The Importance Of Increasing Your Income

The below article is actually a chapter I wrote for a great collaboration ebook put together by Pearler. I would highly recommend checking out the entire eBook (for free of course) which you can grab here.

“A dollar saved is better than a dollar earned”

We’ve all heard that one before. The ability to save more than you earn is a fundamental principle upon which FIRE is built.

Hands-down the most important step for reaching FIRE is how much of your paycheck you can keep and invest.

You cannot earn/invest your way out of bad money habits. It will eventually catch up with you no matter how much money you make. If you’re spending more than you earn, you’re going to be broke. It’s just simple mathematics!

It’s sorta the equivalent of trying to outwork a bad diet and expect results in the gym. In fact, there are so many parallels between good financial habits and being fit and healthy it’s uncanny. Most health/fitness experts would agree that your diet probably plays the biggest role in keeping your body happy. The other two major players would most likely be exercise and sleep. If you’re nailing all three of those, there’s a pretty good chance your body is feeling awesome.

Savings is to FIRE, what eating the right foods is to living a healthy lifestyle.

And if we follow this little analogy a bit further we might conclude that…earning money in FIRE is equivalent to or around the same level of importance as exercise when it comes to health and fitness. And maybe we can put getting a good nights rest at the level of investing.

It’s not a perfect one for one comparison but it makes for a good metaphor so let’s keep rolling with it.

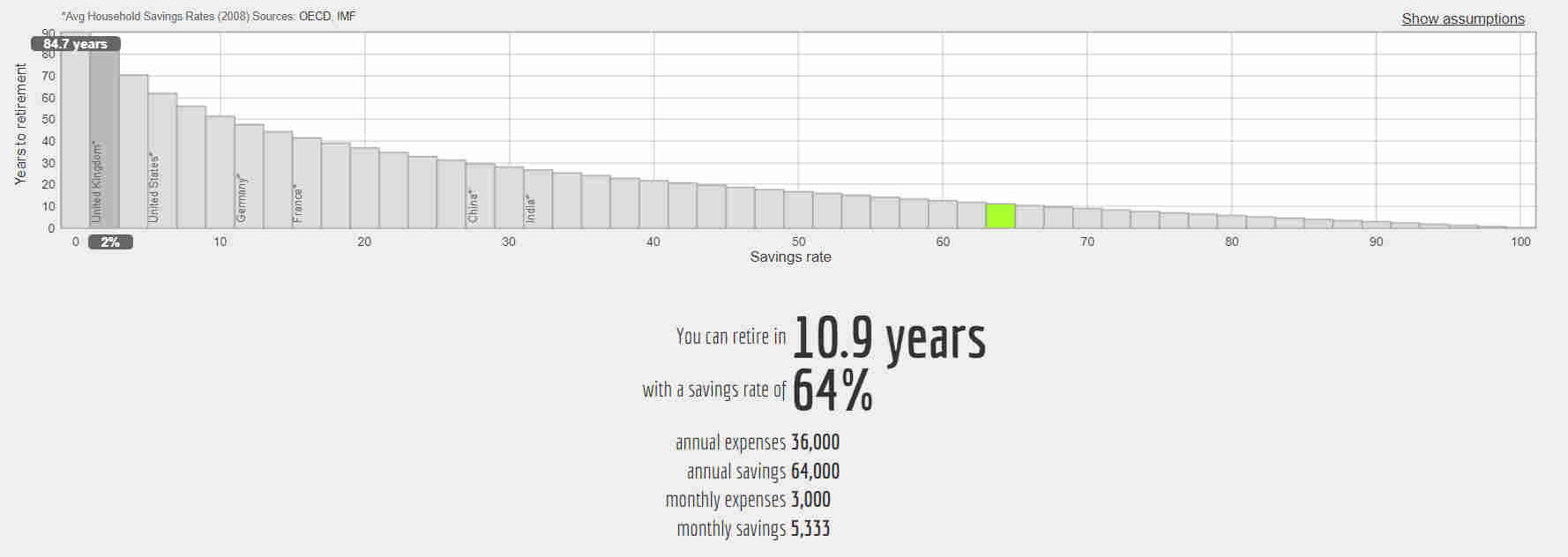

I’d wager that 90% of FIRE content is either about saving money or investing. But we seldom read how to earn more money even though it has astronomical benefits when implemented correctly. It’s true that FIRE is income agnostic, two people with a savings rate of 65% will both reach FIRE in around 10 years even if one earns $60K and the other $400K.

But there comes a point of diminishing returns for both saving money and investing.

The purpose of this article is to explain how beneficial it is to spend more time and energy increasing the amount of $$$ that flow into your accounts. Anyone who is on this path is already doing some form of exercise (earning money) but if you can look past your standard crunches and pushups you’ll discover there are gymnasiums out there filled with weird and wonderful machines that provide all types of workouts. And when you combine a great diet with a dialled in training routine that works best for you, the gainz can be off the charts.

BFYB Factor

The aim here is to illustrate just how much of an impact increasing your income (even a tiny bit!) can have on your journey towards FIRE.

Let’s try and apply the same metric to the three most important focus areas IMHO when it comes to reaching FIRE.

- Save more than you earn

- Increase how much you earn

- Invest your savings

We’ll call the metric BFYB (bang for your buck).

BFYB = The amount of effort required to improve a focus area

Let’s look at our first focus area (save more than you earn) and re-establish why it has the best BFYB value.

Increasing Your Savings Rate

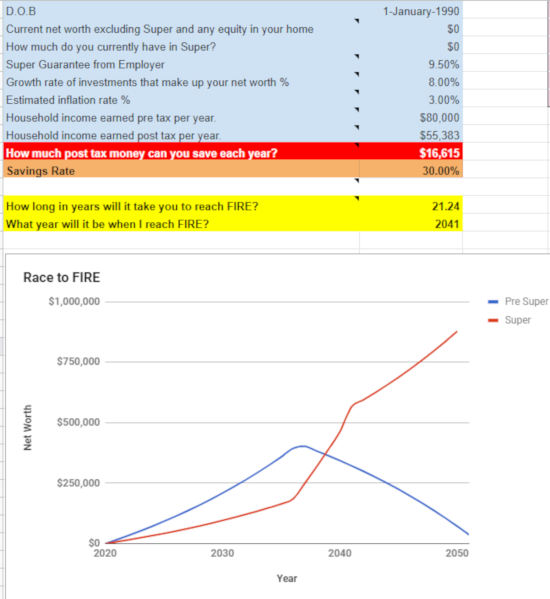

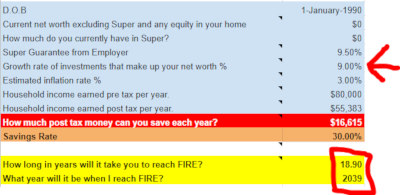

Using The Australian Financial Independence Calculator we can plug in Joe Smith’s journey towards FIRE starting from $0.

