETFs are so great, what the hell are LICs and why should I care? “

I’m so glad you asked.

Let’s begin.

Listed Investment Companies

FYI when I refer to LICs, I’m referring to the older ‘granddaddy‘ LICs like AFI, ARGO, Milton etc.

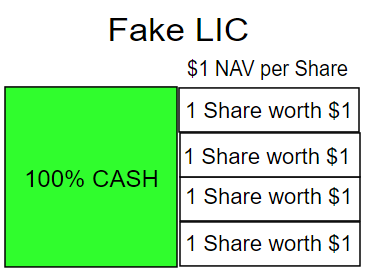

Listed Investment Companies (LICs) are first created by an initial public offering (IPO). Money is raised and a fixed number of shares are created for each investor. The money raised is then used for investing in assets such as a basket of shares which together make up the net asset value (NAV) of the LIC.

The shares of the LIC are traded on the stock exchange where investors are able to buy and sell when the market is open.

Sound familiar?

It should because, in a nutshell, ETFs are essentially doing the same thing. But there are key differences.

Key Differences

There may be more differences than what I’m about to go over, but the ones below are the key differences in my eyes and the ones that reflect my investing decisions.

Management Fees

ETFs tend to have a lower MER than the equivalent LIC but it’s not as bad as it sounds. If you stick to the older LICs (Argo, AFI, Milton etc.) the highest MER is around 0.18% which is not that bad. It’s still more than double that of an Australian index ETF such a BetaShares A200 (0.07%) though.

The management fees reflect the investment style of the two structures.

ETFs track an index or benchmark whereas LICs try to outperform the index. But given the low MER of the older LICs, some active management is acceptable in my view. I only have issues where the fund managers charge > 1.0% for their services.