We’re assuming he is a single 30-year-old Sparky from Brisbane who owns his 3 bedroom home (no mortgage), works 38-40 hours a week, doesn’t have kids and all the below numbers stay constant over the next 30 years to make the modelling super simple.

Ok, so an Australian who earns $80K with a savings rate of 30% can retire in 21.2 years. Not too shabby.

A 30% savings rate is already way above the average but let’s just assume Joe, whilst obviously a diligent saver already, is living a pretty normal consumerist 21st-century lifestyle with a heap more fat to cut. I don’t think it’s unrealistic or even that hard for him to go from a 30% savings rate to 40% given his circumstances above. The difference between 30%-40% is $5,538 a year or $106 week. I would almost guarantee that 90% of Australians spend more than $106 dollars a week on things they don’t need or even want half the time (myself included). Optimising big-ticket items like housing, transport and food would almost certainly save a whole lot more than the $106 a week we require for this example.

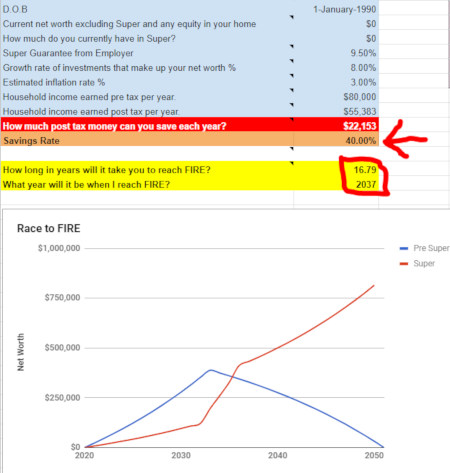

Anyway, if we bump the savings rate up to 40% we wipe off 4.5 years!

Everyone’s circumstances will vary but the effort required in my guesstimation for Joe to increase his savings rate 30% to 40% is rather small and the BFYB is high.

This is what we want. Low effort, high reward.

And it’s why focusing on your savings rate is absolutely the best way to decrease the amount of time towards FIRE… up to a certain point.

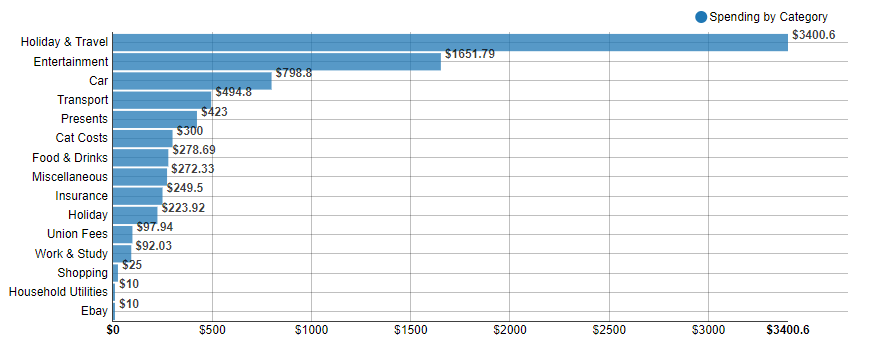

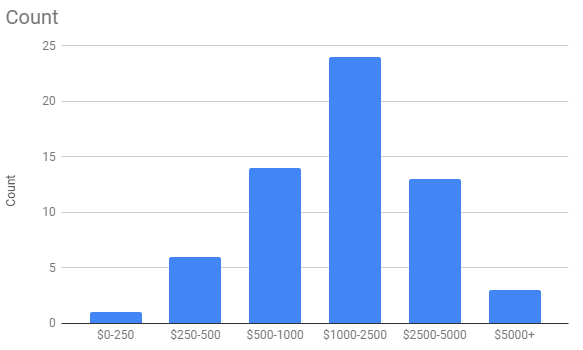

There comes a point of diminishing returns where focusing on your savings rate will not yield a good BFYB and the hard part is that it’s different for everyone because of circumstances. I can only speak for ourselves but this is what our savings rate BFYB chart looks like:

Currently, we can pretty much save close to 40% of our after-tax income without breaking a sweat. That means no sacrifice or comprising on anything. The effort for us to save 40% is almost the exact same as saving 10%. But the effort required to maintain a savings rate of >60% is when things start to change. For us to optimise our lifestyle further and squeeze out a few more percentages is astronomically harder to do when we start to get around the 65%-75%+ range. Don’t get me wrong, we could do it. And that would speed up our journey to FIRE… but at what cost?

If I can draw from our earlier metaphor of our savings rate being similar to a diet, we could say that cutting out junk food during Monday-Friday and making sure you eat some sort of leafy greens every day is a realistic goal with huge health benefits. But if we tried to never drink alcohol or eat Macca’s ever again, firstly we might be setting ourselves up for failure and secondly, whilst being the healthy option, it’s not going to have as big of a health benefit as the first goal. There are diminishing returns for eating healthy just like there are diminishing returns for improving your savings rate.

Increasing Your Income

This is the focus area that doesn’t get enough attention.

Increasing your income has a direct correlation with your savings rate but for whatever reason, a lot of people never put in the time and effort to improve it. There’s so much low hanging fruit which doesn’t really require a whole lot of effort but has a high BFYB value.

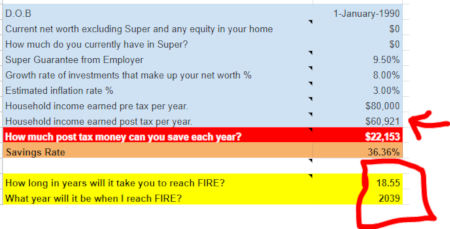

Let’s look back at Joe Smith from above but change one thing. Instead of him saving $5,538 a year, let’s have him earn an extra $5,538 (after tax) a year and see what happens.

Joe increased his after-tax income by $5,538 which in turn wiped off 2.7 years!

BFYB: Really good

We’re going to be talking about the low hanging fruit later on but if I’m being honest, Joe could easily make an extra $5,538 (after tax) purely from giving up more of his time. If we assume he’s making an after-tax hourly rate of $28, he would only need to put in an extra 197 hours worth of work over the year. And that’s not even factoring in overtime or weekend rates. An extra hour for 197 working days a year is really not that much.

Some of the stories I’ve heard first hand from young London bankers is absolutely mind-boggling. Think 70-80 hours per week… and work on weekends is to be expected!

2.7 years is not as good as our savings example above which wiped out 4.5. But if we combined them, we get epic results!

Improving our savings rate and increasing our income by the very same amount has annihilated 6.53 years of working.

Now we’re cooking with gas!

But just like our savings rate, there are diminishing returns in the pursuit of increasing your income. And I keep coming back to circumstances but unfortunately, it’s very much a circumstantial question when we start talking about this focus area because we all aren’t on an even playing field.

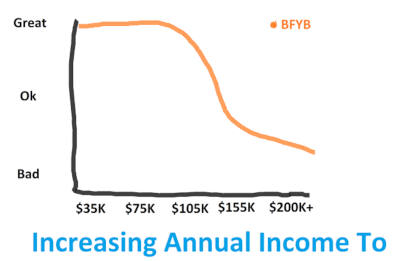

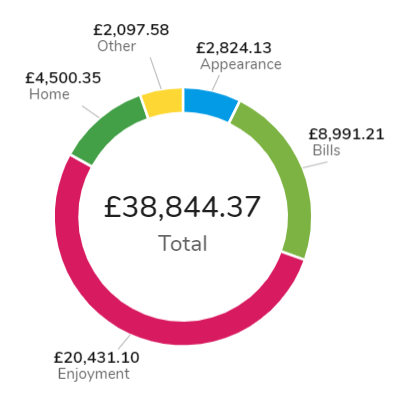

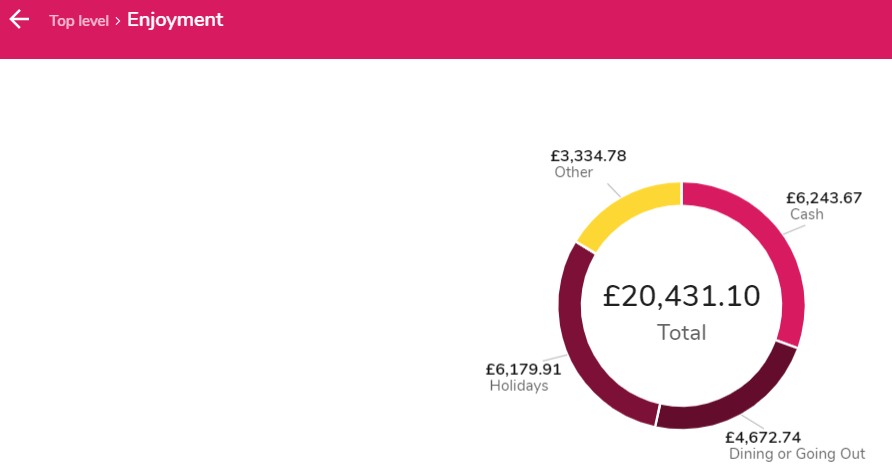

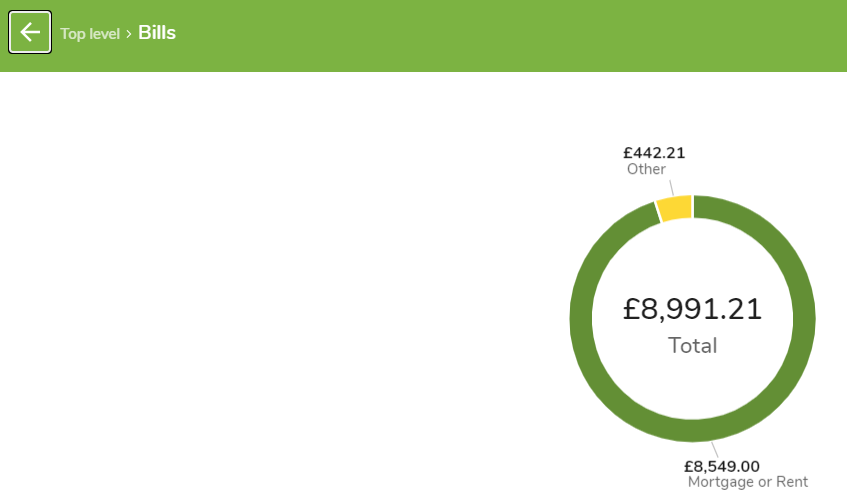

Below is my personal increasing income BFYB chart:

Let me explain what this means because it’s important.

Let’s say I’m unemployed next year (which is what’s most likely going to happen when we move back to Australia) and my salary is $0 (ignoring any investment income of course). I’m scanning through the classifieds looking for my next job, which, for this example will be the sole source of my income.

For my circumstances personally, it doesn’t require any extra effort for me to land a job paying $100K as opposed to around $35K annually. I don’t want to sound overconfident but I have a certain set of skills and experience that the market is willing to pay me and I’m 99% sure I could land a job paying close to $100K no worries. In fact, I’d probably have a harder time getting my old job back at Coles if anything. Beyond $100K is when the effort required starts to increase and the BFYB value starts to go down.

Remember, BFYB = The amount of effort required to improve a focus area.