WINNER: Generally ETFs

Legal Structure/NAV

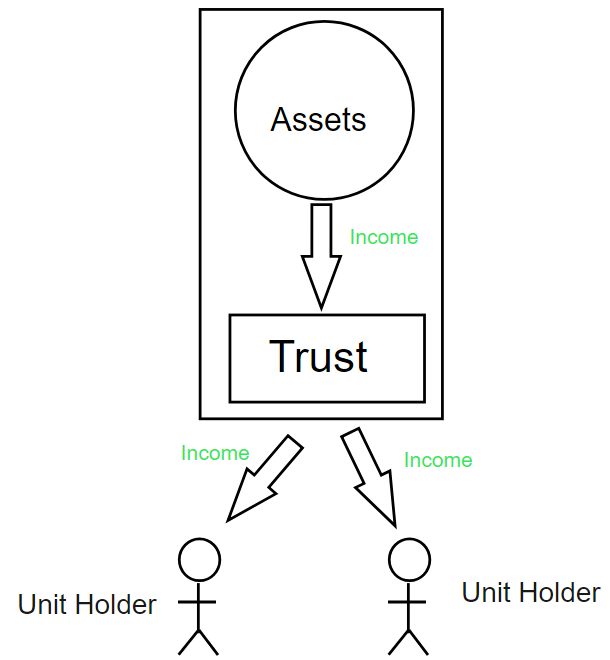

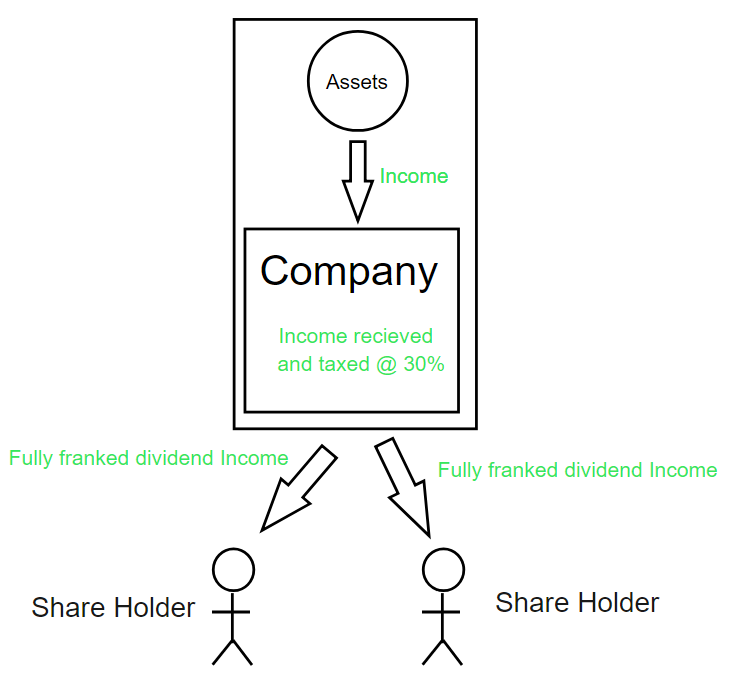

ETFs are a trust structure whereas LICs are a company as the name ‘Listed Investment Company‘ would imply.

This has some semi-big ramifications.

I’m going to try to keep to as simple as possible because we’re about to get technical here for a second.

To truly understand the differences between ETFs and LICs we must first understand how they operate and what’s the difference between Open-End and Closed-End

Closed-Ended

LICs are closed-ended.

This means that when the LIC had its IPO and raised the capital to start the company, a certain number of shares are issued. Once the company has been established and begins investing the capital on the behalf of shareholders, no more shares are issues. New investors wanting to join the LIC have to buy already issued shares on the exchange. The LIC does not create new shares to deal with demand.

Imagine a new LIC that has started with 4 investors each putting in $1. The LIC currently has a Net Asset Value (NAV) of $4 and there are 4 shares issued to each investor.

Those four shares that own the LIC are each worth $1 according to the NAV. But those shares are bought and sold on the market. And depending on how bullish or bearish the market is on Fake LIC, will determine how much the share price will drift away from its NAV value either up or down.

If someone offers 1 unit of Fake LIC for 80c, this is what’s called trading at a discount. If someone offers the same unit for $1.20 it’s known as trading at a premium. LICs can drift away from the actual NAV quite a bit.

Can LICs ever increase the number of shares? Yes, they can raise capital and issue new shares just like any other company but this only happens every so often and not something that’s done daily like ETFs.

Open-Ended

ETFs, on the other hand, are open-ended and can create or redeem new shares in accordance with the market demand. If someone wants to enter the fund, they don’t need to trade with a current shareholder of the fund (like the LIC does). The fund can create a new share.

Conversely, if someone wants to cash out their share. The fund has to come up with a way to get the cash which may mean selling assets within the fund to give the investor their money.

But who sets the price of each unit?

When an Investor wants to buy or sell their units on the exchange, there is a market maker on the other side of the trade. The price they offer is generally very close to the Net Asset Value of the fund.

This is why you can’t really trade an ETF at a discount or premium to the NAV.

WINNER: LICs. The ability to trade at a discount is desirable but the company not having to sell assets during a crisis to meet demand is a big plus.

Investment Style

Traditionally ETFs track an index or benchmark whereas LICs try to outperform the index.

If you actually look into what is in the portfolios of Australian ETFs such as A200 or VAS and compare them with the old LICs, there is a lot of crossover. The whole active vs passive debate is more of a debate when the active fund managers are charging big fees (>1.0%).

I’ve got no issues with a little bit of active management as long as the MER is low. In fact, I like that most of the ‘Grand Daddy’ LICs have a focus on income. This is important to me and something that is reflected with historic returns for those LICs (more on that later).

One issue I do have with LICs is that they can and sometimes do change investment style. The fund manager that has a fantastic track record might retire or get offered a higher wage at another fund. I personally like the fact that most ETFs are legally obligated to track an index and can’t diverge from that strategy no matter what the managers are thinking.

Some would argue that being able to see waves in the market and adjust accordingly is a good thing.

WINNER: Tie. I prefer to track an index but don’t mind a little bit of active management as long as the fees are kept to a minimum.

Retained Earnings