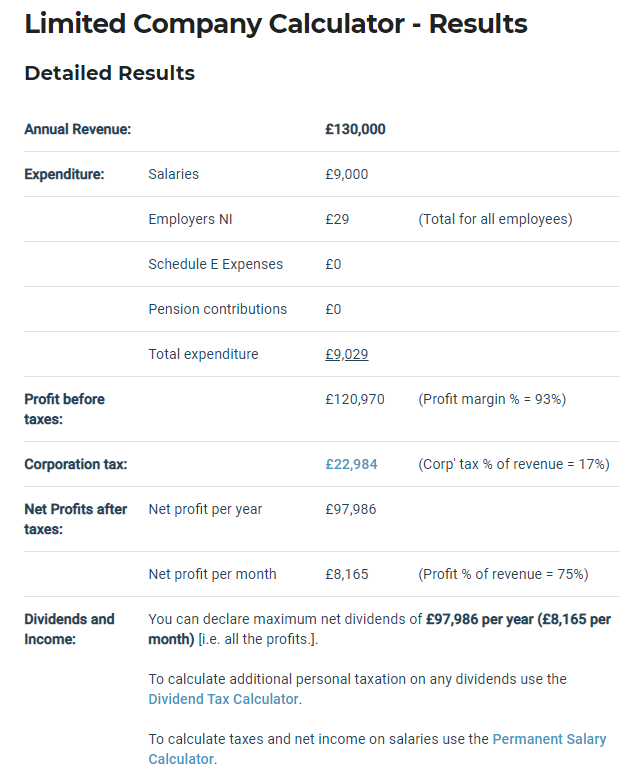

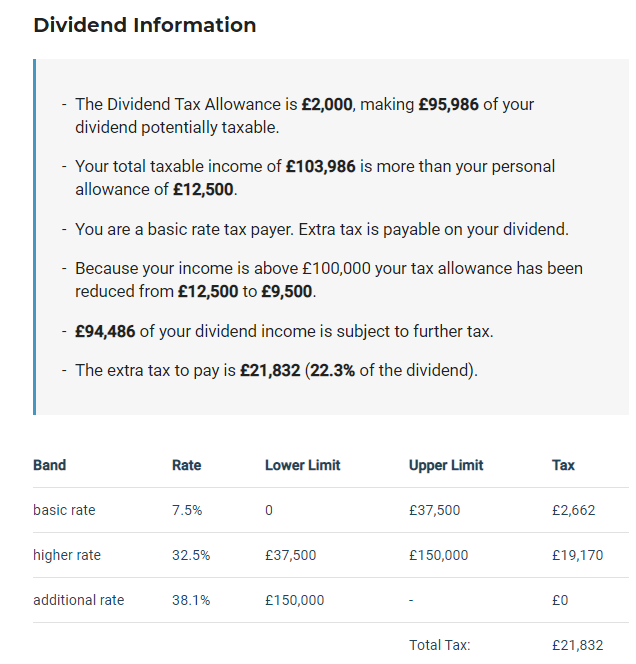

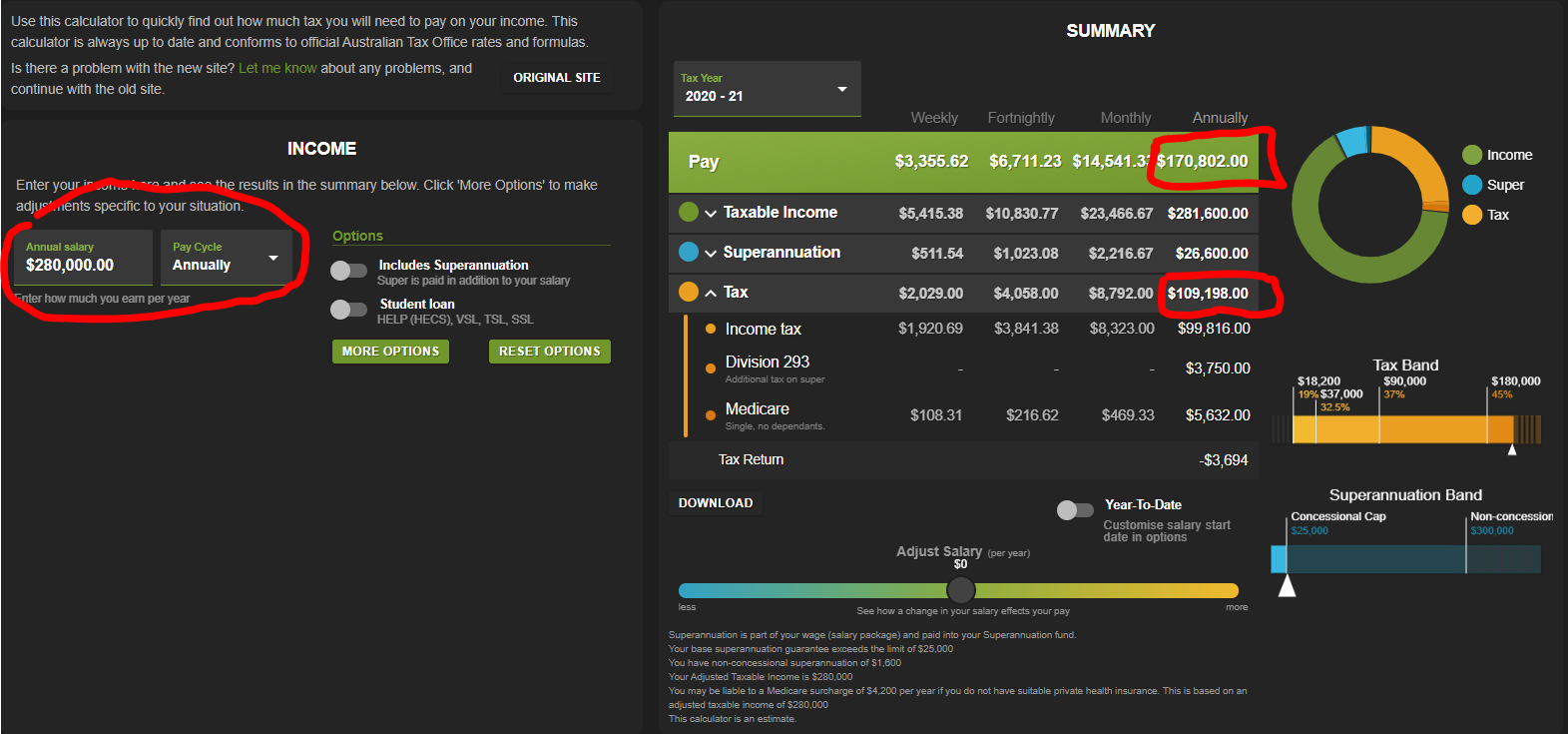

The effort required to earn a salary past $100K starts to increase a lot and for me personally, the extra effort doesn’t justify the extra income at around the $130K-$150K mark. Beyond that, there’s too much sacrifice with not enough gain. Too many responsibilities and work-related stress that I don’t feel is justified for the extra $$$. You may have certain skills and experience where earning $150K is actually quite easy and no different (in terms of effort) than earning $100K.

If we look at the ABS data from 2018 the median income for a full-time employee in Australia is $76K a year. If we adjust for two years of inflation we can round it off to 80K and we now have a benchmark.

$80K a year is the standard form of exercise for full-time Aussies. One light jog and occasional push-ups weekly would probably put you in the average to above-average category of exercise in Australia as sad as that is.

If you’re earning under $80K a year and have already optimised your expenses, you may be in the position to grab some really low hanging fruit and increase your income for an excellent BFYB return.

Adding in some resistance training 2 hours a week is such a small amount of effort that has an incredible return. Not only will you become healthier and stronger, you’ll potentially save yourself a lifetime of injury and illness that’s so common in our sit down all day 21st-century culture. Cardiovascular and resistance training has shown to help with sciatica, pelvic tilt, back pain, heart disease, diabetes etc. I have always considered myself a pretty active person but even I had hip issues 3 years after starting full-time work which I 100% attribute to sitting down all day and not stretching my hip flexors or strengthening my glutes. This hip issues crept into a lower back pain issue and before I knew it, I was going to the physio a few times a month. It didn’t take longer than a few weeks of specific stretching and strengthening exercise to completely resolve all of my issues and I continue parts of that program to this day nearly 10 years later.

You don’t need to jump into a 5X5 strength split or start yelling “Yeah buddy…Ain’t nuttin’ but a peanut!” after every rep in the gym. Three focused 45-minute sessions a week offers great health benefits just like spending a bit more time increasing your income can wipe years off your FIRE journey!

Improving Your Investment Returns

And now we’ve come to the most talked about, most analysed… most overrated focus area.

Investing!

I want to bring up two quotes to set the tone for this focus area.

“If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring.” – George Soros

“There seems to be some perverse human characteristic that likes to make easy things difficult.” – Warren Buffett

I am so guilty of the second quote. When I first discovered financial independence I was convinced that there’s some sort of magic formula that these rich guys must be using to get ahead. It’s part of the reason I started investing in a trust. It was like this complicated black box with all these advantages that only the rich guys understood and used. I wanted in on the secret and did my research hoping to stumble upon the golden goose. While there are some benefits of investing within a trust, I must admit that I was lured to its complexities and perceived mysteries (for whatever reason). It took me years to fully appreciate the power of simplicity and if I could start again, I would have never bothered with the trust.

I feel so many FIRE n00bs fall into the same trap. They go looking for a magical formula that simply does not exist. And even if it does, it’s almost certainly locked away in a secure blockchain quant investment hedge fund somewhere.

Here’s the deal, you can absolutely optimise your investment results up until a certain degree with barely any more effort involved. I’m going to ignore inflation, risk appetite and investment horizons for a second to make the point.

Investment returns have historically fallen around these marks:

0% – Storing your money in a shoebox under your bed

2% – HISA

3.5% – Bonds

7% – Real estate

8% – Shares

You can argue back and forth about how those numbers were gathered and what methodologies were used but it doesn’t really matter.

Realistically, any Aussie out there can achieve those returns rates in those asset classes without an economics degree. Index investing opened Pandora’s box and enabled the average Joe to grab a piece of the market without needing to spend the time researching and analysing financial statements.

Diversification and low management fees provide the best BFYB when it comes to this focus area. Everything else has such minute benefits that it’s laughable so many people spend so much time and effort trying to see which ones better.

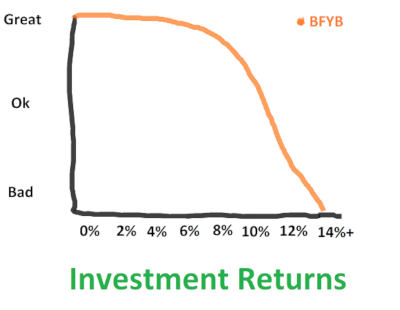

To demonstrate this here is our BFYB chart for investment returns

So basically we can get up to around 8% without much effort required. It’s always good to put the time and effort into understanding the asset class but theoretically, any Joe Blow could dump their money into a diversified index fund like VDHG and get ~8% over the long term.

I don’t know any assets class where you can get a better return without extra effort. There’s plenty of ways to improve your return on investment. I sold my first investment property and calculated an after-tax annualised return of 36% but the number of extra hours I put into that investment was the equivalent to another part-time job.

Newbies to FIRE and investing don’t really understand just how hard it truly is to beat the market consistently over a long period of time (20+ years). There are people who can do it, I’m not saying it isn’t possible. But the amount of effort and skill that is required to actually discover alpha year after year is something only a very few incredibly skilled people have managed to achieve.

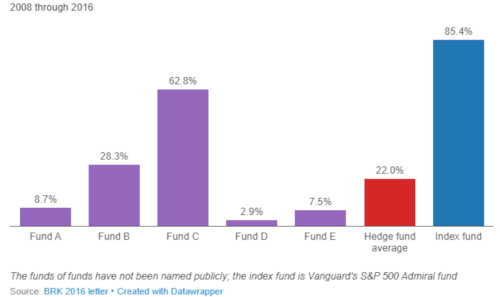

We’ve all heard the famous story of Warren Buffett betting a $1M bucks against 5 hedge funds that a simple index-tracking ETF would outperform them over an eight-year period. Not only did he win that bet, but it wasn’t even close.

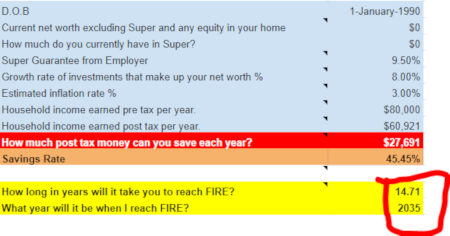

But let’s just entertain the idea that you’re an outlier. You possess incredible skills and techniques far beyond most active traders and hedge fund managers all around the world and you’re able to consistently beat the market.

How much better off would you be if you were able to outpace the market by a whopping 100 basis point (1%). 1% doesn’t sound impressive but if someone can beat the market by 1% over a long period of time then you’re most likely going to make more money in a hedge fund picking stock than you are at your day job. Your skills are extremely valuable.

We’re going to pretend that you keep this incredible skill to yourself and only use your god-given talents for your personal share portfolio. How much of a difference would 1% actually make?

Let’s find out.

Even using our top tier investing prowess we only managed to wipe off 2.3 years which was actually the worst result compared to saving $5,538 (4.5 years) or earning an additional $5,538 (2.7 years).

BFYB: Bad

Think about how much time and effort some funds put into research for investing. It’s a full-time job with an army of analysts and advisors all crunching numbers, creating models and using the latest predictive methods in the odd chance that they can justify their hefty management fees. And most of these funds don’t even beat the index when fees are accounted for.

What hope in hell do the rest of us have?

The example above used a huge 1% difference over nearly 20 years.

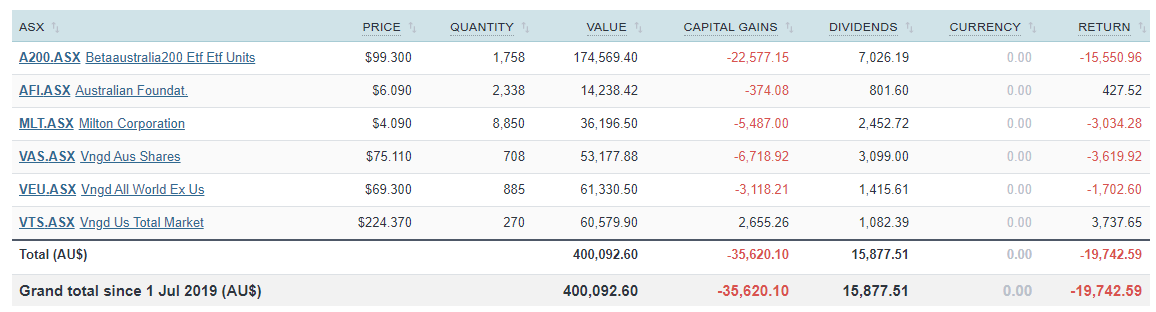

How many times have you seen someone ask about A200 vs VAS on the internet? It’s gotta be one of the most discussed and analysed topics within FIRE communities. The difference in management fees between these two funds is 0.03%…

Let me say that again. 0.03%

They do track different indexes (ASX200 vs ASX300) and do you know what the difference has been between those two indexes over the last 10 years… 0.04%

So maybe… just maybe those two funds might return a difference of +-0.1% over the long term.

10 basis points of difference is your reward for correctly picking the better performing ETF over that time period.. and that’s assuming you’re even able to use skill to pick the one that’s going to perform better (which you almost certainly won’t be able to do).

BFYB: Horrendous

A200 or VAS?

A200+VGS or VAS+VTS+VEU?

IVV or VTS?

AFI or VAS?

LICs or ETFs?

VDHG or create my own?

Most of these arguments don’t make a huge difference. It’s really important to understand the key concepts around management fees, diversification and why index investing works. But just understand that if you’ve got one of the above combo’s, you’re already more diversified and paying lower fees than most Australian investors to begin with.

The basic investing principles for Australian FIRE is to build a low cost, diversified share portfolio mainly made up by ETFs/LICS. You want to buy consistently no matter what the market is doing and grow your snowball to a point where it’s passive income can fund your lifestyle.

There’s going to be a 100 different flavours of that ice cream but once you have those basics down pat, the bulk of the work is done. You can always tweak and improve your portfolio to suit your circumstances but honestly, if you’re trying to reach FIRE faster and think that crunching numbers in Excel for 10 hours a week is going save you years of working, you might be in for a rude shock!

Keep your investing simple and boring. Use your precious time optimising your expenses and working on ways to increase the amount of money that flows into your account because IMHO, focusing time and energy on savings and increasing your income has the best BFYB returns.

Different Ways to Increase your Income

I hope after reading the above you can now appreciate just how underrated increasing your income is. The saving rate is held in high regard within the FIRE community thankfully, so there’s not much to add there.

But my goodness does investing get way too much of the limelight. It’s largely out of your control too. Other than choosing your diversification levels and sticking to a low-cost fund, you’re very limited to how much you can improve the results.

When it comes to increasing your income though, the complete opposite is true. The harder you grind the more money you will make! And the more money you make, the higher your savings rate will be (if lifestyle inflation doesn’t get ya)

So let’s jump in to see how we can improve our crunches and pushups and maybe head over to the dark corner of the gym, away from the treadmills and cross-fitters… the weight room!

Ask For A Raise

We’re going to start by improving our current workout (salary job).

One of the easiest and most low hanging fruits on anyone’s list should be to simply have a conversation with their boss about their salary and ask for a raise if they think they deserve more money.

How many times have you heard about someone complaining for years that they’re underpaid but never actually taking the action of setting up the meeting to discuss their pay? I’m not saying this will have a 100% success rate but more often than not, it will start the process of you either getting more benefits or creating the plan for your next raise or bonus.

You probably want to approach the meeting with some sort of reasoning like citing average incomes within your industry or comparing the work you do with someone else that’s being paid more.

BFYB: Great

Hardly any effort with the potential to add thousands extra to your accounts for years to come! No real risk either and it’s not like you have to learn something new.

Change Jobs Regularly

Asking for a raise or putting your head down and bum up climbing the corporate ladder is a noble way to jump the food chain and reap the rewards. But the sad truth in my experience is that loyalty to a company (or business for that matter) is rarely rewarded.

Your utility provider doesn’t offer a better deal when you’ve been a loyal customer for 10 years. It’s only when you leave do they all of a sudden roll the red carpet out.

If your goal is to make the most money in your field, changing jobs every 2-3 years is the best way to do it.

Be bold, be confident. Apply for positions beyond your capabilities. Back yourself to get the job done after you land it.

Fortune favours the bold!

I’m not saying to lie your way to a position only to fall flat on your face. Just understand that an ungodly amount of people are in jobs they were never qualified for or completely lacked the experience necessary to perform it at the start.

When I worked for the government back in Australia, we would engage with consultants all the time from various companies who always charged an obscene day rate to perform projects. Think $1,000+ a day. I worked directly with a lot of these consultants on the technical side and it always struck me as odd when they clearly didn’t know a whole lot. Here we were, getting charged $1,000 a day and I would end up doing 30% of the work.

Fast forward 5 years and I became a consultant myself after picking up contract work in London. My second contract was at one of the big four global consulting firms who are widely regarded as having some of the best professional services networks in the world. And boy do they charge accordingly for that reputation.

I worked on client-side with a team of consultants but was the only contractor. Two of the team members were really junior. One was 18 months out of uni and whilst really smart and willing to learn, didn’t know a whole lot about the technologies we were implementing.

My day rate for that contract was a whopping £500. It was more than double my daily earnings from back home and I couldn’t believe that a company would be willing to pay me so much.

Well, you might have guessed that I was completely blown away when I found out that the consulting company who I was subcontracting for, was actually charging me out at their SC (senior consultant) rate which is a staggering £1,250 a day 🤯. Even at £500 a day, I was only getting 40% of the pie!

And now it made sense why all the firm’s partners were driving McLaren’s…

But here’s the point of the story… everyone on the team was also being charged out at £1,250 a day!

I mean… honestly. One of them barely knew anything. And it was at this point that I realised that companies will lie and exaggerate the skills and experience of their products/services in order to get the most amount of money they think they can get away with.

You should be doing the same!

Last point on this one, be prepared to move somewhere where your skills are in demand. This might mean international.

BFYB: Great

Side Hustles

Time to get out of your comfort zone!

The two tips above were focussed on improving your current situation. Everyone’s working out to some degree so it would make sense that we start by improving your running technique or buying training gear. But now I want to take you into that dark corner of the gym where you might not have been before. It’s not going to be easy and learning new things can be difficult. But I promise you that the benefits here are worth the effort.

I’d rather not bore you by listing every single side hustle I can think of either. I have personal experience in a few side hustles which I’d like to talk about but there’s really an unlimited amount of ways to bring in a little extra cashola.

Work a second job:

This one depends on how exhausted you are working your main job, but there’s plenty of people who work two jobs and cope just fine. Mrs FB used to do a bit of bar work on Thursday and Friday nights even though she didn’t need to. She worked with her sister and a few friends and half the time most of her friends were drinking at the bar (a small country town so not many other options lol) so she was sort of where she’d be anyway just earning money instead of spending it. A little bit of extra work equated to thousands of extra dollars in her account without too much effort involved.

The second gig can be anything too. Teaching piano, tutoring, Uber driver etc.

BFYB: Ok

Sell stuff:

One of my biggest pet peeves is throwaway culture. The amount of effort that went into digging something out of the ground, refining it, transporting it, manufacturing it, shipping it, storing it and to have someone finally buy/consume it… only for it to be thrown away in the trash not long after.

Utter insanity!

Never throw away something just because you don’t want it anymore. If it was once a good product, odds are you can sell it online to someone and recoup some of your losses. Hell, I even managed to sell my old pair of Nike’s for $30 once. Legit took me less than 10 minutes to list it. How many of you out there would be willing to work for $180 an hour?

At worst go down to your local Salvos and donate it. Chucking something that is perfectly fine in the trash is sooooo lazy, a bad financial habit and adds to humanities ballooning trash pile that mostly ends up in our oceans.

BFYB: Ok

Credit Card Hacking:

I’ve been credit card hacking for nearly a decade. In a nutshell, you sign up to new cards to take advantage of the signup bonus these CC companies offer and then spend the points on products, flights or convert them to cash. You can also pay for everything on the CC and accumulate points over the course of the year. A little bit of effort for a pretty decent bump IMO. The only risk is that you need to ensure you pay off the CC amount in full at the end of each month.

Oh, and some cards come with free travel insurance which can cost hundreds of dollars.

BFYB: Ok

Matched Betting:

Something I only discovered in 2019 after ignoring it for nearly 6 months because I thought it was a scam. The principles are very similar to CC hacking. The bookies offer you signup bonuses where you join with the caveat that you need to gamble the bet in order to access it. Matched betting is the mathematical approach for discovering arbitrage opportunities between back and lay bets. Or simply put, playing the bookies against each other to make money. When you do it correctly it’s mathematically impossible to lose but it’s a lot more complicated than CC hacking.

There’s a lot of low hanging fruit here for those who who want to put the time and effort into learning it. The two advantages that matched betting has over CC hacking is that firstly the amount of money you can make is a lot more. The low hanging fruit can be anywhere between $1K-$2K. And secondly, matched betting can be done for an extended period of time and not be just a one-off. I’ve had many people email me about the money they have made from matched betting exceeding $15K.

The signup bonuses are the low hanging fruit because after that it basically turns into another job. The fact that you can do it over the internet is a huge plus in my book.

Full warning with this side hustle though, you must do your research because if you make mistakes you can lose a lot of money. I’d suggest listening to the matched betting podcast I recording in 2019 and reading about the feedback I received from readers later that year. Some people had good experiences, some had bad.

BFYB: Ok

Start An Online Business

I’ve become an enormous advocate for having a crack at online business.

There are just so many advantages that being 100% online offers to the traditional way of doing things.

Some of my favourites are:

- Can run the business/company from anywhere in the world as long as you have an internet connection

- Startup speed. You can literally create a website/blog/YouTube Channel and begin creating content/a product and have the world at your fingertips within hours. This is simply mindboggling and it gives any entrepreneur a realistic chance to create something that will be successful.

- Incredibly small start-up costs. Gone are the days where you’d have to risk financial ruin in order to start a business. How many people over the last 100 years have had a killer idea but lacked the capital to get it off the ground? I think Aussie Firebug cost me <$100 the first year.

- Can scale as your business grows. This is what I love about cloud services in general. You only pay for how big you are and you can scale in a matter of seconds to accommodate a larger audience if/when you get there.

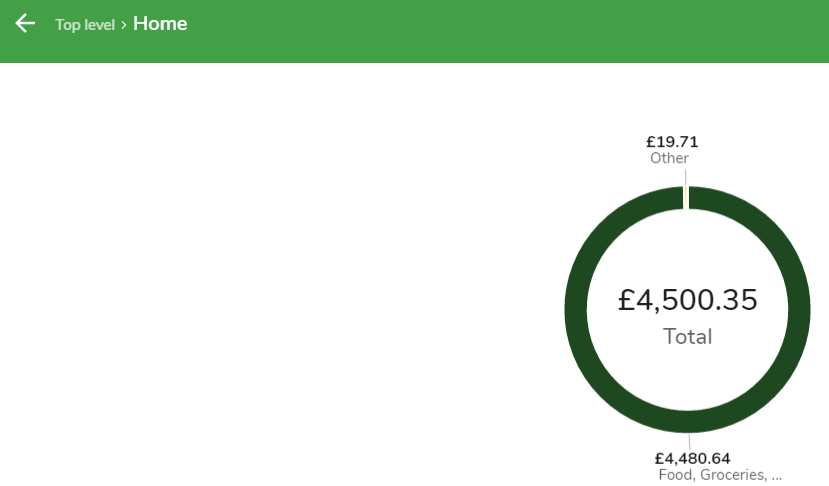

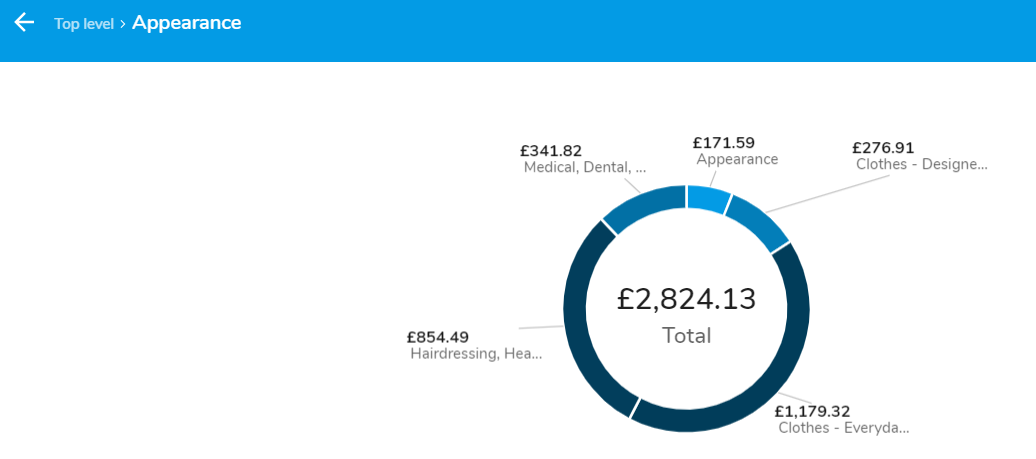

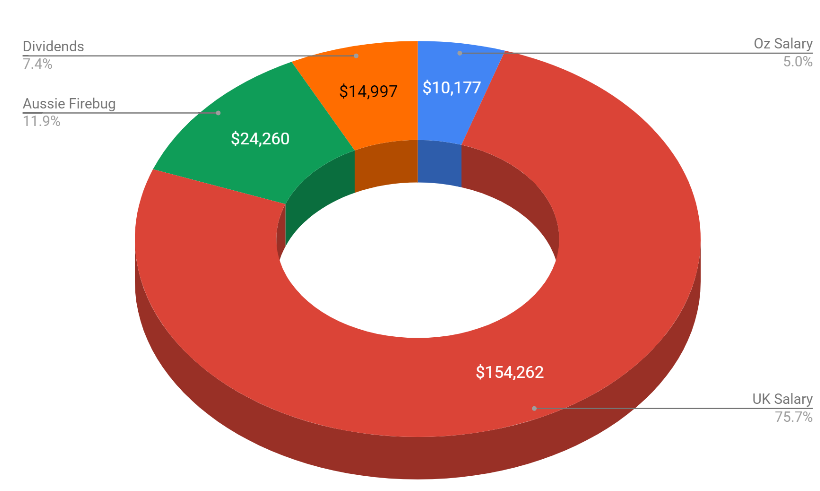

Aussie Firebug will always be a passion project but around late 2018 I officially started to monetise my content and miraculously it managed to make over $30K last year and I’m on track to make it again this FY.

I could do an entire article about how to monetise a blog/podcast because making money digitally is such a new concept (relatively) and there’s a lot to get your head around. Even though I’ve already listed a whole bunch of benefits above, probably the biggest advantage that an online business can offer someone on the road to FIRE is its ability to make semi-passive income.

A website/podcast/YouTube Channel is constantly available to everyone in the world. It’s not like a shop where you need to physically be there to make things run. And if your product is digital (you’re not selling something physical) you don’t need to store it and it can be replicated without any cost. If you sell a physical book you will need to pay to get that book printed and shipped. If you sell an ebook, you can literally just copy and paste a new version and send it to people straight away. The power of the internet!

Plus there’s a whole bunch of automation you can set up in the background where a lot of the day to day business operations can run on autopilot.

I think back to how many hours I put into Aussie Firebug during the first three years. The amount of time was crazy, probably averaged 1.5 hours each weeknight for 3 straight years. But the beauty of something like a blog/podcast is that most people are making the content because they really enjoy it. I didn’t earn anything for the first three years but I built the content that would later be the main drivers to allow the site to be monetised.

I’ve made over $60K during the last 2 years and I’d say on average I’m lucky to spend ~5 hours a month these days. My life has become completely different since moving overseas and travelling around and I just can’t dedicate as much to Aussie Firebug as I would like to.

But the point is that I’ve set up certain automations that enable the site to make me money while I sleep. I can’t tell you how satisfying it feels to wake up most mornings and see people taking advantage of companies that I use and recommend.

This concept is immensely powerful no matter what the online business is. Work can be recycled and can continue to make you money even while you sleep. I know a YouTuber that basically earns most of his money from a few videos he recorded years ago. Yes, he still continues to make new videos to keep the channel up to date, but the bulk of his income is still being generated from 2 or 3 pieces of digital content he created a long time ago.

That’s something you simply cannot do when you trade your time for money.

If you’re thinking about creating content I’d probably say that YouTube is the easiest way to start earning serious cash, followed by starting a podcast and unfortunately, dead last would be blogging.

The Double Whammy Effect

Side hustles and online businesses are a great way to bump up your income but there’s also a massive opportunity to simultaneously work on something that’s often forgotten about.

What are you going to do once you reach financial independence?

You don’t need to be FI to start plugging away at your passion project or whatever it is you’ve always wanted to have a crack at.

Start that project this weekend!

Momentum is a powerful force. If you have a little side hustle or project you get to work on for fun in your spare time, more often than not, when you do decide you’ve had enough of sitting in a cubicle for 40 hours a week, the transition is so much easier because you’ve already built up something to further sink your teeth into.

My preference will always be an online business but it doesn’t have to be that. Make candles, sell scented oils from Etsy, create a monthly COD tournament in your area. Anything you’re interested in will do. And don’t worry about making money because 9/10 times if you start doing something you love it somehow finds a way to pay for itself eventually.

Wrapping It All Up

I wrote this article with the intention of highlighting one of the most underrated focus areas in our community. Everyone should know by now that your savings rate is king but rarely do I see such admiration for putting time and effort into earning more money in your day job or by hustling on the side.

Far too often people come to the FIRE community hoping to discover the secret sauce that enables us to retire 30 years earlier than most. The methods we use to invest are actually incredibly boring and simple.

If you’re anything like me, discovering the concept of FIRE can change your life. I was bursting with excitement and enthusiasm when I realised that financial independence was an achievable goal that nearly any Australian can achieve if they prioritise it highly enough.

Focus more of this energy into something that’s within your control. That’s saving money and earning more. The majority of investment returns are largely out of our control which is why the never-ending debate between which investment is the best is largely a waste of your time. I’m not saying you shouldn’t educate yourself about investing. Just know that the difference between choosing A200 or VAS will not be a difference-maker that could potentially wipe years off your journey.

On the contrary, starting a hobby of making and selling custom jewellery in your spare time does have the potential to eliminate multiple years and maybe even decades. But more importantly, side hustles/businesses can offer the more important benefit of shaping your future in retirement. No one wants to reach financial independence just to say they did it. We want the freedom that it grants. But using that freedom to create your ideal lifestyle doesn’t have to start once you reach that magical number, you can start meaningful work right now and it can help you along the journey!

If I can refer back to our metaphor from the intro one last time I’ll leave you with this…

Most of you guys already have a great diet. Some are dialled in so well that you are hitting your macro and micro-nutrients to the gram. But it’s time now to look at your workout routine and see if you can fit in a few more sessions every week to really take it to the next level!

Spark that 🔥